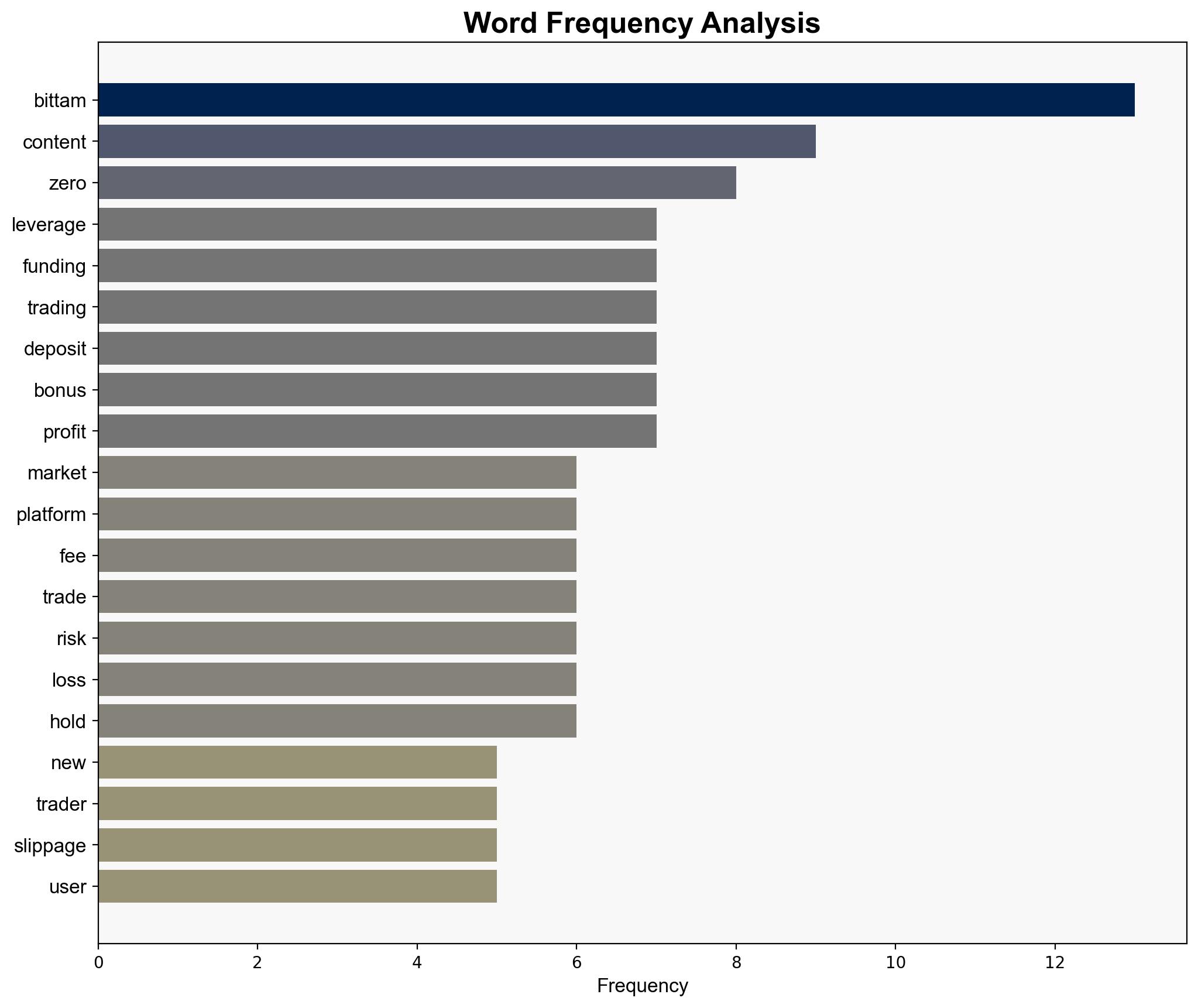

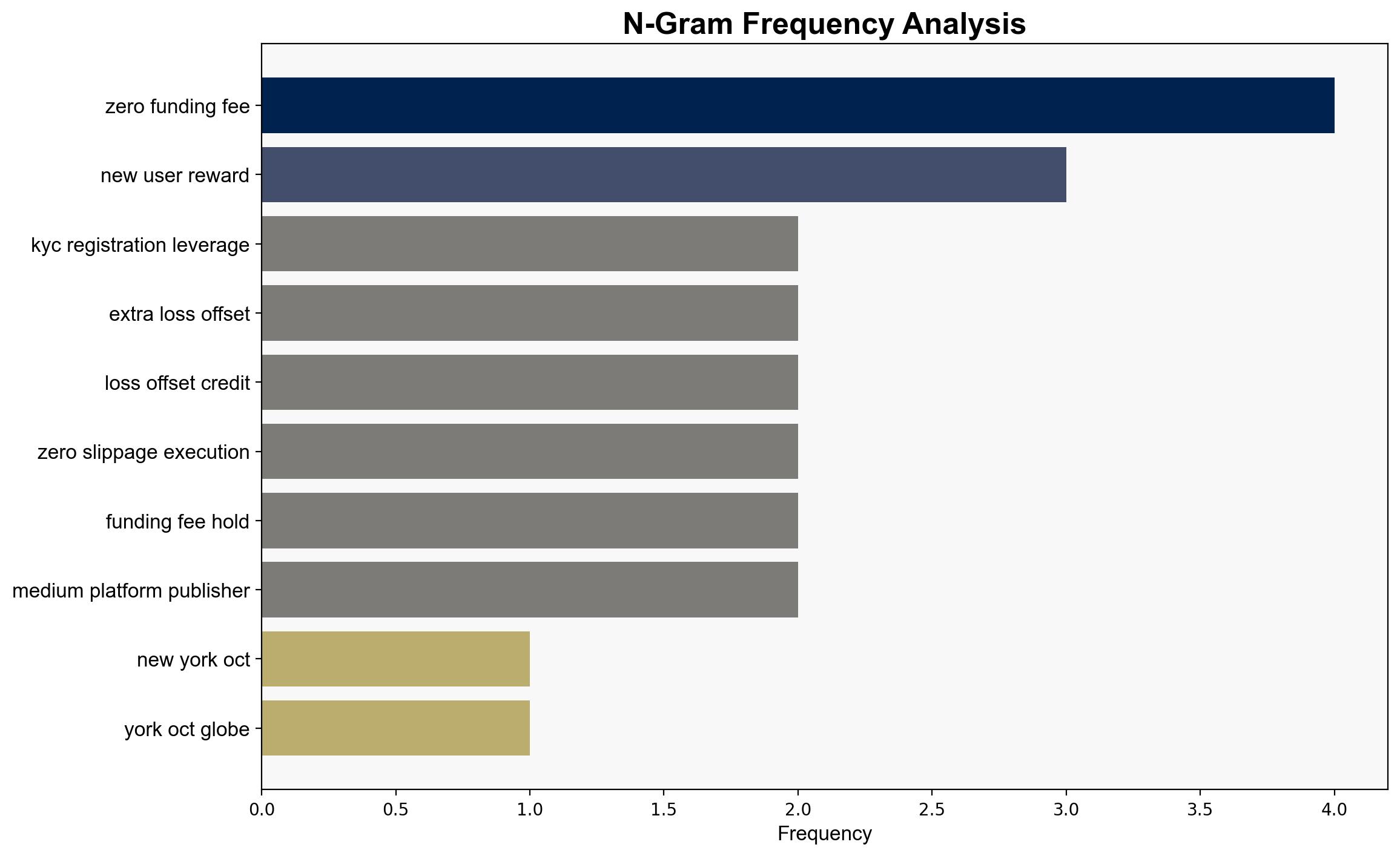

Bittam create No KYC Up to 200 Leverage Zero Slippage Zero Funding Fees 100 Deposit Bonus and Up to 3000 New User Rewards – GlobeNewswire

Published on: 2025-10-18

Intelligence Report: Bittam create No KYC Up to 200 Leverage Zero Slippage Zero Funding Fees 100 Deposit Bonus and Up to 3000 New User Rewards – GlobeNewswire

1. BLUF (Bottom Line Up Front)

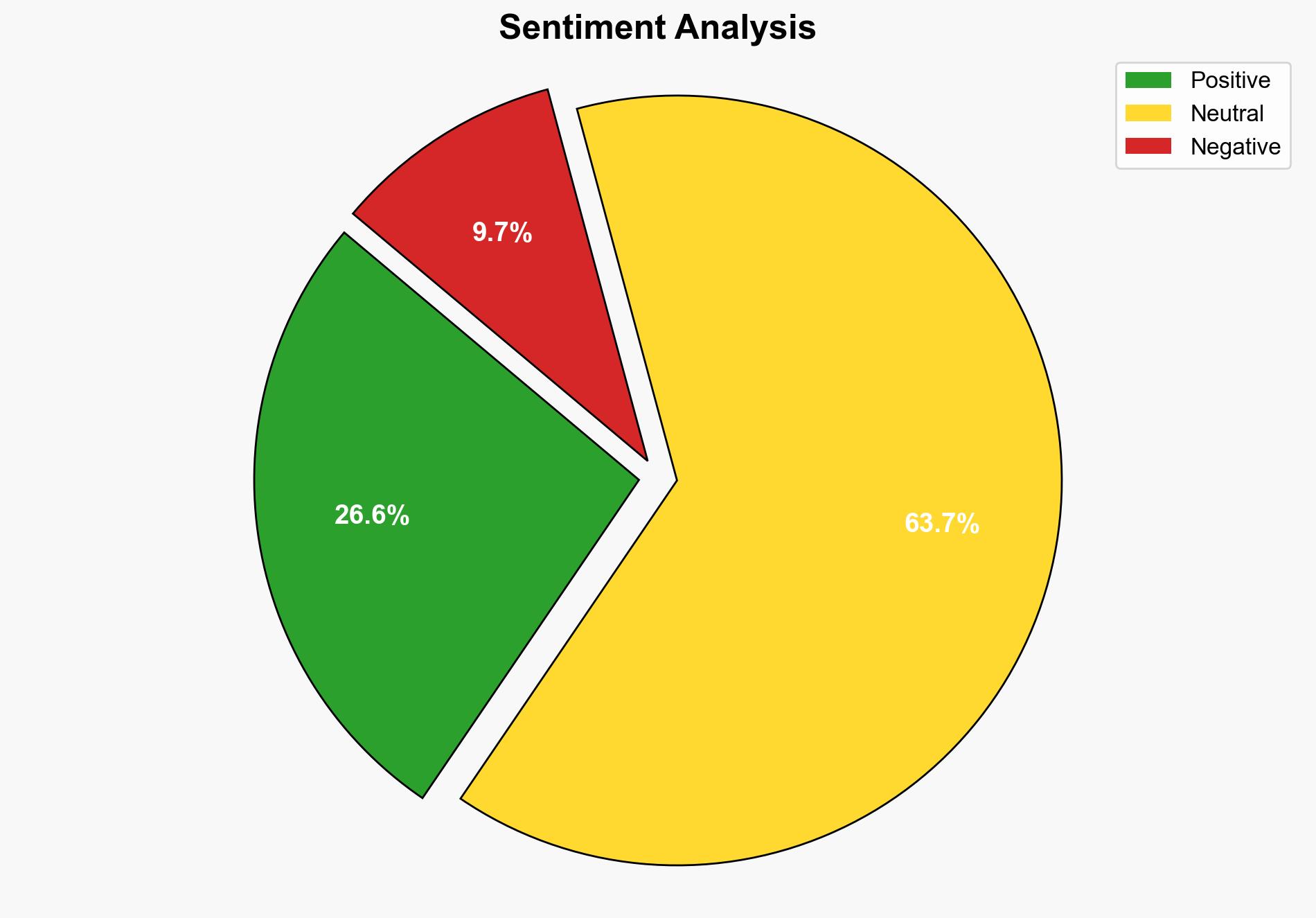

Bittam Exchange’s offering of high-leverage trading with no KYC requirements and zero fees presents both a disruptive opportunity and a potential regulatory challenge in the cryptocurrency market. The most supported hypothesis is that Bittam aims to rapidly expand its user base by appealing to traders seeking anonymity and cost efficiency. Confidence Level: Moderate. Recommended action: Monitor regulatory responses and market adoption trends to assess long-term viability and compliance risks.

2. Competing Hypotheses

1. **Expansion Strategy Hypothesis**: Bittam is leveraging its no-KYC, high-leverage, and zero-fee model to rapidly capture market share by attracting traders who prioritize privacy and cost efficiency.

2. **Regulatory Evasion Hypothesis**: Bittam’s model is primarily designed to circumvent regulatory scrutiny by minimizing user identification requirements, potentially attracting illicit activities.

Using ACH 2.0, the Expansion Strategy Hypothesis is better supported due to the structured incentives for legitimate traders and the presence of regulatory licenses in Canada and Australia, suggesting a strategic approach to compliance.

3. Key Assumptions and Red Flags

– **Assumptions**: The assumption that regulatory licenses in Canada and Australia will suffice for global operations; the belief that traders will prioritize anonymity over regulatory compliance.

– **Red Flags**: Lack of detailed information on how Bittam ensures compliance with international regulations; potential for misuse by illicit actors due to no-KYC policy.

– **Blind Spots**: Possible underestimation of regulatory backlash and the impact of future policy changes on business operations.

4. Implications and Strategic Risks

– **Economic**: Bittam’s model could pressure competitors to lower fees, impacting industry profitability.

– **Cyber**: Increased risk of cyber threats targeting Bittam due to its high-profile, low-barrier entry model.

– **Geopolitical**: Potential friction with jurisdictions enforcing strict KYC and AML regulations, leading to operational constraints.

– **Psychological**: Appeal to traders seeking autonomy may drive rapid user adoption, but also increase scrutiny from regulators.

5. Recommendations and Outlook

- Monitor regulatory developments in key markets to anticipate compliance challenges.

- Engage with legal experts to ensure alignment with international regulatory standards.

- Scenario Projections:

- **Best Case**: Bittam successfully navigates regulatory landscapes, becoming a leading global exchange.

- **Worst Case**: Regulatory crackdowns limit operations, leading to significant financial and reputational damage.

- **Most Likely**: Gradual adoption with periodic regulatory adjustments, maintaining a niche market presence.

6. Key Individuals and Entities

– Bittam Exchange

– Regulatory bodies in Canada and Australia

7. Thematic Tags

cryptocurrency regulation, financial innovation, market disruption, regulatory compliance