Banks turn to AI supervisors as agent use surges – CIO Dive

Published on: 2025-11-12

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Banks turn to AI supervisors as agent use surges – CIO Dive

1. BLUF (Bottom Line Up Front)

The strategic judgment is that the integration of AI agents in the banking sector is poised to significantly transform operational efficiencies and open new market opportunities. However, this transformation is contingent upon overcoming regulatory, skill, and cost barriers. The most supported hypothesis is that banks will successfully integrate AI agents, leading to enhanced productivity and competitive advantage. Confidence level: Moderate.

2. Competing Hypotheses

Hypothesis 1: Banks will successfully integrate AI agents, resulting in increased efficiency, reduced operational costs, and new market opportunities. This is supported by the current trend of AI adoption in banks and the reported optimism from industry executives.

Hypothesis 2: Banks will face significant challenges in AI integration, such as regulatory compliance, skill gaps, and high implementation costs, which may hinder the expected benefits and slow down adoption.

The first hypothesis is more likely due to the proactive measures banks are taking, such as in-house development of AI agents and strategic partnerships, as well as the economic value AI is projected to deliver.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that regulatory frameworks will adapt to accommodate AI advancements, and that banks will effectively bridge the skill gap through training and recruitment.

Red Flags: Potential over-reliance on AI without adequate human oversight could lead to vulnerabilities. There is also a risk of underestimating the complexity of regulatory compliance across different jurisdictions.

4. Implications and Strategic Risks

The widespread adoption of AI in banking could lead to significant shifts in employment patterns, with potential job displacement in certain roles. Cybersecurity risks may escalate as AI systems become targets for sophisticated attacks. Economically, banks that fail to adopt AI may lose competitive ground. Politically, there may be increased scrutiny and pressure for regulatory reforms.

5. Recommendations and Outlook

- Actionable Steps: Banks should invest in comprehensive training programs to address skill gaps and establish robust cybersecurity measures to protect AI systems. Engaging with regulators early to shape favorable policies is crucial.

- Best Scenario: Successful AI integration leads to industry-wide efficiency gains and new service offerings.

- Worst Scenario: Regulatory hurdles and skill shortages stall AI adoption, leading to competitive disadvantages.

- Most-likely Scenario: Gradual adoption with mixed success, as banks navigate regulatory and operational challenges.

6. Key Individuals and Entities

Ravi Khokhar, EVP Global Head Cloud Financial Service, Capgemini; Leigh Ann Russell, CIO, BNY.

7. Thematic Tags

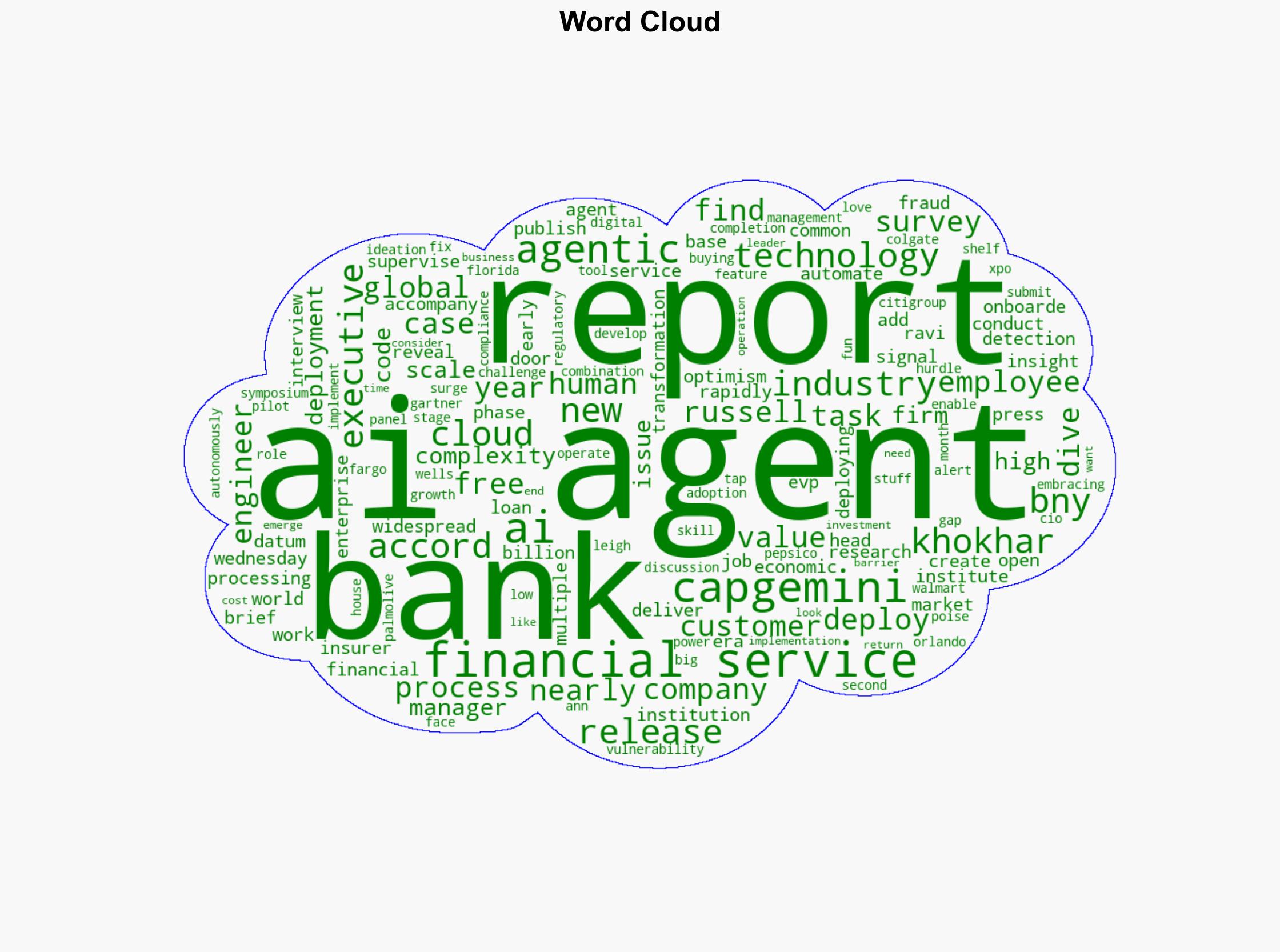

Cybersecurity, AI Integration, Financial Services, Regulatory Compliance, Workforce Transformation

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology