Asian Shares Rise As US-China Trade Tensions Cool Markets Wrap – Ndtvprofit.com

Published on: 2025-10-20

Intelligence Report: Asian Shares Rise As US-China Trade Tensions Cool Markets Wrap – Ndtvprofit.com

1. BLUF (Bottom Line Up Front)

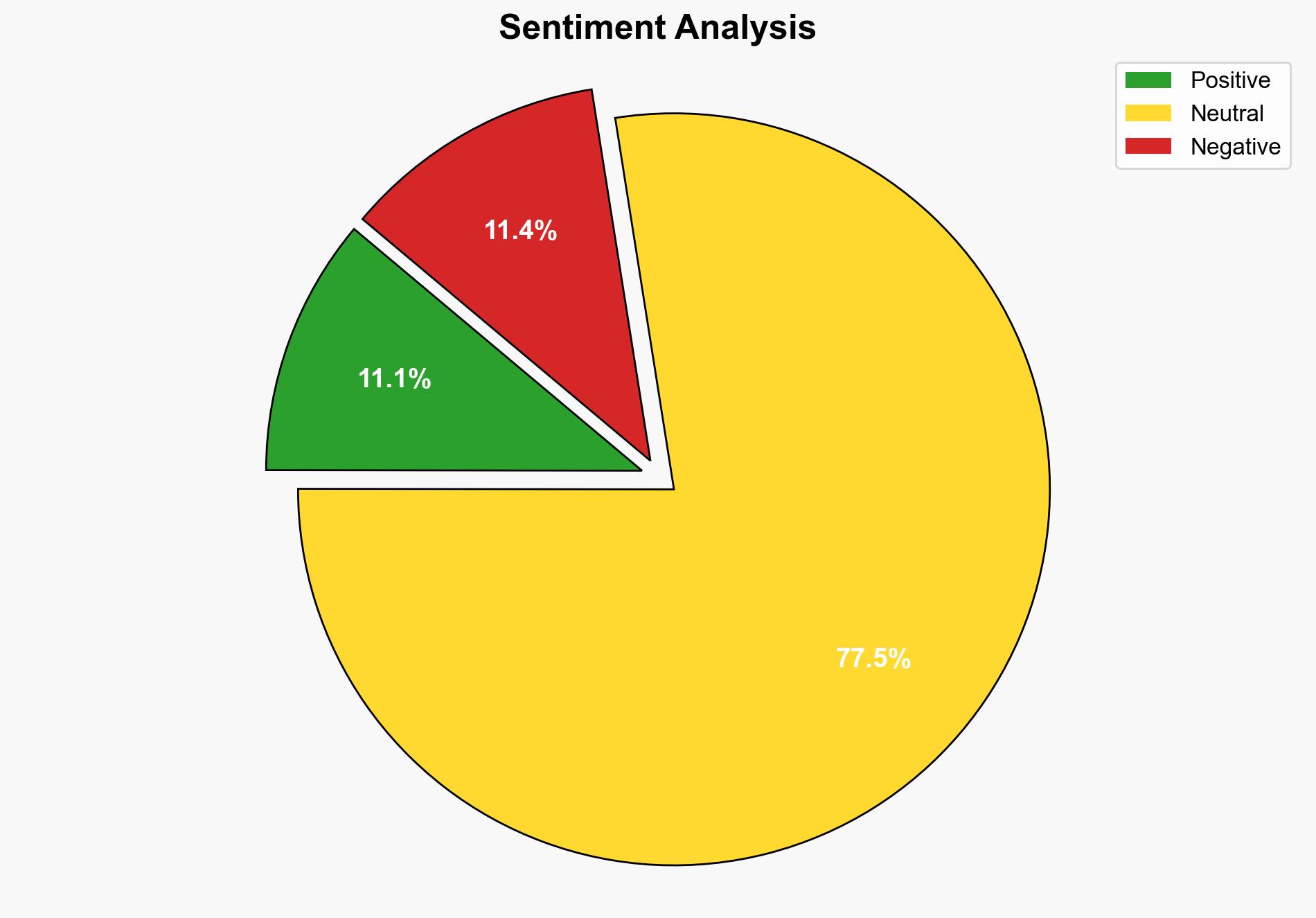

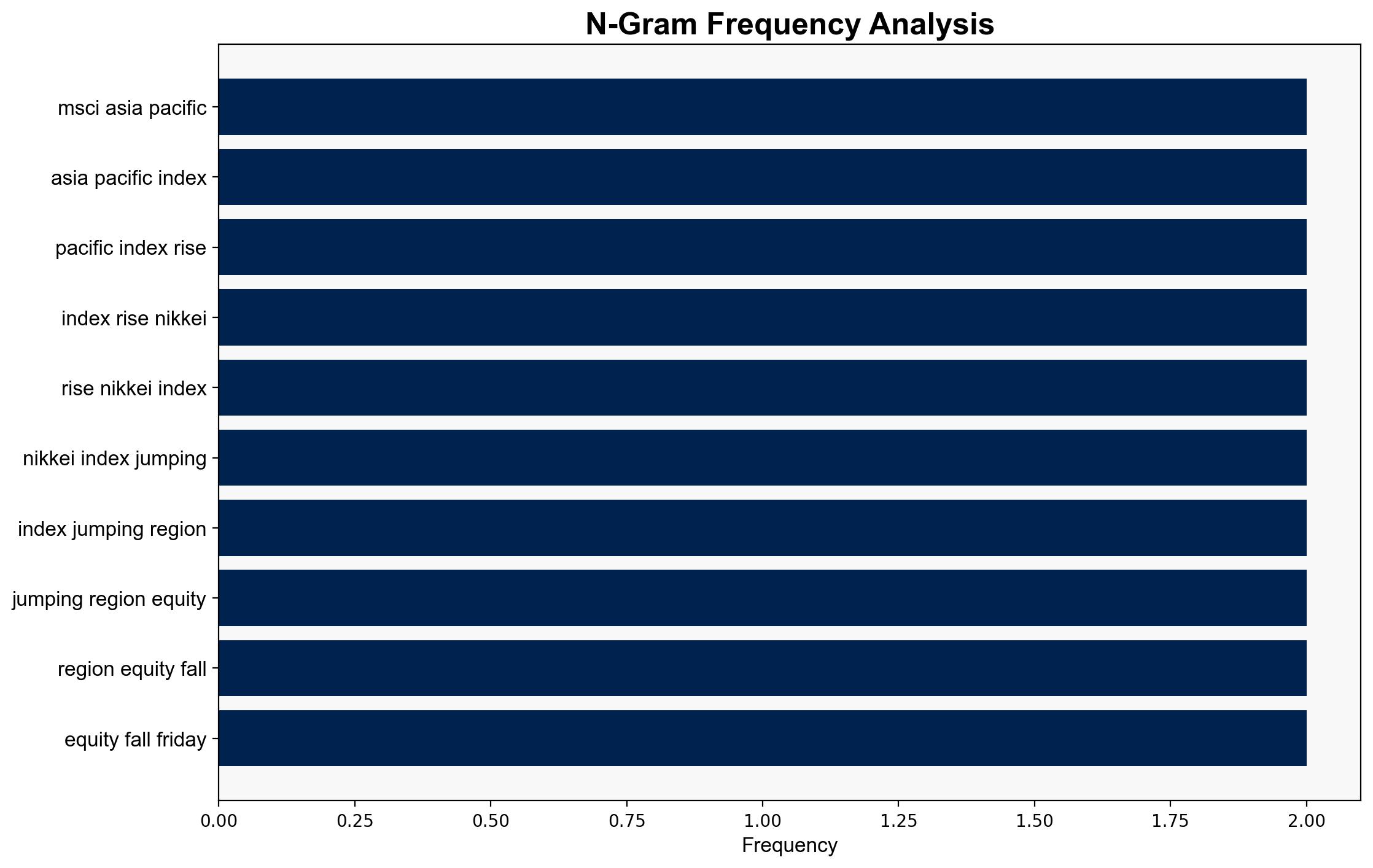

The most supported hypothesis is that the easing of US-China trade tensions is temporarily boosting Asian markets, but underlying geopolitical and economic uncertainties remain. Confidence level: Moderate. Recommended action: Monitor ongoing trade negotiations closely and prepare for potential volatility in response to geopolitical developments.

2. Competing Hypotheses

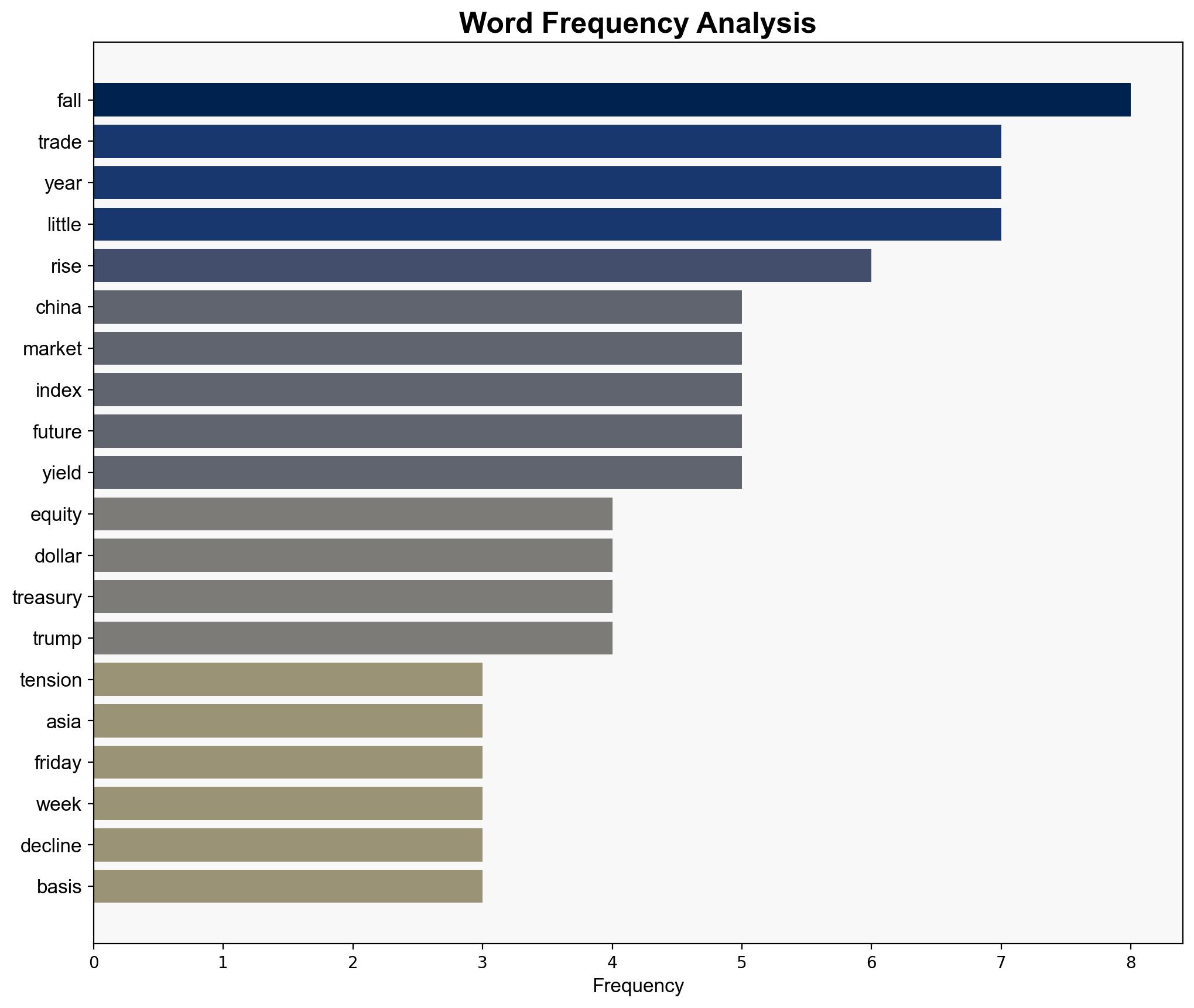

1. **Hypothesis A**: The rise in Asian shares is primarily due to genuine progress in US-China trade negotiations, suggesting a sustainable positive trend in market sentiment.

2. **Hypothesis B**: The rise in Asian shares is a temporary reaction to perceived easing of tensions, with no substantial progress in negotiations, indicating potential volatility ahead.

Using ACH 2.0, Hypothesis B is better supported. The report highlights that while there are talks scheduled, there is no explicit backdown or resolution, suggesting that the market response may be premature.

3. Key Assumptions and Red Flags

– **Assumptions**: Both hypotheses assume that market movements are directly influenced by trade negotiations. Hypothesis A assumes that negotiations will lead to a positive outcome.

– **Red Flags**: The lack of explicit announcements or agreements raises questions about the sustainability of market optimism. The potential for cognitive bias exists if analysts overestimate the impact of negotiations without concrete results.

4. Implications and Strategic Risks

– **Economic Risks**: Continued uncertainty in US-China trade relations could lead to market volatility, affecting global supply chains and economic stability.

– **Geopolitical Risks**: Escalation in trade tensions could exacerbate geopolitical frictions, impacting regional security dynamics.

– **Psychological Risks**: Investor sentiment may become overly reliant on speculative news, leading to erratic market behavior.

5. Recommendations and Outlook

- Monitor the progress of US-China trade talks and prepare for rapid response to any announcements.

- Develop contingency plans for potential market volatility, including hedging strategies.

- Scenario Projections:

- Best Case: Successful trade negotiations lead to sustained market growth.

- Worst Case: Breakdown in talks results in renewed trade tensions and market decline.

- Most Likely: Continued uncertainty with intermittent market fluctuations.

6. Key Individuals and Entities

– Donald Trump

– Scott Bessent

– Li Feng

– Jamieson Greer

– Chris Weston

7. Thematic Tags

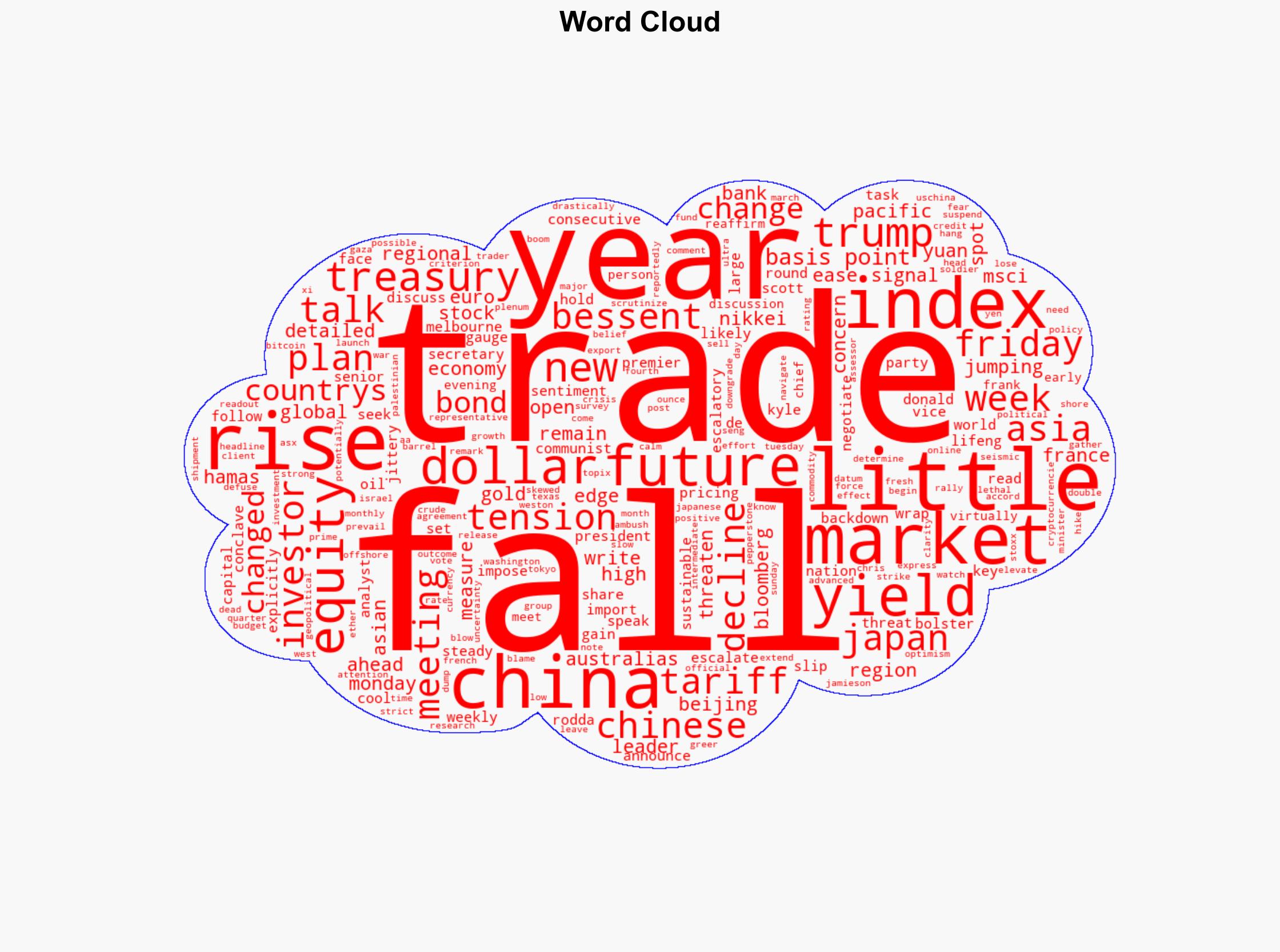

national security threats, economic stability, geopolitical tensions, market volatility