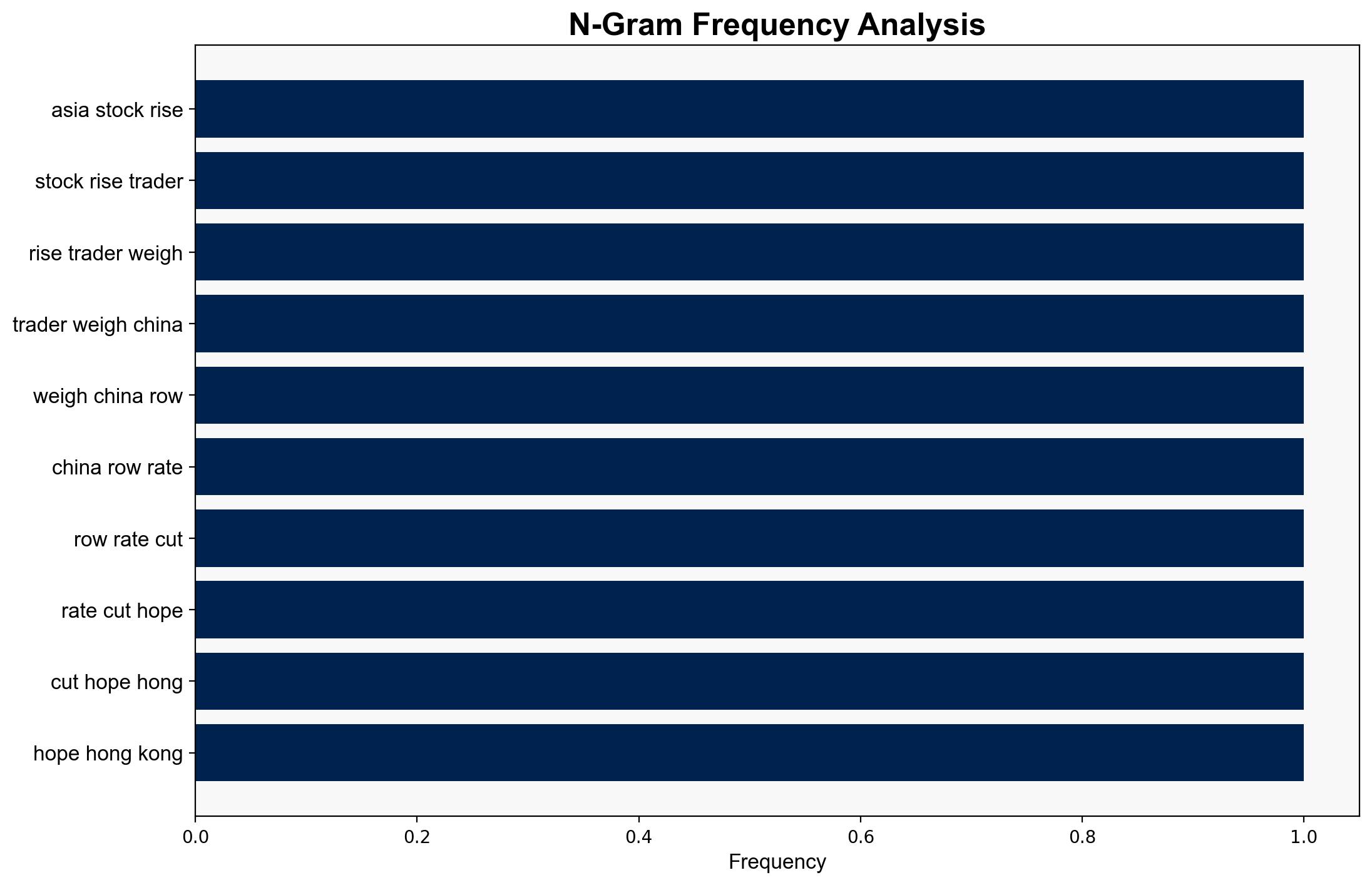

Asia Stocks Rise As Traders Weigh China-US Row Rate Cut Hopes – International Business Times

Published on: 2025-10-16

Intelligence Report: Asia Stocks Rise As Traders Weigh China-US Row Rate Cut Hopes – International Business Times

1. BLUF (Bottom Line Up Front)

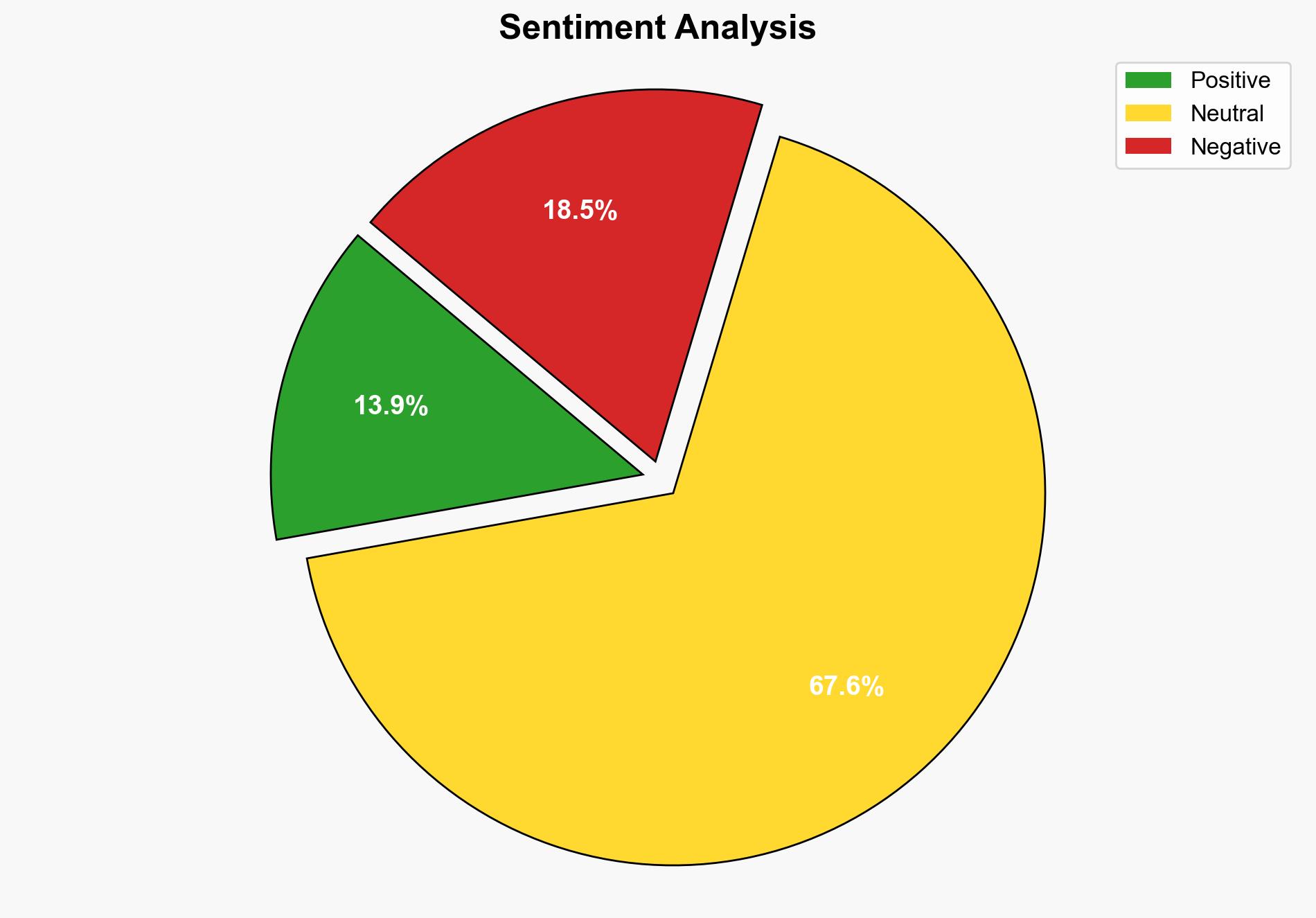

The most supported hypothesis is that the recent rise in Asian stocks is primarily driven by investor optimism regarding potential Federal Reserve rate cuts, despite ongoing trade tensions between China and the US. Confidence Level: Moderate. Recommended action is to monitor central bank communications closely and prepare for potential market volatility due to geopolitical developments.

2. Competing Hypotheses

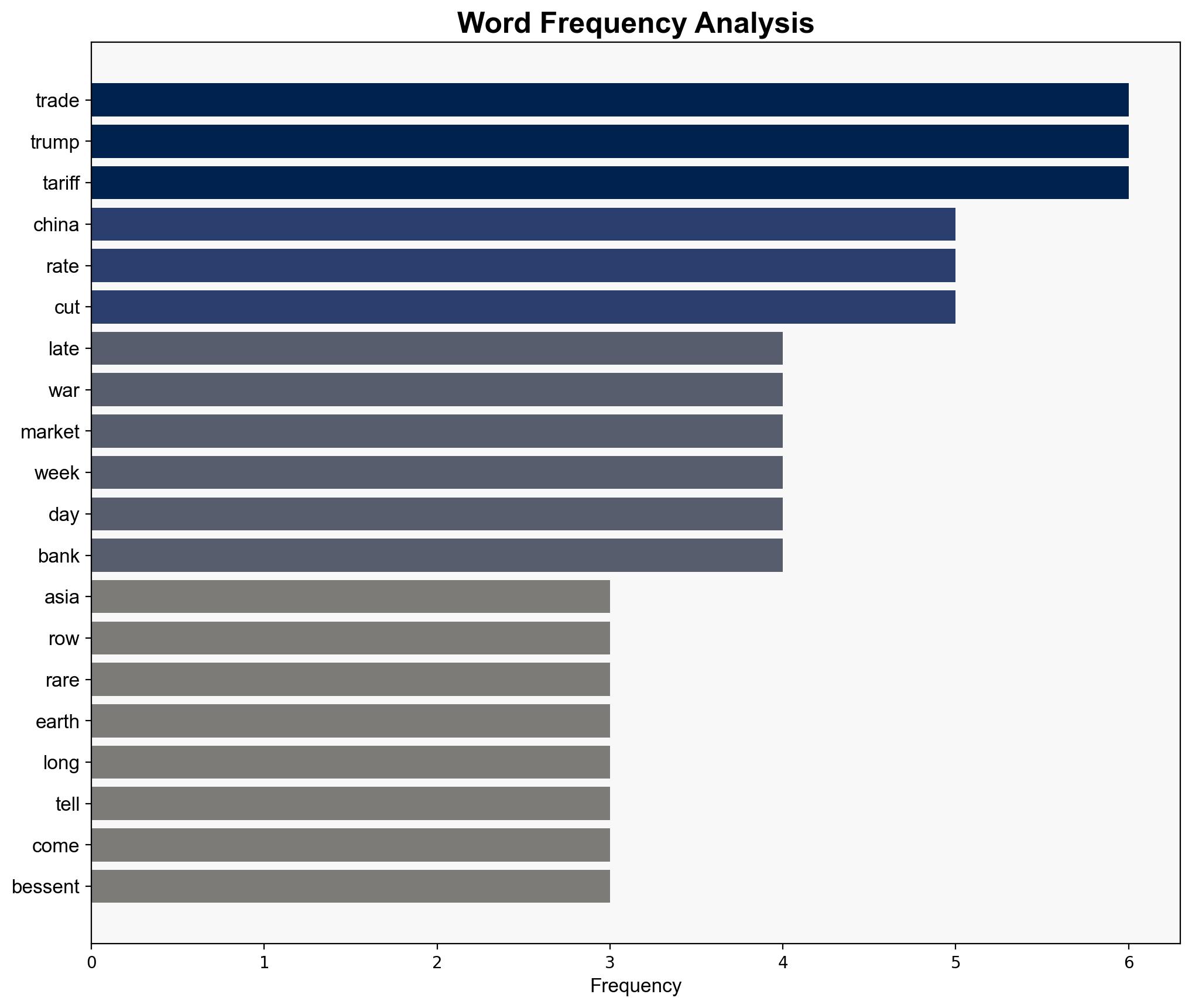

1. **Hypothesis A**: The rise in Asian stocks is primarily due to investor optimism about potential Federal Reserve rate cuts, which are expected to stimulate economic growth and offset trade war impacts.

2. **Hypothesis B**: The rise in Asian stocks is primarily driven by a temporary easing of tensions in the China-US trade war, as indicated by recent conciliatory statements and potential tariff pauses.

Using ACH 2.0, Hypothesis A is better supported due to the consistent focus on central bank actions and economic indicators, while Hypothesis B relies on less concrete and more volatile diplomatic signals.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that central bank actions have a more immediate and predictable impact on market behavior than diplomatic developments. Hypothesis B assumes that diplomatic gestures will lead to substantive policy changes.

– **Red Flags**: Potential over-reliance on central bank interventions as a market stabilizer. Diplomatic statements may not translate into concrete actions, leading to market corrections.

– **Blind Spots**: The impact of other global economic factors, such as European market stability or Middle East tensions, is not considered.

4. Implications and Strategic Risks

– **Economic**: Continued reliance on rate cuts could lead to long-term economic imbalances and reduced monetary policy effectiveness.

– **Geopolitical**: Escalation in trade tensions could lead to broader geopolitical instability, impacting global supply chains.

– **Psychological**: Market sentiment may become increasingly volatile, driven by mixed signals from economic and diplomatic fronts.

5. Recommendations and Outlook

- Monitor Federal Reserve communications for indications of future rate cuts.

- Prepare for potential market volatility by diversifying investments and hedging against geopolitical risks.

- Scenario Projections:

- Best Case: Successful trade negotiations lead to a stable market environment.

- Worst Case: Breakdown in negotiations results in increased tariffs and market instability.

- Most Likely: Continued ambiguity with intermittent market fluctuations driven by central bank actions.

6. Key Individuals and Entities

– Donald Trump

– Xi Jinping

– Scott Bessent

– Jerome Powell

– Stephen Inne

– Dilip Parmar

7. Thematic Tags

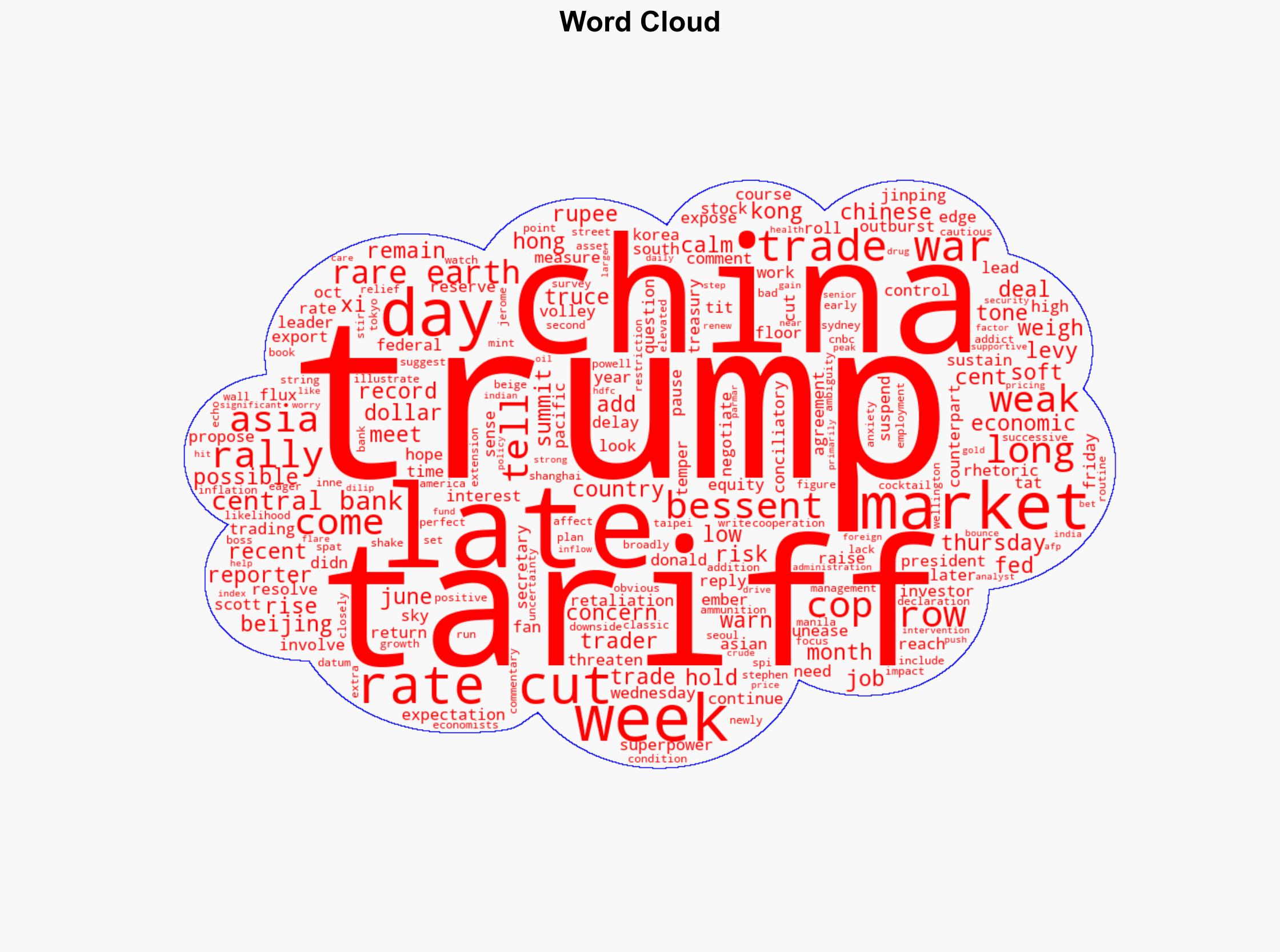

national security threats, economic stability, trade negotiations, central bank policy