Asia-Pacific Markets Fall After Open on Fears of Trump’s Tariffs – Sputnikglobe.com

Published on: 2025-04-07

Intelligence Report: Asia-Pacific Markets Fall After Open on Fears of Trump’s Tariffs – Sputnikglobe.com

1. BLUF (Bottom Line Up Front)

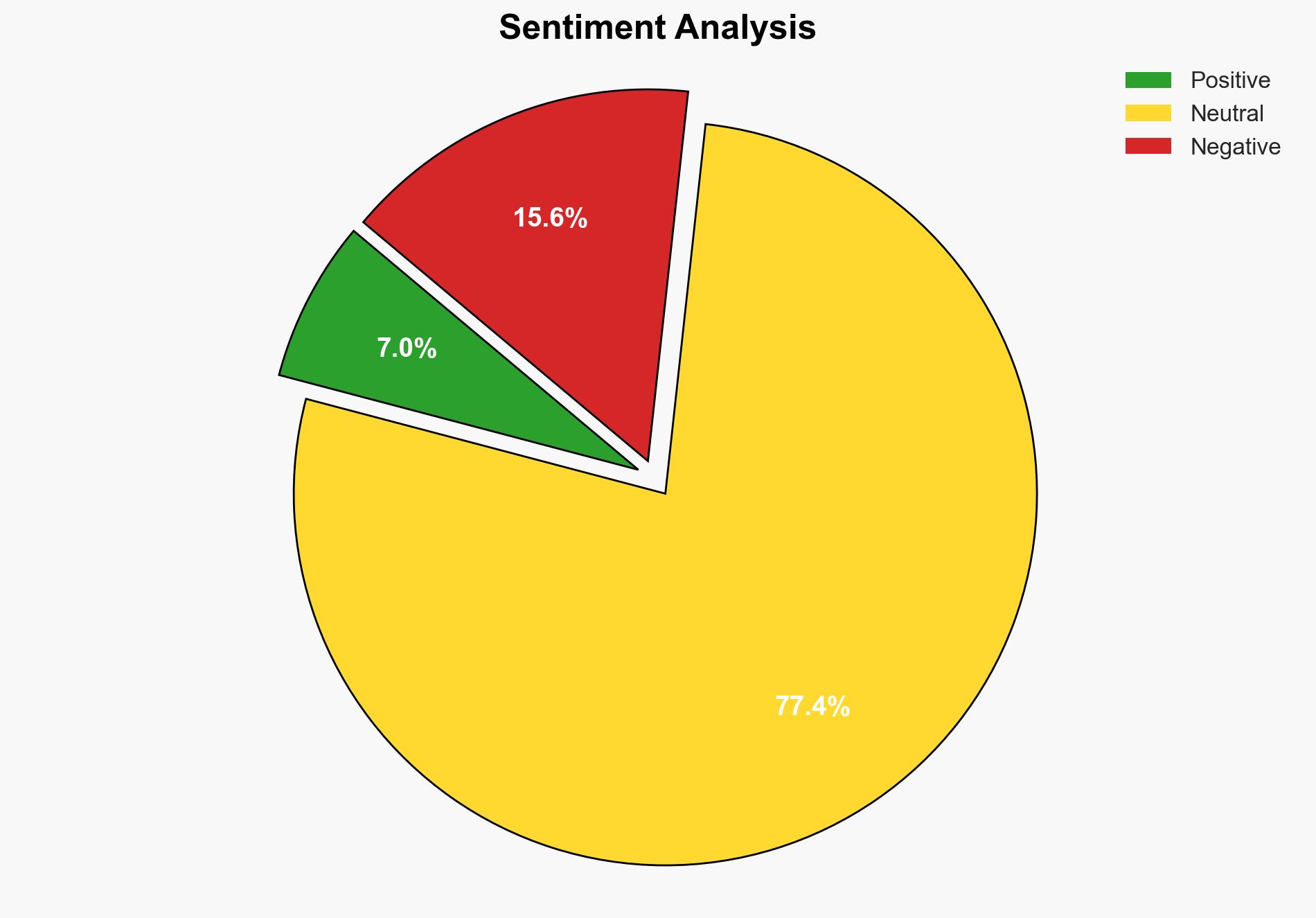

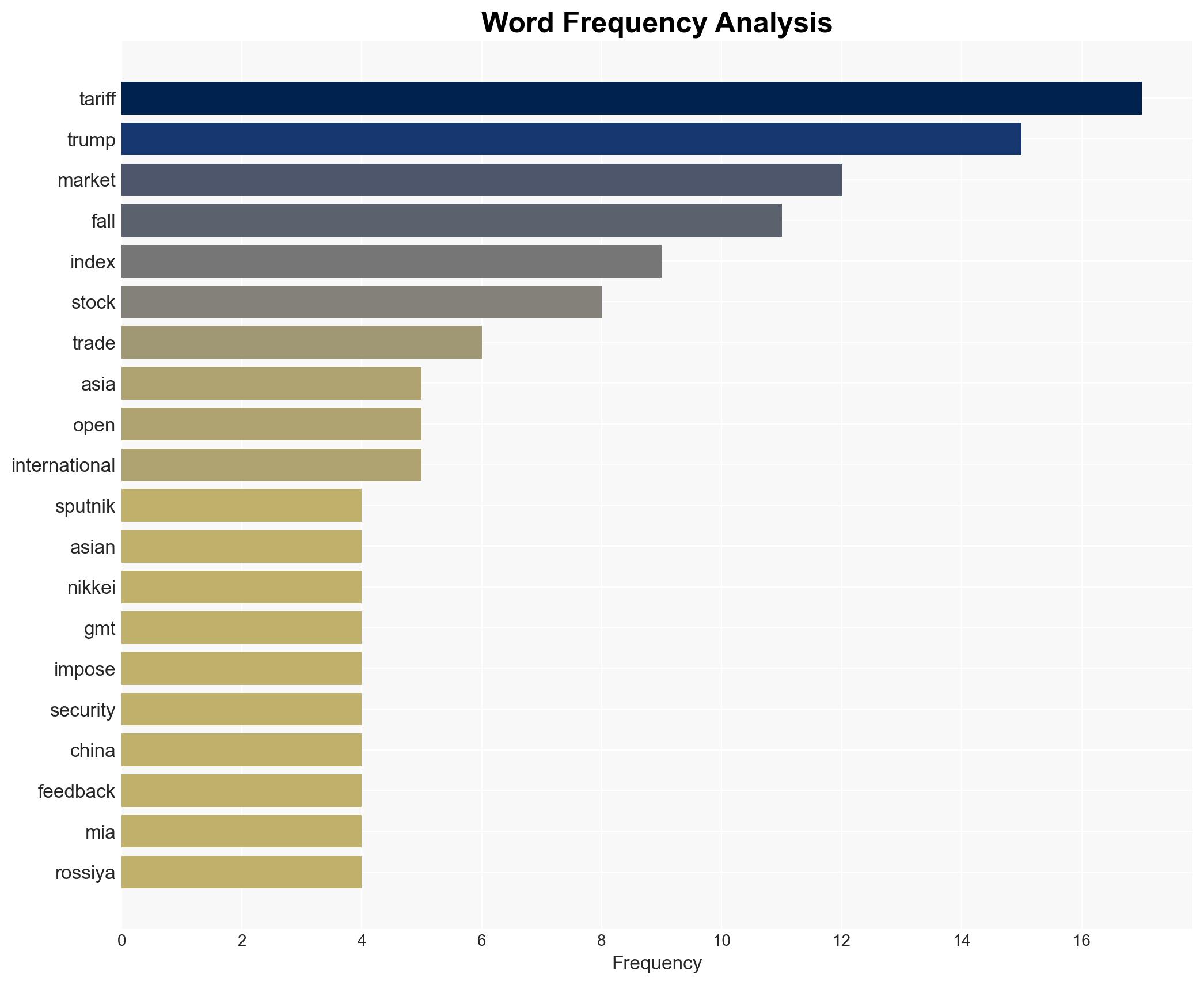

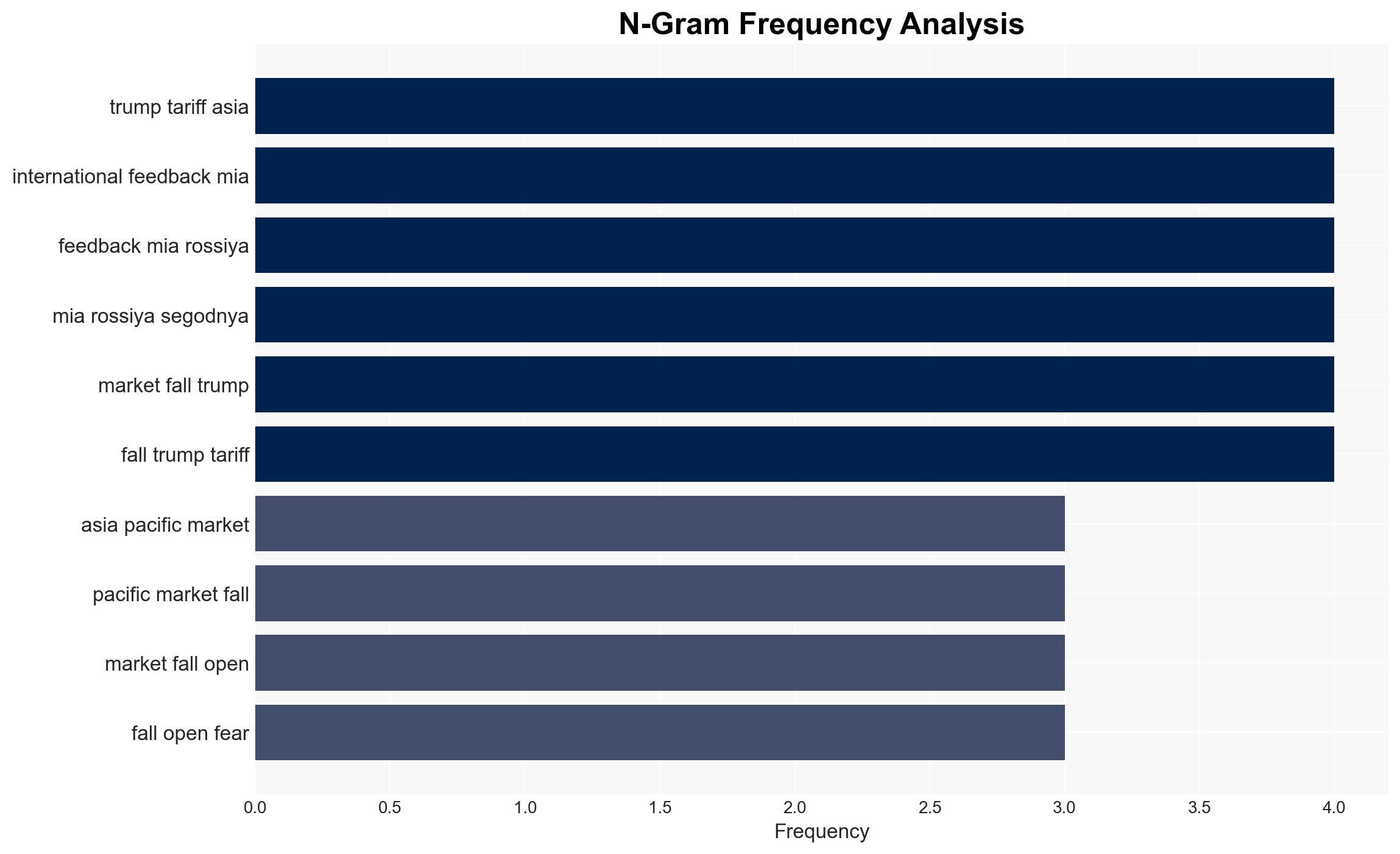

The Asia-Pacific markets experienced a significant downturn following the introduction of tariffs by Donald Trump. The tariffs, aimed at imports such as passenger cars and auto parts, have led to a sharp decline in major indices, including the Nikkei and Hang Seng. This development poses potential risks to regional economic stability and could escalate trade tensions between the United States and China. Immediate strategic measures are recommended to mitigate economic impacts and stabilize market conditions.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

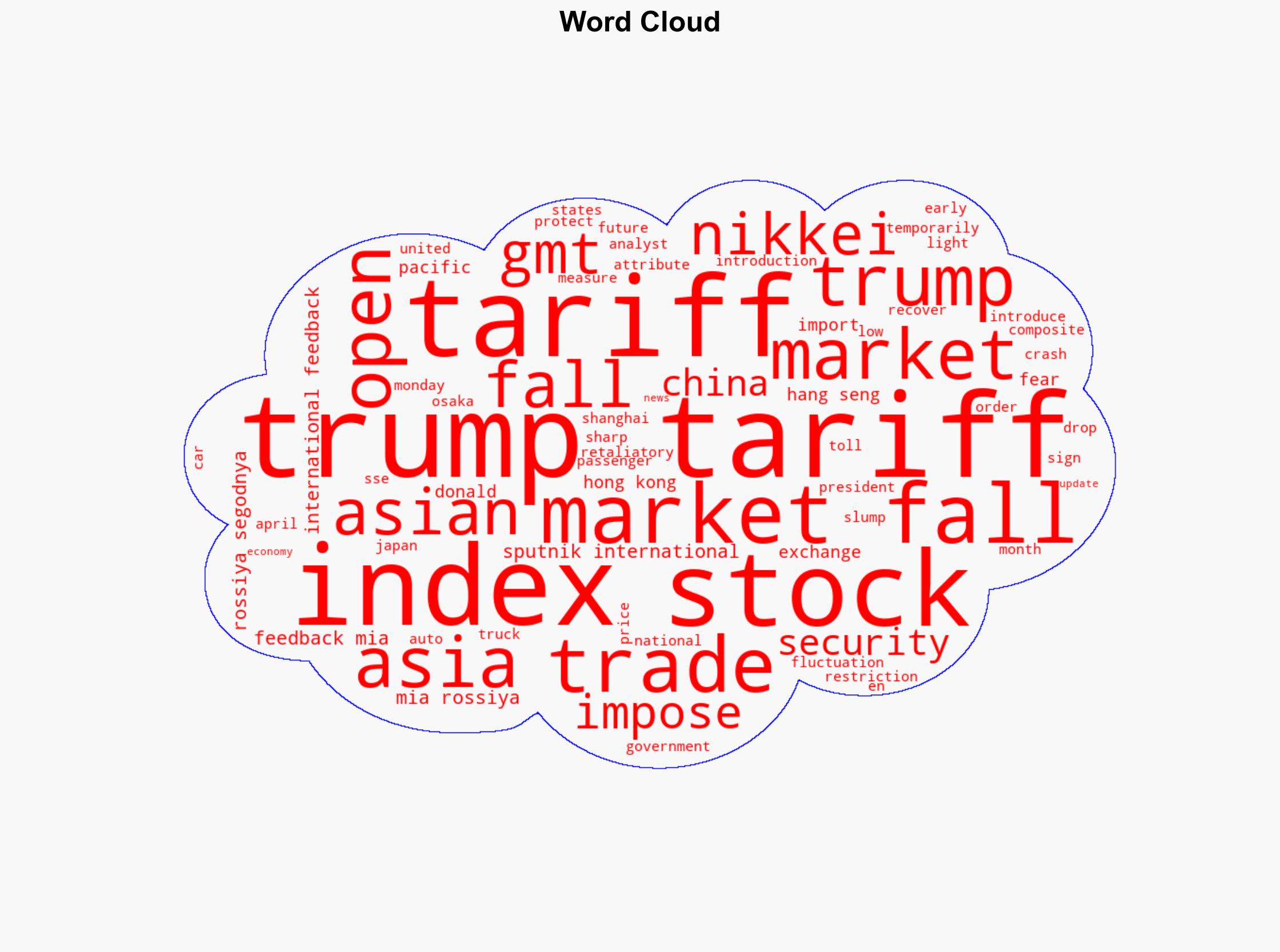

The imposition of tariffs by Donald Trump has triggered a negative reaction in the Asia-Pacific stock markets. The Nikkei index and Hang Seng index both experienced significant drops, with the Nikkei reaching a monthly low. The Osaka Stock Exchange imposed temporary restrictions on trading futures to manage sharp price fluctuations. Analysts attribute these market reactions to the introduction of tariffs and the retaliatory measures expected from China. The tariffs are perceived as a measure to protect national security but have raised concerns about their broader economic implications.

3. Implications and Strategic Risks

The tariffs introduced by Donald Trump could lead to several strategic risks, including:

- Increased trade tensions between the United States and China, potentially leading to a trade war.

- Negative impacts on regional economic stability, particularly in countries heavily reliant on exports.

- Potential retaliatory tariffs from China, further affecting global trade dynamics.

- Risks to national security if economic conditions deteriorate significantly.

4. Recommendations and Outlook

Recommendations:

- Engage in diplomatic dialogues to de-escalate trade tensions and negotiate tariff reductions.

- Implement economic policies to support affected industries and stabilize market conditions.

- Enhance monitoring of market fluctuations and prepare contingency plans for further economic disruptions.

Outlook:

Best-case scenario: Successful negotiations lead to a reduction in tariffs, stabilizing markets and improving economic conditions.

Worst-case scenario: Escalation of trade tensions results in a prolonged trade war, severely impacting global markets.

Most likely outcome: Continued market volatility with gradual adjustments as stakeholders adapt to new trade policies.

5. Key Individuals and Entities

The report mentions the following significant individuals and entities:

- Donald Trump

- Nikkei Index

- Hang Seng Index

- Osaka Stock Exchange

- Shanghai SSE Composite Index