Asian Equity Markets Drop After Trump Reignites Tariff Row – International Business Times

Published on: 2025-10-13

Intelligence Report: Asian Equity Markets Drop After Trump Reignites Tariff Row – International Business Times

1. BLUF (Bottom Line Up Front)

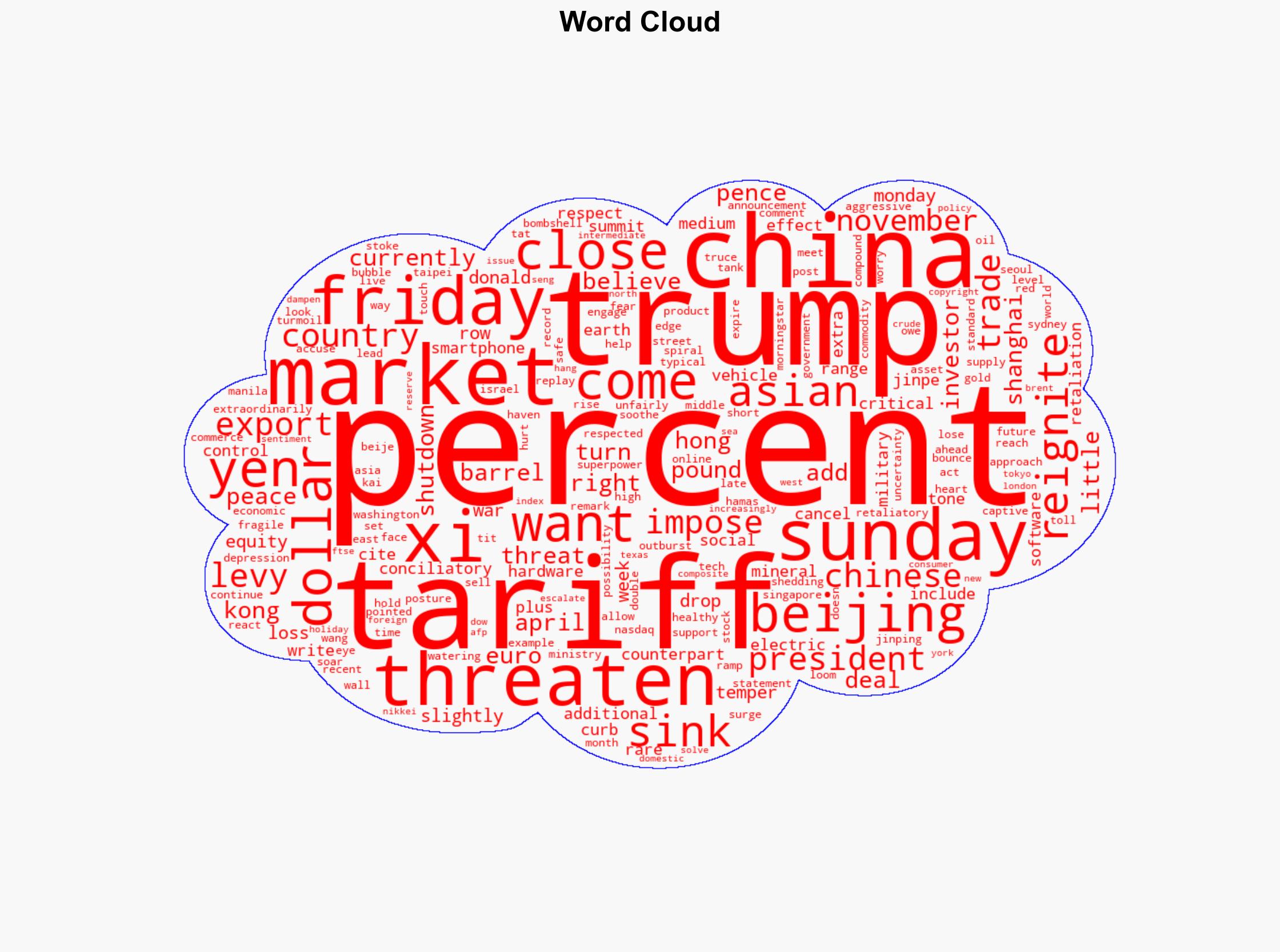

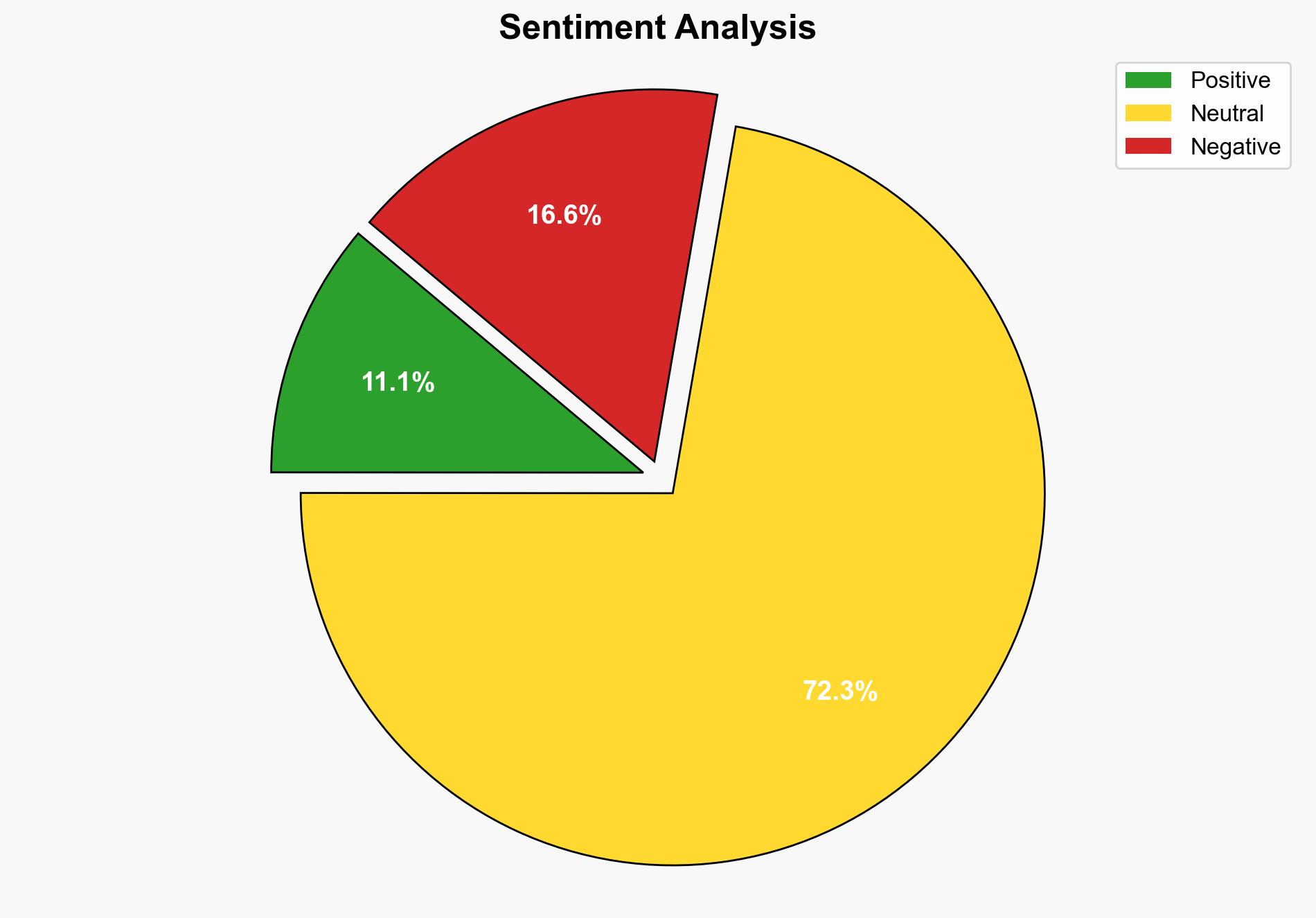

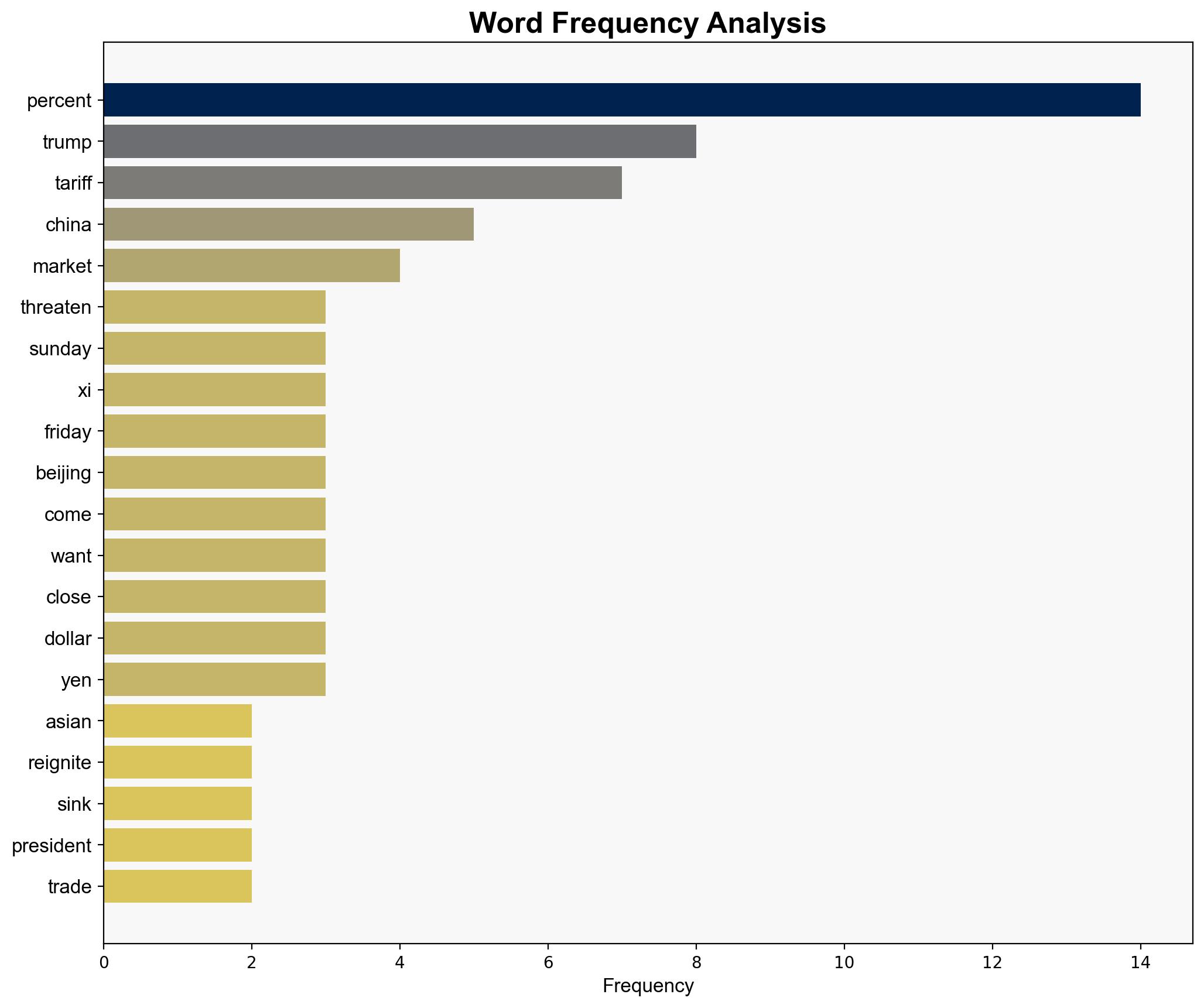

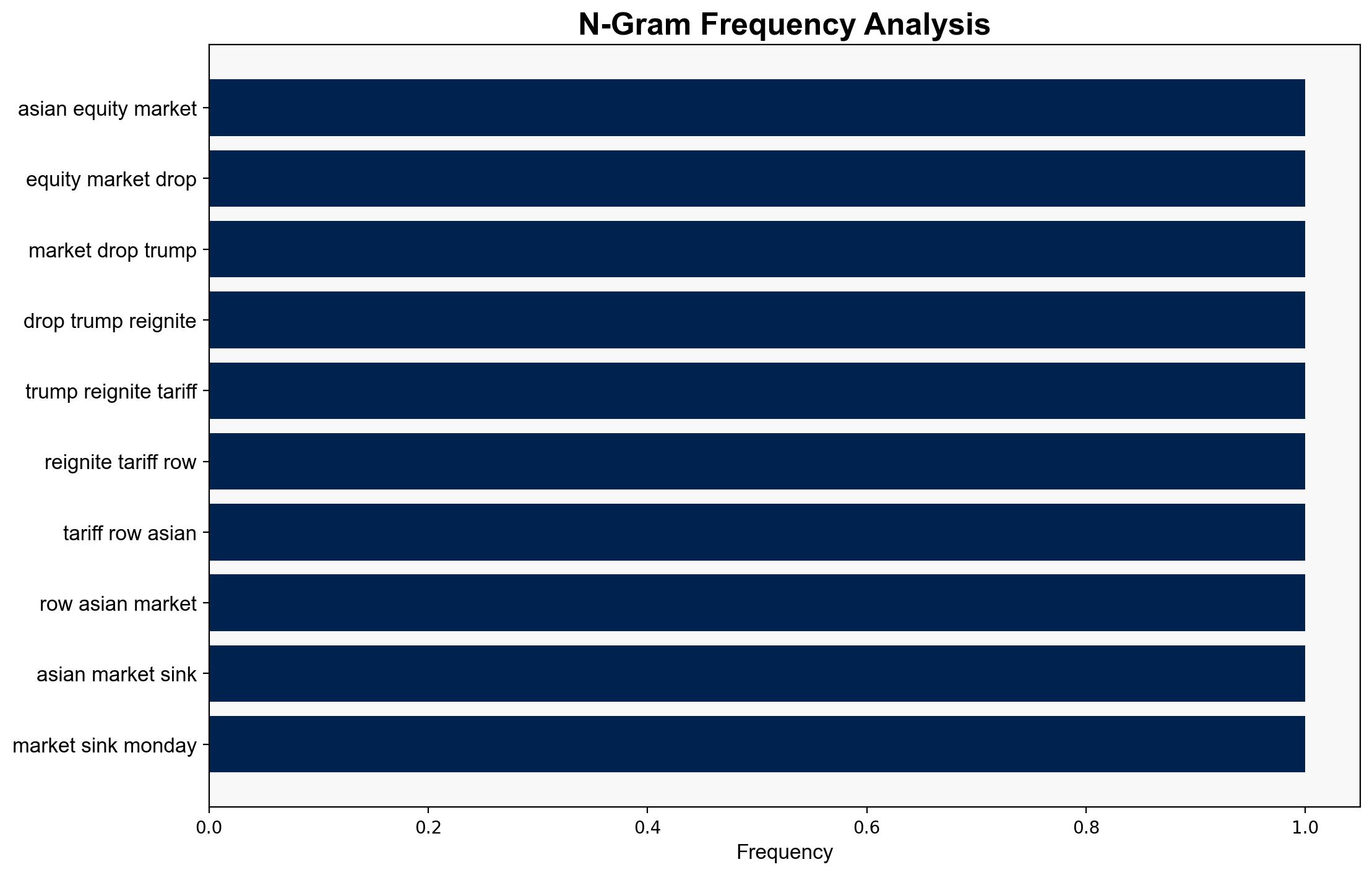

The most supported hypothesis is that the Asian equity market drop is primarily due to renewed trade tensions between the U.S. and China, exacerbated by President Trump’s tariff threats. Confidence level: Moderate. Recommended action: Monitor further U.S.-China trade negotiations and prepare for potential market volatility. Consider diplomatic engagements to de-escalate tensions.

2. Competing Hypotheses

Hypothesis 1: The drop in Asian equity markets is primarily due to President Trump’s announcement of additional tariffs on Chinese goods, which has reignited fears of an escalating trade war between the U.S. and China.

Hypothesis 2: The market decline is driven by broader economic concerns, including potential global economic slowdown and domestic issues such as the U.S. government shutdown, with the tariff announcement being a secondary factor.

Using ACH 2.0, Hypothesis 1 is better supported as the timing of the market drop closely follows Trump’s tariff announcement, and the specific mention of tariffs in market analyses suggests a direct correlation. Hypothesis 2 lacks direct evidence linking broader economic concerns to the immediate market reaction.

3. Key Assumptions and Red Flags

– Assumption: Market reactions are primarily influenced by geopolitical events rather than underlying economic fundamentals.

– Red Flag: The assumption that the tariff announcement is the sole cause of market decline may overlook other contributing factors such as investor sentiment or unrelated economic indicators.

– Potential Bias: Confirmation bias in attributing market movements solely to the most recent news event.

– Missing Data: Lack of detailed analysis on other potential economic indicators influencing market behavior.

4. Implications and Strategic Risks

– Economic Implications: Prolonged trade tensions could lead to sustained market volatility, affecting global supply chains and economic growth.

– Geopolitical Risks: Escalation in U.S.-China tensions could strain international relations and impact global trade agreements.

– Psychological Impact: Investor confidence may be undermined, leading to increased market speculation and risk aversion.

– Cybersecurity Threats: Heightened tensions could increase the risk of cyberattacks as a form of economic warfare.

5. Recommendations and Outlook

- Engage in diplomatic efforts to facilitate dialogue between the U.S. and China, aiming to de-escalate tensions and reach a trade agreement.

- Prepare for market volatility by diversifying investments and strengthening economic resilience measures.

- Monitor for signs of economic slowdown and adjust fiscal policies accordingly.

- Scenario Projections:

- Best Case: Successful trade negotiations lead to market stabilization and economic recovery.

- Worst Case: Escalation of trade war results in severe market downturn and global economic recession.

- Most Likely: Continued market fluctuations with intermittent progress in trade talks.

6. Key Individuals and Entities

– Donald Trump

– Xi Jinping

– Ministry of Commerce (China)

7. Thematic Tags

national security threats, economic volatility, U.S.-China relations, trade policy