Bank of America US-Made iPhones Would Face 90 Cost Surge – MacRumors

Published on: 2025-04-10

Intelligence Report: Bank of America US-Made iPhones Would Face 90% Cost Surge – MacRumors

1. BLUF (Bottom Line Up Front)

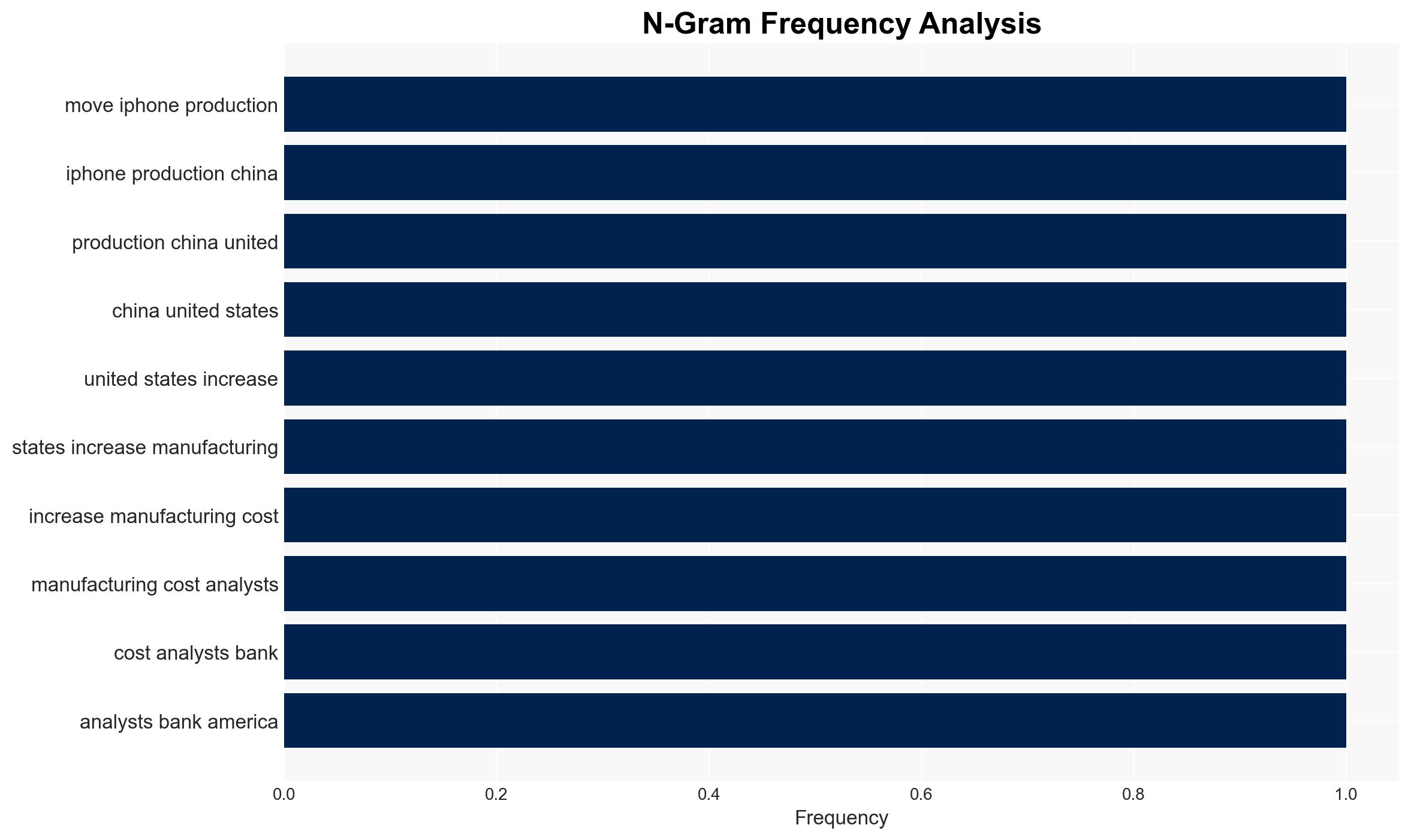

Moving iPhone production from China to the United States could increase manufacturing costs by up to 90%, primarily due to higher labor costs and potential tariffs on imported components. This shift is technically feasible but economically challenging. Current U.S.-China trade tensions exacerbate the situation, impacting Apple’s stock significantly. Strategic diversification of Apple’s supply chain is recommended to mitigate risks.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

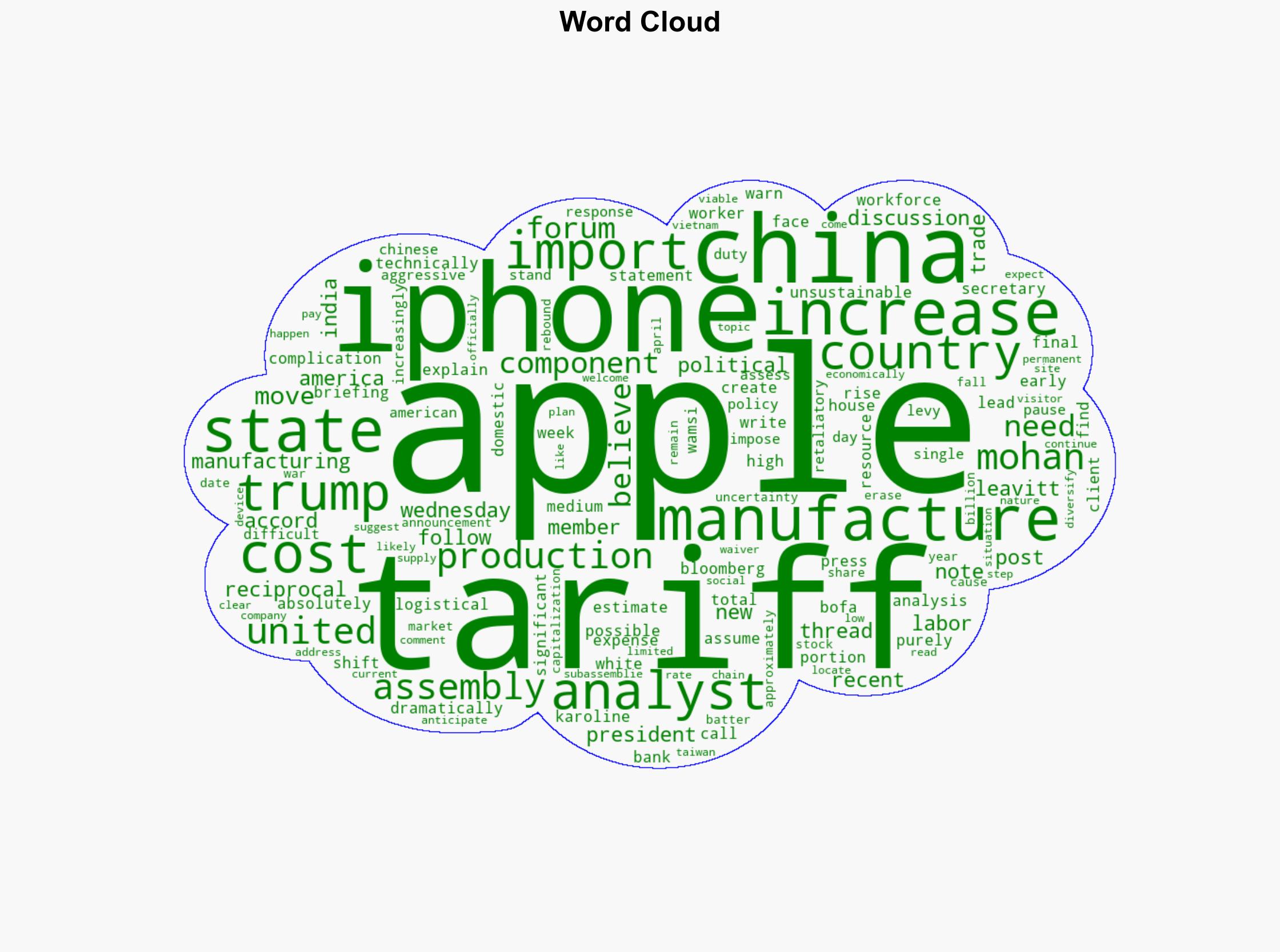

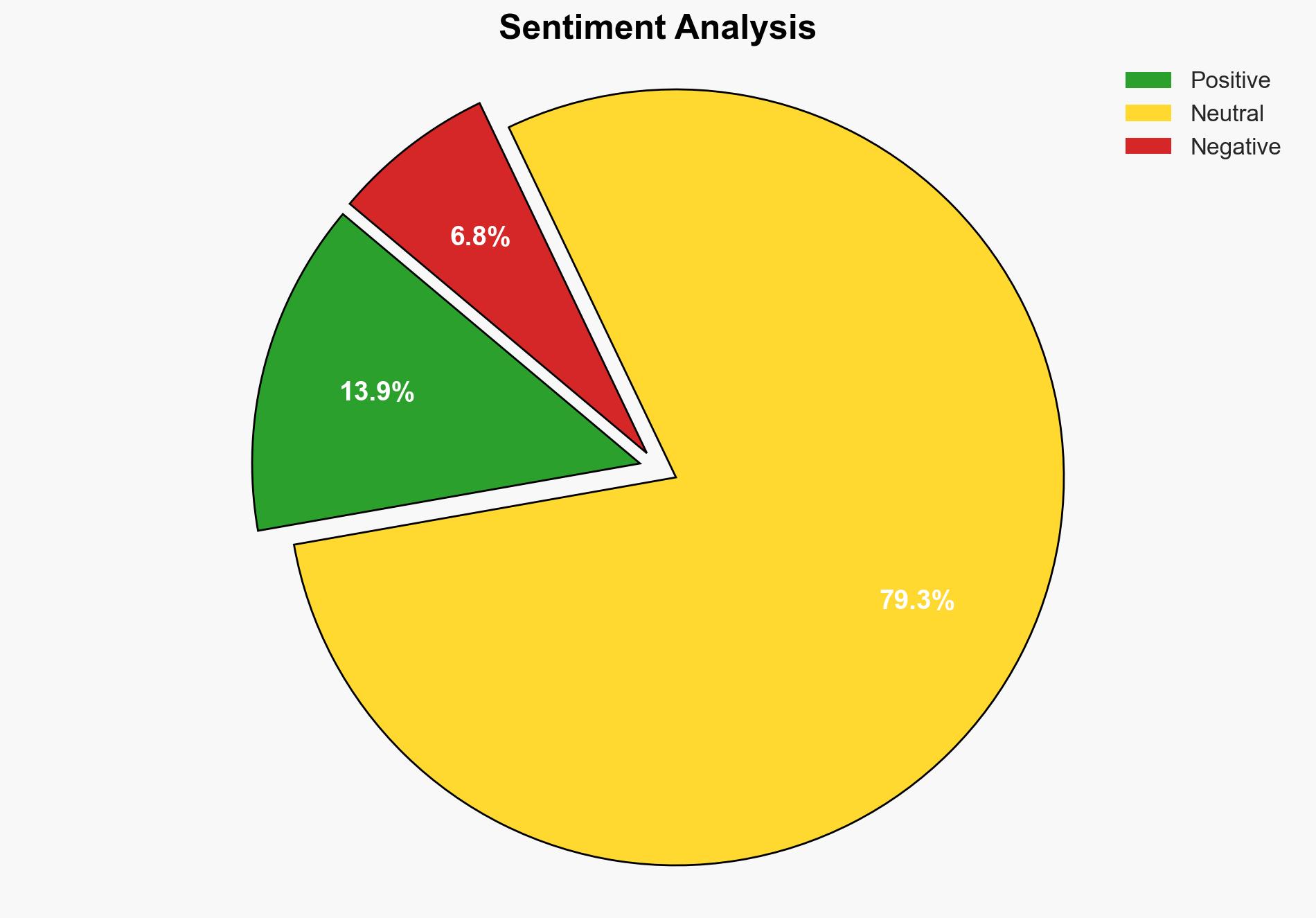

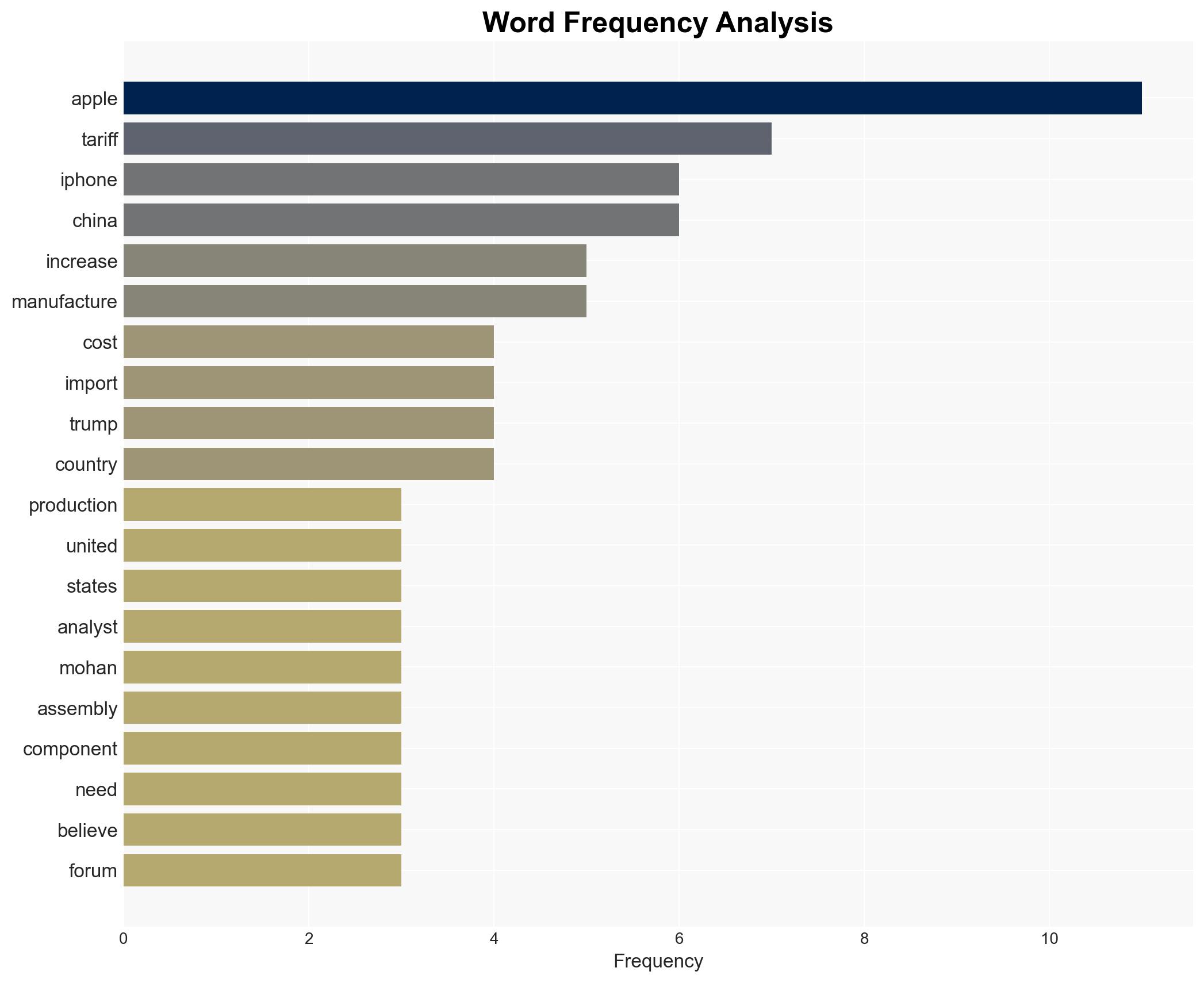

General Analysis

The analysis by Bank of America, led by Wamsi Mohan, highlights the significant cost implications of relocating iPhone assembly to the U.S. The primary cost drivers include a 25% increase due to higher domestic labor costs and additional expenses from tariffs on components still manufactured in China. The current geopolitical climate, marked by heightened U.S.-China trade tensions, further complicates the economic feasibility of such a move. The imposition of a 125% tariff on Chinese imports and China’s retaliatory measures have created a volatile market environment, leading to a 14% drop in Apple’s stock since early April.

3. Implications and Strategic Risks

The potential relocation of iPhone production to the U.S. poses several strategic risks:

- Economic Impact: A 90% increase in manufacturing costs could lead to higher consumer prices, affecting sales and market competitiveness.

- Supply Chain Disruption: Continued reliance on Chinese components amidst trade tensions could lead to supply chain vulnerabilities.

- Market Volatility: Ongoing trade disputes contribute to stock market instability, affecting investor confidence and corporate valuations.

These risks underscore the need for strategic diversification and contingency planning to safeguard against geopolitical and economic uncertainties.

4. Recommendations and Outlook

Recommendations:

- Apple should explore tariff waivers for critical components to mitigate cost increases.

- Enhance supply chain diversification by increasing production in countries like India, Taiwan, and Vietnam.

- Engage in diplomatic efforts to stabilize trade relations and reduce tariff impacts.

Outlook:

Best-Case Scenario: Successful negotiation of tariff waivers and improved trade relations could stabilize costs and market conditions.

Worst-Case Scenario: Prolonged trade disputes and lack of tariff relief could lead to sustained cost increases and market volatility.

Most Likely Scenario: Apple will continue to diversify its supply chain while navigating ongoing trade tensions, leading to moderate cost increases and gradual market stabilization.

5. Key Individuals and Entities

The report mentions significant individuals and organizations:

- Wamsi Mohan

- Donald Trump

- Karoline Leavitt

- Apple

- Bank of America