Black Hat USA 2025 Is a high cyber insurance premium about your risk or your insurers – We Live Security

Published on: 2025-08-08

Intelligence Report: Black Hat USA 2025 Is a high cyber insurance premium about your risk or your insurers – We Live Security

1. BLUF (Bottom Line Up Front)

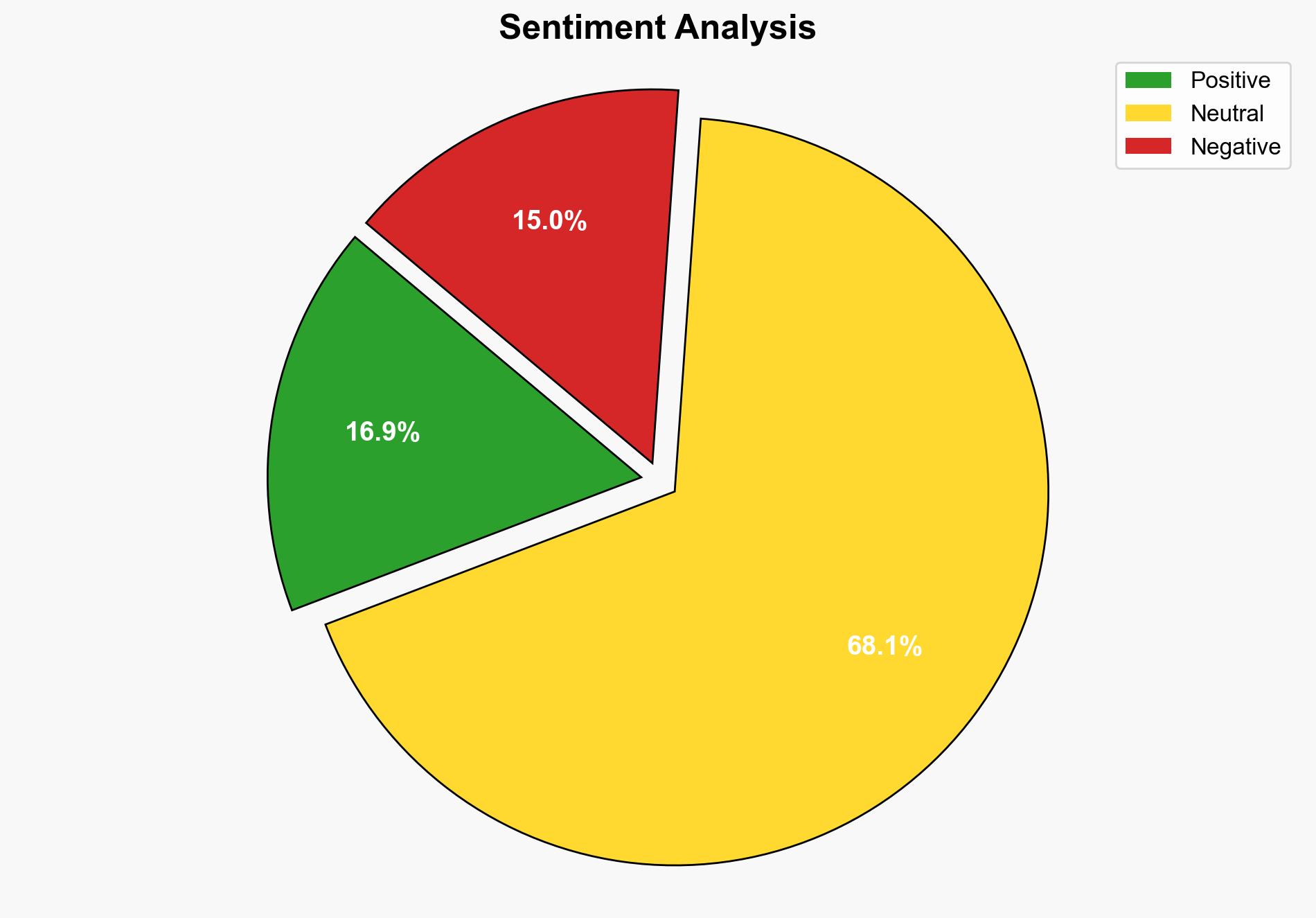

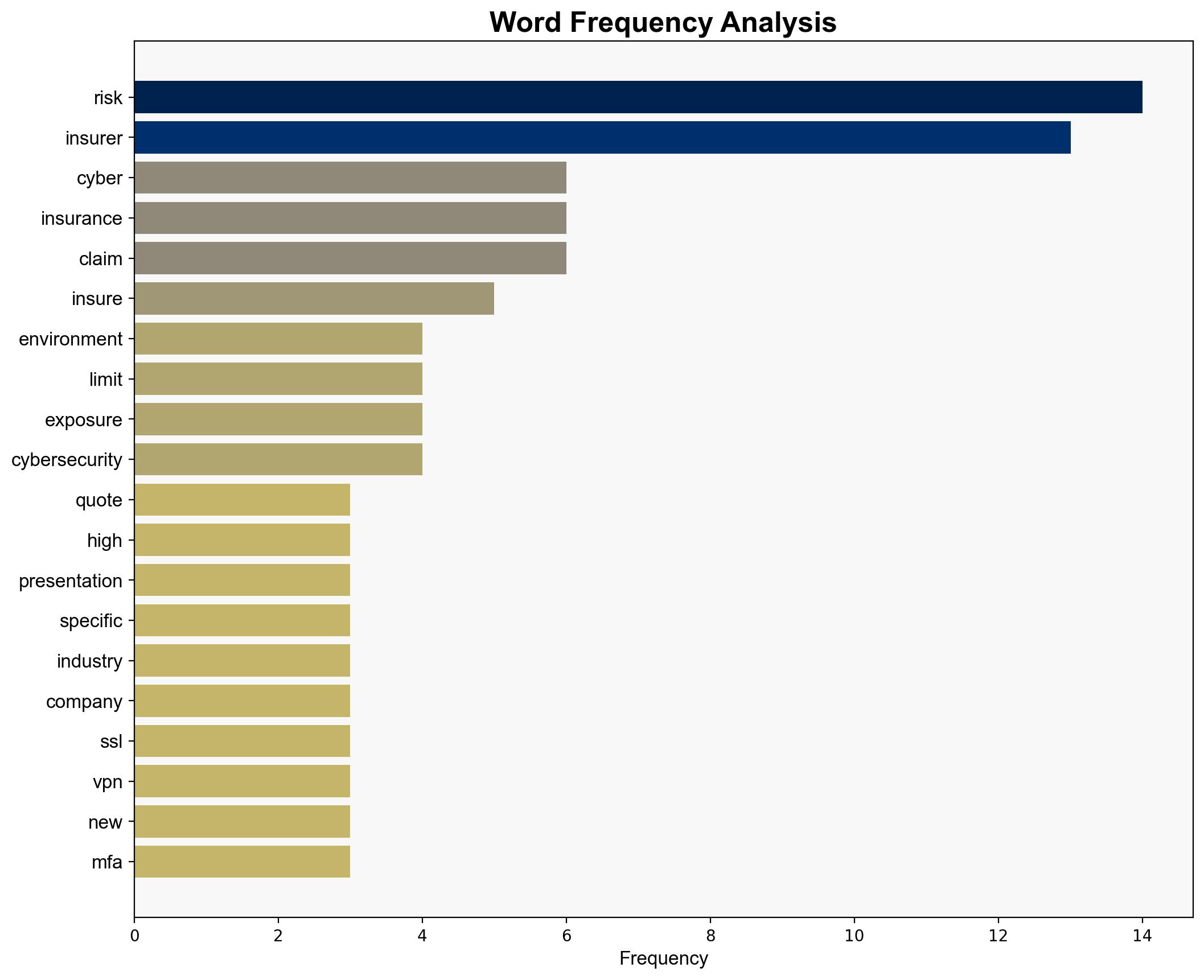

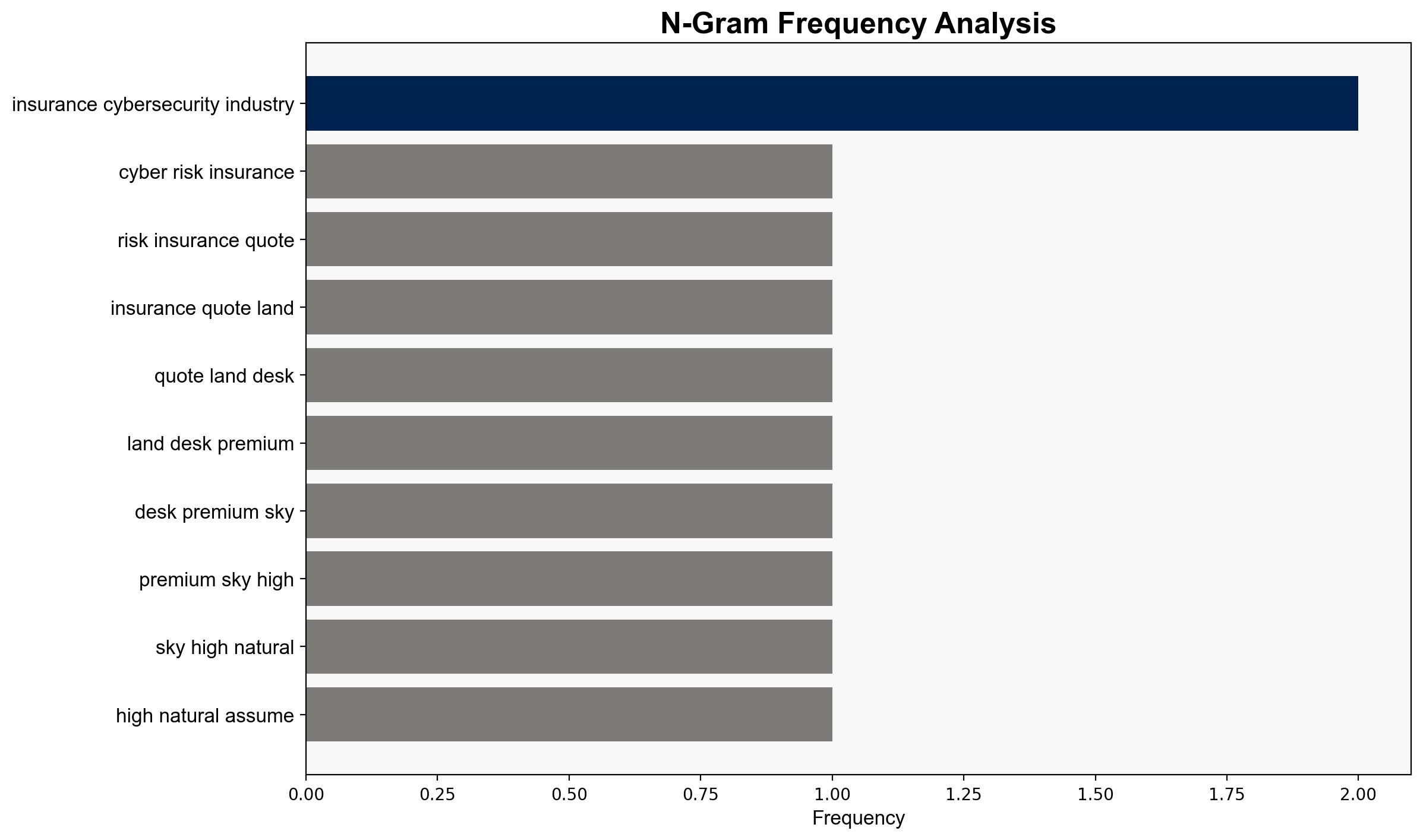

The most supported hypothesis is that high cyber insurance premiums are primarily driven by insurers’ efforts to limit their own risk exposure rather than solely reflecting the policyholder’s risk profile. Confidence Level: Moderate. Recommended action includes enhancing cybersecurity measures to potentially lower premiums and engaging in negotiations with insurers to better understand premium determinants.

2. Competing Hypotheses

1. **Hypothesis A**: High cyber insurance premiums reflect the policyholder’s specific risk profile, driven by factors such as inadequate cybersecurity measures and high exposure to cyber threats.

2. **Hypothesis B**: High premiums are primarily a result of insurers’ strategies to limit their own risk exposure, irrespective of the policyholder’s actual risk level.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis B is better supported. The source indicates insurers are actively limiting exposure through high premiums and specific policy conditions, suggesting a strategic focus on managing their risk.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Hypothesis A assumes that insurers have accurate and comprehensive data on each policyholder’s cybersecurity posture.

– Hypothesis B assumes insurers prioritize their financial risk management over accurately assessing individual client risk.

– **Red Flags**:

– Lack of transparency in how insurers calculate risk and premiums.

– Potential bias in insurers’ data collection methods, possibly leading to inflated risk assessments.

4. Implications and Strategic Risks

– **Economic**: High premiums could discourage businesses from obtaining necessary coverage, increasing vulnerability to cyber incidents.

– **Cyber**: Insurers’ focus on limiting exposure might lead to standardized policies that do not adequately address specific client risks.

– **Geopolitical**: Variations in premiums across regions could reflect geopolitical tensions or differing regulatory environments.

– **Psychological**: Businesses may feel a false sense of security if they assume high premiums equate to comprehensive coverage.

5. Recommendations and Outlook

- Enhance cybersecurity measures, such as implementing multi-factor authentication, to potentially lower premiums.

- Engage with insurers to gain clarity on premium calculations and negotiate terms that reflect actual risk.

- Scenario Projections:

- Best Case: Improved cybersecurity measures lead to lower premiums and better coverage.

- Worst Case: Continued high premiums without transparency lead to underinsurance and increased cyber risk.

- Most Likely: Incremental improvements in cybersecurity lead to modest premium reductions.

6. Key Individuals and Entities

No specific individuals are mentioned in the source text. Key entities include cyber insurance providers and businesses seeking coverage.

7. Thematic Tags

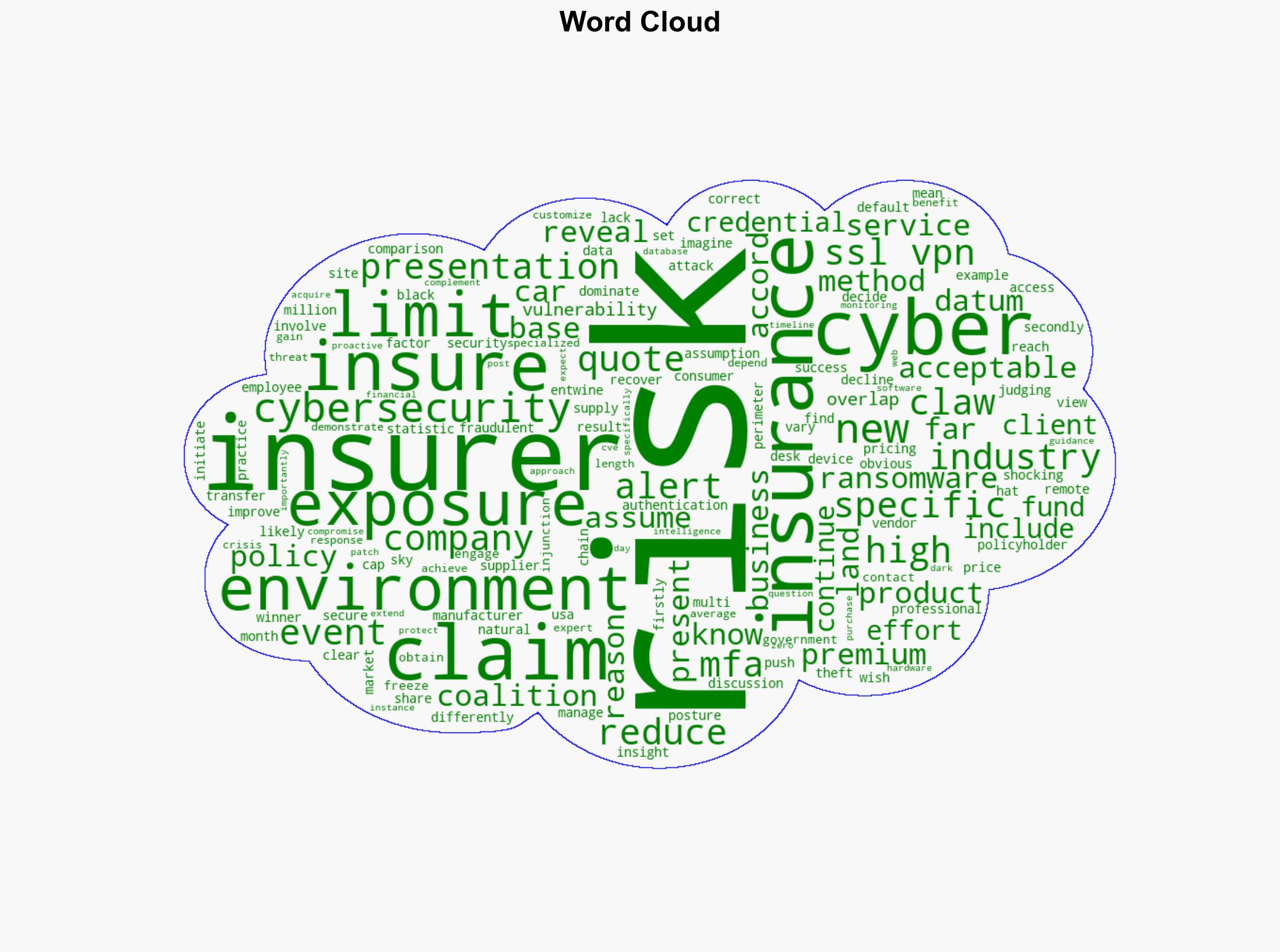

national security threats, cybersecurity, insurance industry, risk management