Balancing Trust Agility and Speed The Critical Trio for AI Success in Banking Erica Andersen – Finextra

Published on: 2025-10-26

Intelligence Report: Balancing Trust Agility and Speed The Critical Trio for AI Success in Banking Erica Andersen – Finextra

1. BLUF (Bottom Line Up Front)

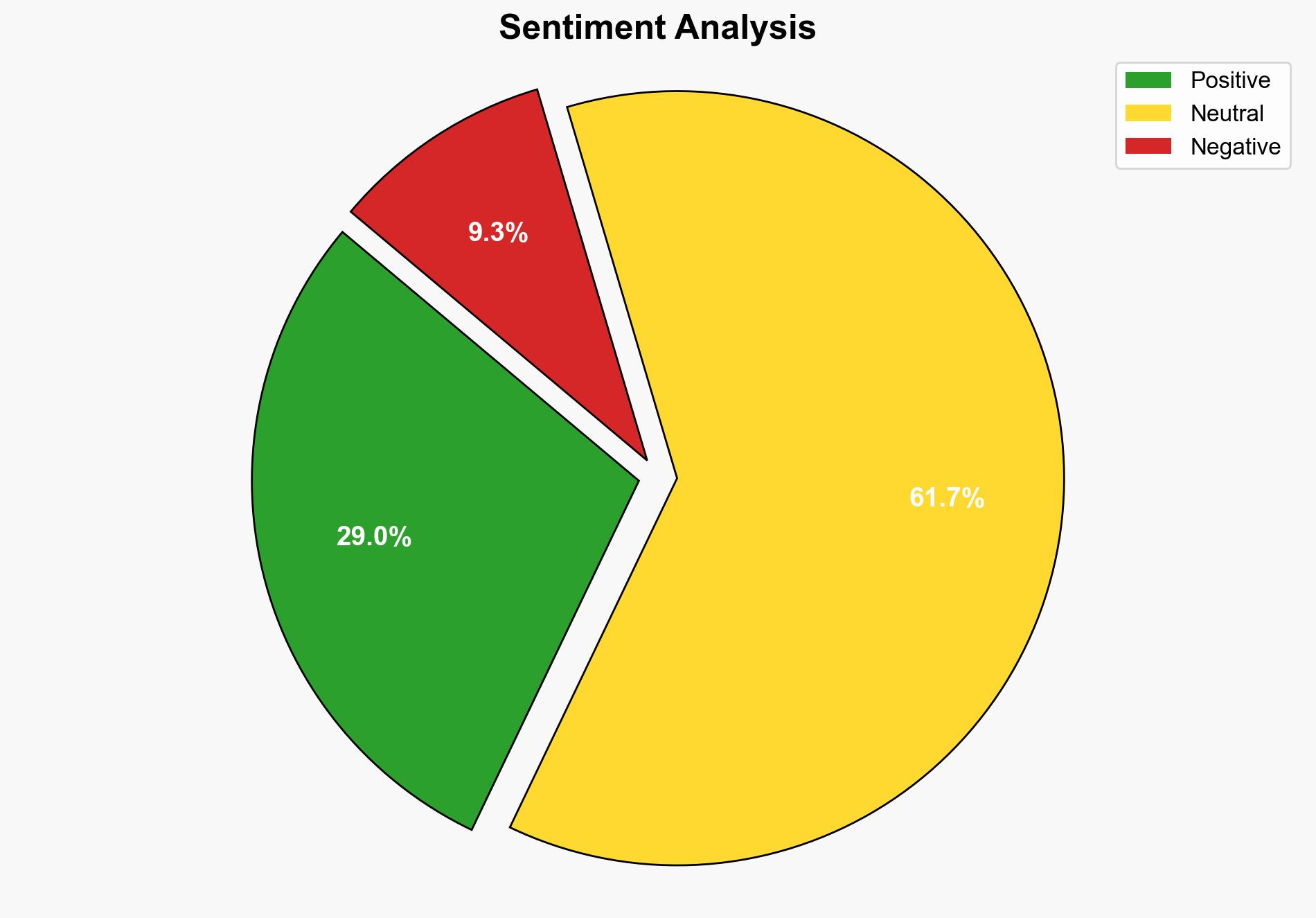

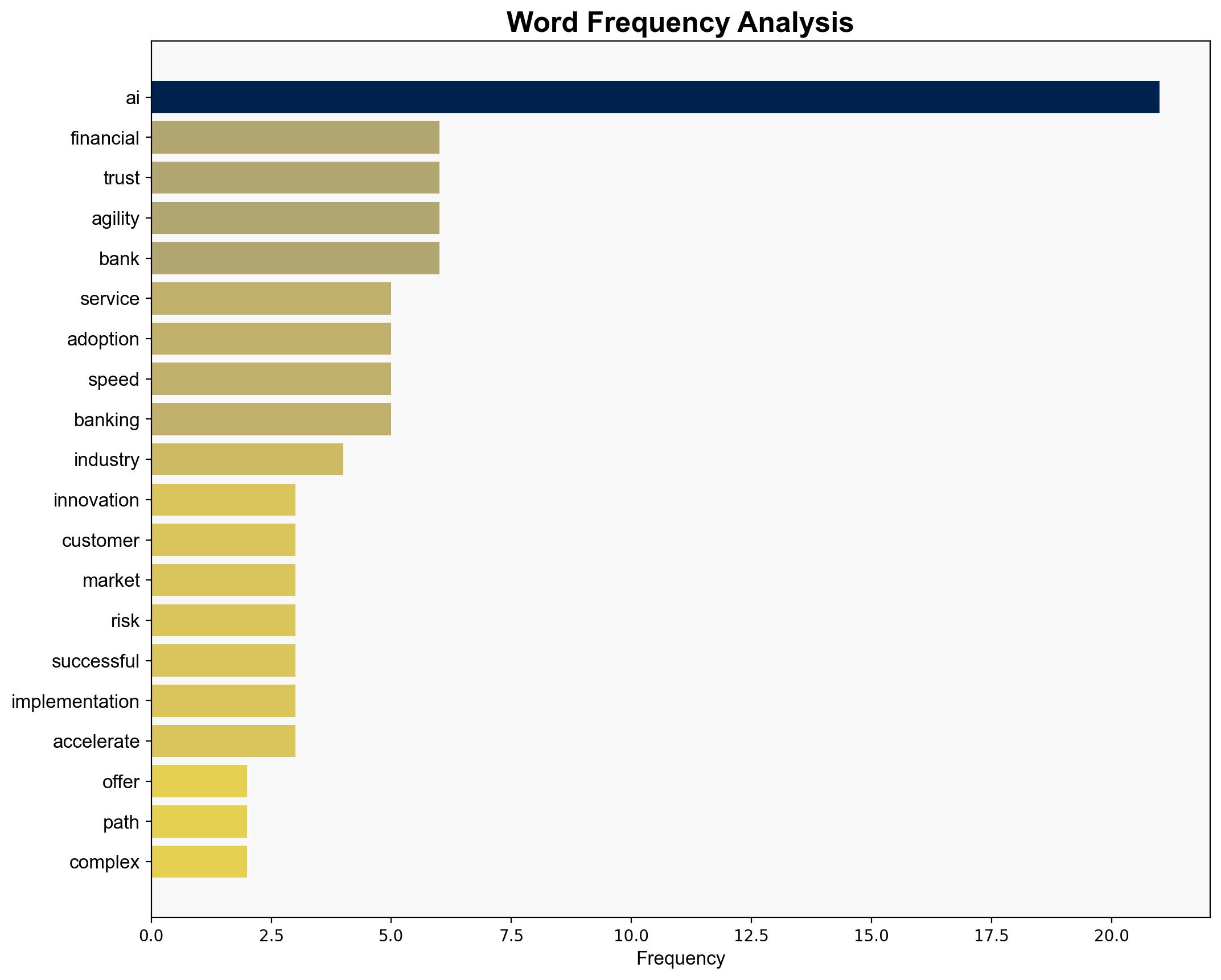

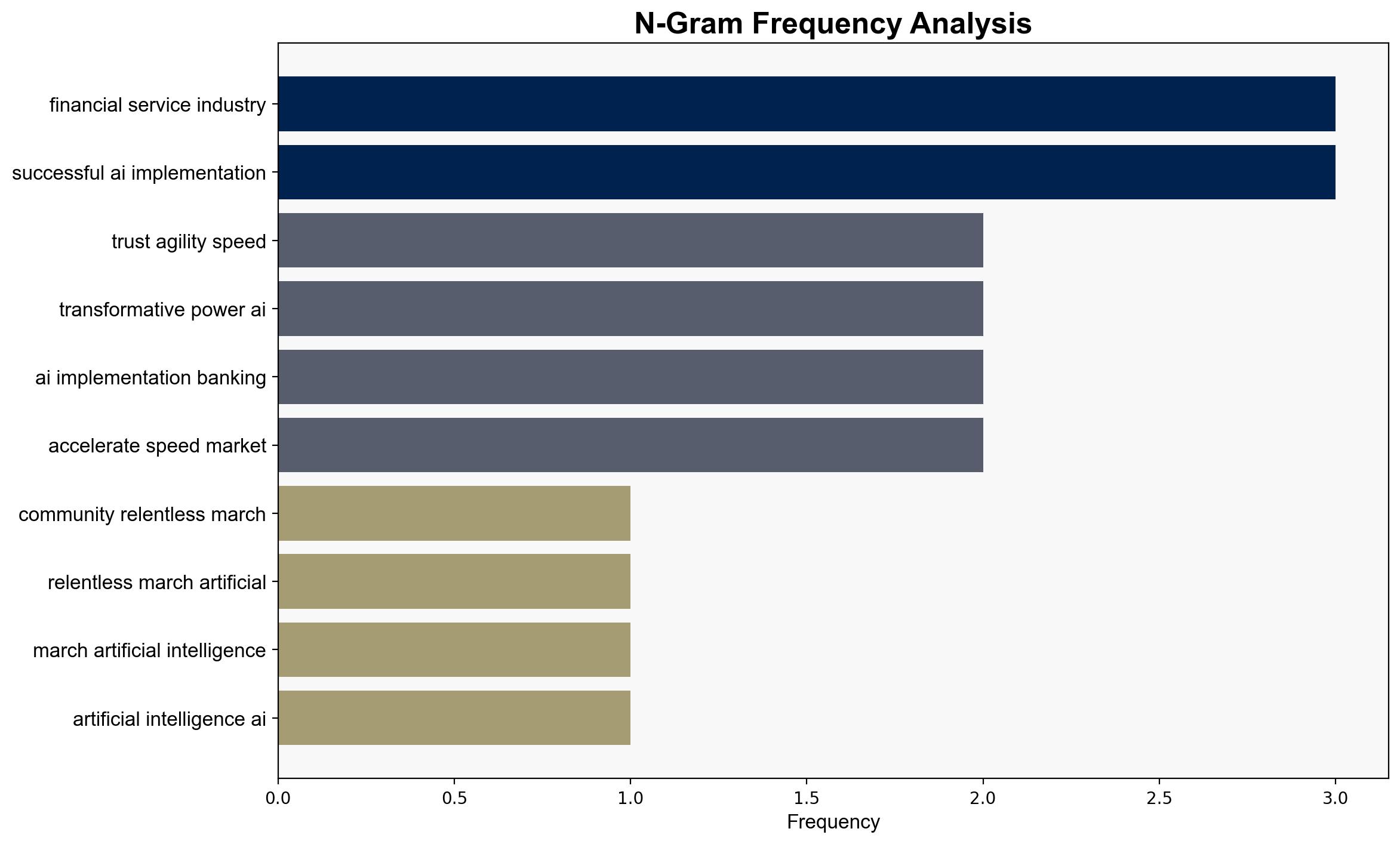

The strategic judgment is that the successful adoption of AI in banking hinges on balancing trust, agility, and speed. The most supported hypothesis is that banks prioritizing these elements will gain a competitive advantage. Confidence level: High. Recommended action: Financial institutions should strategically integrate AI by fostering trust, enhancing agility, and accelerating implementation speed to mitigate risks and capitalize on AI’s transformative potential.

2. Competing Hypotheses

Hypothesis 1: Banks that prioritize trust, agility, and speed in AI adoption will achieve sustainable success and competitive advantage.

Hypothesis 2: The complexity of AI integration, regulatory challenges, and potential financial penalties will hinder banks from effectively balancing these elements, leading to strategic missteps.

Structured Analysis: Using ACH 2.0, Hypothesis 1 is better supported due to the emphasis on strategic imperatives and the potential for competitive gains outlined in the source. Hypothesis 2 is less supported due to a lack of specific evidence on insurmountable barriers.

3. Key Assumptions and Red Flags

Assumptions:

– Trust, agility, and speed are equally critical and can be balanced effectively.

– Banks have the capability to adapt quickly to AI technologies.

Red Flags:

– Over-reliance on AI without addressing underlying data quality issues.

– Potential underestimation of regulatory challenges and their impact on AI integration.

4. Implications and Strategic Risks

Implications: Successful AI adoption can revolutionize banking operations, enhancing efficiency and customer experience. However, failure to adapt could result in financial penalties and loss of market share.

Strategic Risks: Economic risks include potential financial penalties for slow adoption. Cyber risks involve data breaches and compliance failures. Geopolitical risks may arise from differing international regulatory standards. Psychological risks include customer distrust if AI is perceived as invasive.

5. Recommendations and Outlook

- Mitigate risks by investing in robust data management and compliance frameworks.

- Exploit opportunities by developing AI strategies focused on customer-centric innovations.

- Scenario-based projections:

- Best: Rapid AI adoption leads to market leadership and innovation.

- Worst: Regulatory challenges and data issues result in financial penalties and reputational damage.

- Most Likely: Gradual AI integration with moderate gains and manageable risks.

6. Key Individuals and Entities

Erica Andersen, Bo Harald, Muhammad Qasim, Mete Feridun, John Reese

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus