Cash-strapped Taliban Look To Airspace For Windfall – International Business Times

Published on: 2025-08-29

Intelligence Report: Cash-strapped Taliban Look To Airspace For Windfall – International Business Times

1. BLUF (Bottom Line Up Front)

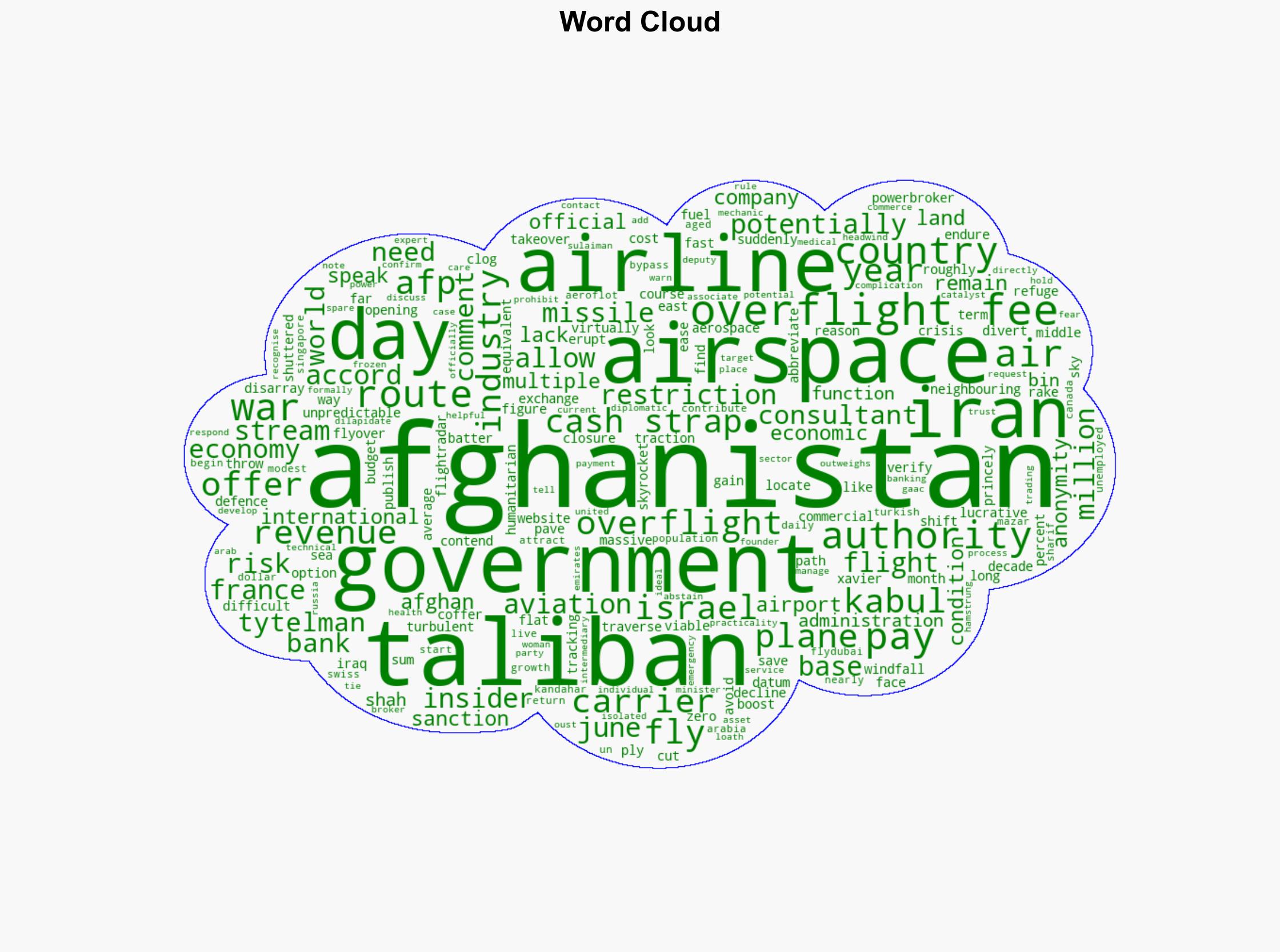

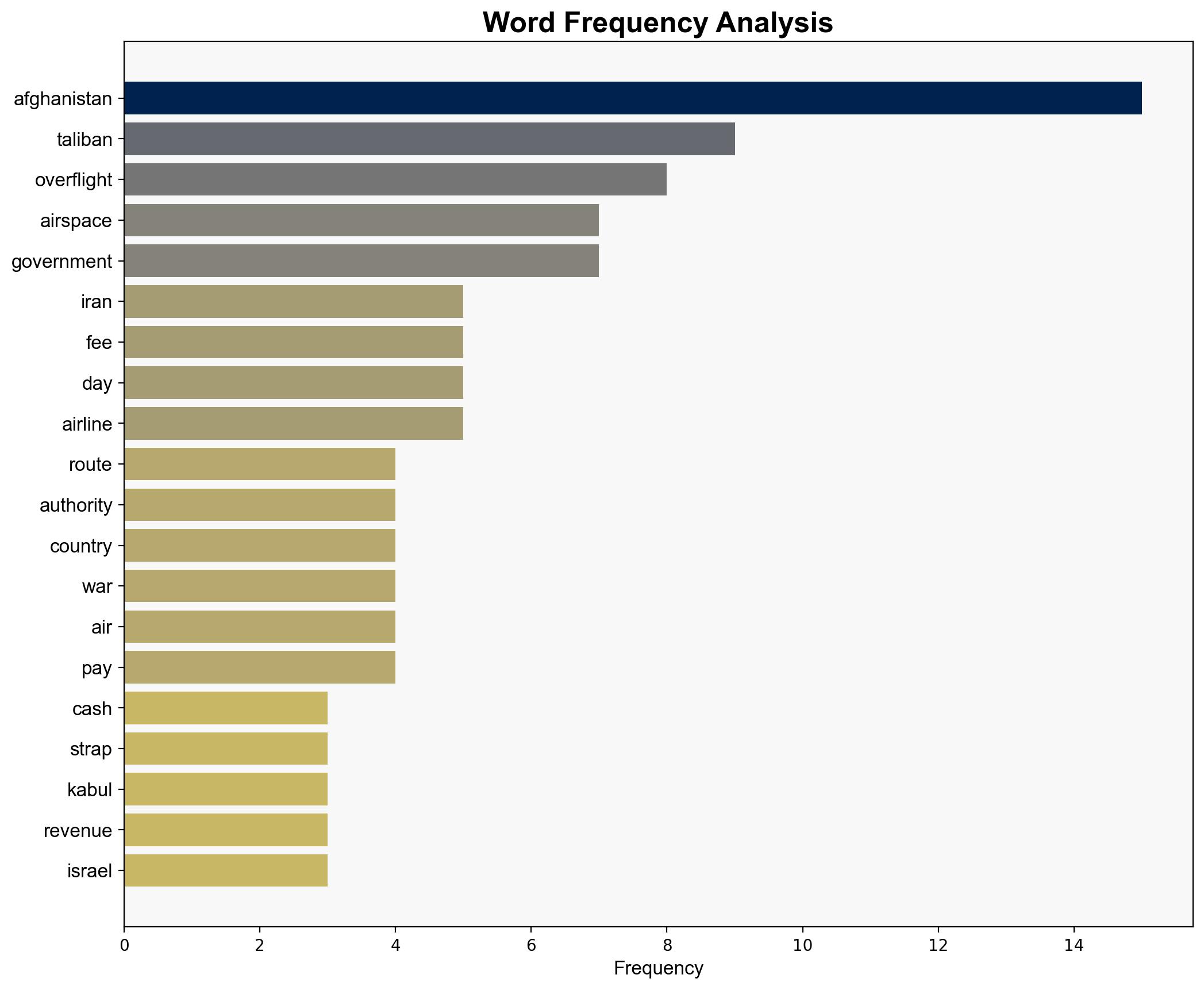

The Taliban’s strategy to monetize Afghanistan’s airspace by charging overflight fees presents a viable short-term revenue stream amidst economic isolation. The most supported hypothesis is that this move is primarily economically motivated, aimed at alleviating immediate fiscal pressures. Confidence in this assessment is moderate due to potential geopolitical and security implications. Recommended action includes monitoring regional airspace dynamics and assessing the impact on international relations and security.

2. Competing Hypotheses

1. **Economic Motivation Hypothesis**: The Taliban’s primary goal is to generate revenue through overflight fees to address Afghanistan’s economic crisis and humanitarian needs.

2. **Geopolitical Leverage Hypothesis**: The Taliban seeks to use airspace control as a geopolitical tool to gain international recognition and leverage in diplomatic negotiations.

Using ACH 2.0, the economic motivation hypothesis is better supported by the evidence of immediate financial needs and the potential revenue from overflight fees. The geopolitical leverage hypothesis is less supported due to the lack of direct evidence of diplomatic negotiations linked to airspace control.

3. Key Assumptions and Red Flags

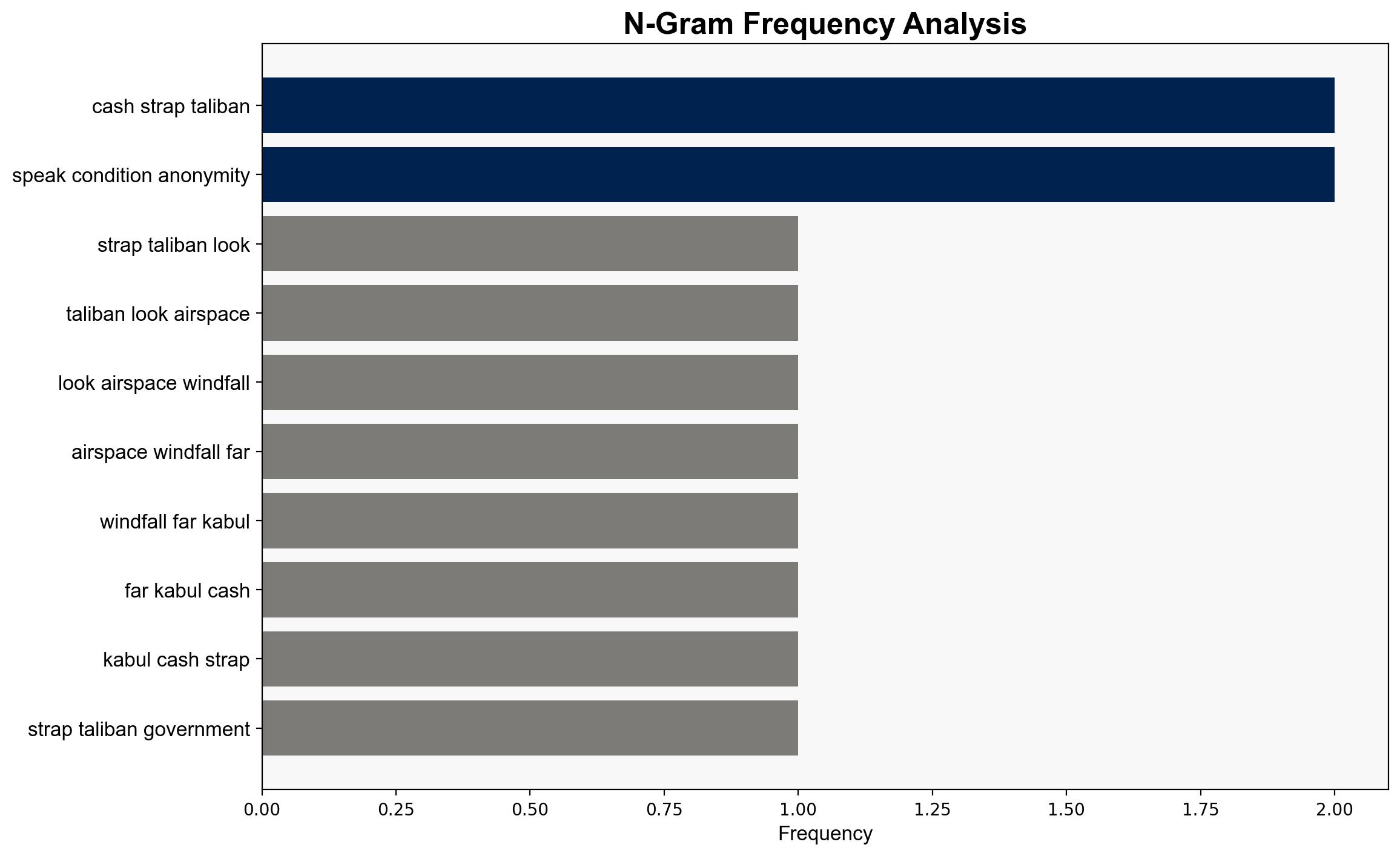

– **Assumptions**: It is assumed that airlines will continue to prefer Afghan airspace despite potential risks. Another assumption is that the Taliban can maintain stable airspace operations without international assistance.

– **Red Flags**: The lack of transparency in overflight fee transactions and the involvement of intermediaries could indicate financial irregularities or corruption. Additionally, the Taliban’s historical unpredictability poses a risk to sustained airspace management.

4. Implications and Strategic Risks

The monetization of airspace could stabilize the Taliban’s economy temporarily but may also attract scrutiny from international actors concerned about funding sources. There is a risk of escalating regional tensions if neighboring countries perceive this move as a threat to their airspace security. Additionally, reliance on this revenue stream could make Afghanistan vulnerable to shifts in regional air traffic patterns.

5. Recommendations and Outlook

- Monitor airspace usage patterns and airline compliance with overflight fees to detect any shifts in regional dynamics.

- Engage in diplomatic dialogues with regional stakeholders to mitigate potential airspace security concerns.

- Scenario Projections:

- Best Case: Increased airspace revenue leads to improved economic stability and humanitarian conditions.

- Worst Case: Regional tensions escalate, leading to airspace closures and loss of revenue.

- Most Likely: Moderate revenue generation with ongoing geopolitical complexities.

6. Key Individuals and Entities

– Sulaiman Bin Shah

– Xavier Tytelman

– GAAC Holding

7. Thematic Tags

national security threats, economic stability, regional dynamics, airspace management