Bitcoin mining news Bitcoin mining stocks Lose 8B Bitdeers datacenter fire AI delays hit CORZ – Blockspace.media

Published on: 2025-11-15

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Bitcoin Mining Sector Challenges and Strategic Analysis

1. BLUF (Bottom Line Up Front)

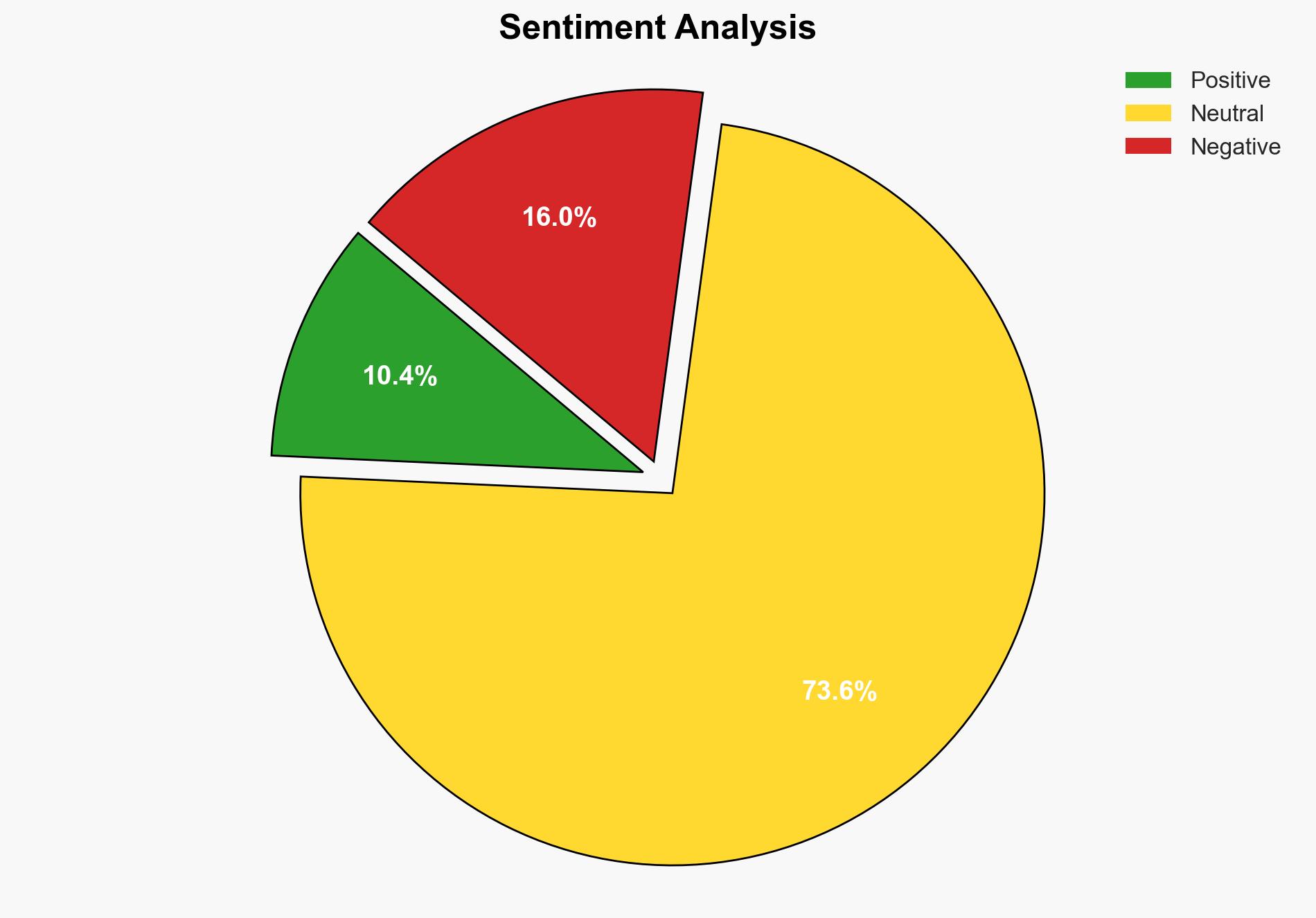

The Bitcoin mining sector is currently facing significant challenges, including financial losses, operational disruptions, and strategic shifts towards AI. The most supported hypothesis is that these difficulties are primarily driven by external market pressures and internal operational inefficiencies. Confidence level: Moderate. Recommended action: Companies should diversify their revenue streams and enhance operational resilience to mitigate risks.

2. Competing Hypotheses

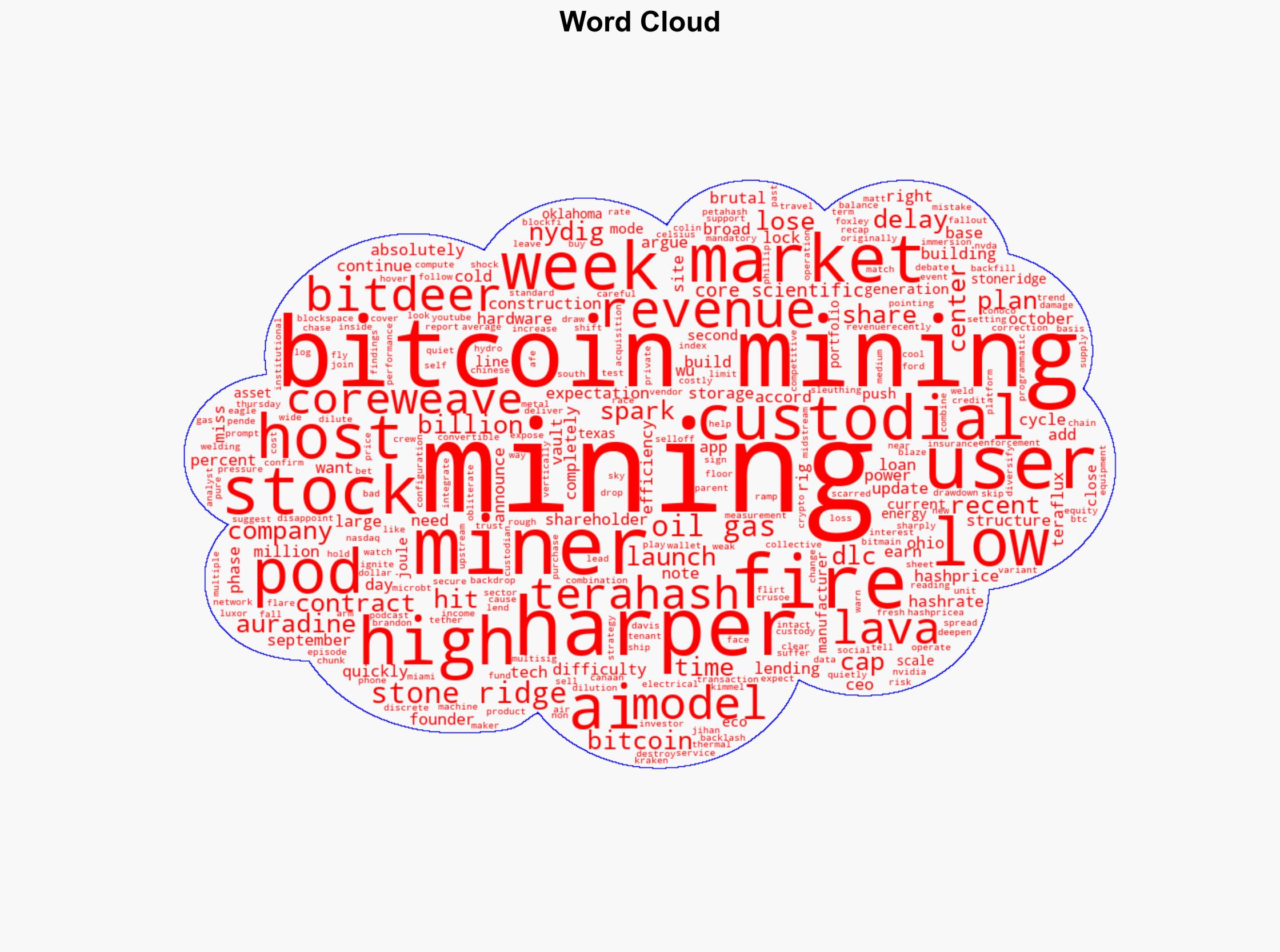

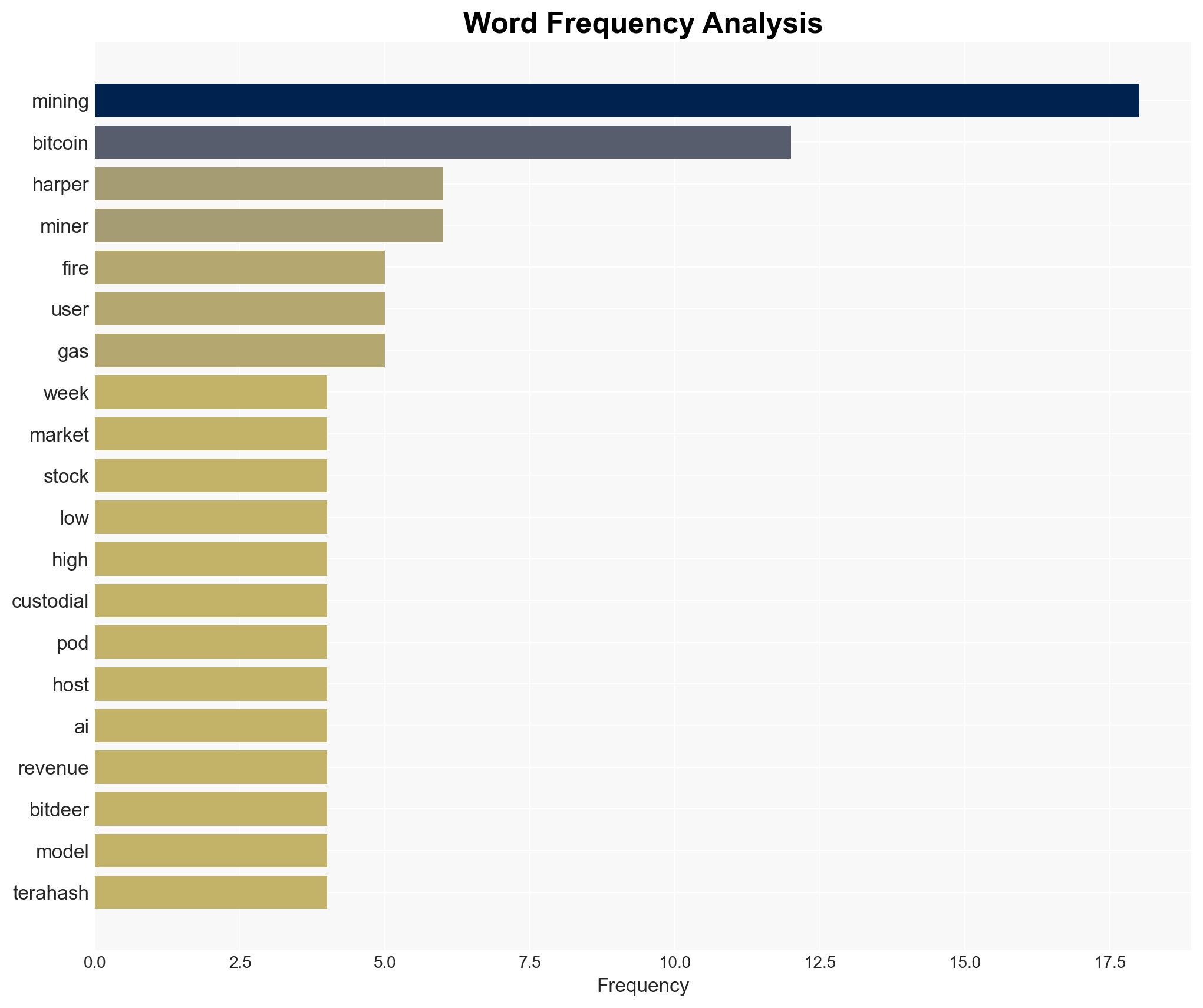

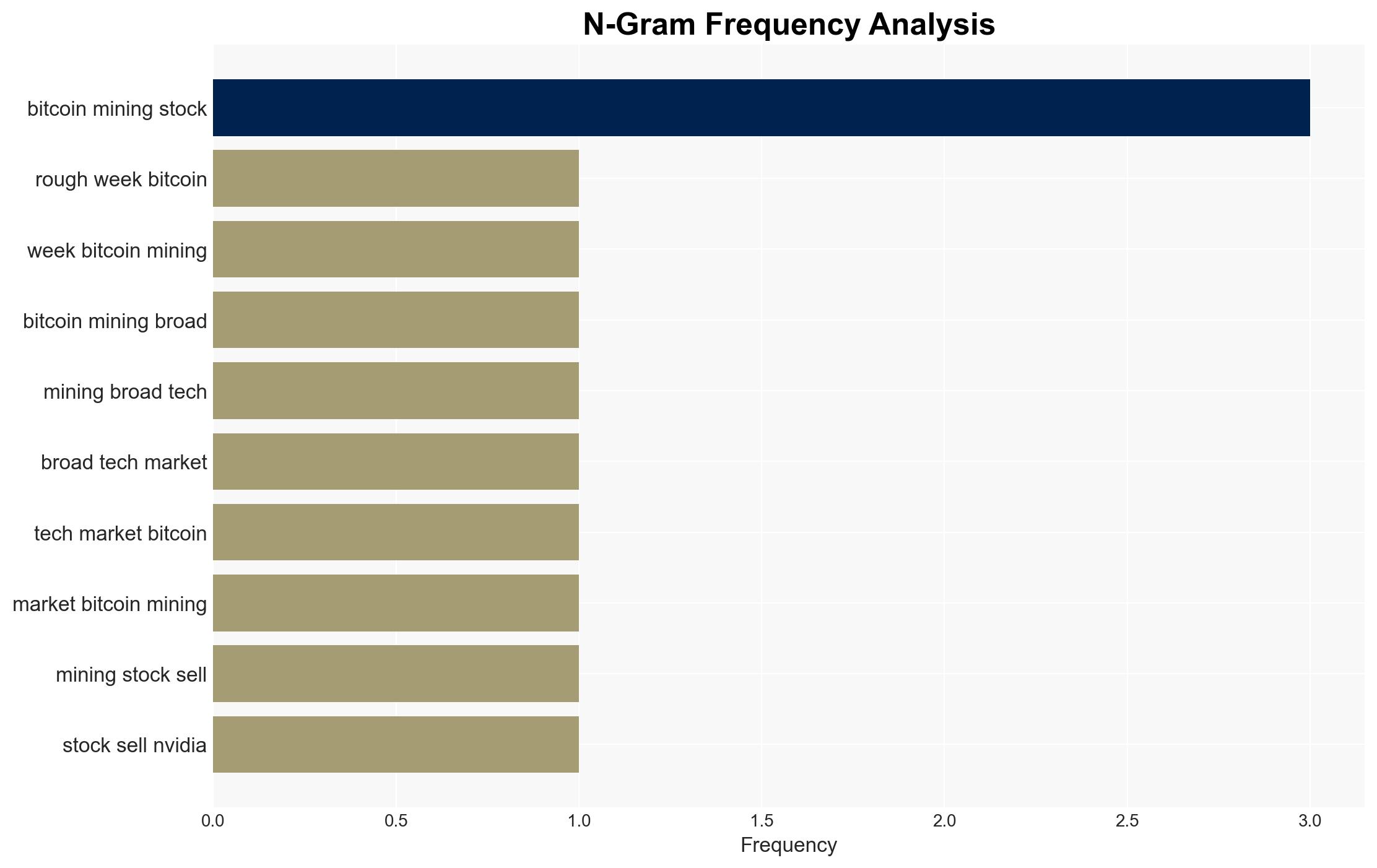

Hypothesis 1: The downturn in Bitcoin mining stocks and operational challenges are primarily due to external market pressures, such as the broader tech market selloff and high Bitcoin mining difficulty.

Hypothesis 2: The issues are largely internal, stemming from operational inefficiencies, such as the Bitdeer data center fire and AI-related delays, which exacerbate financial vulnerabilities.

Assessment: Hypothesis 1 is more likely given the widespread impact of tech market corrections and high mining difficulty affecting all players, not just isolated incidents. However, internal factors cannot be entirely discounted as they compound the sector’s challenges.

3. Key Assumptions and Red Flags

Assumptions include the belief that market pressures are the primary driver of current challenges and that operational issues are secondary. Red flags include potential underreporting of operational inefficiencies and the possibility of strategic missteps in transitioning to AI. Deception indicators could arise if companies downplay internal issues to maintain investor confidence.

4. Implications and Strategic Risks

The cascading threats include potential financial instability for Bitcoin mining companies, reduced investor confidence, and increased regulatory scrutiny. Economic risks are heightened by potential shifts in energy costs and technological advancements in AI. Cyber risks may arise from increased reliance on digital infrastructure and custodial models.

5. Recommendations and Outlook

- Actionable steps: Companies should diversify into AI and other high-performance computing sectors, improve operational safety protocols, and enhance transparency with stakeholders.

- Best-case scenario: Companies successfully diversify and stabilize financial performance.

- Worst-case scenario: Continued operational failures lead to significant financial losses and potential bankruptcies.

- Most-likely scenario: A gradual recovery as companies adapt to market conditions and operational challenges.

6. Key Individuals and Entities

Jihan Wu (CEO of Bitdeer), Colin Harper (Podcast Host), Blockspace Founder Foxley.

7. Thematic Tags

Cybersecurity, Financial Markets, Operational Risk, AI Integration, Bitcoin Mining

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us

·