Asian Stocks Rally As Traders Cheer Trump-Xi Meeting Plan – International Business Times

Published on: 2025-10-24

Intelligence Report: Asian Stocks Rally As Traders Cheer Trump-Xi Meeting Plan – International Business Times

1. BLUF (Bottom Line Up Front)

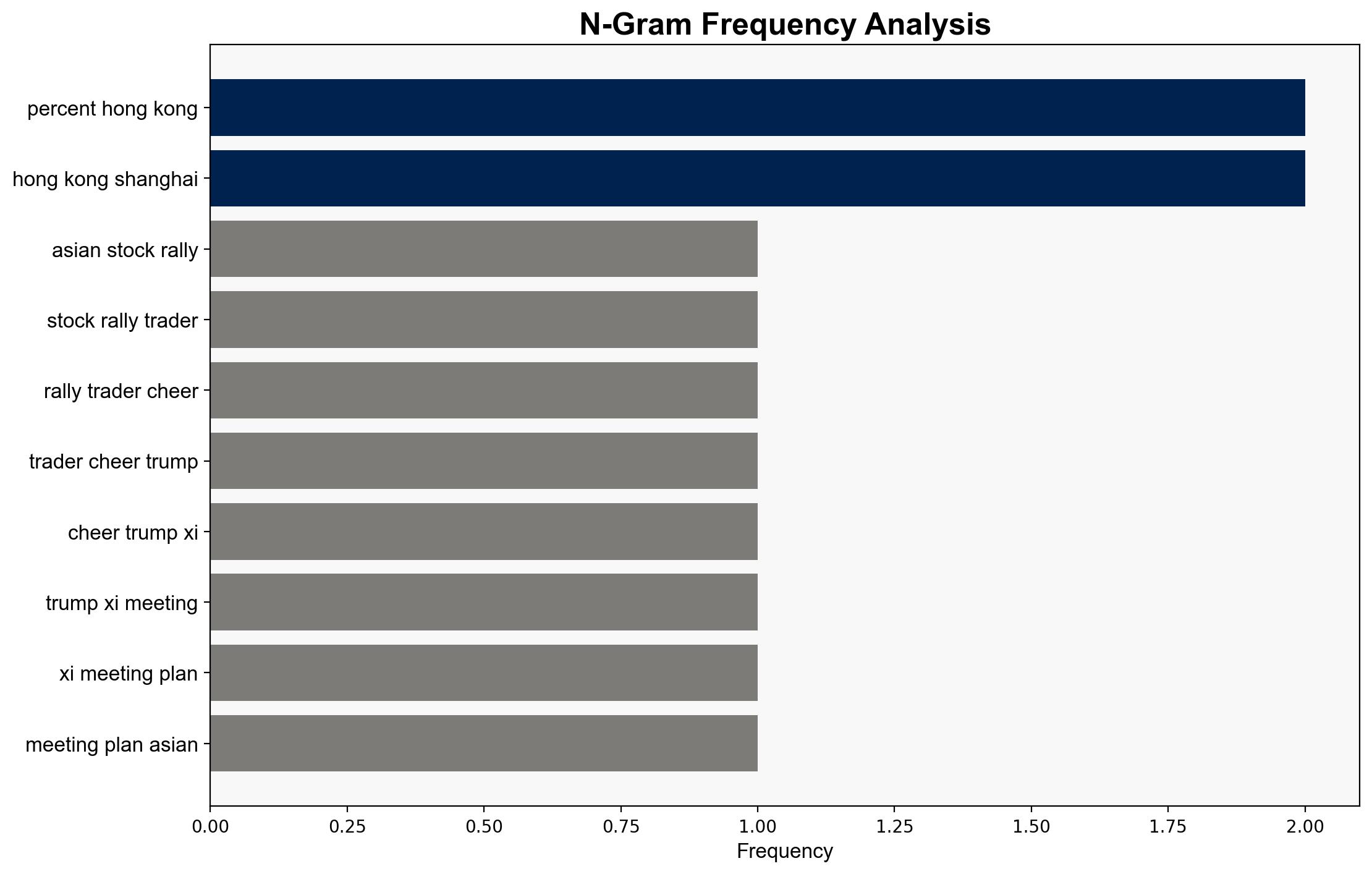

The strategic judgment is that the planned meeting between Donald Trump and Xi Jinping is likely to temporarily stabilize Asian markets, with a moderate confidence level. The hypothesis that the meeting will lead to a de-escalation of trade tensions is better supported. It is recommended to monitor the outcomes of the meeting closely and prepare for potential volatility in case the talks do not yield substantial agreements.

2. Competing Hypotheses

Hypothesis 1: The announcement of the Trump-Xi meeting will lead to a sustained rally in Asian markets due to expectations of reduced trade tensions and improved economic relations between the U.S. and China.

Hypothesis 2: The market rally is temporary and largely speculative, with underlying economic issues and geopolitical tensions likely to resurface, causing potential volatility.

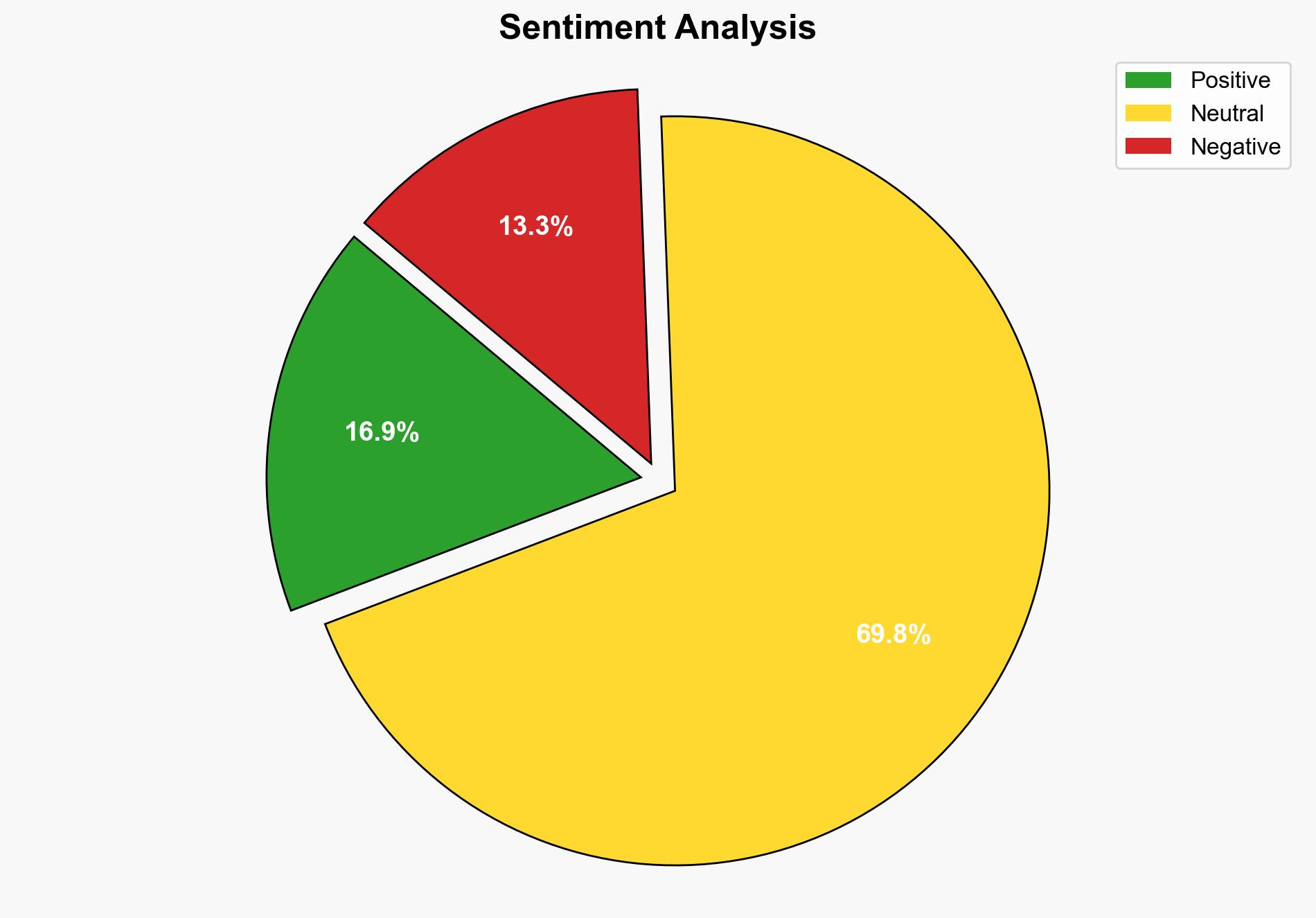

Using Analysis of Competing Hypotheses (ACH), Hypothesis 1 is better supported by the immediate positive market reaction and historical precedence of market optimism following diplomatic engagements. However, Hypothesis 2 cannot be dismissed due to ongoing geopolitical tensions and economic challenges.

3. Key Assumptions and Red Flags

Assumptions:

– The meeting will proceed as planned without significant disruptions.

– Both leaders are committed to easing trade tensions.

Red Flags:

– Previous meetings have not resulted in long-term resolutions.

– Potential for unexpected geopolitical developments, such as increased sanctions or military actions, which could derail market optimism.

– Lack of detailed information on the agenda and expected outcomes of the meeting.

4. Implications and Strategic Risks

The meeting could lead to a temporary easing of trade tensions, positively impacting global markets. However, failure to achieve substantial agreements could result in renewed volatility. The ongoing sanctions on Russian oil and potential retaliatory measures pose additional risks. Economically, unresolved issues in China’s domestic market, such as the property sector crisis, could undermine any positive outcomes from the meeting.

5. Recommendations and Outlook

- Monitor the meeting’s outcomes and prepare for potential market volatility.

- Engage in scenario planning for both positive and negative outcomes of the meeting.

- Strengthen economic ties with alternative markets to mitigate risks from potential trade disruptions.

- Best Case: The meeting results in a clear path to reducing tariffs, stabilizing markets.

- Worst Case: Talks collapse, leading to increased tariffs and market instability.

- Most Likely: Temporary market stabilization with ongoing negotiations needed for long-term solutions.

6. Key Individuals and Entities

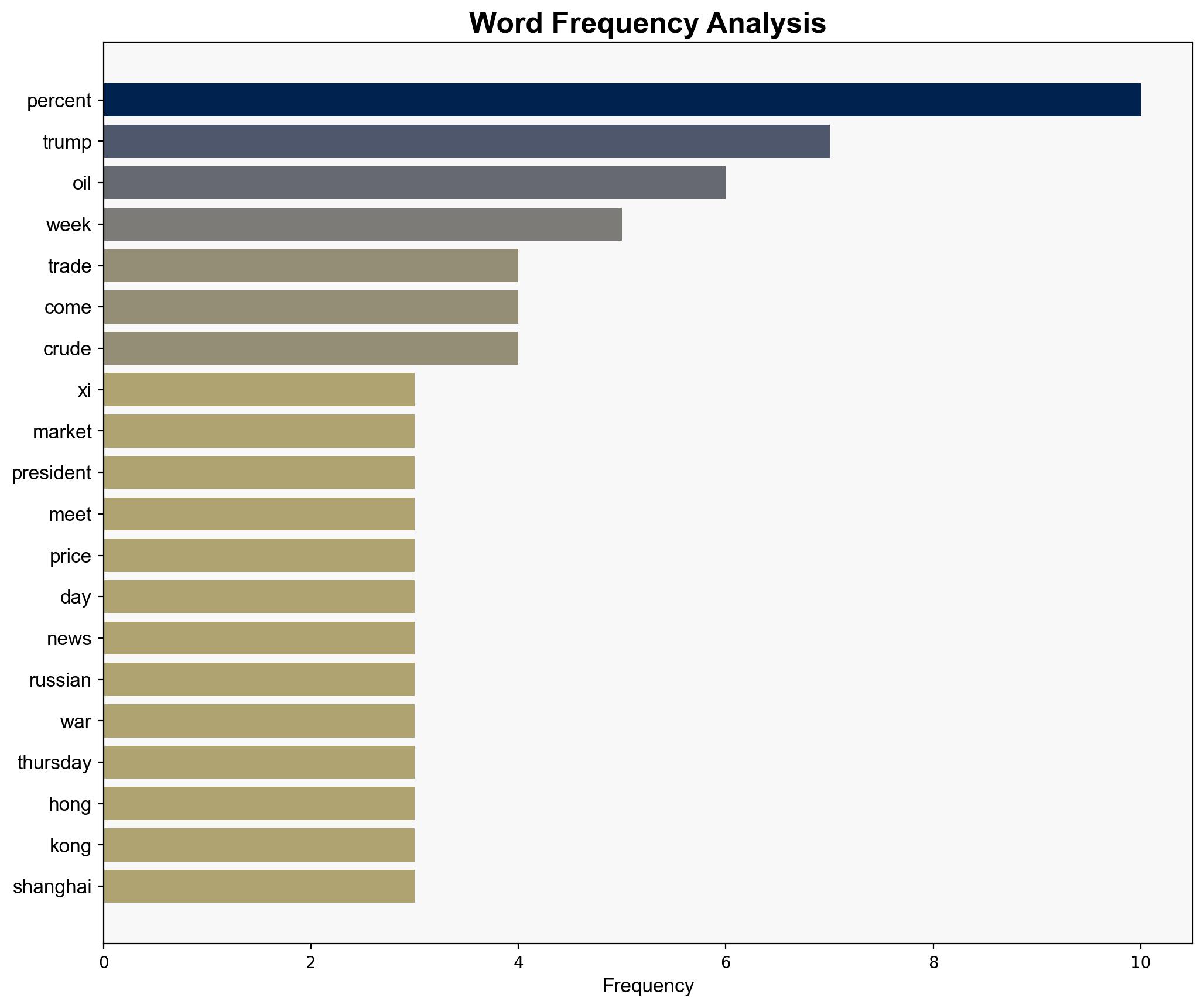

Donald Trump, Xi Jinping, Karoline Leavitt, Vladimir Putin, Intel Corp.

7. Thematic Tags

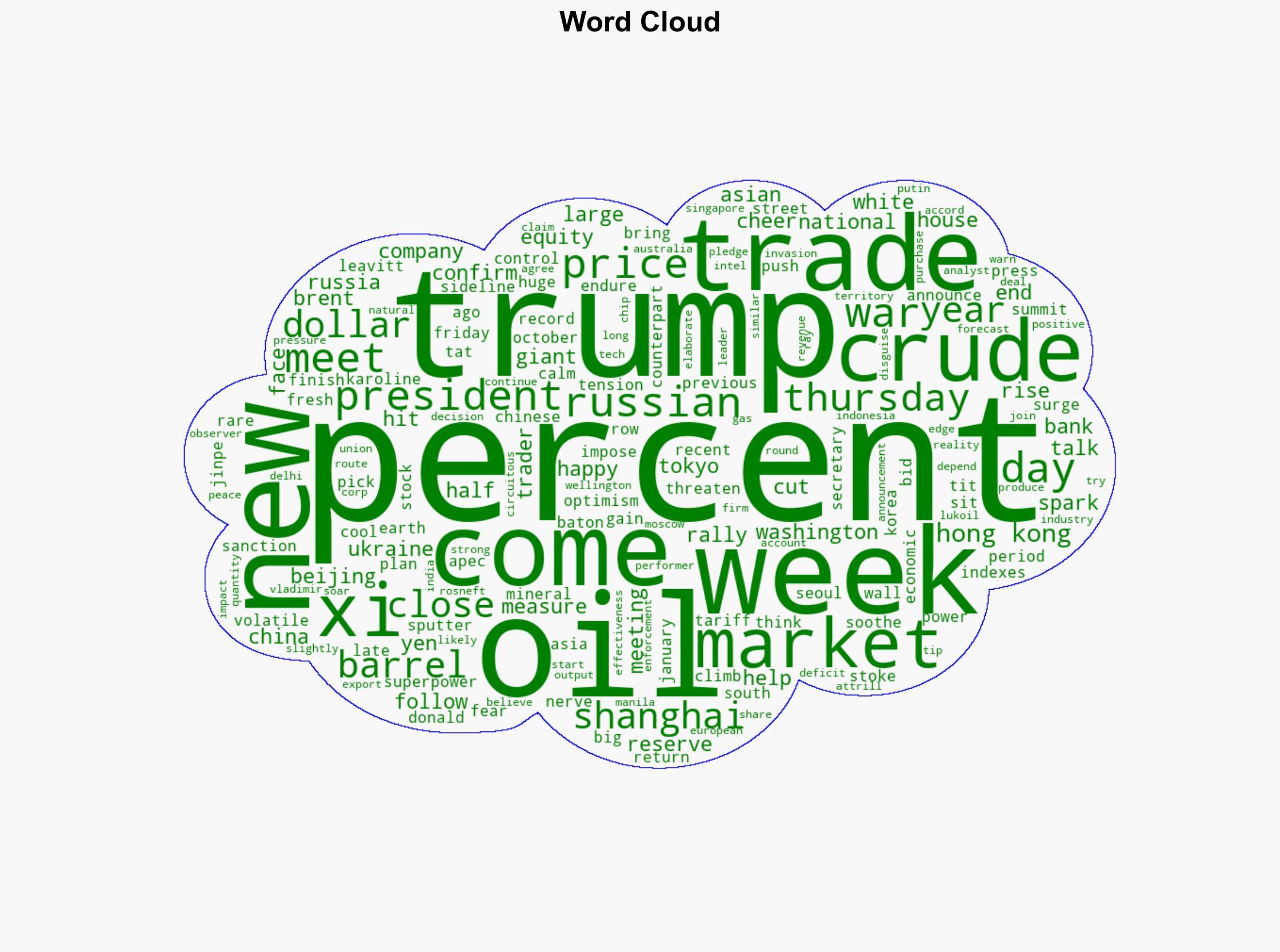

national security threats, economic stability, trade negotiations, geopolitical tensions