Bitcoin Drops Below $78,000 Amid Escalating US-Iran Tensions and Geopolitical Concerns

Published on: 2026-01-31

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

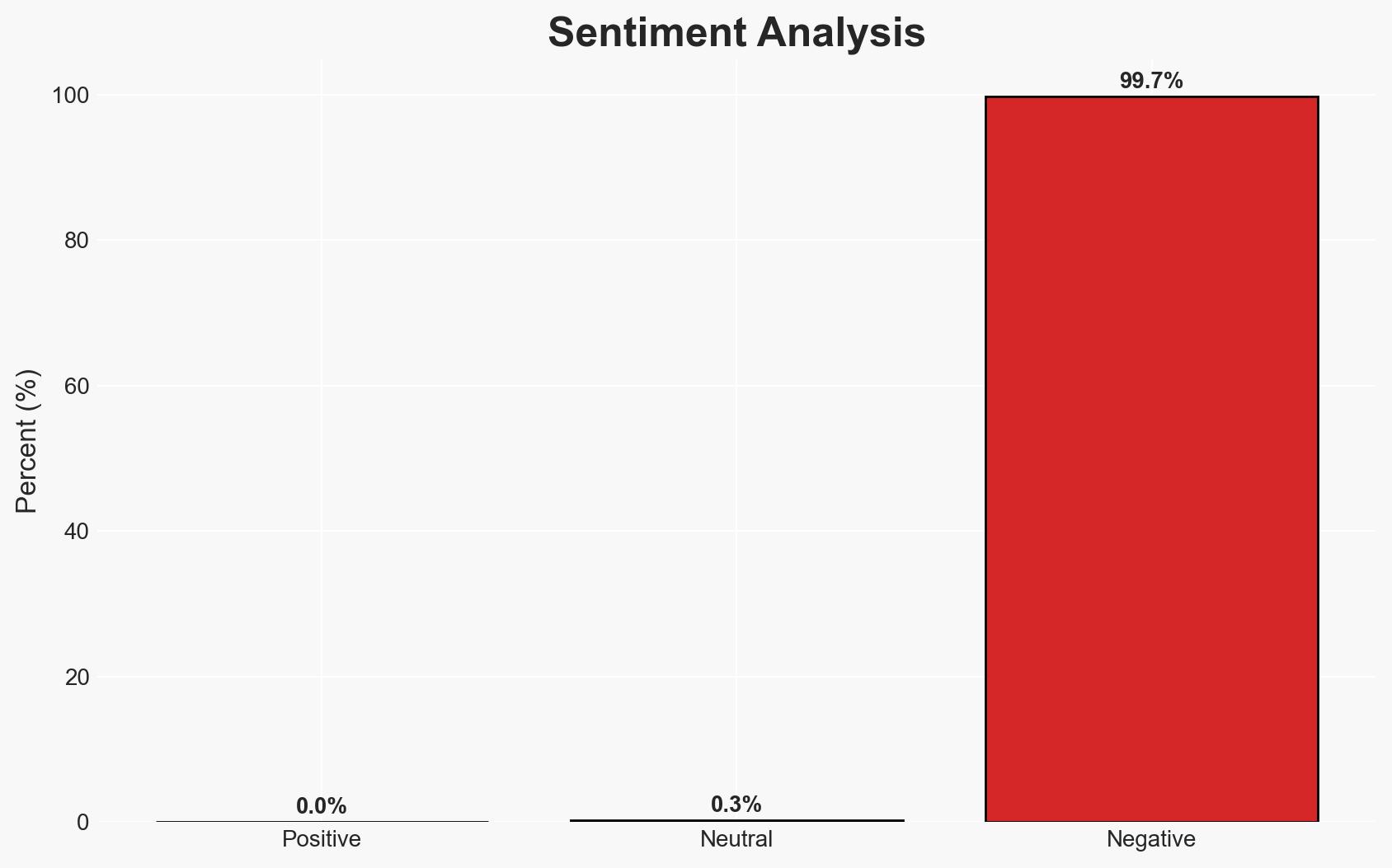

Intelligence Report: Bitcoin plunges under 80000 as US-Iran attacks deepen

1. BLUF (Bottom Line Up Front)

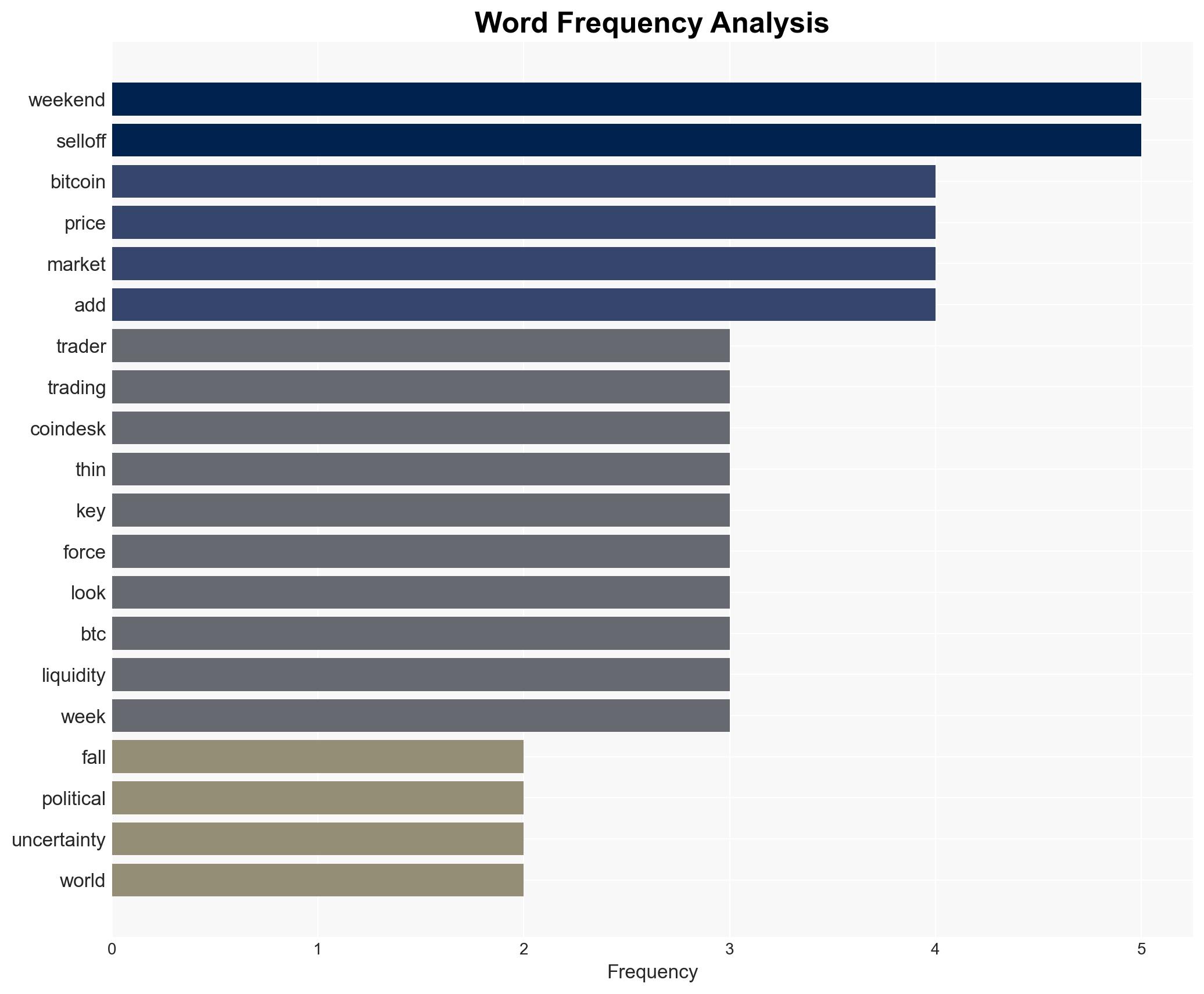

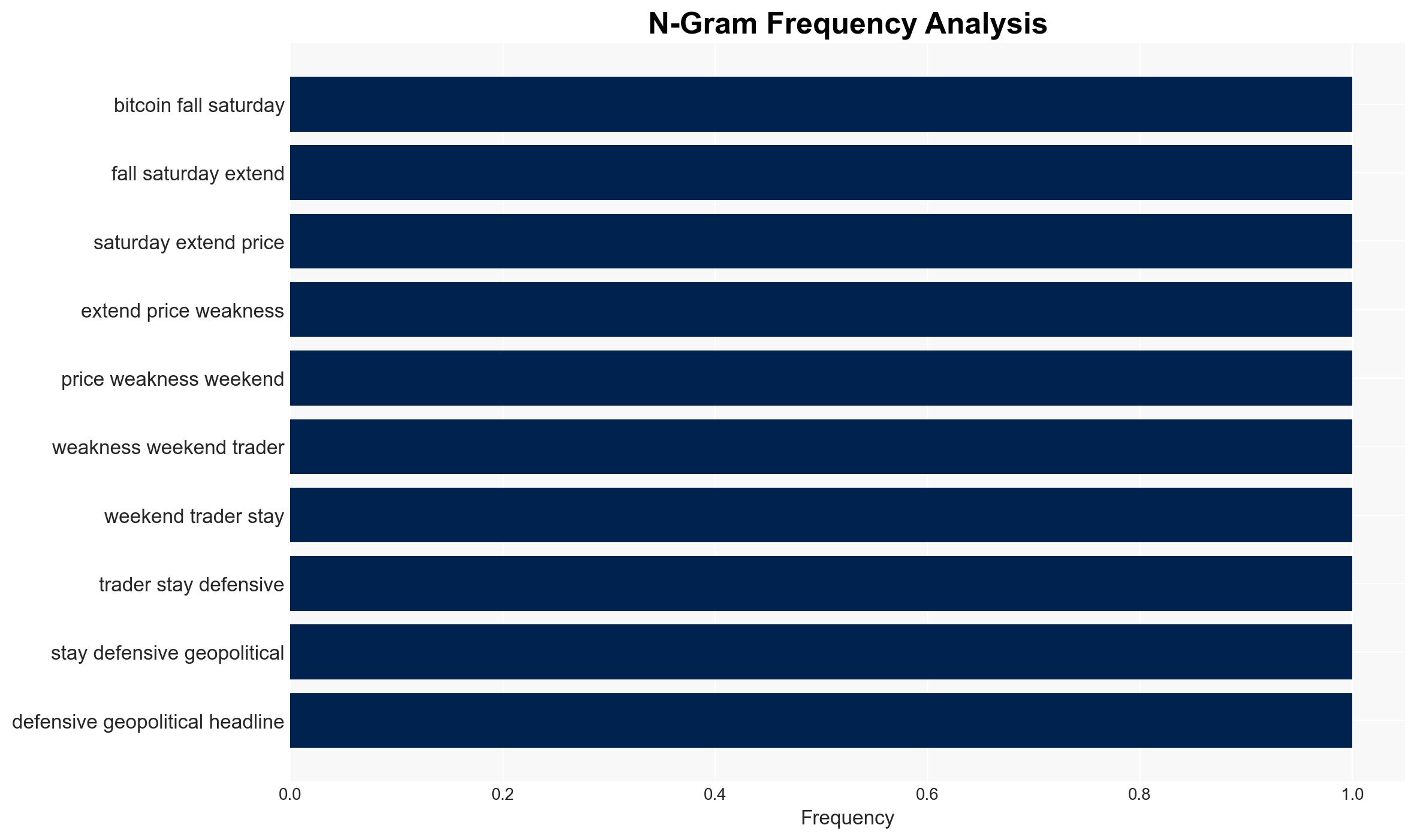

Bitcoin’s price drop below $78,000 is primarily driven by geopolitical tensions between the U.S. and Iran, compounded by domestic political uncertainty in the U.S. and structural weaknesses in crypto markets. The situation affects global financial stability and investor sentiment, with moderate confidence in this assessment.

2. Competing Hypotheses

- Hypothesis A: The decline in Bitcoin’s value is primarily due to geopolitical tensions between the U.S. and Iran, leading to risk aversion among investors. Supporting evidence includes the explosion at Iran’s Bandar Abbas port and increased military posturing. Contradicting evidence is the lack of direct impact on Bitcoin fundamentals.

- Hypothesis B: The price drop is mainly due to structural issues within the cryptocurrency market, such as thin liquidity and forced deleveraging. Supporting evidence includes reports of “Phantom Liquidity” and shallow order books. Contradicting evidence is the simultaneous occurrence of geopolitical events.

- Assessment: Hypothesis A is currently better supported due to the broader impact of geopolitical tensions on global markets, which aligns with historical patterns of risk aversion. Key indicators that could shift this judgment include changes in U.S.-Iran relations or significant crypto market reforms.

3. Key Assumptions and Red Flags

- Assumptions: Geopolitical tensions will continue to influence market sentiment; U.S. domestic political uncertainty will persist; crypto market structural weaknesses will not be immediately resolved.

- Information Gaps: Detailed intelligence on the strategic intentions of the U.S. and Iran; comprehensive data on crypto market liquidity across different platforms.

- Bias & Deception Risks: Potential bias in media reporting on geopolitical events; risk of market manipulation by large crypto holders or coordinated trading groups.

4. Implications and Strategic Risks

The current developments could lead to sustained volatility in financial markets, affecting investor confidence and potentially triggering broader economic repercussions.

- Political / Geopolitical: Escalation in U.S.-Iran tensions could lead to further destabilization in the Middle East, impacting global oil supply and international relations.

- Security / Counter-Terrorism: Heightened military presence in the region increases the risk of miscalculation or conflict, potentially involving non-state actors.

- Cyber / Information Space: Increased cyber operations targeting financial institutions and critical infrastructure could occur, exploiting the current geopolitical climate.

- Economic / Social: Prolonged market instability may lead to economic downturns, affecting employment and social stability in affected regions.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Enhance monitoring of geopolitical developments and crypto market trends; engage with financial regulators to assess systemic risks.

- Medium-Term Posture (1–12 months): Develop resilience measures for financial systems; strengthen partnerships with international allies to manage geopolitical risks.

- Scenario Outlook:

- Best: De-escalation of U.S.-Iran tensions leads to market stabilization.

- Worst: Escalation into military conflict disrupts global markets and oil supply.

- Most-Likely: Continued volatility with episodic geopolitical flare-ups affecting market sentiment.

6. Key Individuals and Entities

- Donald Trump, Former U.S. President

- Islamic Revolutionary Guard Corps (IRGC)

- Russell Thompson, Chief Investment Officer at Hilbert Group

- Chris Soriano, Co-founder & CCO of BridgePort

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

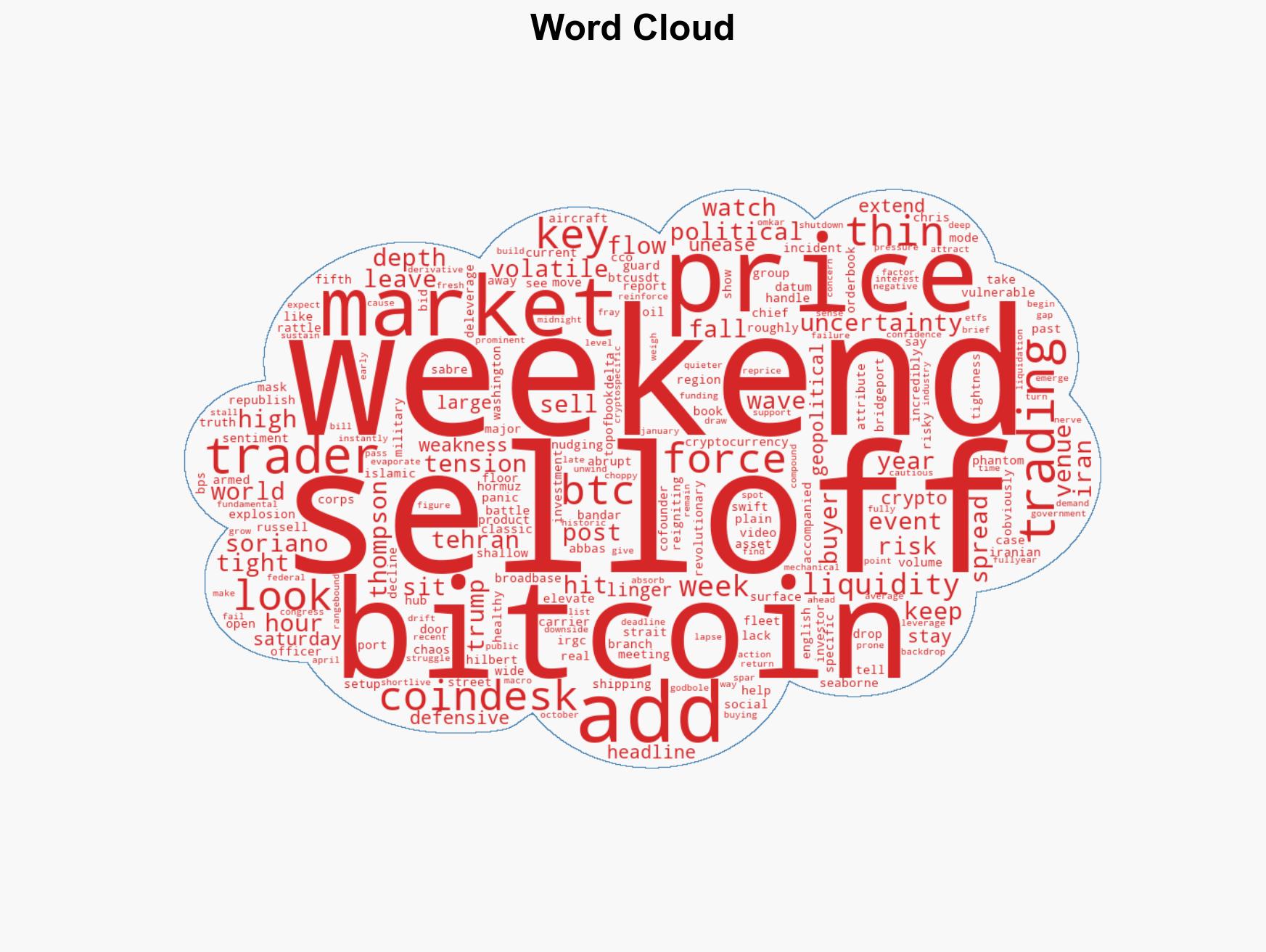

regional conflicts, geopolitical tensions, cryptocurrency market, U.S.-Iran relations, financial stability, risk aversion, market volatility, economic impact

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Conflicts Briefs ·

Daily Summary ·

Support us