Brussels Eyes Frozen Russian Assets To Finance Ukraine Beyond 2025 – Globalsecurity.org

Published on: 2025-09-30

Intelligence Report: Brussels Eyes Frozen Russian Assets To Finance Ukraine Beyond 2025 – Globalsecurity.org

1. BLUF (Bottom Line Up Front)

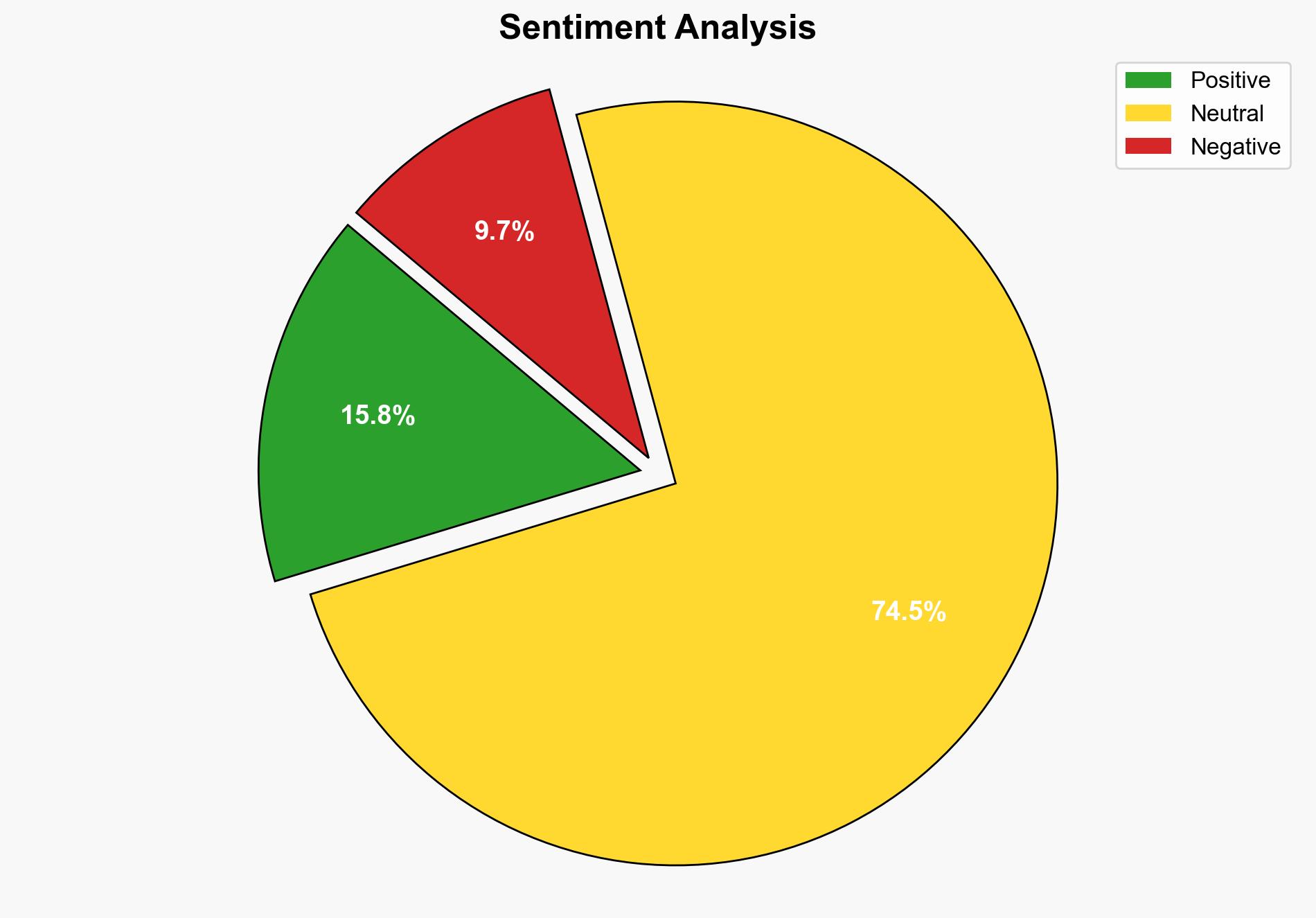

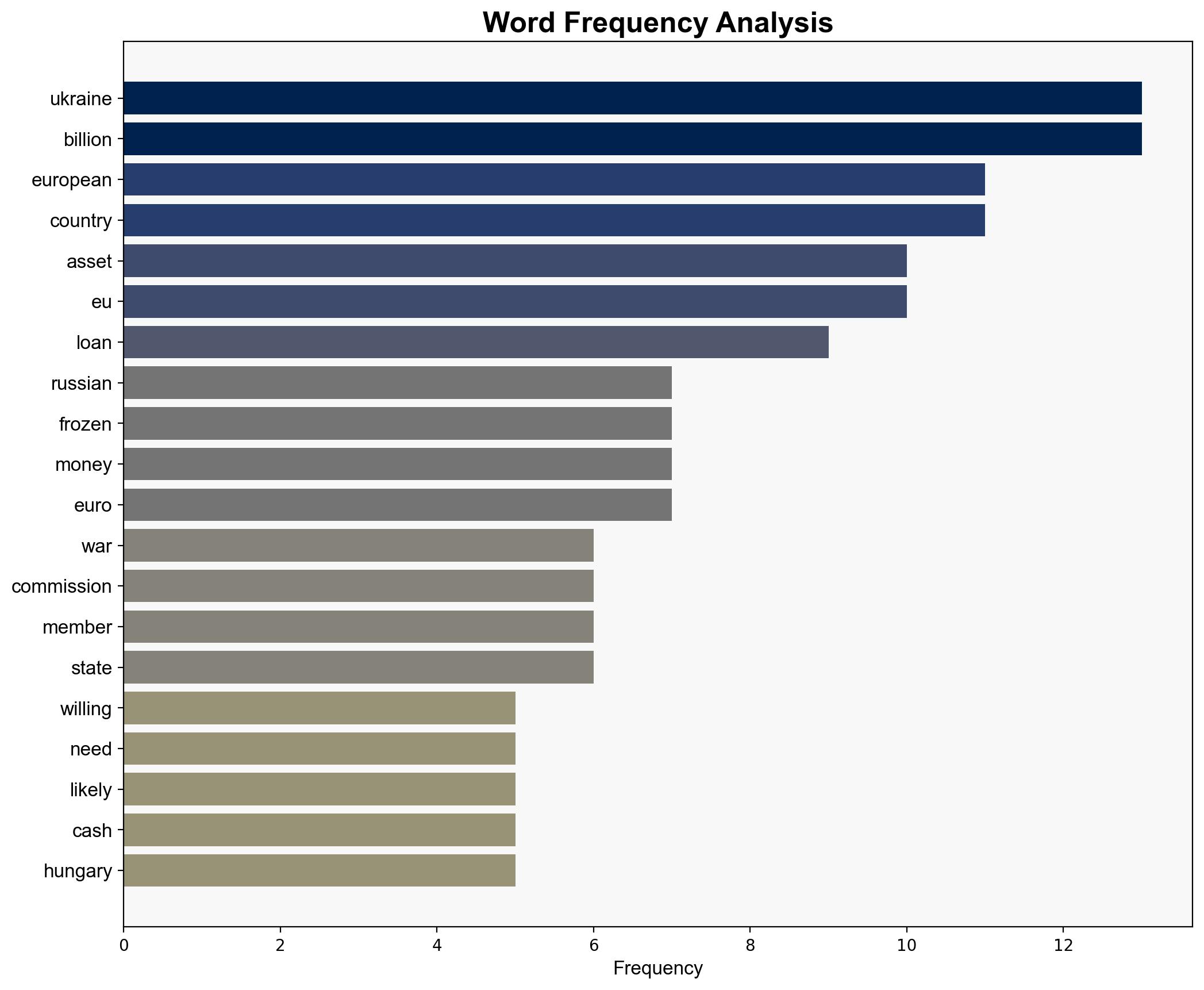

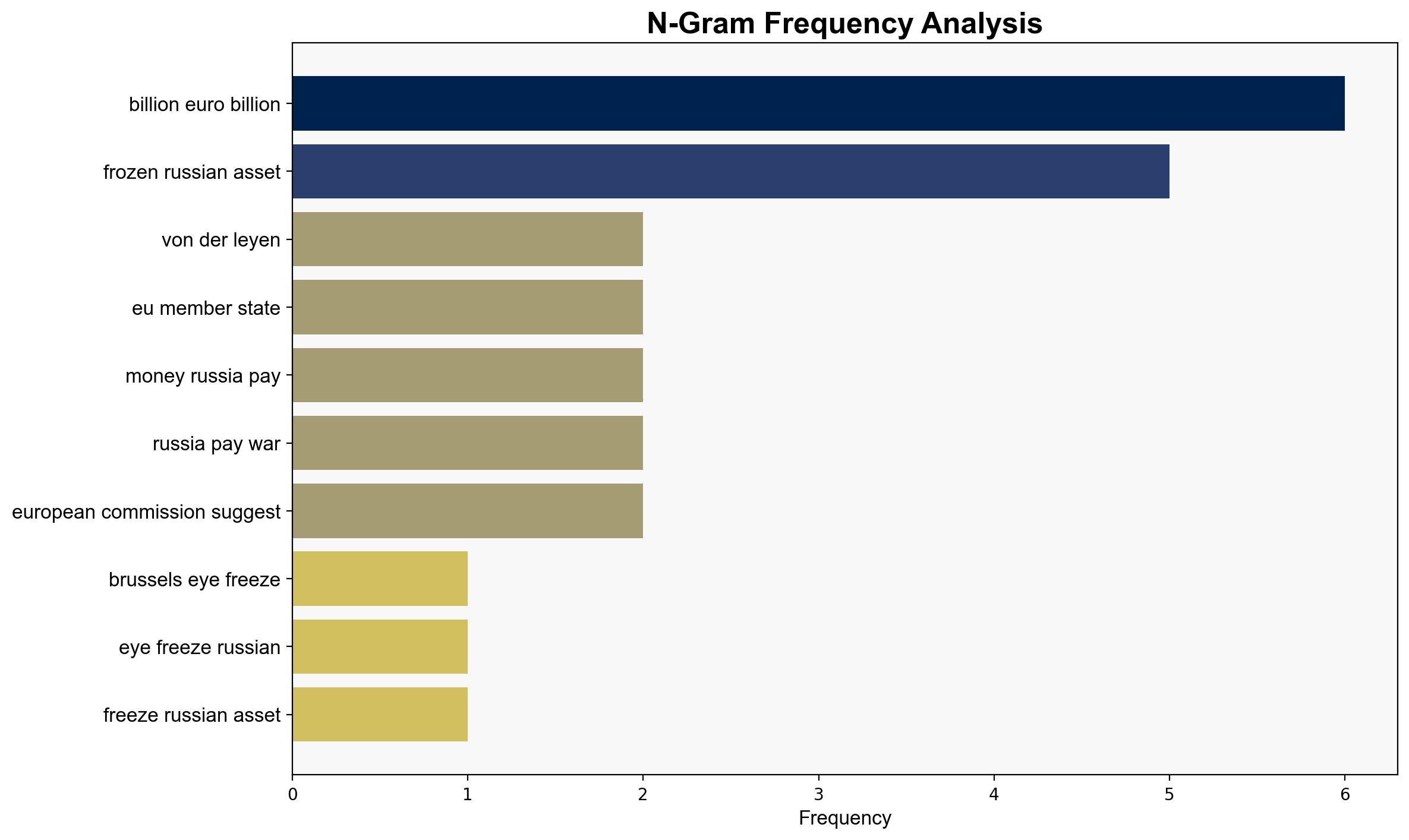

The European Union is exploring the use of frozen Russian assets to finance Ukraine’s reconstruction beyond 2025. The most supported hypothesis suggests that the EU will establish a mechanism to utilize these assets without directly confiscating them, thereby mitigating legal and diplomatic risks. Confidence Level: Moderate. Recommended action includes diplomatic engagement with EU member states to ensure consensus and legal frameworks to support the initiative.

2. Competing Hypotheses

Hypothesis 1: The EU will implement a loan mechanism using frozen Russian assets as collateral, avoiding direct confiscation to prevent legal challenges and maintain international financial stability.

Hypothesis 2: The EU will pursue direct confiscation of frozen Russian assets to finance Ukraine, prioritizing immediate financial needs over potential legal and diplomatic repercussions.

Using ACH 2.0, Hypothesis 1 is better supported due to the EU’s historical caution in legal matters and the potential economic implications of asset confiscation on the Euro’s status as a reserve currency.

3. Key Assumptions and Red Flags

Assumptions for Hypothesis 1 include the belief that legal frameworks can be adapted to facilitate the loan mechanism without triggering significant legal disputes. For Hypothesis 2, it assumes that immediate financial needs outweigh long-term legal and diplomatic consequences. A red flag is the lack of clarity on how the loan mechanism would be structured and the potential for member state vetoes.

4. Implications and Strategic Risks

The EU’s decision could set a precedent for handling frozen assets in geopolitical conflicts, impacting international financial systems and diplomatic relations. Economic risks include potential destabilization of the Euro if assets are confiscated. Geopolitically, this could escalate tensions with Russia, leading to retaliatory measures. The psychological impact on EU unity and public perception could also be significant.

5. Recommendations and Outlook

- Engage in diplomatic discussions with key EU member states to build consensus on the loan mechanism.

- Develop legal frameworks to support the use of frozen assets without direct confiscation.

- Scenario Projections:

- Best Case: Successful implementation of the loan mechanism, enhancing EU unity and financial stability.

- Worst Case: Legal challenges and diplomatic fallout from asset confiscation, leading to economic instability.

- Most Likely: Gradual implementation of a cautious financial mechanism, balancing legal and financial considerations.

6. Key Individuals and Entities

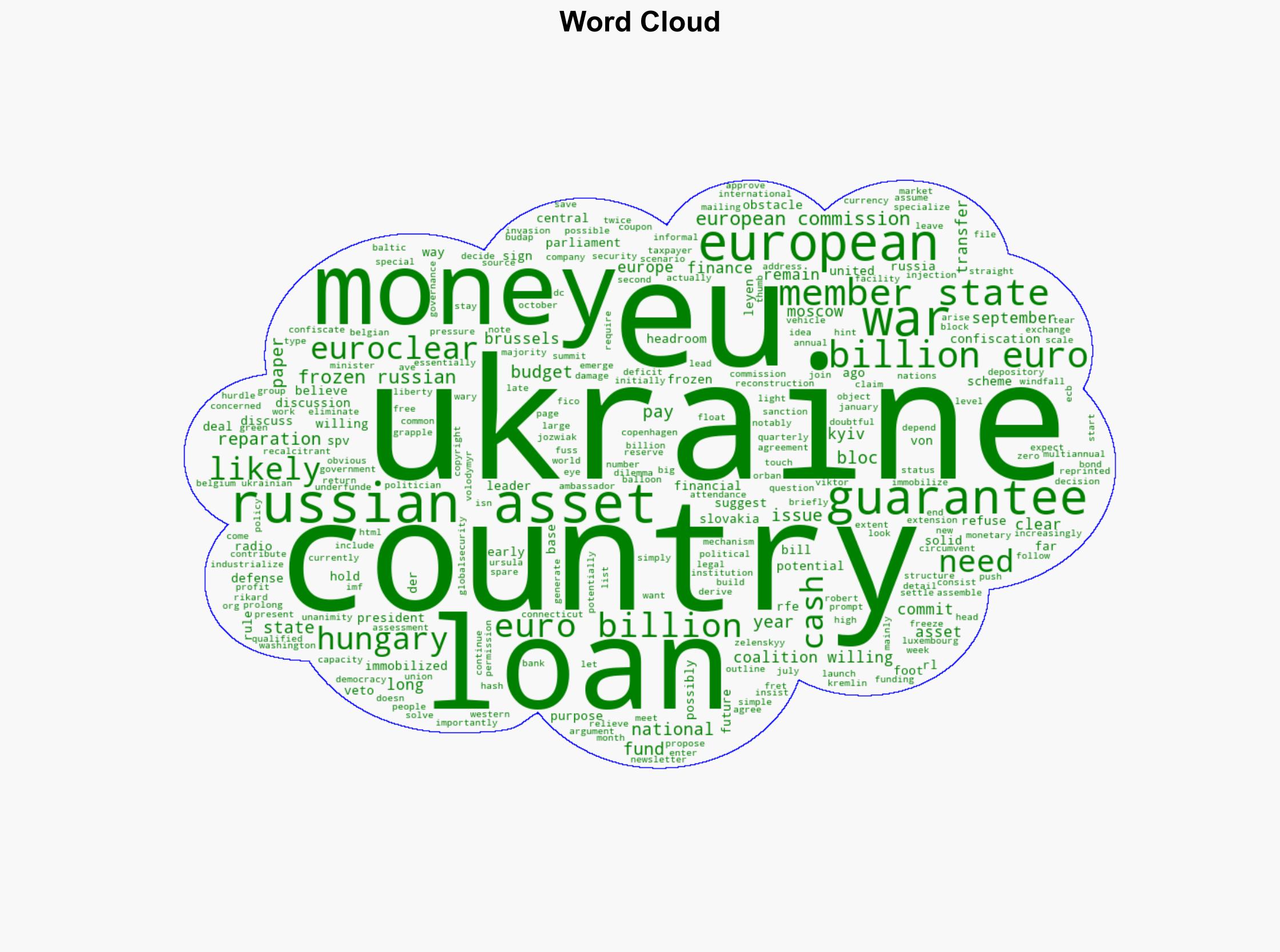

Ursula von der Leyen, Volodymyr Zelenskyy, Rikard Jozwiak, European Commission, Euroclear, European Central Bank.

7. Thematic Tags

national security threats, economic stability, geopolitical strategy, EU-Russia relations