Bitcoin Cash Gains 19 to 518 Breaking Key Resistance – CoinDesk

Published on: 2025-11-13

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Bitcoin Cash Gains 19 to 518 Breaking Key Resistance – CoinDesk

1. BLUF (Bottom Line Up Front)

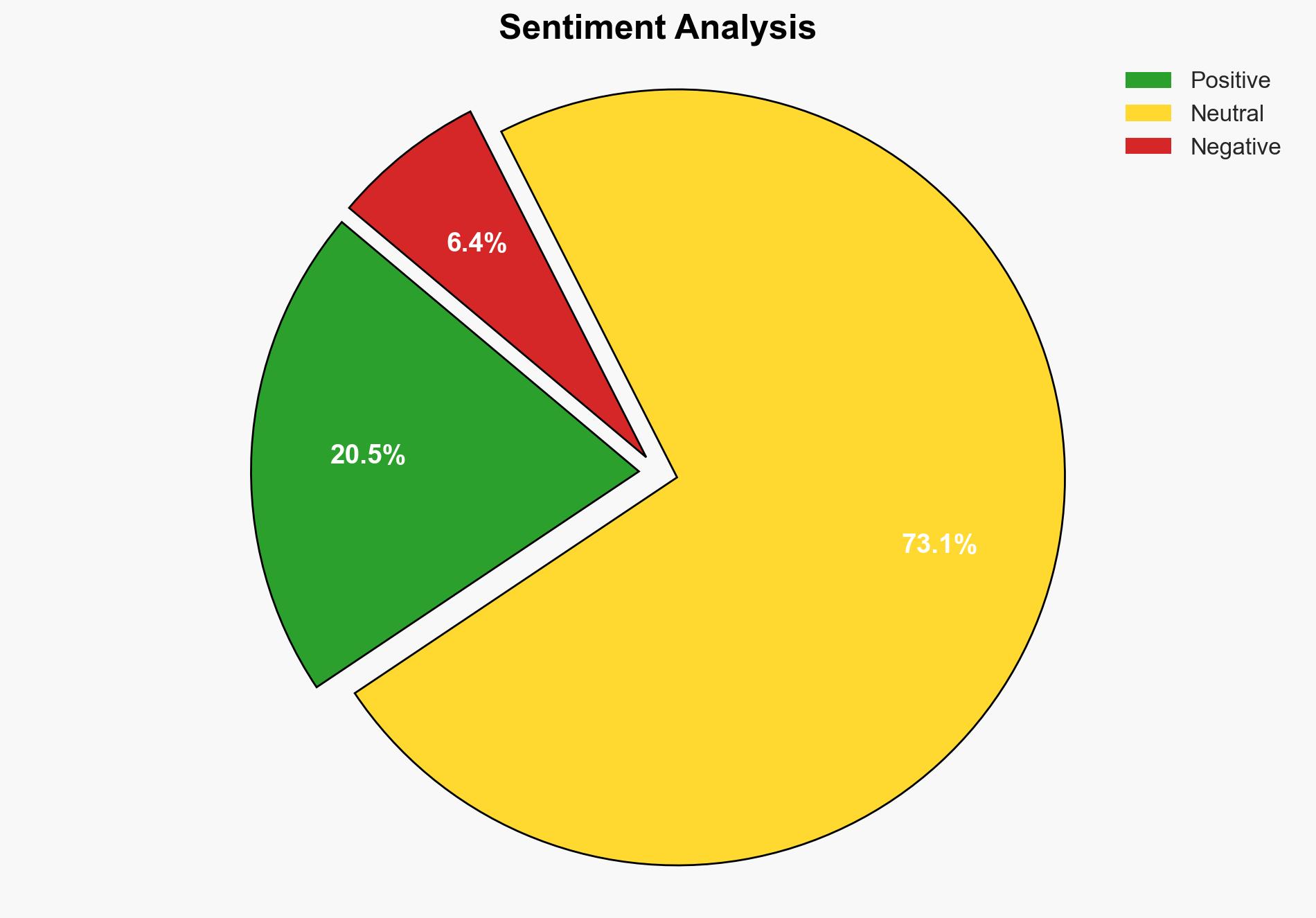

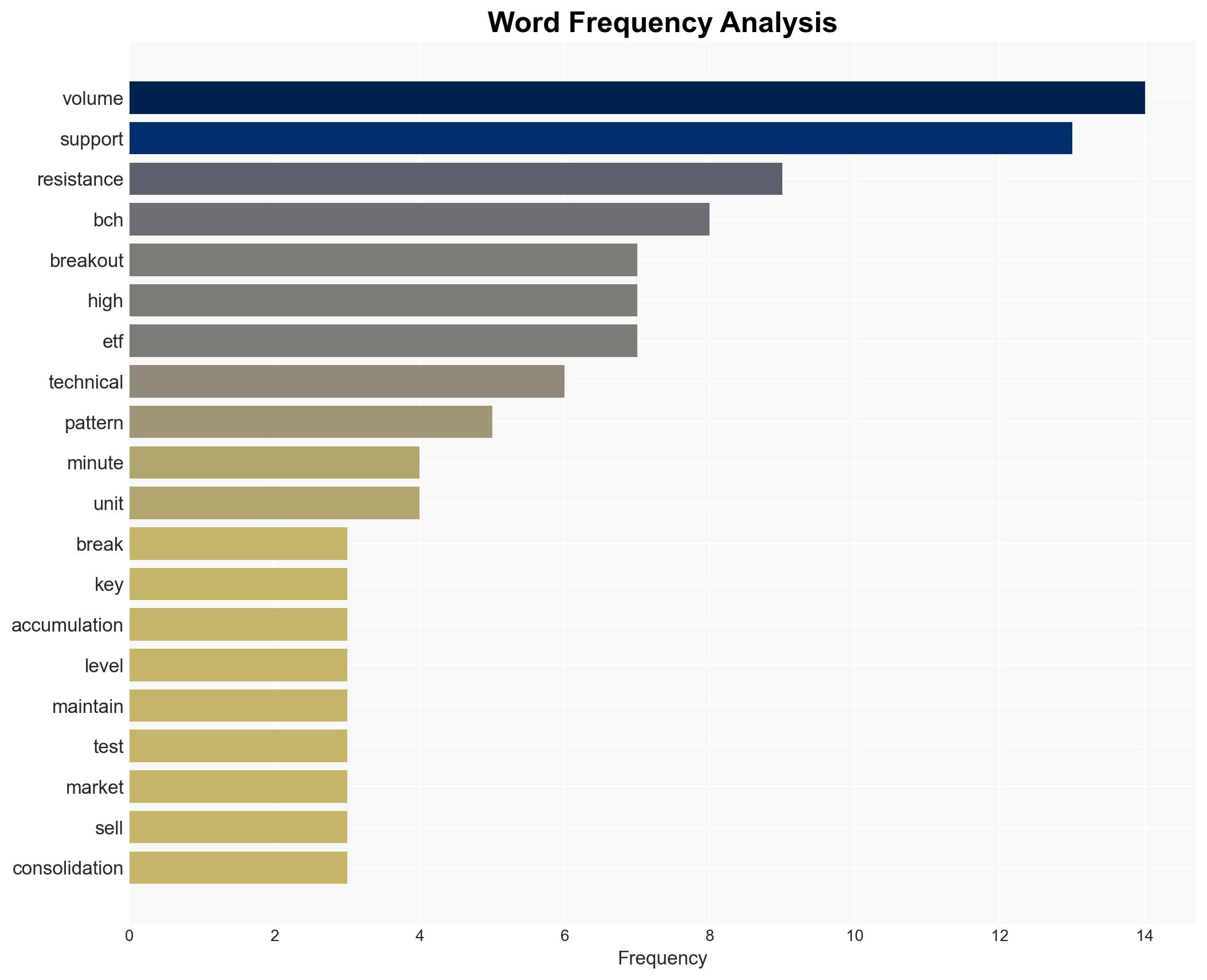

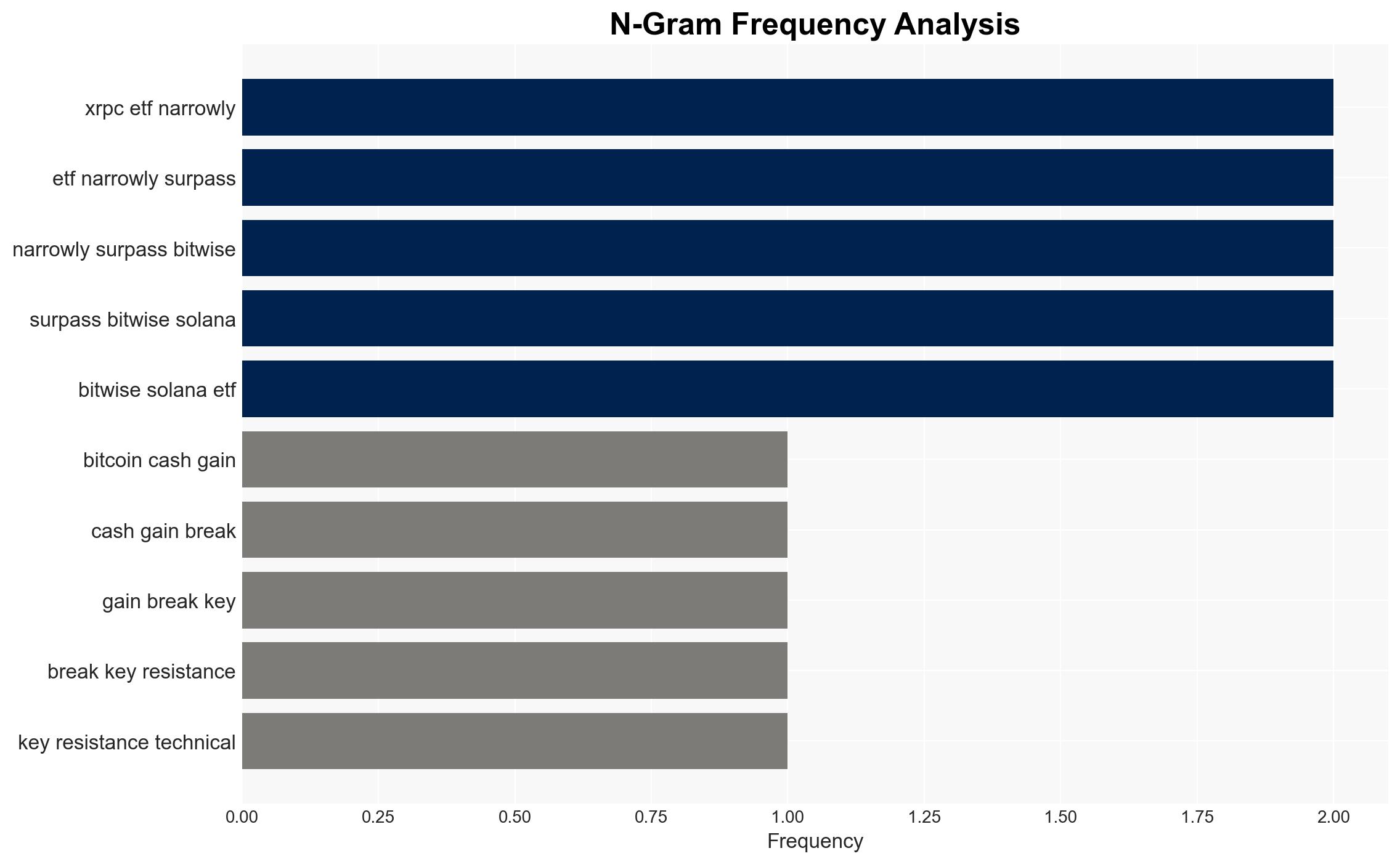

Bitcoin Cash (BCH) has experienced a significant price surge, breaking key resistance levels, suggesting potential continued bullish momentum. The most supported hypothesis is that institutional accumulation is driving this trend. Confidence level: Moderate. Recommended action: Monitor BCH for further institutional activity and potential regulatory impacts.

2. Competing Hypotheses

Hypothesis 1: Institutional accumulation is driving the price increase of BCH, as evidenced by high trading volumes and sustained support levels.

Hypothesis 2: The price surge is primarily driven by speculative retail trading, with technical breakouts attracting short-term traders rather than long-term institutional interest.

Assessment: Hypothesis 1 is more likely given the volume patterns and the establishment of new support levels, which are indicative of institutional involvement. However, the possibility of speculative retail trading cannot be entirely dismissed.

3. Key Assumptions and Red Flags

Assumptions: The analysis assumes that the reported volume data is accurate and that institutional investors are the primary drivers of the observed trading patterns.

Red Flags: Potential manipulation of trading volumes or misleading signals by large market players could skew the analysis. Additionally, reliance on technical analysis without considering broader market conditions poses a risk.

4. Implications and Strategic Risks

The continued bullish trend in BCH could attract further institutional interest, potentially stabilizing the asset’s price. However, regulatory scrutiny on cryptocurrencies could pose a significant risk, potentially leading to market volatility. Economic implications include increased investor confidence in digital assets, while political and cyber risks involve potential regulatory crackdowns and cybersecurity threats to exchanges.

5. Recommendations and Outlook

- Monitor regulatory developments that could impact BCH and the broader cryptocurrency market.

- Encourage diversification strategies for investors to mitigate potential volatility risks.

- Best Scenario: BCH continues to rise, driven by sustained institutional interest, leading to a stable price increase.

- Worst Scenario: Regulatory actions lead to a sharp decline in BCH value, causing market instability.

- Most-likely Scenario: BCH experiences moderate growth with periodic volatility, influenced by both institutional and retail activities.

6. Key Individuals and Entities

No specific individuals are mentioned in the source text. Entities involved include institutional investors and cryptocurrency exchanges.

7. Thematic Tags

Cryptocurrency, Market Analysis, Institutional Investment, Regulatory Risk

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology