Bill Gates says robots that take your job should pay taxes too after claiming AI will replace humans for most things

Published on: 2025-11-24

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

With a moderate confidence level, the most supported hypothesis is that AI and robotics will significantly disrupt the job market, necessitating policy interventions such as taxation on automation to manage economic and social impacts. Strategic actions should focus on developing adaptive workforce policies and exploring taxation frameworks for AI-driven productivity gains.

2. Competing Hypotheses

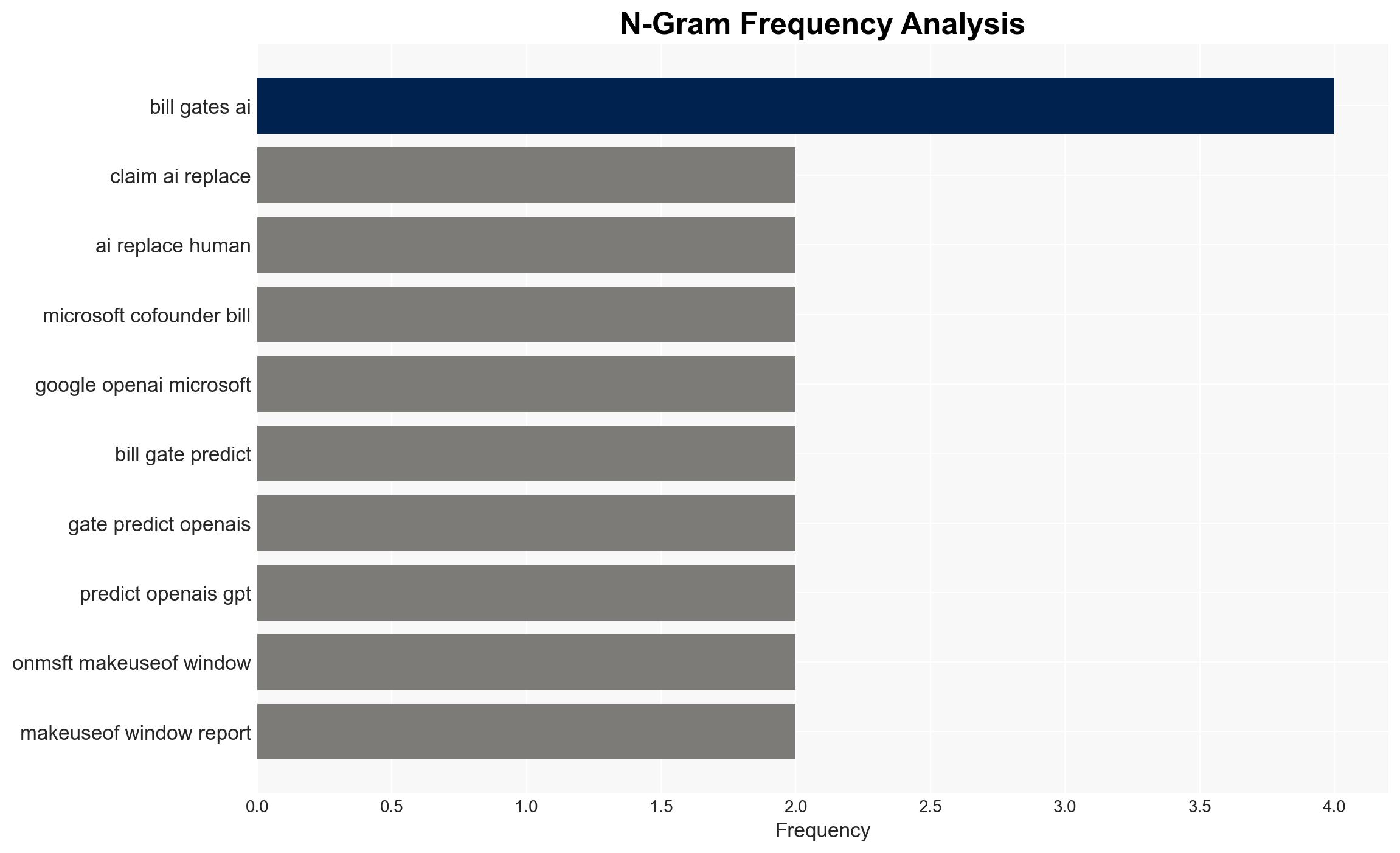

Hypothesis 1: AI and robotics will replace a significant portion of human jobs, leading to economic disruption and necessitating new taxation policies to sustain public services.

Hypothesis 2: AI and robotics will augment human work rather than replace it, leading to increased productivity without significant job loss, thereby reducing the need for drastic policy changes like robot taxes.

Hypothesis 1 is more likely given current trends in automation and AI integration into workflows, as well as Gates’ emphasis on the need for policy intervention to manage job displacement.

3. Key Assumptions and Red Flags

Assumptions: AI and robotics will continue to advance at a rapid pace; governments will be able to effectively implement and enforce new taxation policies.

Red Flags: Overestimation of AI capabilities could lead to premature policy decisions; resistance from industries benefiting from automation could impede policy implementation.

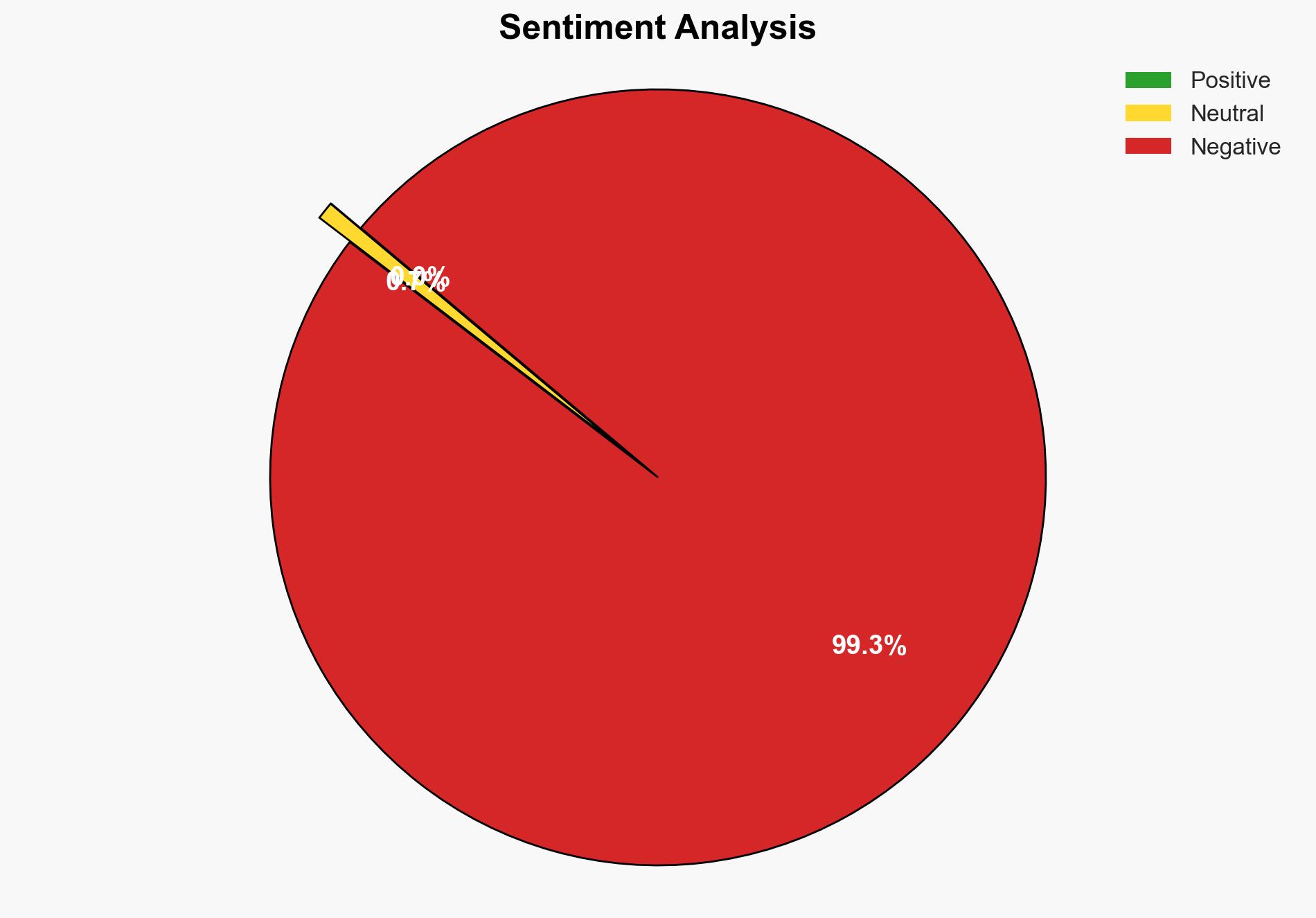

Deception Indicators: Potential bias in reports from companies heavily invested in AI, such as Microsoft, may downplay negative impacts of automation.

4. Implications and Strategic Risks

The displacement of jobs by AI poses significant economic risks, including increased unemployment and social unrest. Politically, failure to address these issues could lead to instability. Economically, the lack of a taxation framework for AI could result in decreased public revenue and increased inequality. Cyber risks include potential vulnerabilities in AI systems that could be exploited.

5. Recommendations and Outlook

- Develop adaptive workforce policies that include retraining programs for displaced workers.

- Explore and pilot taxation frameworks for AI-driven productivity gains to fund social services.

- Best-case scenario: AI augments human work, leading to economic growth and improved quality of life.

- Worst-case scenario: Widespread job displacement without effective policy intervention leads to economic and social crises.

- Most-likely scenario: A mixed outcome where some sectors experience significant job loss while others see productivity gains, requiring targeted policy responses.

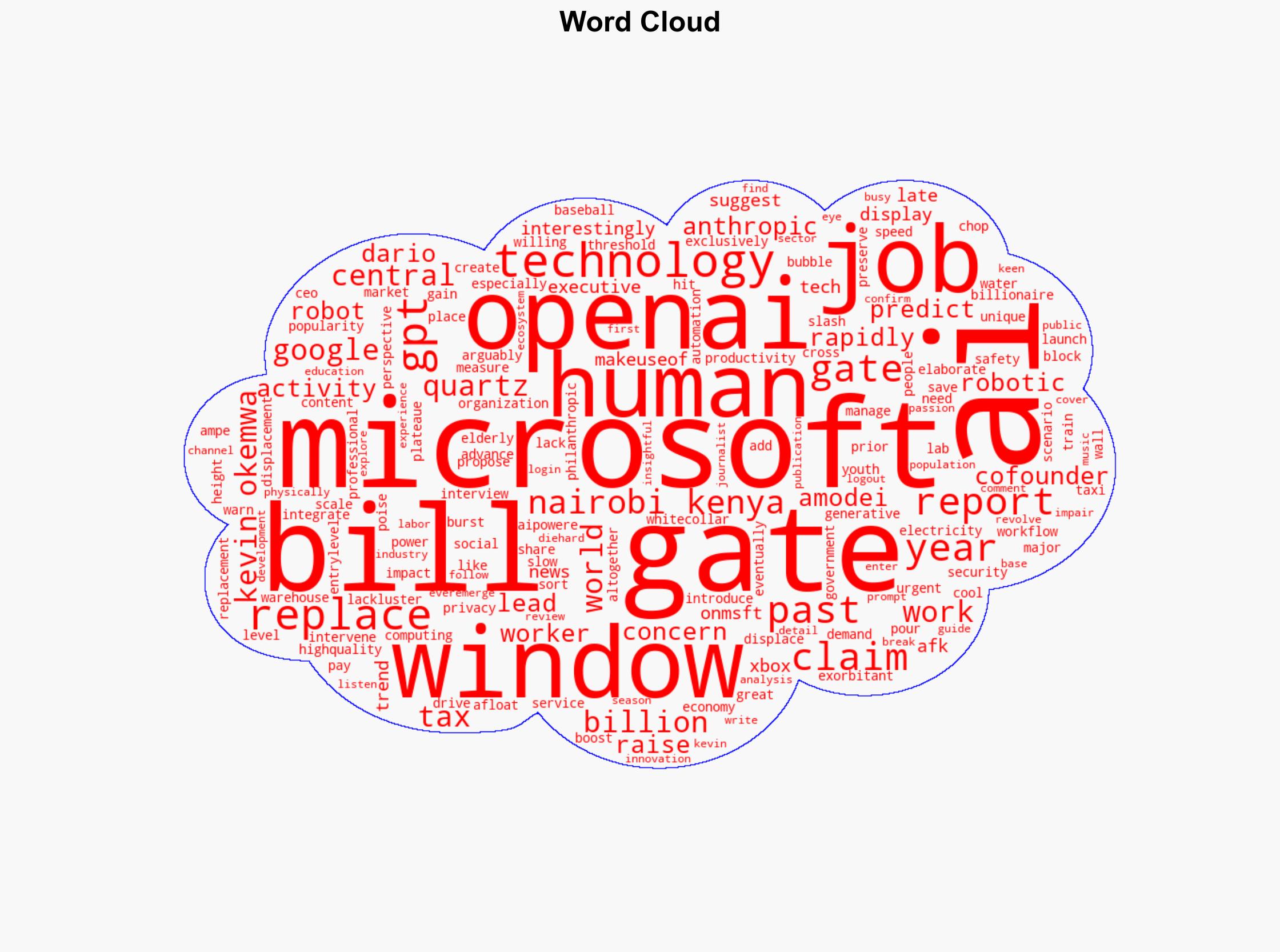

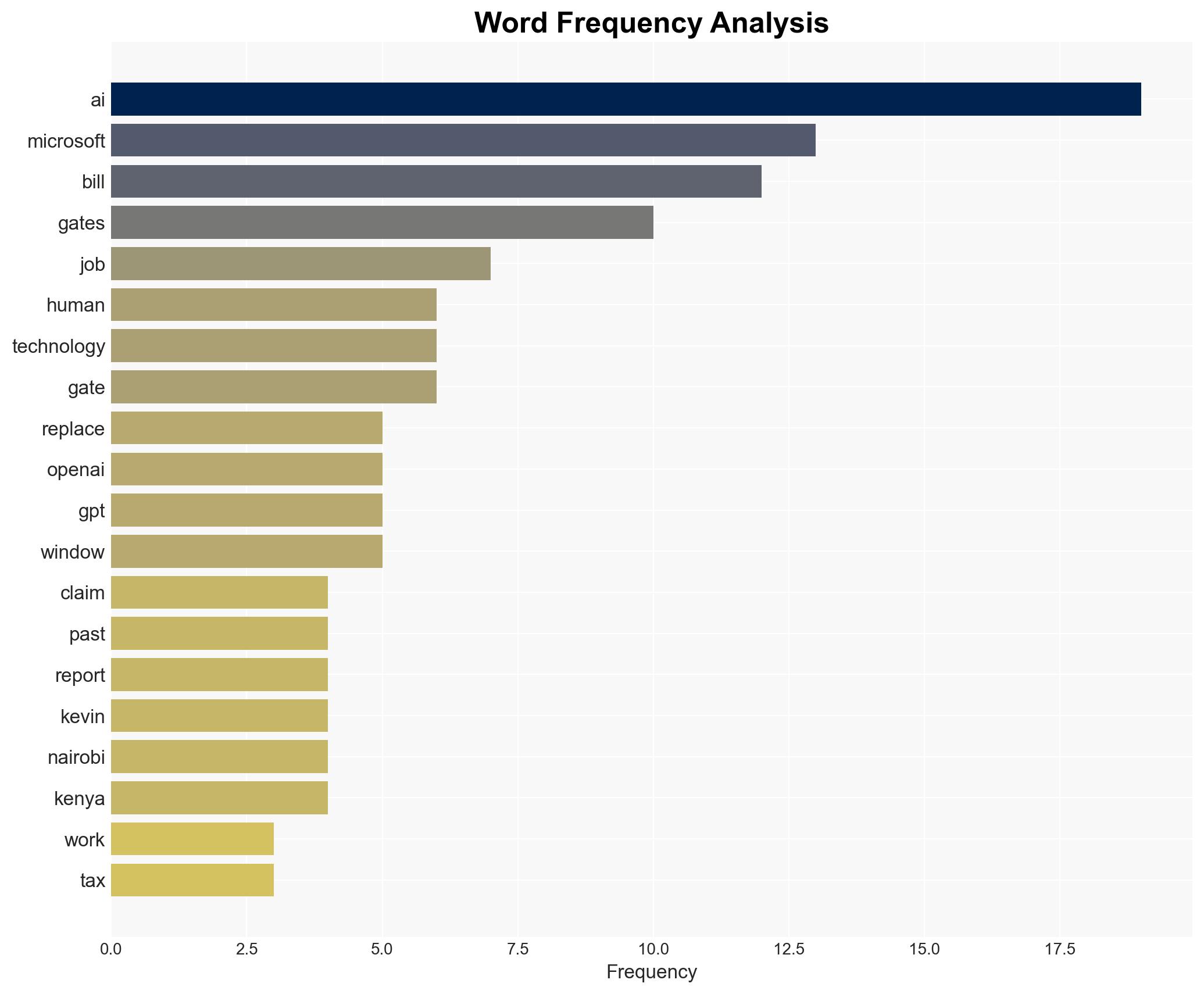

6. Key Individuals and Entities

Bill Gates, Dario Amodei, Microsoft, OpenAI, Google

7. Thematic Tags

Cybersecurity, Economic Policy, AI and Automation, Workforce Development

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Forecast futures under uncertainty via probabilistic logic.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us