Central Bank Gold Holdings – Econbrowser.com

Published on: 2025-07-05

Intelligence Report: Central Bank Gold Holdings – Econbrowser.com

1. BLUF (Bottom Line Up Front)

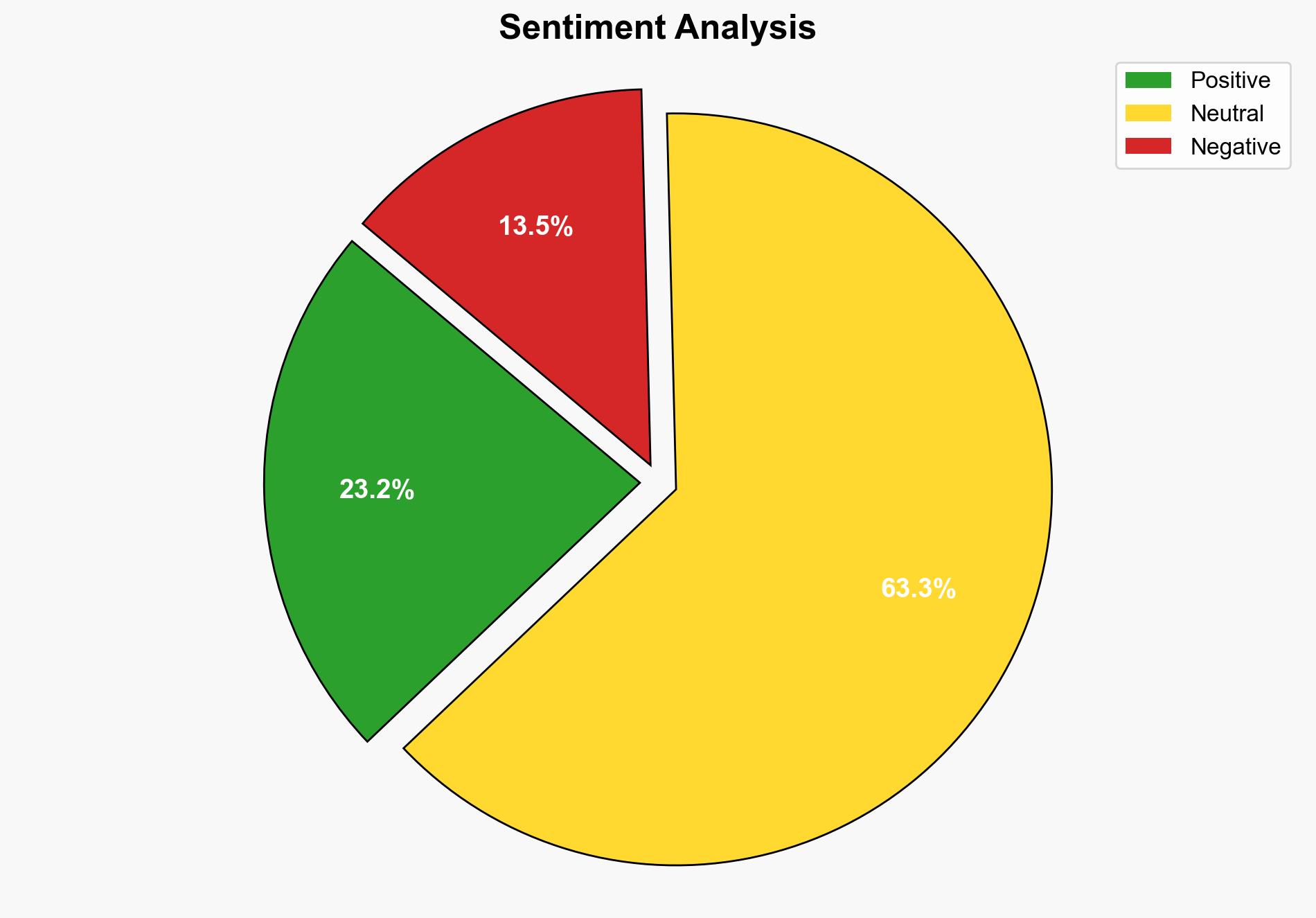

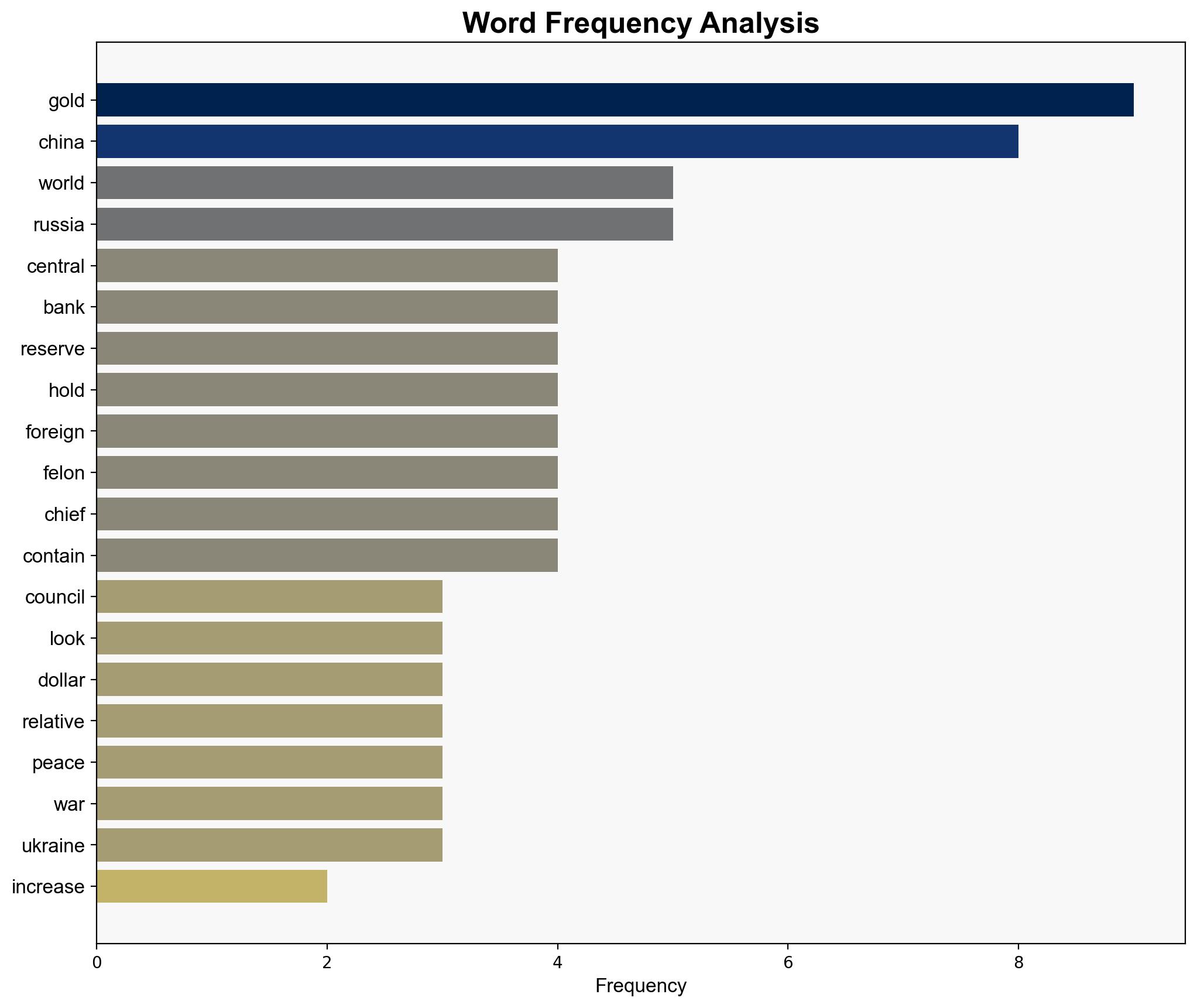

Central banks globally are increasing their gold reserves, driven by geopolitical tensions and economic uncertainties. This trend is likely to continue as nations seek to safeguard their reserves against potential geopolitical shocks. The strategic appeal of gold as a stable asset is reinforced by recent developments in the Middle East and ongoing global conflicts. Key recommendations include monitoring central bank activities and adjusting national reserve strategies to mitigate risks associated with currency fluctuations and geopolitical instability.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

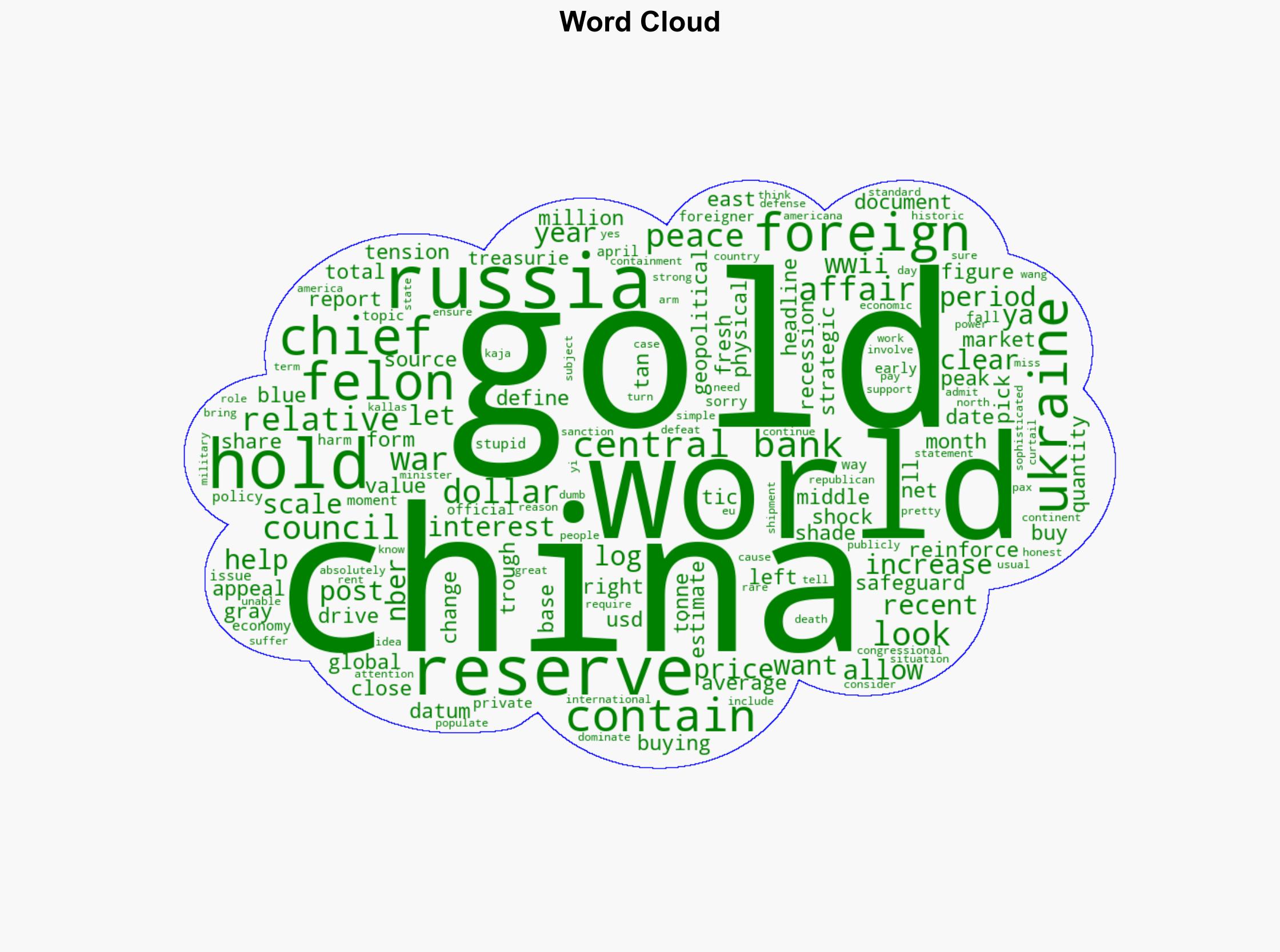

Surface events indicate increased gold purchases by central banks. Systemic structures show a shift towards diversifying reserves away from traditional currencies. Worldviews reflect a growing distrust in the stability of global financial systems, while myths emphasize gold’s historical role as a safe haven.

Cross-Impact Simulation

Increased gold holdings by central banks may influence global gold prices, impacting economies reliant on gold exports. Geopolitical tensions, particularly in the Middle East, could further drive demand for gold, affecting international trade dynamics.

Scenario Generation

In a scenario where geopolitical tensions escalate, gold prices may surge, prompting further purchases by central banks. Conversely, a resolution in global conflicts could stabilize markets, reducing the urgency for gold accumulation.

3. Implications and Strategic Risks

The trend of increasing gold reserves presents both opportunities and risks. Economically, nations with substantial gold holdings may gain leverage in international negotiations. However, reliance on gold could expose countries to market volatility. Politically, the shift may signal a move away from dollar-dominated reserves, impacting global financial stability.

4. Recommendations and Outlook

- Monitor central bank gold purchasing patterns to anticipate shifts in global economic strategies.

- Consider diversifying national reserves to include gold, balancing against potential currency devaluation.

- Scenario-based projections:

- Best Case: Stabilization of geopolitical tensions leads to a balanced reserve strategy.

- Worst Case: Escalation in conflicts results in a gold price surge, straining economies with low reserves.

- Most Likely: Continued moderate increase in gold reserves as a hedge against uncertainty.

5. Key Individuals and Entities

Wang Yi, Kaja Kallas

6. Thematic Tags

national security threats, economic stability, geopolitical strategy, reserve diversification