Barrick Sells Its Last Gold Mine in Canada for 11 Billion – Financial Post

Published on: 2025-09-11

Intelligence Report: Barrick Sells Its Last Gold Mine in Canada for 11 Billion – Financial Post

1. BLUF (Bottom Line Up Front)

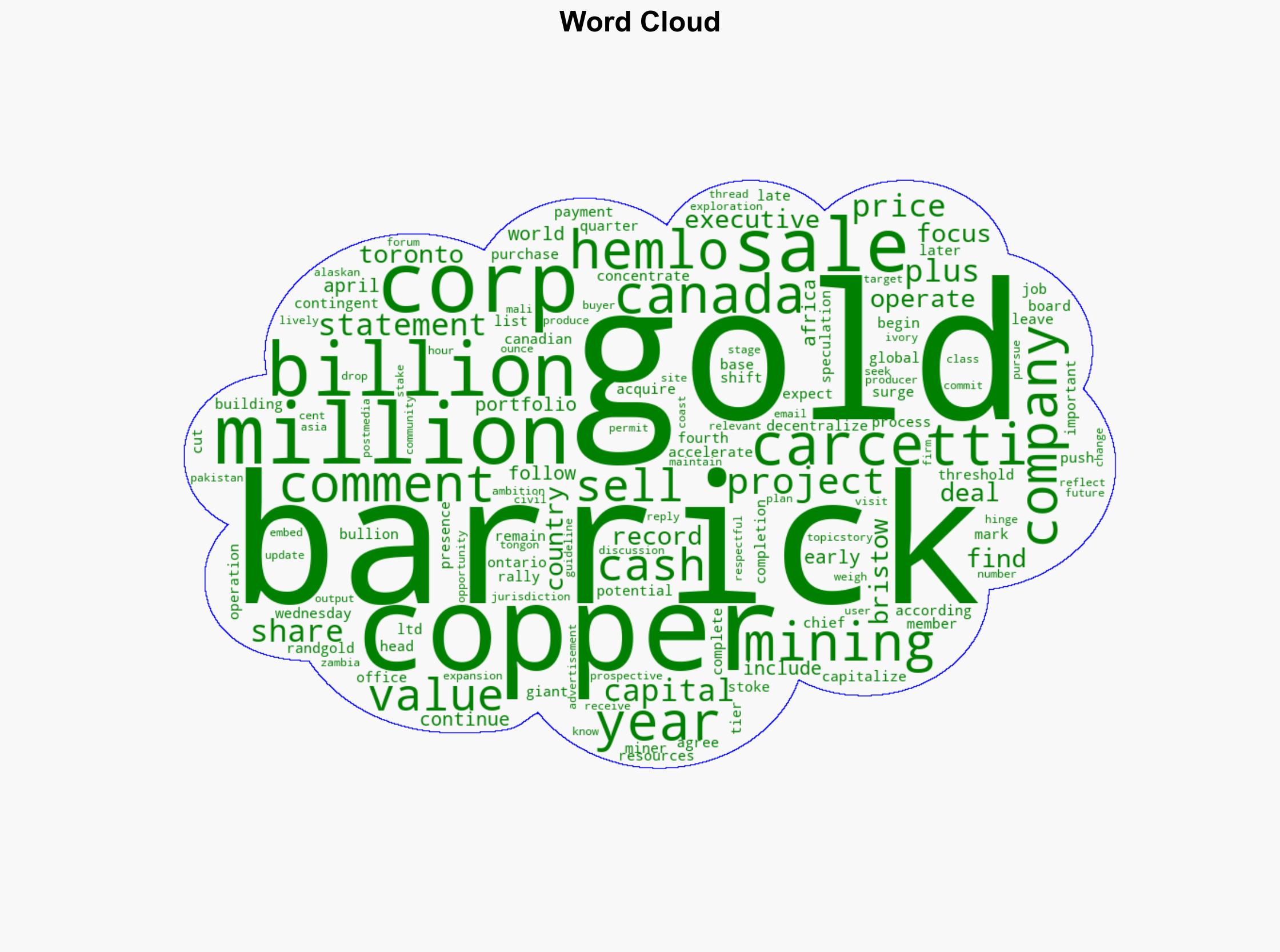

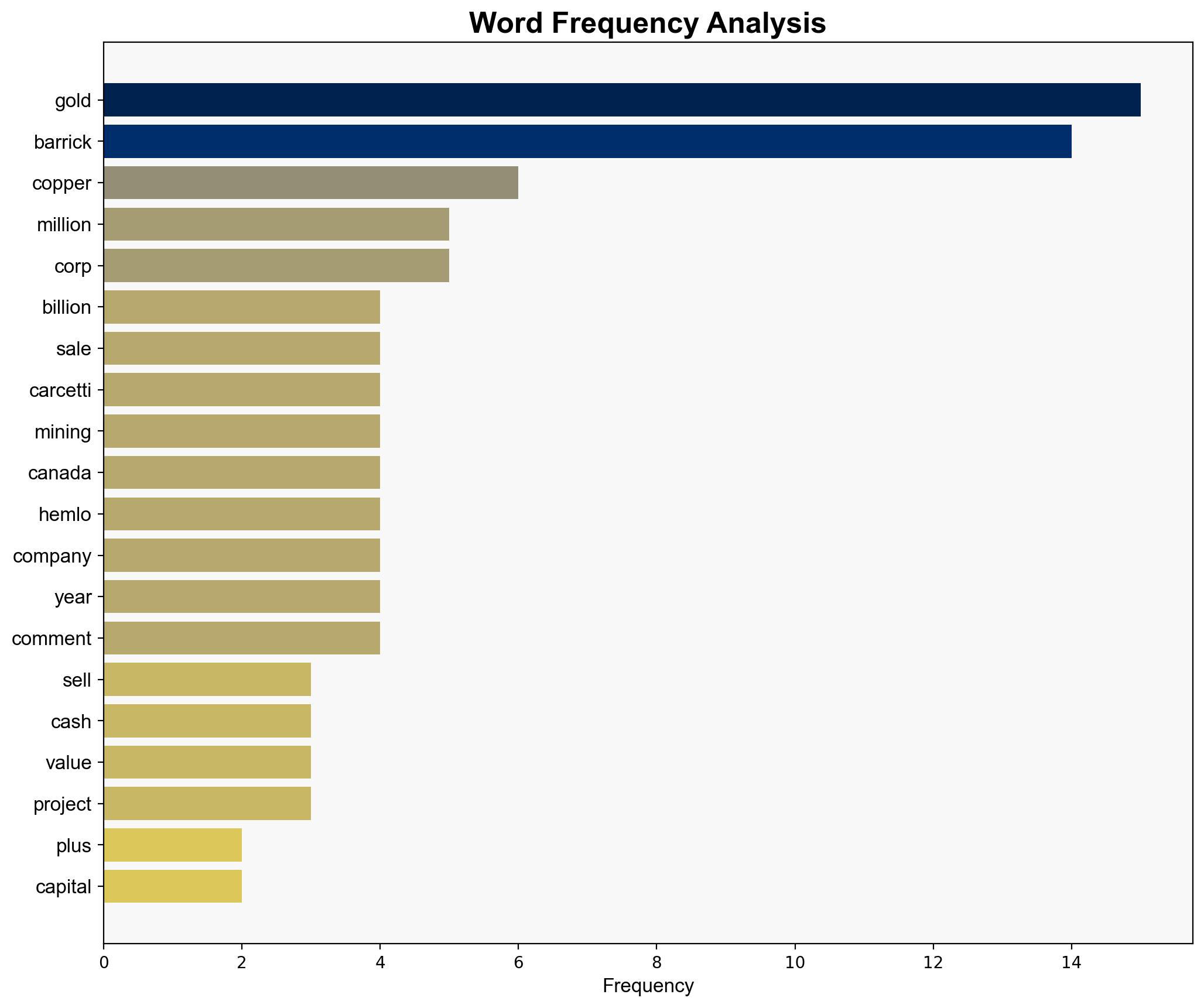

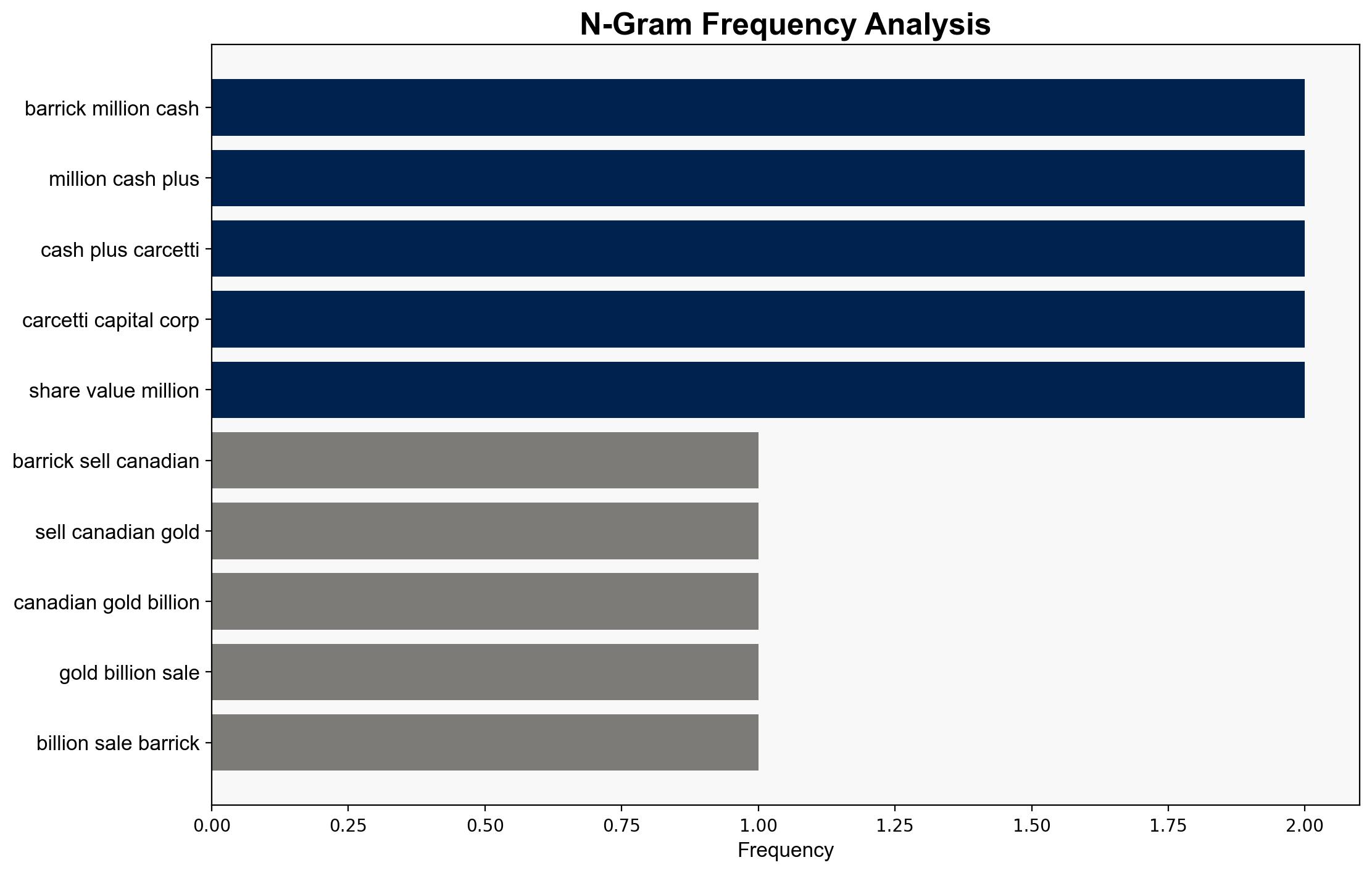

Barrick Gold Corp’s decision to sell its last Canadian gold mine for $11 billion is strategically aimed at reallocating resources towards a more diversified portfolio, focusing on copper and other global opportunities. The most supported hypothesis is that Barrick is strategically repositioning to capitalize on the rising demand for copper, which is crucial for technological and green energy advancements. Confidence Level: High. Recommended action: Monitor Barrick’s future acquisitions and shifts in global mining operations to assess potential impacts on the mining industry and commodity markets.

2. Competing Hypotheses

Hypothesis 1: Barrick is selling its Canadian gold mine to capitalize on high bullion prices and reinvest in copper, aligning with global trends towards renewable energy and technological advancements.

Hypothesis 2: The sale is primarily driven by operational challenges and regulatory pressures in Canada, prompting Barrick to focus on more favorable jurisdictions.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes a sustained increase in copper demand and prices.

– Hypothesis 2 assumes significant regulatory or operational challenges in Canada.

Red Flags:

– Lack of detailed information on regulatory pressures in Canada.

– Potential overestimation of copper market stability.

– Absence of explicit statements from Barrick regarding operational issues in Canada.

4. Implications and Strategic Risks

The sale could lead to a shift in the mining industry, with increased focus on copper and other critical minerals. This may influence global supply chains and commodity markets. Risks include potential geopolitical tensions over resource control and environmental concerns associated with new mining projects. Economic implications may arise from fluctuating commodity prices affecting global markets.

5. Recommendations and Outlook

- Monitor Barrick’s strategic moves in copper and other minerals to anticipate market shifts.

- Engage with stakeholders in the mining sector to assess regulatory changes in Canada.

- Scenario Projections:

- Best Case: Barrick successfully diversifies, leading to increased profitability and market stability.

- Worst Case: Regulatory and operational challenges in new jurisdictions lead to financial losses.

- Most Likely: Barrick achieves moderate success in diversification, with some volatility in commodity markets.

6. Key Individuals and Entities

Mark Bristow (Barrick Chief Executive), Barrick Gold Corp, Carcetti Capital Corp.

7. Thematic Tags

global mining strategy, commodity markets, resource diversification, regulatory impacts