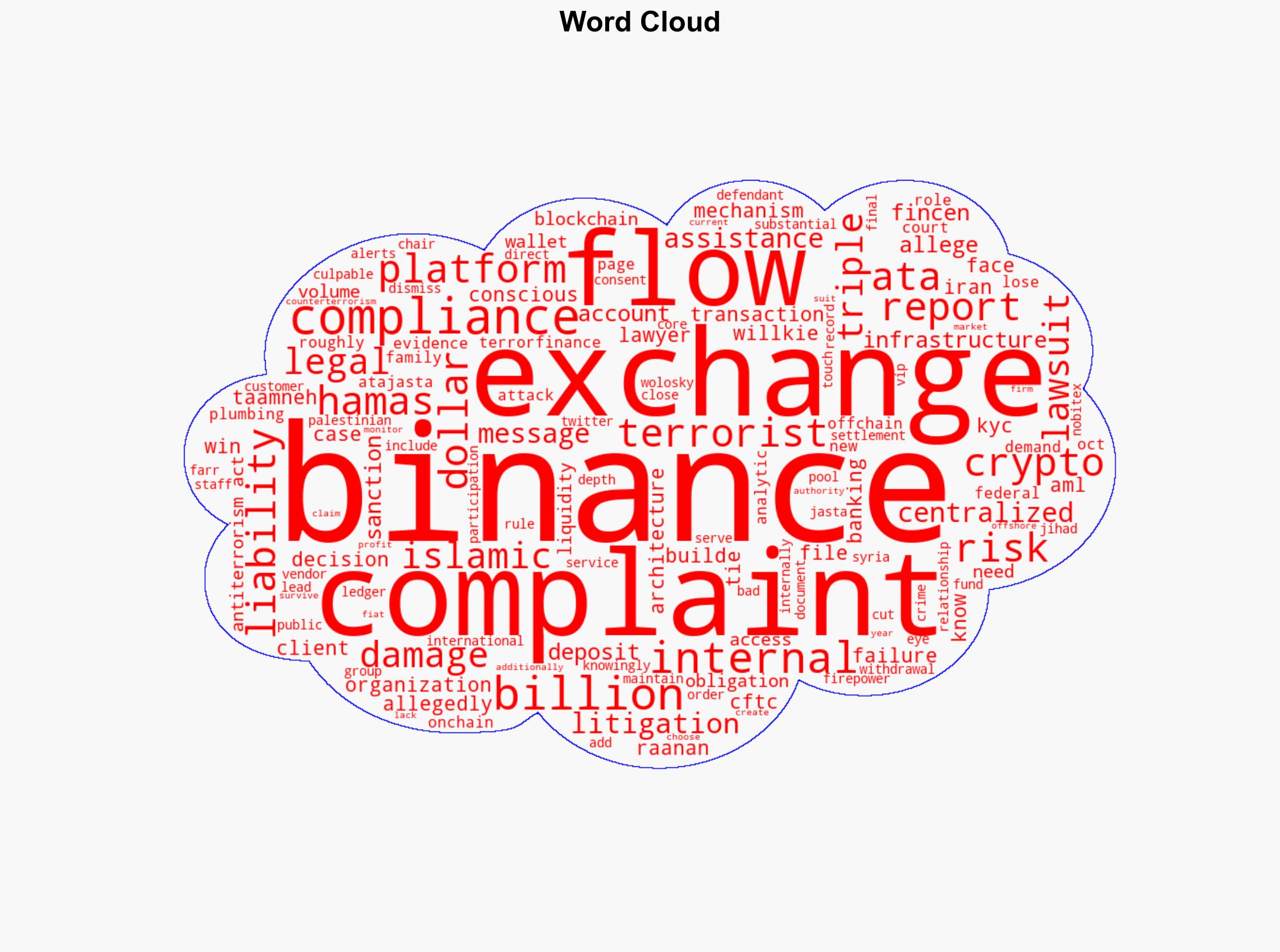

Binance faces potential triple damages in terror financing case, raising compliance concerns for exchanges

Published on: 2025-11-26

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

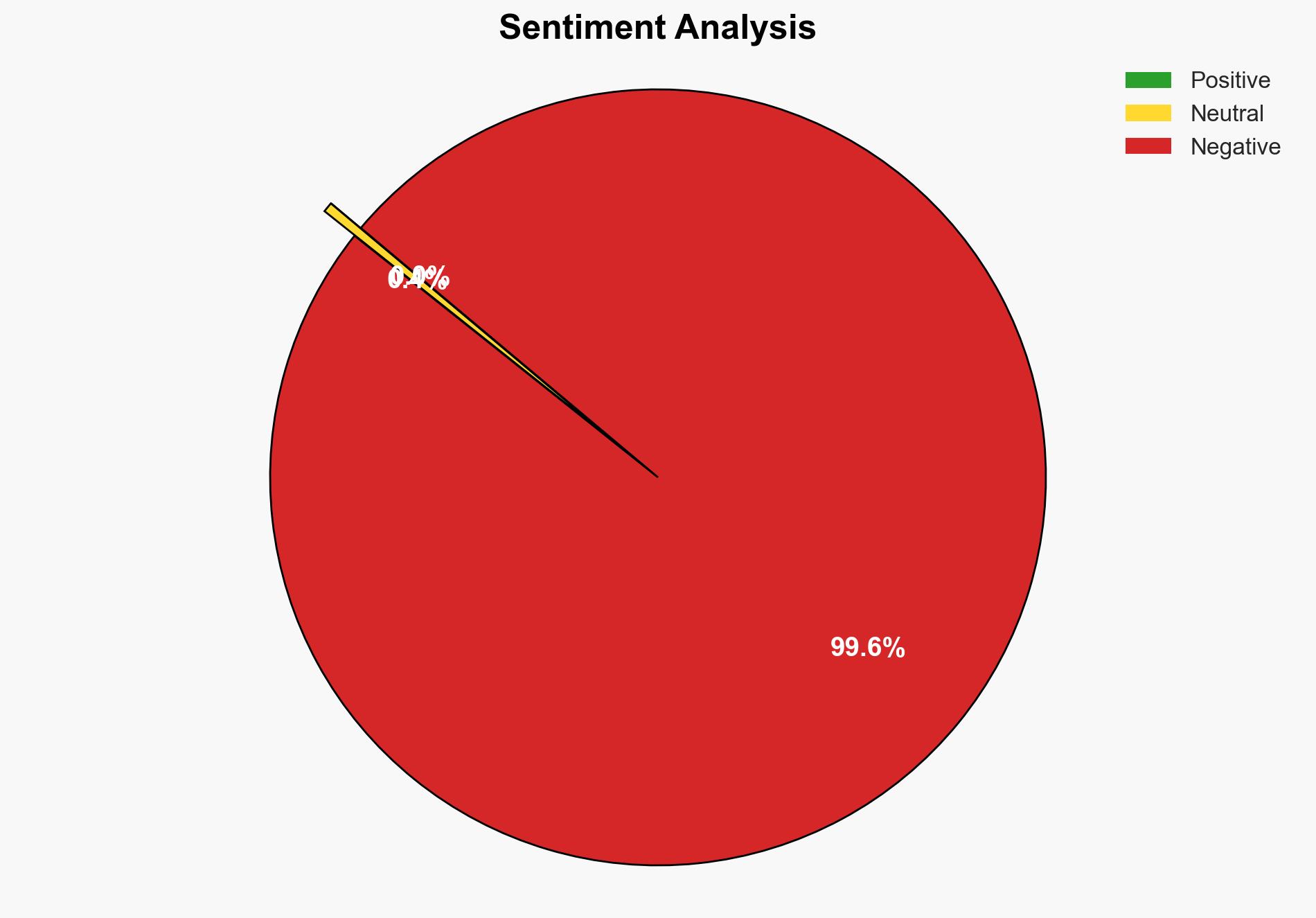

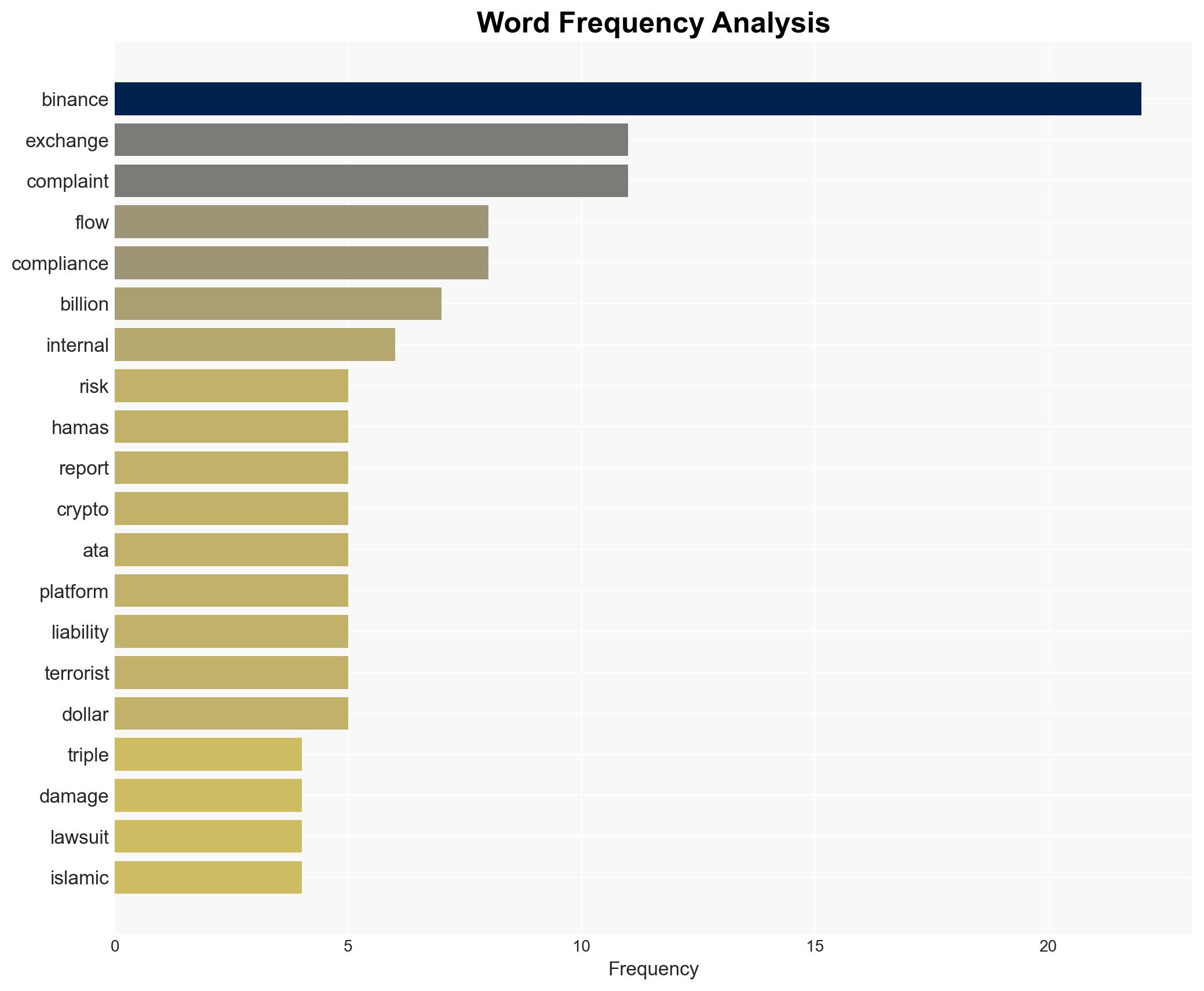

The strategic judgment is that Binance faces significant legal and reputational risks due to allegations of facilitating terror financing. The most supported hypothesis is that Binance’s internal compliance failures have inadvertently allowed terrorist organizations to exploit its platform. The recommended action is for Binance to immediately enhance its compliance protocols and cooperate with international regulatory bodies to mitigate potential legal repercussions and restore trust.

2. Competing Hypotheses

Hypothesis 1: Binance’s internal compliance failures have inadvertently facilitated terror financing activities. This hypothesis is supported by evidence of alleged non-compliance with AML/KYC obligations and the use of off-chain mechanisms to obscure transactions.

Hypothesis 2: The allegations against Binance are part of a strategic legal maneuver to pressure the exchange into a settlement, leveraging the high-profile nature of terror financing claims. This hypothesis considers the strategic use of the Anti-Terrorism Act and the involvement of high-profile legal teams.

Hypothesis 1 is more likely due to the detailed allegations in the complaint, including specific instances of non-compliance and internal communications suggesting awareness of illicit activities.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that the legal complaint is based on verifiable evidence and that Binance’s compliance mechanisms are insufficient to prevent misuse by illicit actors.

Red Flags: The timing of the lawsuit and the involvement of high-profile legal teams may indicate a strategic attempt to leverage public and legal pressure on Binance.

Deception Indicators: The possibility of exaggerated claims within the lawsuit to force a settlement, given the potential for triple damages under the Anti-Terrorism Act.

4. Implications and Strategic Risks

The case against Binance could lead to increased regulatory scrutiny on cryptocurrency exchanges globally, potentially resulting in stricter compliance requirements. Politically, it may strain relationships between the cryptocurrency sector and regulatory bodies. Economically, Binance could face substantial financial penalties, affecting its market position. There is also a risk of cyber threats as exchanges may become targets for retaliatory actions by illicit actors.

5. Recommendations and Outlook

- Binance should enhance its AML/KYC protocols and engage with international regulators to demonstrate compliance and transparency.

- Conduct an internal audit to identify and rectify compliance gaps.

- Best-case scenario: Binance successfully addresses compliance issues, mitigating legal risks and restoring trust.

- Worst-case scenario: Binance faces severe legal penalties and loss of market share due to reputational damage.

- Most-likely scenario: Binance reaches a settlement while implementing enhanced compliance measures to prevent future incidents.

6. Key Individuals and Entities

Changpeng Zhao (Binance CEO), Guangying Heina Chen (Binance Executive), Lee Wolosky (Lead Attorney), Christopher Giancarlo (CFTC Chair), Willkie Farr & Gallagher (Legal Team).

7. Thematic Tags

Structured Analytic Techniques Applied

- ACH 2.0: Reconstruct likely threat actor intentions via hypothesis testing and structured refutation.

- Indicators Development: Track radicalization signals and propaganda patterns to anticipate operational planning.

- Narrative Pattern Analysis: Analyze spread/adaptation of ideological narratives for recruitment/incitement signals.

Explore more:

Counter-Terrorism Briefs ·

Daily Summary ·

Support us