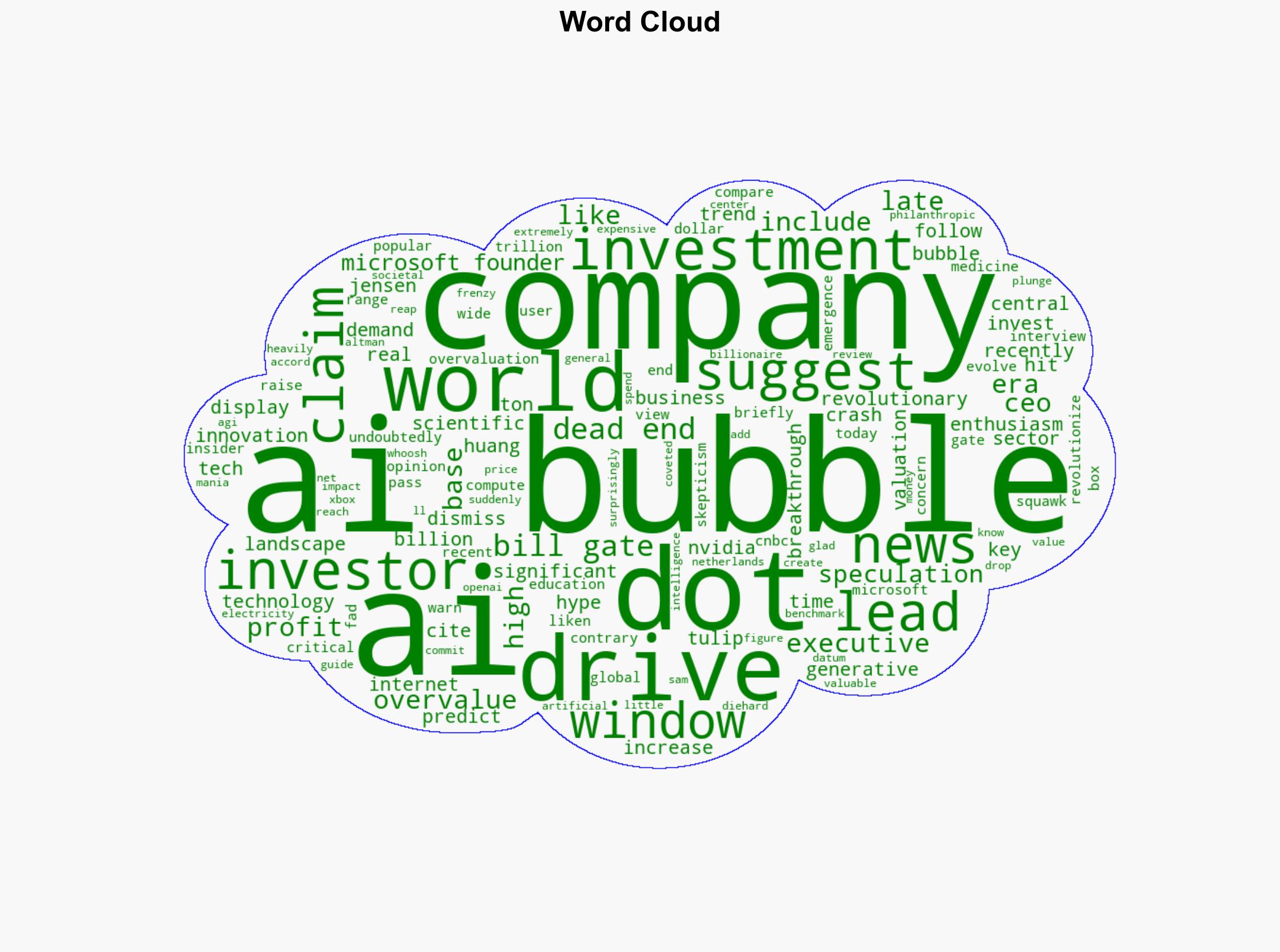

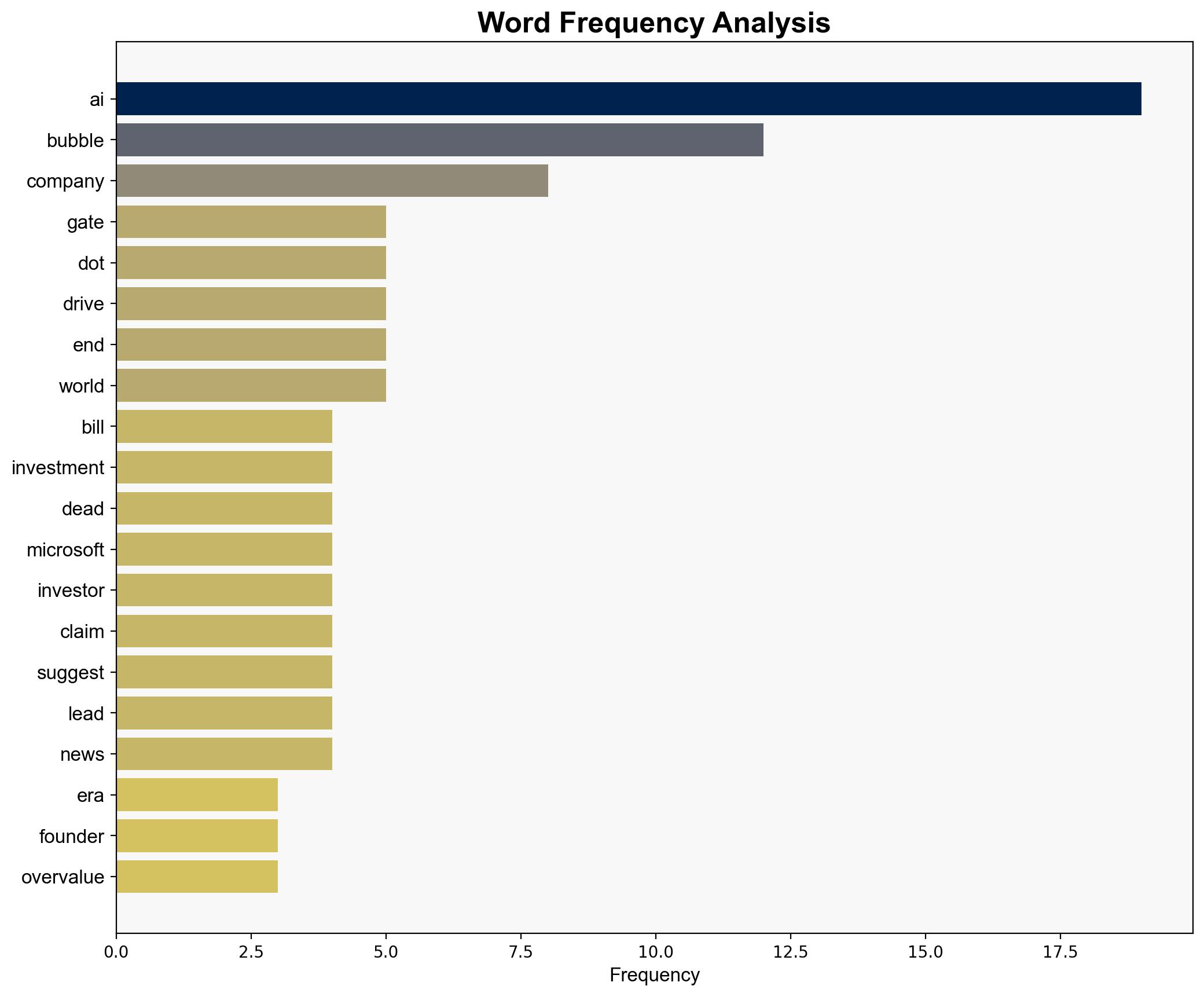

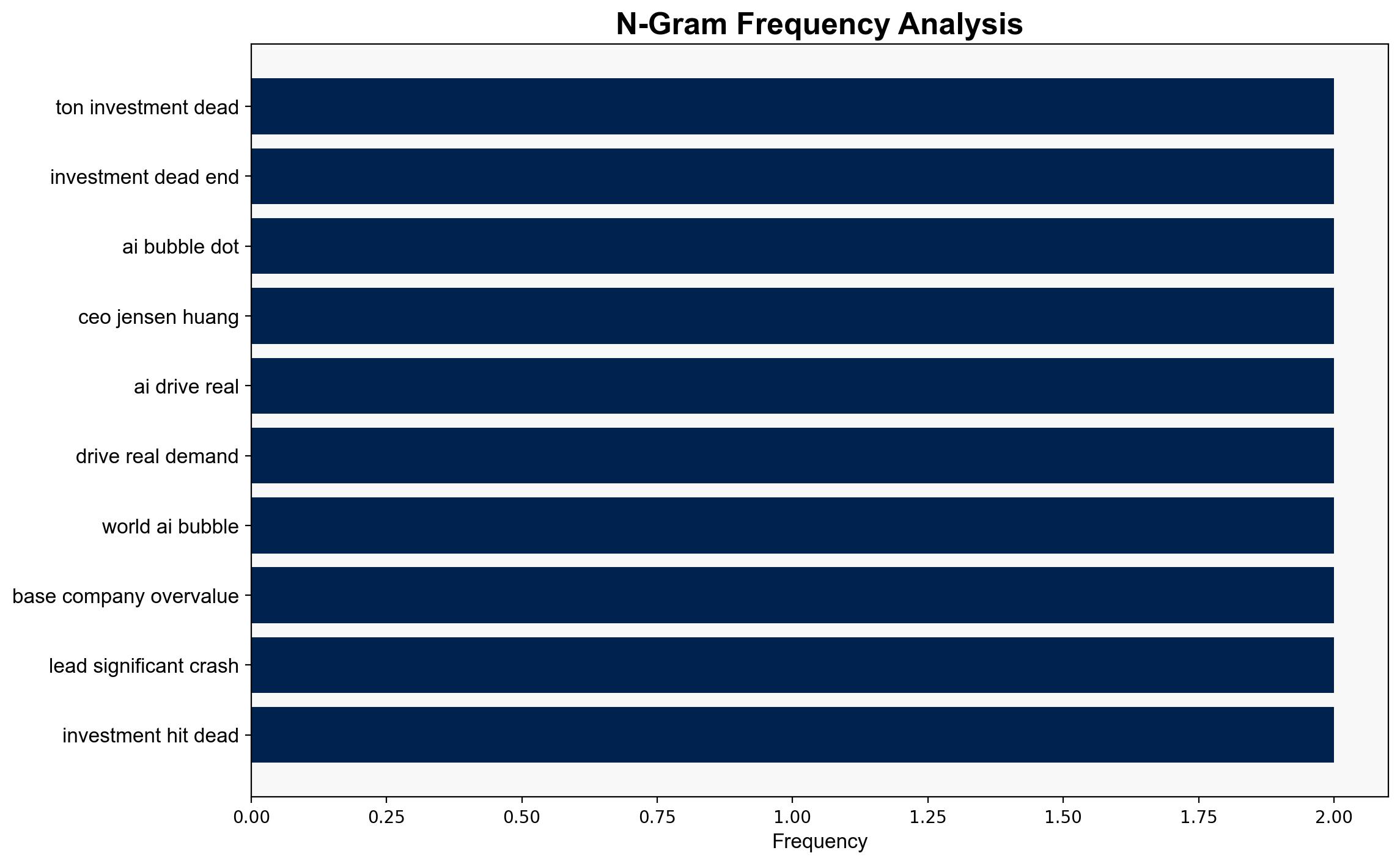

Bill Gates recently warned of an AI bubble likening it to the dot-com era’s hype-driven overvaluations There are a ton of these investments that will be dead ends – Windows Central

Published on: 2025-10-31

Intelligence Report: Bill Gates recently warned of an AI bubble likening it to the dot-com era’s hype-driven overvaluations – Windows Central

1. BLUF (Bottom Line Up Front)

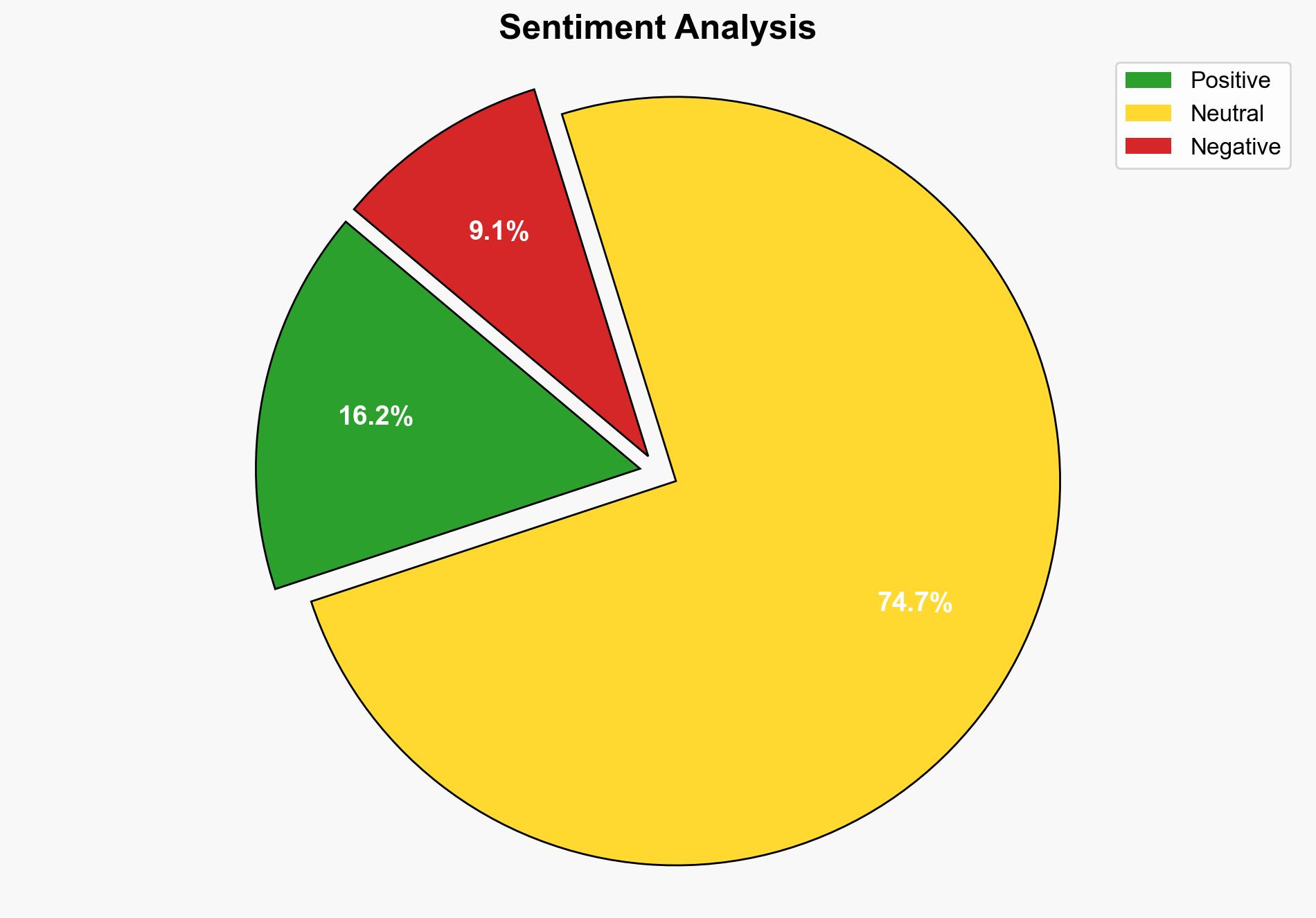

The most supported hypothesis is that the current AI investment climate is experiencing speculative overvaluation similar to the dot-com bubble, with a high likelihood of many investments failing to yield returns. Confidence level: Moderate. Recommended action: Stakeholders should conduct thorough due diligence and risk assessments before investing in AI ventures, focusing on sustainable business models and technological viability.

2. Competing Hypotheses

1. **Hypothesis A**: The AI sector is experiencing a speculative bubble akin to the dot-com era, leading to overvalued companies and potential market corrections.

2. **Hypothesis B**: The AI sector is not in a bubble; instead, it is undergoing a transformative phase with genuine demand and sustainable growth, driven by technological advancements and real-world applications.

3. Key Assumptions and Red Flags

– **Assumptions for Hypothesis A**: Investor enthusiasm is primarily speculative, and many AI companies lack viable business models. The comparison to the dot-com bubble assumes historical patterns will repeat.

– **Assumptions for Hypothesis B**: AI technology will continue to advance and integrate into various sectors, creating sustainable demand. The dismissal of bubble concerns assumes current valuations are justified by future growth.

– **Red Flags**: Potential cognitive bias in comparing AI to past bubbles without considering unique technological differences. Lack of concrete data on the financial health of AI companies.

4. Implications and Strategic Risks

– **Economic**: A burst in the AI bubble could lead to significant financial losses and reduced investor confidence in tech sectors.

– **Cyber**: Overvaluation may lead to underinvestment in cybersecurity, increasing vulnerability to cyber threats.

– **Geopolitical**: Global competition in AI development could intensify, with countries vying for technological leadership.

– **Psychological**: Market corrections could lead to a loss of trust in AI technologies, affecting adoption rates.

5. Recommendations and Outlook

- Conduct comprehensive risk assessments for AI investments, focusing on long-term viability and technological innovation.

- Encourage transparency and accountability in AI company valuations to prevent speculative bubbles.

- Scenario-based projections:

- **Best Case**: AI investments lead to sustainable growth and technological breakthroughs.

- **Worst Case**: A market crash results in widespread financial losses and reduced innovation.

- **Most Likely**: A market correction occurs, with some companies failing while others adapt and thrive.

6. Key Individuals and Entities

– Bill Gates

– Jensen Huang

– Sam Altman

7. Thematic Tags

economic risk, technological innovation, market speculation, investment strategy