Asian Stocks Fall With Wall St As US Credit Fears Add To Worries – International Business Times

Published on: 2025-10-17

Intelligence Report: Asian Stocks Fall With Wall St As US Credit Fears Add To Worries – International Business Times

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that the current market downturn is primarily driven by a combination of heightened credit market fears and geopolitical tensions, particularly involving US-China trade relations. Confidence level: Moderate. Recommended action: Monitor developments in US-China trade negotiations and credit market indicators closely, while preparing for potential policy interventions to stabilize markets.

2. Competing Hypotheses

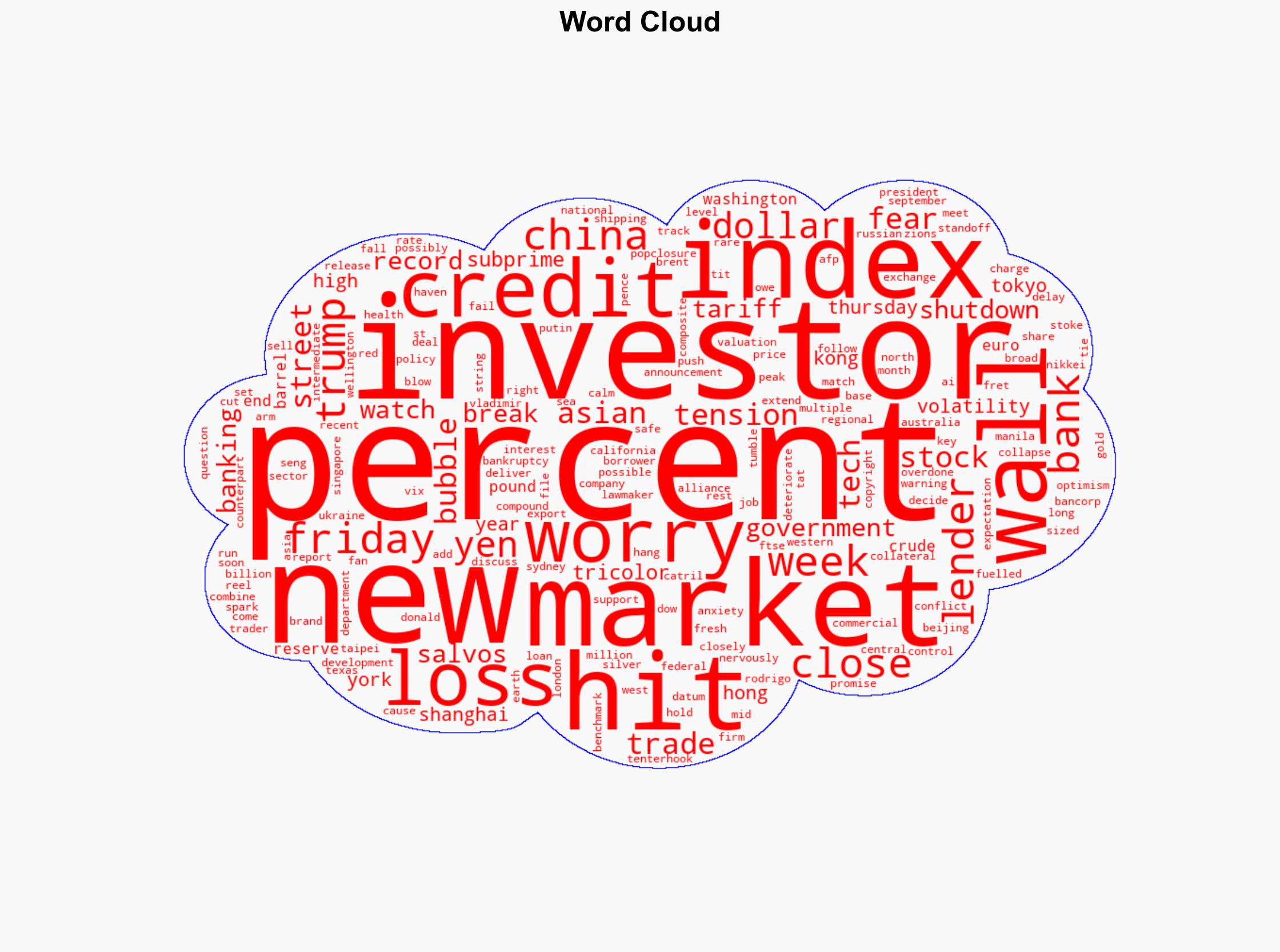

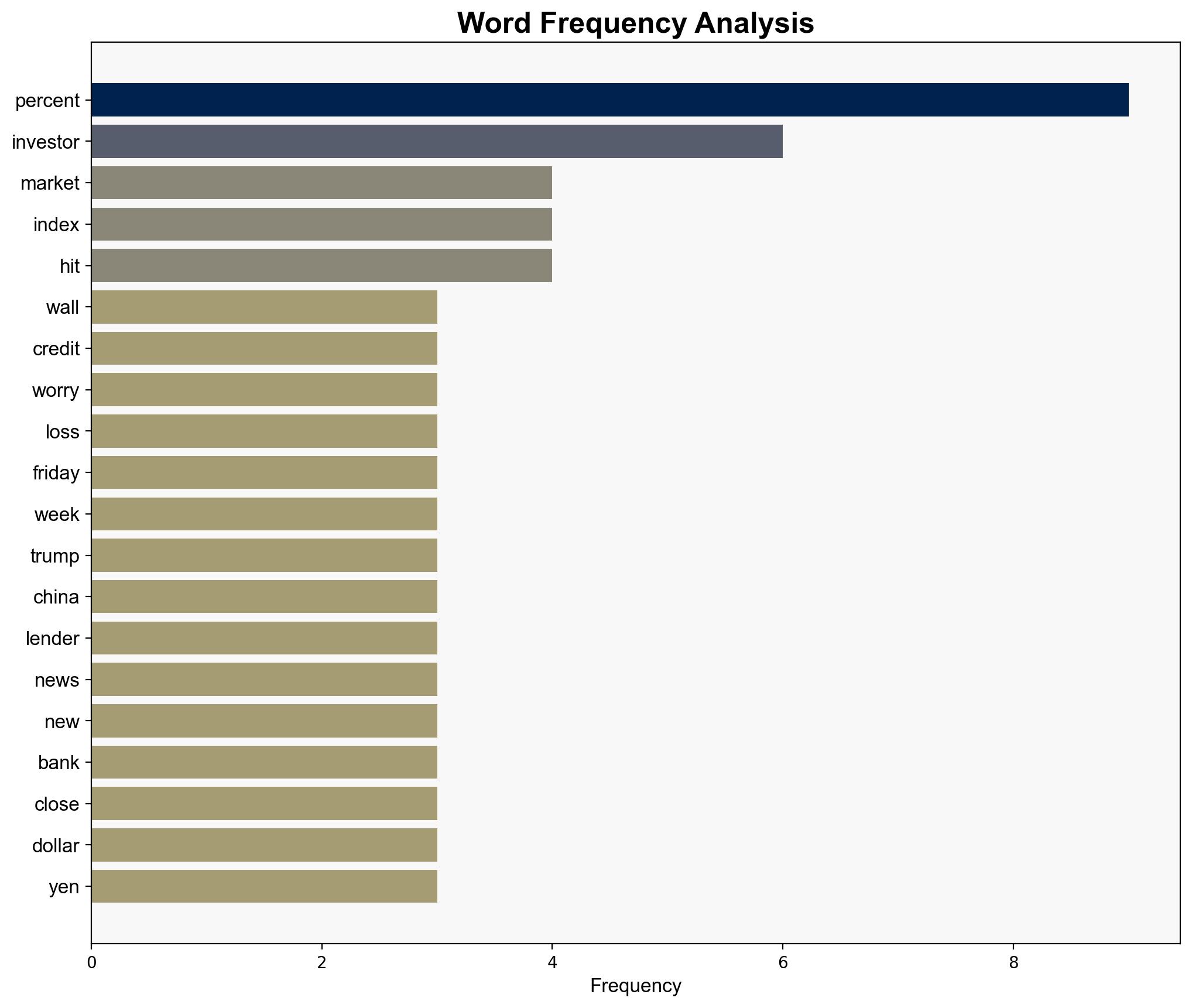

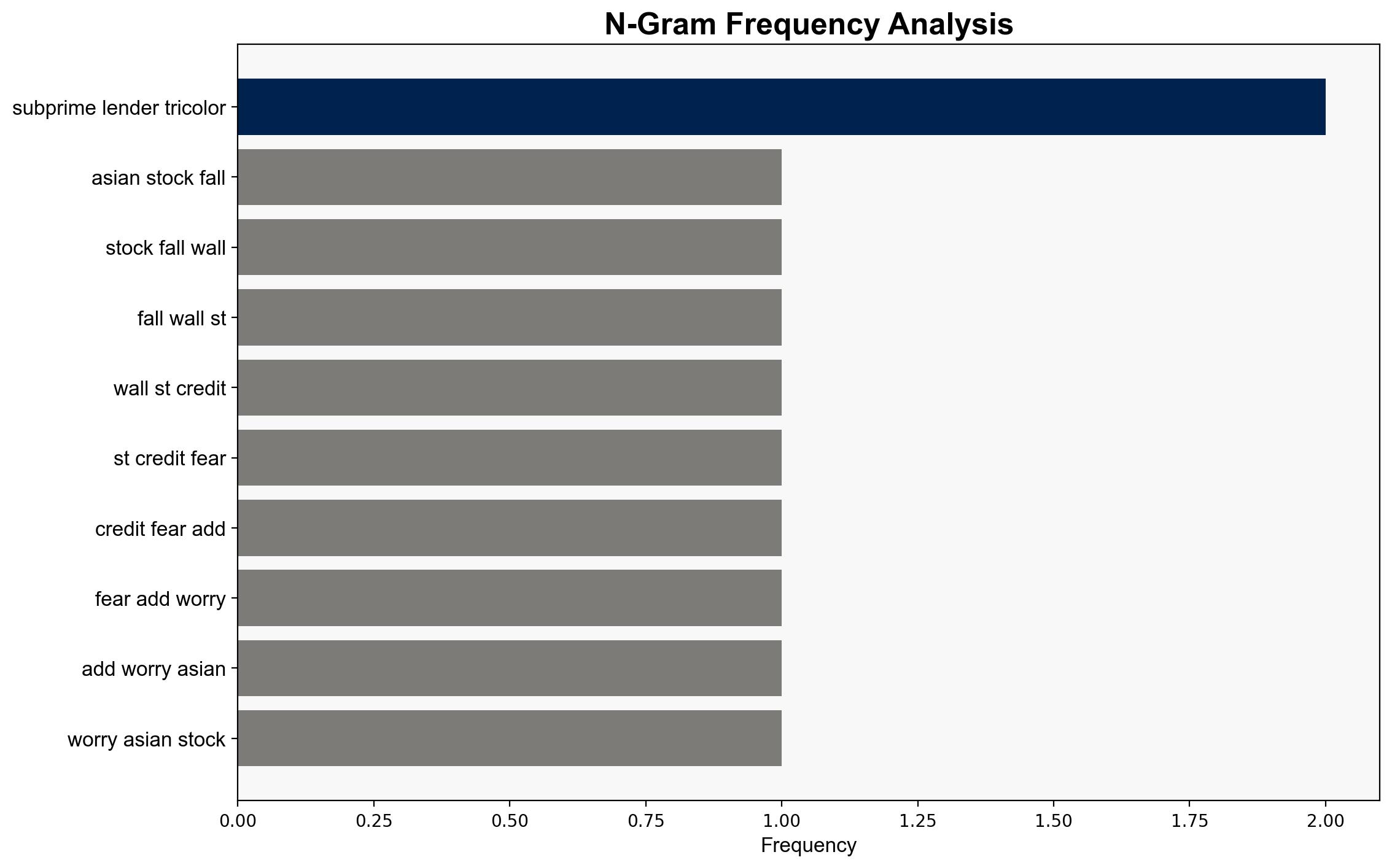

1. **Hypothesis A**: The decline in Asian and Wall Street stocks is mainly due to renewed fears in the credit markets, exacerbated by the recent bankruptcy of subprime lender Tricolor and the financial instability of mid-sized banks.

2. **Hypothesis B**: The stock market downturn is primarily driven by geopolitical tensions, particularly the US-China trade standoff, compounded by fears of a tech bubble burst and government shutdown impacts.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is supported by the immediate financial indicators and recent banking sector developments. However, Hypothesis B is reinforced by the broader geopolitical context and historical market reactions to similar tensions.

3. Key Assumptions and Red Flags

– **Assumptions**: Both hypotheses assume that investor behavior is significantly influenced by either financial or geopolitical news. Hypothesis A assumes a direct causal link between credit fears and market performance, while Hypothesis B assumes geopolitical tensions have a more substantial impact.

– **Red Flags**: The potential underestimation of the tech bubble’s impact and the lack of concrete data on the extent of the government shutdown’s economic effects.

– **Blind Spots**: Limited information on the resilience of the tech sector and potential mitigating actions by central banks.

4. Implications and Strategic Risks

– **Economic Risks**: Prolonged market instability could lead to reduced investor confidence and a slowdown in economic growth.

– **Geopolitical Risks**: Escalation in US-China trade tensions could further destabilize global markets and impact international relations.

– **Psychological Risks**: Increased market volatility may lead to panic selling and exacerbate financial instability.

5. Recommendations and Outlook

- **Mitigation**: Encourage diplomatic engagement between the US and China to reduce trade tensions. Monitor credit market developments closely.

- **Opportunities**: Explore investment in safe-haven assets like gold and silver as a hedge against market volatility.

- **Scenario Projections**:

– **Best Case**: Resolution of US-China trade issues leads to market stabilization.

– **Worst Case**: Continued escalation in trade tensions and credit market instability trigger a broader economic downturn.

– **Most Likely**: Ongoing volatility with intermittent stabilization efforts by central banks.

6. Key Individuals and Entities

– Donald Trump

– Vladimir Putin

– Tricolor Holdings

– Zions Bancorp

– National Australia Bank

7. Thematic Tags

national security threats, economic instability, geopolitical tensions, financial markets