Asian markets rally as new US jobs data fans rate cut hopes – Digital Journal

Published on: 2025-09-10

Intelligence Report: Asian markets rally as new US jobs data fans rate cut hopes – Digital Journal

1. BLUF (Bottom Line Up Front)

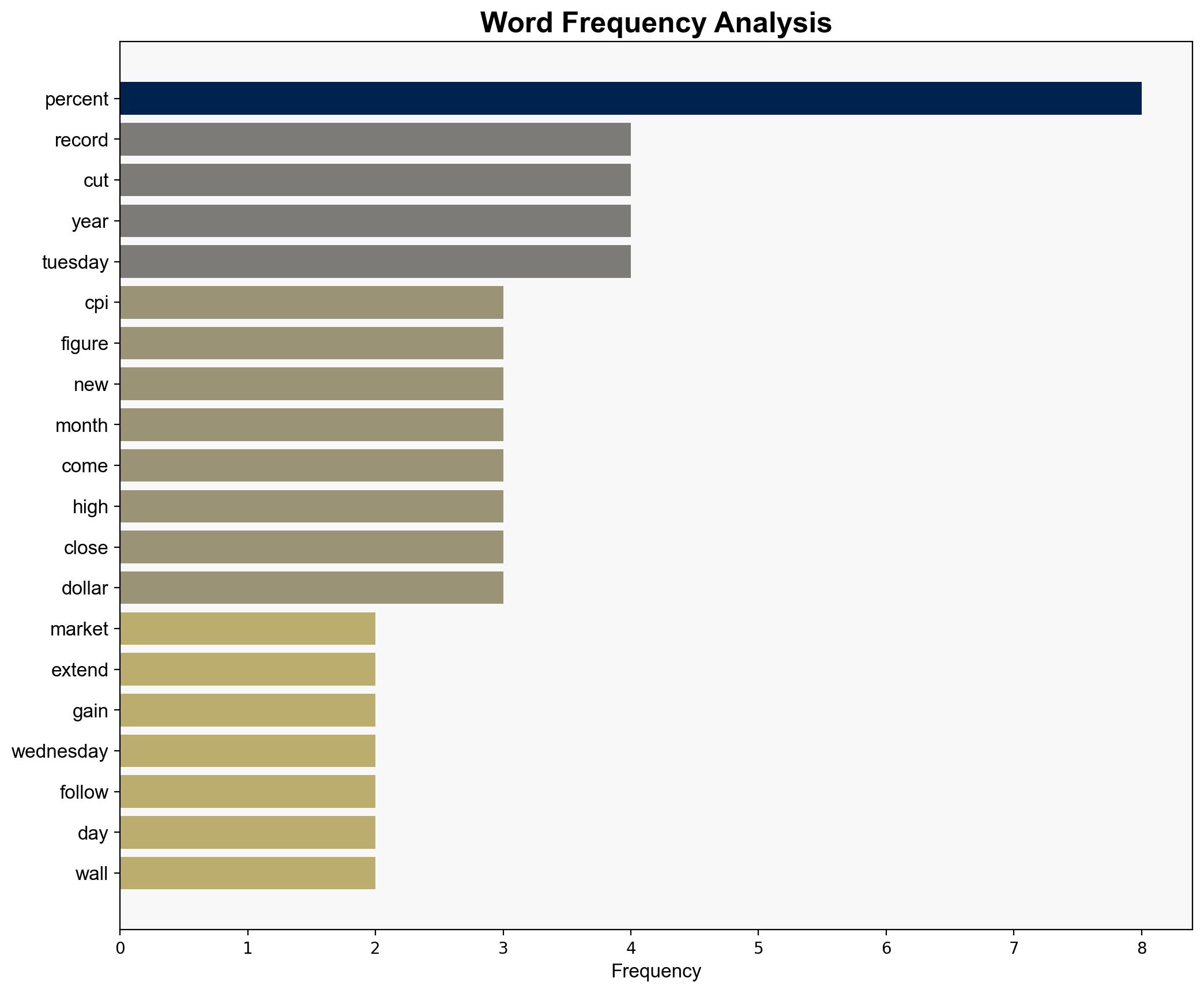

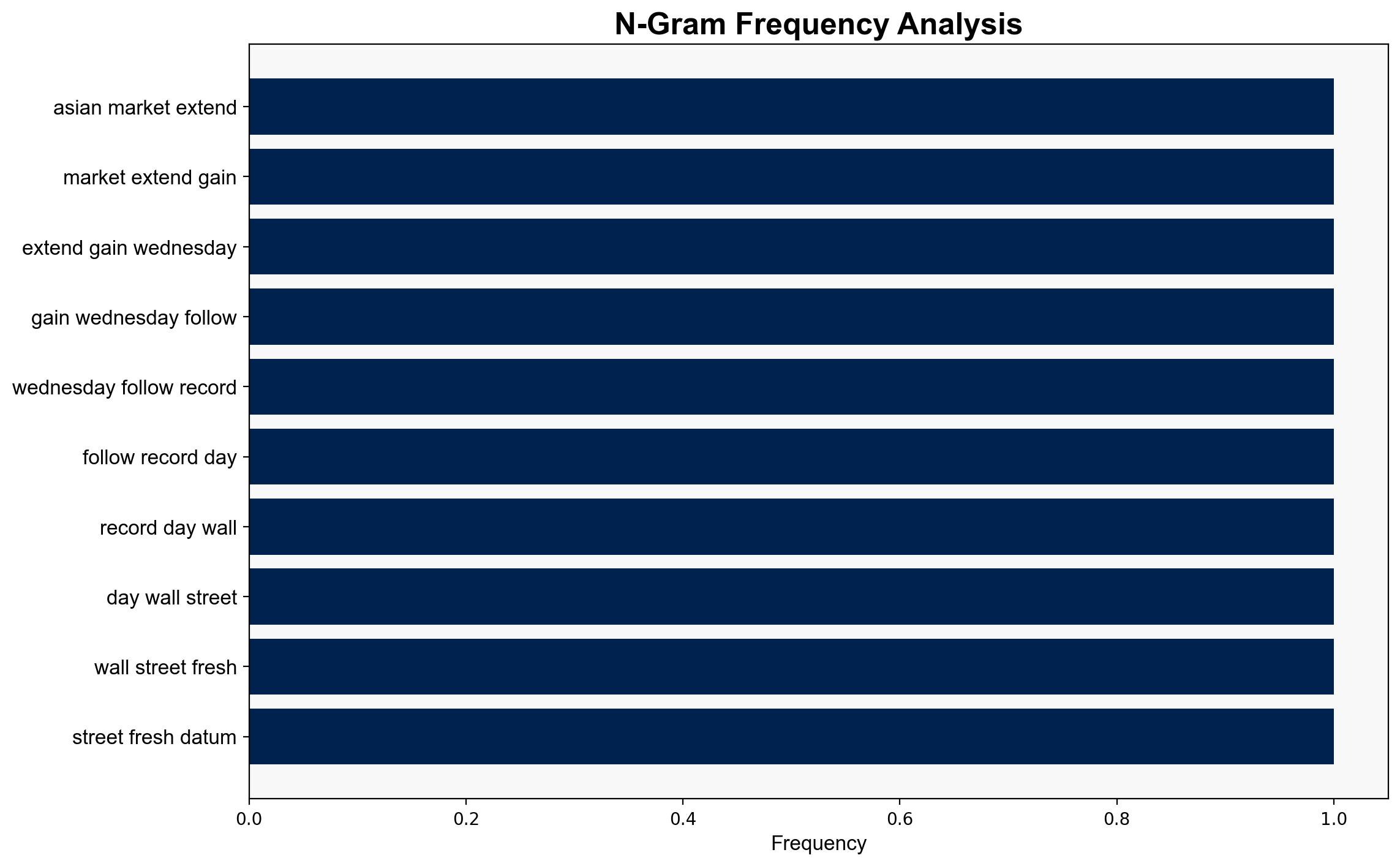

The most supported hypothesis is that the recent US jobs data, indicating a weakening job market, has increased expectations for Federal Reserve rate cuts, thereby boosting Asian markets. Confidence level: Moderate. Recommended action: Monitor upcoming Federal Reserve announcements and CPI figures closely to anticipate market movements and adjust investment strategies accordingly.

2. Competing Hypotheses

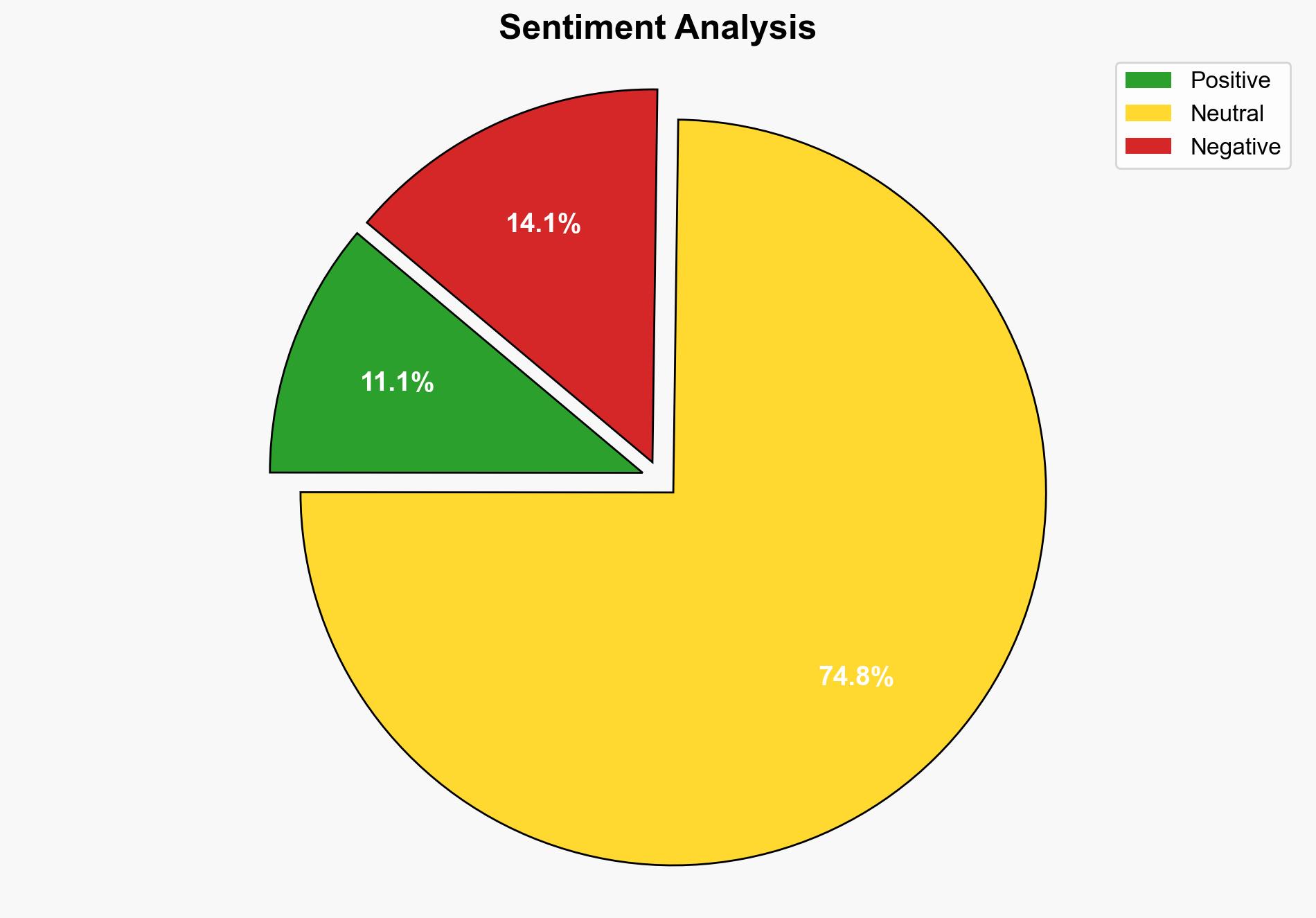

1. **Hypothesis A**: The weakening US job market data has heightened expectations for Federal Reserve rate cuts, leading to a rally in Asian markets as investors anticipate easier monetary policy.

2. **Hypothesis B**: The rally in Asian markets is primarily driven by regional factors, such as economic reforms in South Korea and stimulus measures in China, with US data playing a secondary role.

Using ACH 2.0, Hypothesis A is better supported due to the immediate market reactions following the US jobs data release and the historical sensitivity of markets to Federal Reserve policy expectations.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that market participants heavily weigh US economic indicators and Federal Reserve actions. Hypothesis B assumes regional developments have a significant independent impact on market movements.

– **Red Flags**: Potential over-reliance on US data as a market driver may overlook significant regional economic developments. Additionally, the assumption that rate cuts will positively impact markets may not hold if inflation remains high.

4. Implications and Strategic Risks

– **Economic Risks**: A misalignment between market expectations and Federal Reserve actions could lead to increased volatility.

– **Geopolitical Risks**: Ongoing US-China trade tensions and regional political instability could undermine market confidence.

– **Psychological Risks**: Investor sentiment may shift rapidly if anticipated rate cuts do not materialize or if CPI data indicates persistent inflation.

5. Recommendations and Outlook

- Monitor Federal Reserve communications and CPI data releases to anticipate potential market shifts.

- Consider diversifying investments to hedge against regional economic volatility.

- Scenario Projections:

- Best Case: Federal Reserve cuts rates, CPI data shows controlled inflation, leading to sustained market growth.

- Worst Case: No rate cuts, high inflation persists, resulting in market downturns.

- Most Likely: Moderate rate cuts with mixed CPI data, leading to cautious market optimism.

6. Key Individuals and Entities

– Jerome Powell

– President Donald Trump

– Prabowo Subianto

– Sri Mulyani Indrawati

– Peiqian Liu

7. Thematic Tags

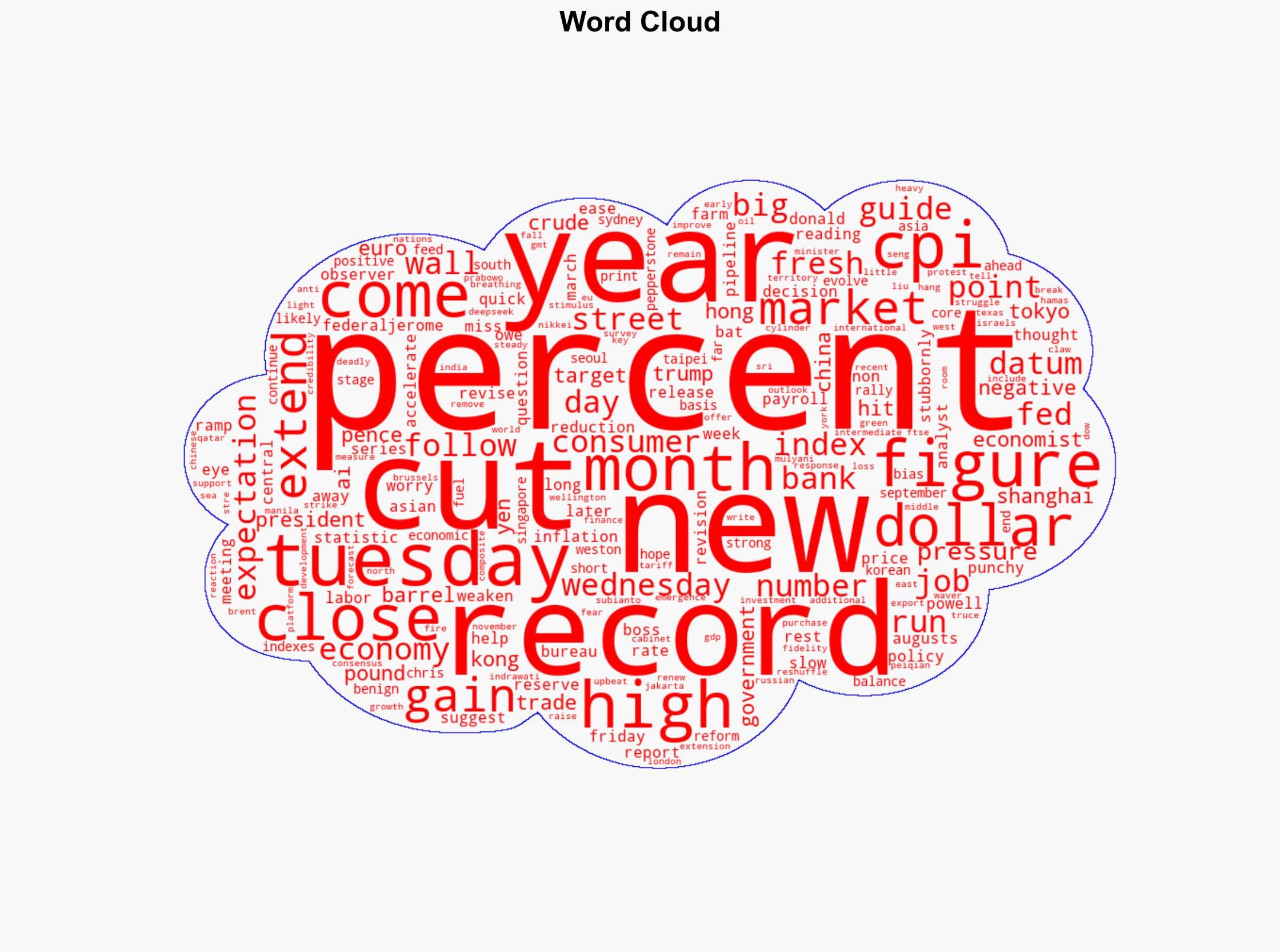

economic policy, market analysis, Federal Reserve, Asian markets, geopolitical risk