CFOs Confront the New Economics of Fraud – pymnts.com

Published on: 2025-10-15

Intelligence Report: CFOs Confront the New Economics of Fraud – pymnts.com

1. BLUF (Bottom Line Up Front)

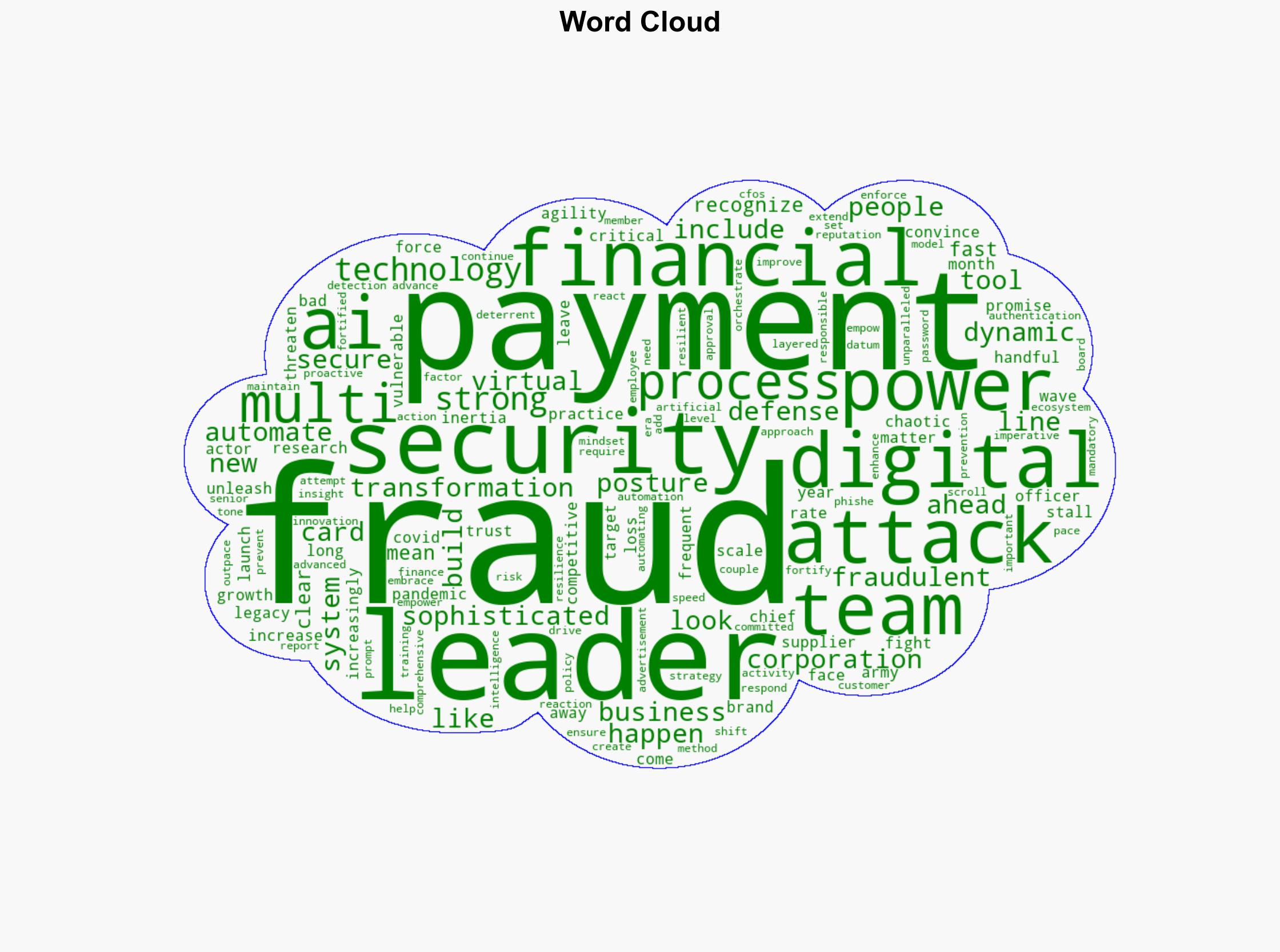

The most supported hypothesis suggests that the rapid digital transformation and automation in financial systems have inadvertently increased vulnerability to sophisticated fraud attacks. Confidence level: High. Recommended action: Implement a comprehensive, multi-layered fraud prevention strategy that integrates advanced AI tools and robust employee training programs.

2. Competing Hypotheses

1. **Hypothesis A**: The increase in fraud is primarily due to the rapid digital transformation and automation processes, which have outpaced the implementation of adequate security measures.

2. **Hypothesis B**: The rise in fraud is largely due to the inherent weaknesses in legacy payment systems that have been exacerbated by the pandemic-induced shift to digital platforms.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported due to the emphasis on the sophistication of attacks and the need for advanced AI-powered detection models mentioned in the source.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Digital transformation inherently increases vulnerability without concurrent security enhancements.

– AI and automation are effective deterrents against sophisticated fraud.

– **Red Flags**:

– Over-reliance on technology without human oversight.

– Lack of specific data on the effectiveness of current fraud prevention strategies.

4. Implications and Strategic Risks

The ongoing digital transformation could lead to a persistent increase in fraud if security measures do not evolve at the same pace. This poses economic risks through financial losses and reputational damage. Cybersecurity threats may escalate, impacting broader economic stability and trust in digital financial systems.

5. Recommendations and Outlook

- **Mitigation Actions**: Develop a proactive fraud prevention strategy that includes AI-driven tools, mandatory employee training, and multi-factor authentication.

- **Scenario Projections**:

– Best Case: Rapid adaptation of advanced security measures reduces fraud incidents significantly.

– Worst Case: Continued increase in fraud leads to severe financial and reputational damage.

– Most Likely: Incremental improvements in security measures lead to a gradual reduction in fraud incidents.

6. Key Individuals and Entities

– No specific individuals mentioned in the source text.

7. Thematic Tags

national security threats, cybersecurity, digital transformation, financial security