Asian Stocks Edge Up At Open Bitcoin In Focus Markets Wrap – Ndtvprofit.com

Published on: 2025-11-17

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

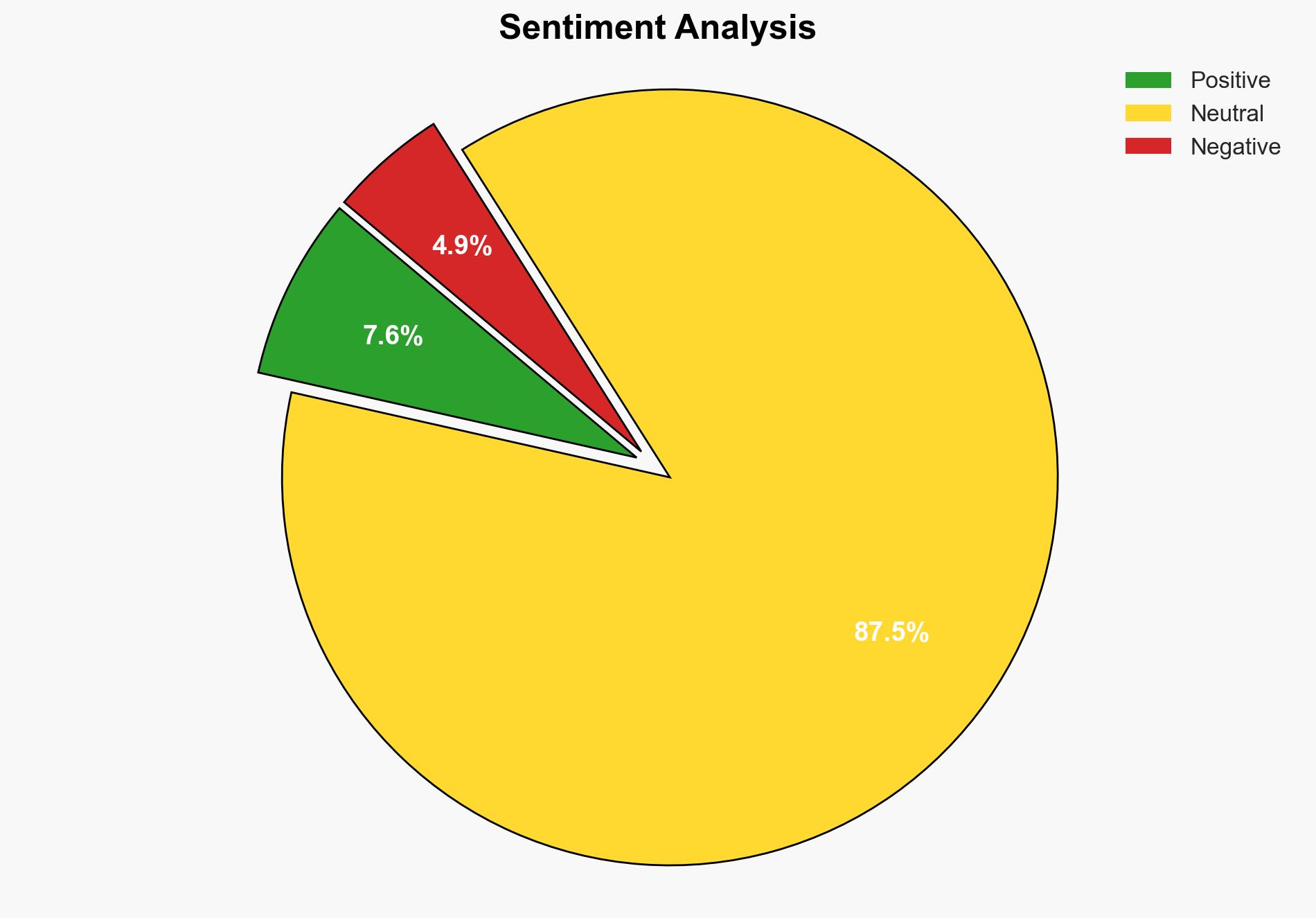

With a moderate confidence level, the most supported hypothesis is that the current market volatility and cautious investor sentiment are primarily driven by mixed economic indicators and uncertainties surrounding Federal Reserve policies. Strategic recommendation includes closely monitoring Federal Reserve communications and economic data releases to anticipate market shifts and adjust investment strategies accordingly.

2. Competing Hypotheses

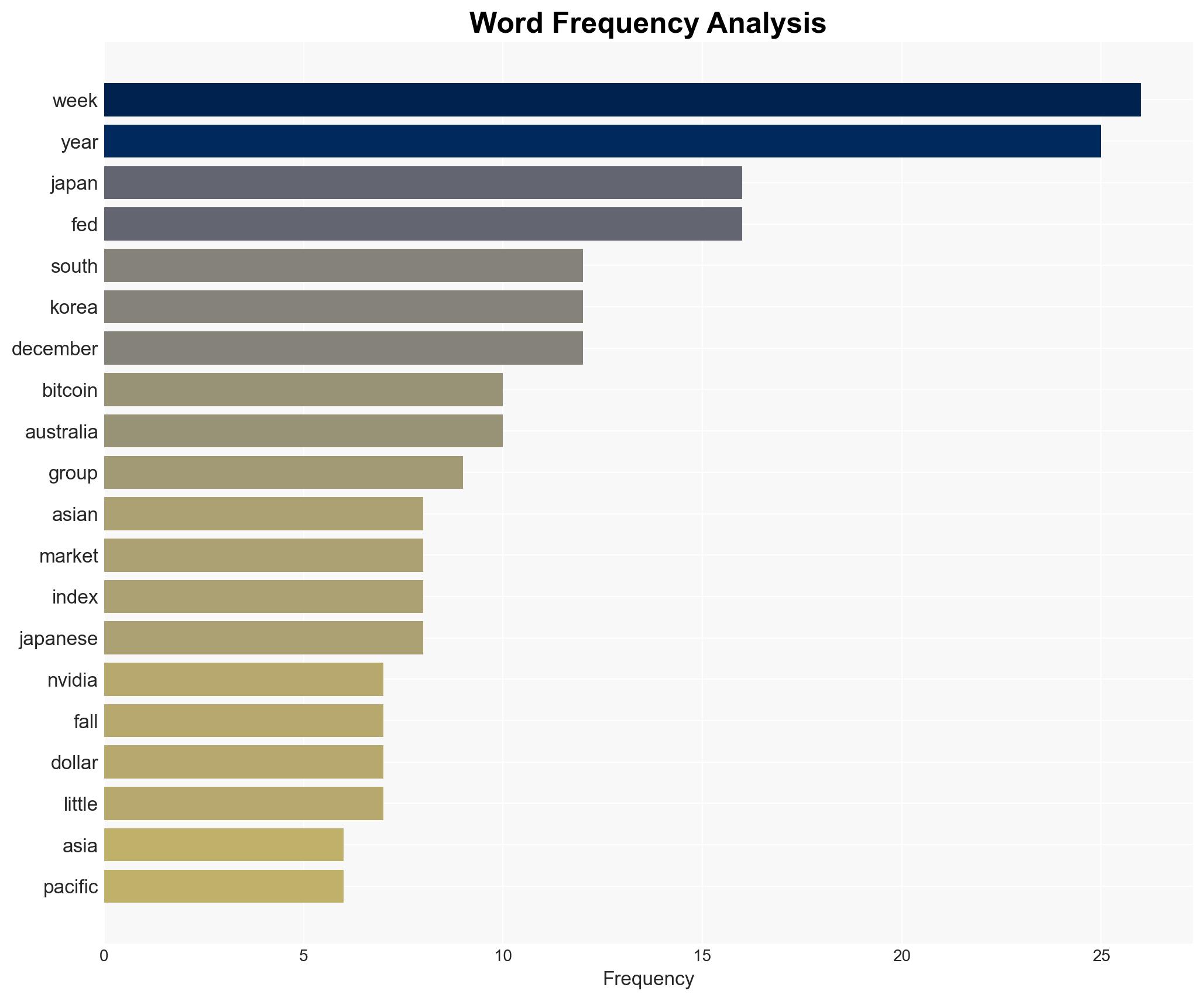

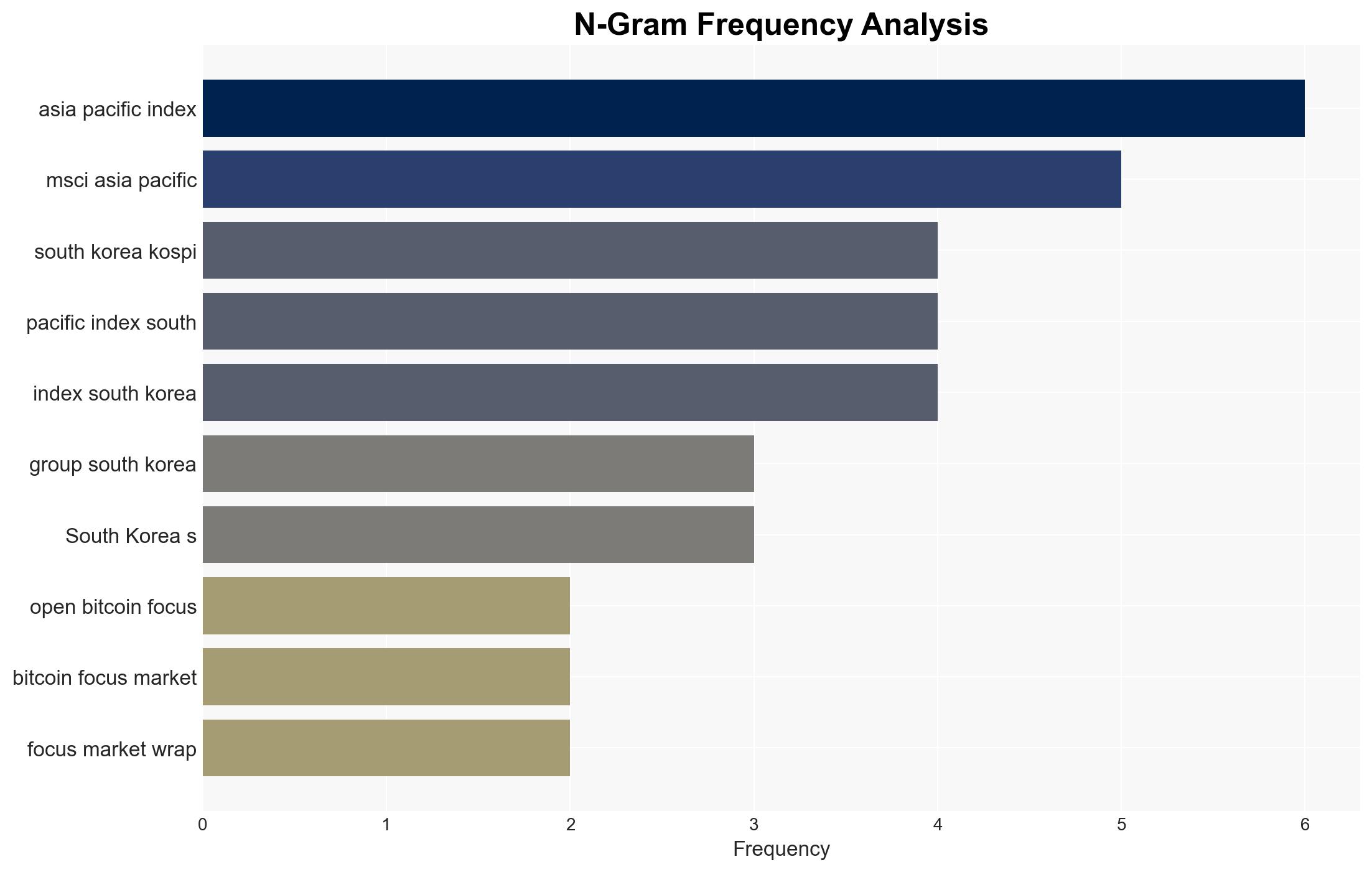

Hypothesis 1: The volatility in Asian stock markets and the focus on Bitcoin are primarily driven by mixed economic data and uncertainties regarding Federal Reserve interest rate policies.

Hypothesis 2: The market movements are significantly influenced by geopolitical tensions, particularly between China and Japan, and the impact of AI and technology sector valuations.

Hypothesis 1 is more likely due to the emphasis on economic indicators and Federal Reserve policy discussions in the source text. The mention of Nvidia’s earnings and AI valuations suggests a secondary influence, but the primary driver appears to be economic and monetary policy-related.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that investor sentiment is heavily influenced by economic data and Federal Reserve policies. Another assumption is that geopolitical tensions have a lesser immediate impact on market volatility.

Red Flags: The potential for misinterpretation of economic data and Federal Reserve communications could lead to unexpected market reactions. Additionally, the reliance on AI and technology sector performance introduces volatility due to high valuations.

4. Implications and Strategic Risks

The primary risk is economic, with the potential for market corrections if Federal Reserve policy diverges from investor expectations. Geopolitical tensions could escalate, impacting trade and market stability. Cyber threats targeting financial systems could exacerbate market volatility. Informational risks include misinformation or misinterpretation of economic data and policy announcements.

5. Recommendations and Outlook

- Monitor Federal Reserve communications and economic data releases closely to anticipate market shifts.

- Consider diversifying investment portfolios to mitigate risks associated with high technology sector valuations.

- Best-case scenario: Clear communication from the Federal Reserve stabilizes markets, and positive economic indicators support growth.

- Worst-case scenario: Miscommunication or adverse economic data leads to significant market corrections and increased volatility.

- Most-likely scenario: Continued cautious market sentiment with moderate volatility as investors navigate mixed signals.

6. Key Individuals and Entities

Jerome Powell (Federal Reserve Chair), Shane Oliver (Chief Economist, Head of Investment Strategy), Nvidia Corp, Samsung Group, SK Group, Alibaba Group Holding Ltd.

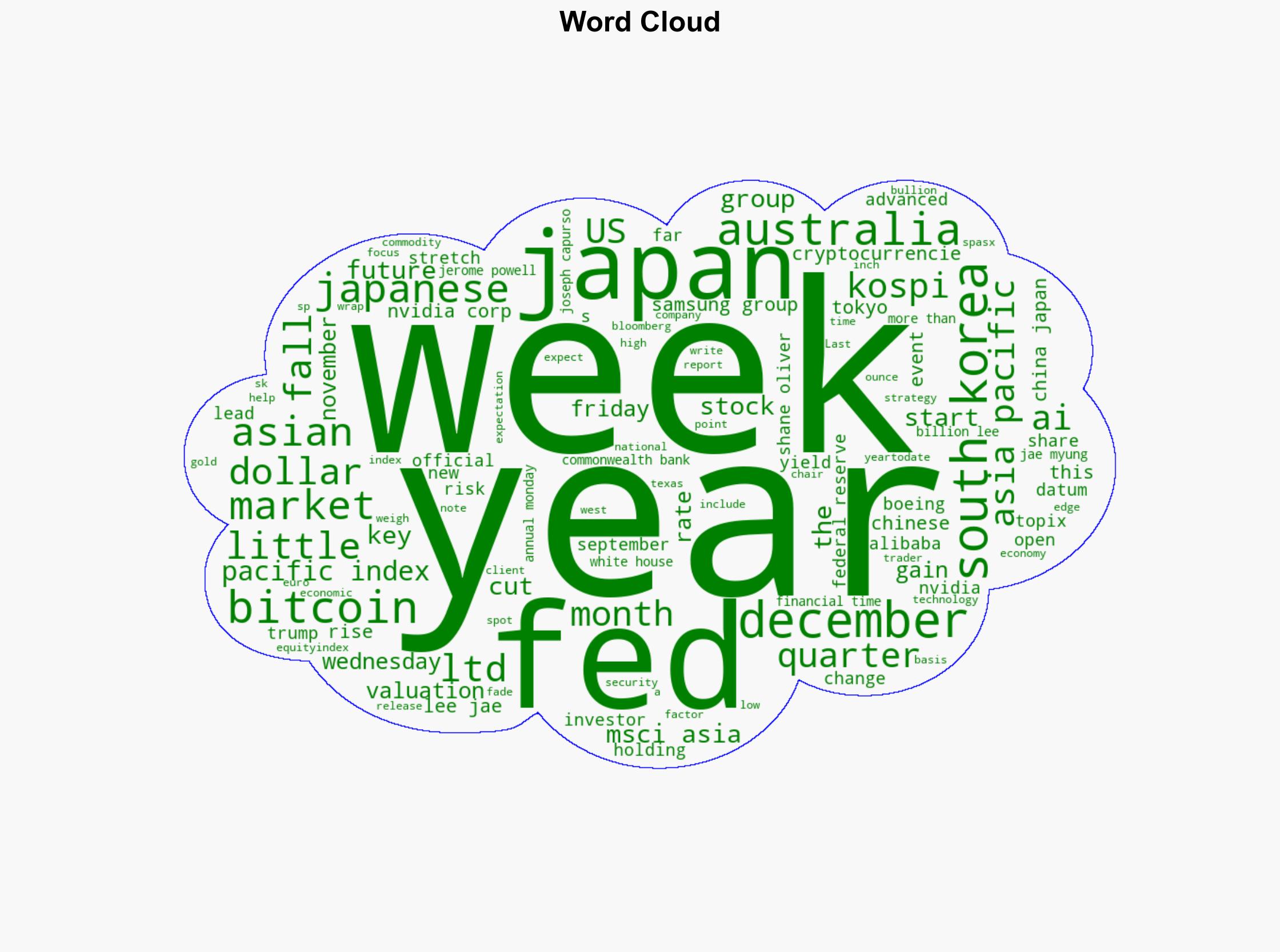

7. Thematic Tags

National Security Threats, Economic Volatility, Federal Reserve Policy, Geopolitical Tensions, Technology Sector Valuations

Structured Analytic Techniques Applied

- Cognitive Bias Stress Test: Expose and correct potential biases in assessments through red-teaming and structured challenge.

- Bayesian Scenario Modeling: Use probabilistic forecasting for conflict trajectories or escalation likelihood.

- Network Influence Mapping: Map relationships between state and non-state actors for impact estimation.

Explore more:

National Security Threats Briefs ·

Daily Summary ·

Support us

·