Asian Markets Bounce Back As China-US Trade Fears Ease – International Business Times

Published on: 2025-10-20

Intelligence Report: Asian Markets Bounce Back As China-US Trade Fears Ease – International Business Times

1. BLUF (Bottom Line Up Front)

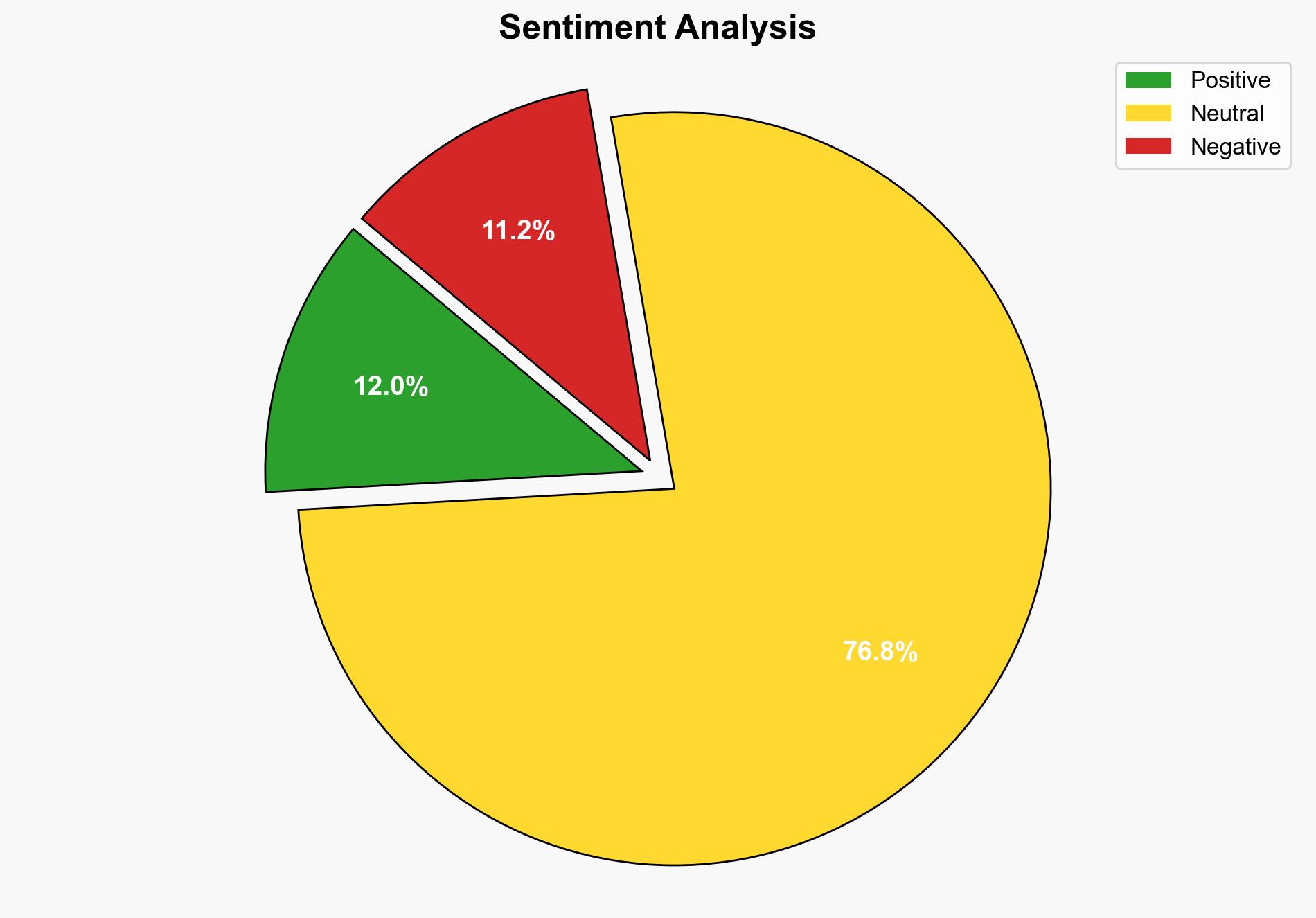

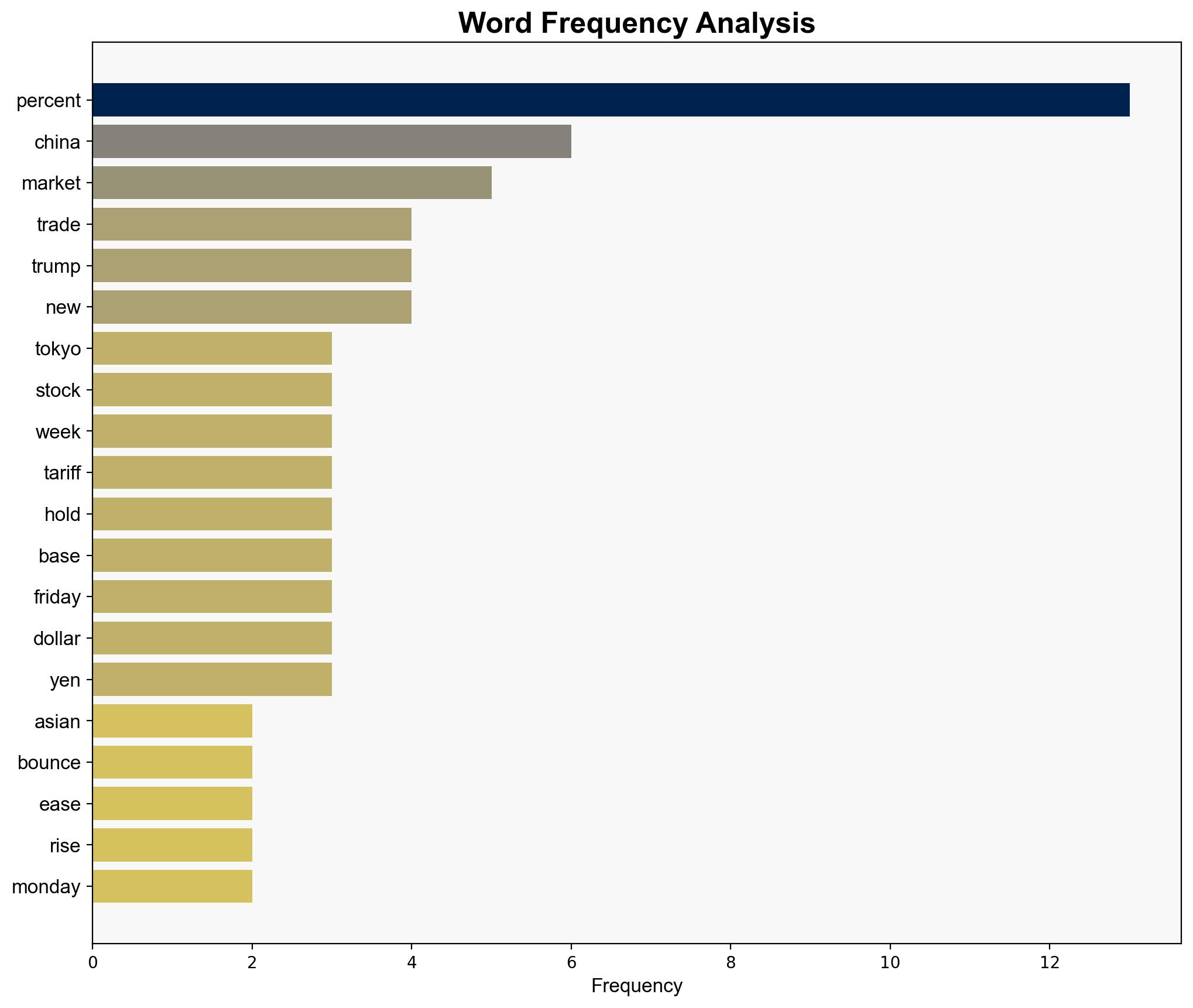

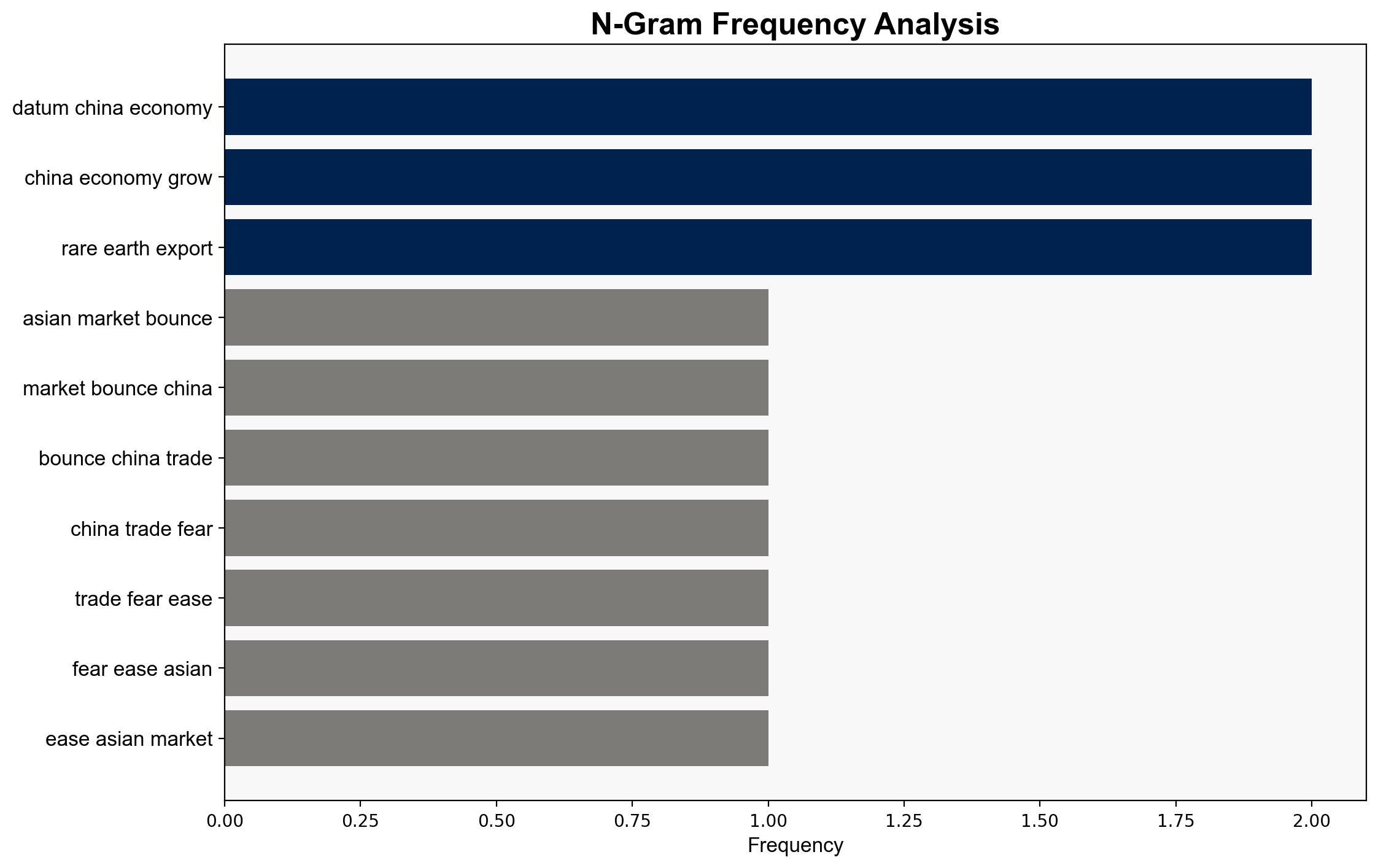

The most supported hypothesis is that the easing of trade tensions between the US and China is driving a temporary positive response in Asian markets. Confidence level: Moderate. It is recommended to monitor ongoing trade negotiations closely and prepare for potential volatility should talks falter.

2. Competing Hypotheses

Hypothesis 1: The positive movement in Asian markets is primarily due to the easing of trade tensions between the US and China, as indicated by recent conciliatory comments and planned trade talks.

Hypothesis 2: The market bounce is a temporary reaction driven by domestic factors in Asia, such as Japan’s political stability and China’s economic performance, rather than a significant shift in US-China trade relations.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes that US-China trade negotiations will continue to progress positively.

– Hypothesis 2 assumes that domestic economic indicators in Asian countries are strong enough to sustain market growth independently of US-China relations.

Red Flags:

– Potential over-reliance on political statements without concrete trade agreements.

– Lack of detailed information on the depth and outcomes of the recent US-China discussions.

4. Implications and Strategic Risks

– If US-China trade talks deteriorate, markets may experience increased volatility, impacting global economic stability.

– Continued positive market trends could bolster investor confidence, but reliance on political developments introduces significant risk.

– Geopolitical tensions could escalate if trade negotiations fail, affecting not only economic but also cyber and security domains.

5. Recommendations and Outlook

- Monitor US-China trade negotiations closely for any signs of breakdown or progress.

- Prepare for market volatility by diversifying investments and hedging against potential risks.

- Best-case scenario: Successful trade negotiations lead to sustained market growth.

- Worst-case scenario: Breakdown in talks results in renewed tariffs and market downturn.

- Most likely scenario: Fluctuations in market sentiment as negotiations progress with intermittent challenges.

6. Key Individuals and Entities

– Donald Trump

– Xi Jinping

– Li Feng

– Scott Bessent

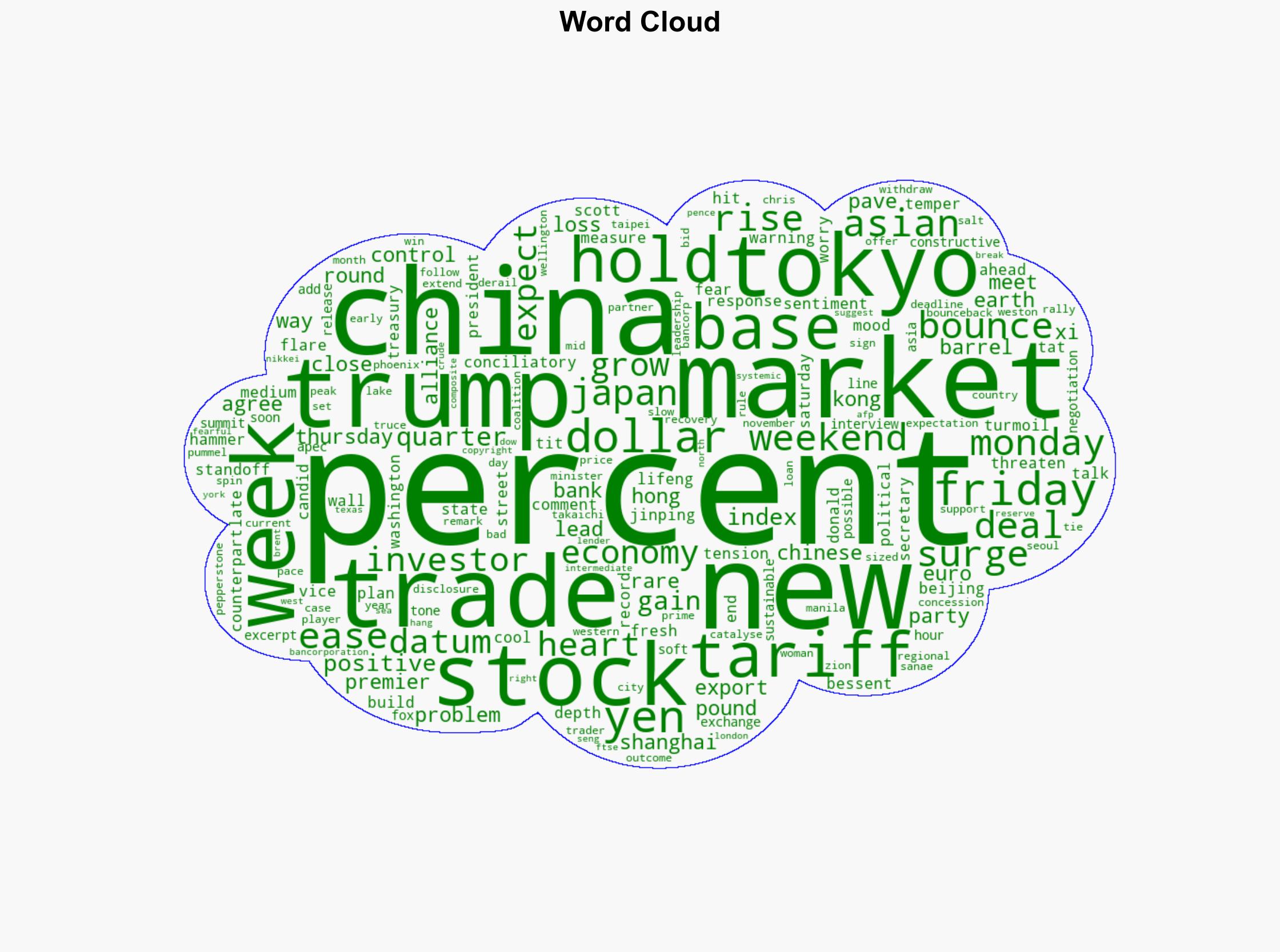

7. Thematic Tags

national security threats, economic stability, geopolitical dynamics, trade negotiations