China markets under threat from risk of renewed US trade war – The Japan Times

Published on: 2025-10-13

Intelligence Report: China markets under threat from risk of renewed US trade war – The Japan Times

1. BLUF (Bottom Line Up Front)

The strategic judgment is that the potential for a renewed US-China trade war poses a significant threat to Chinese markets, with a moderate confidence level. The most supported hypothesis is that both nations will engage in a strategic negotiation phase, using tariffs and export controls as leverage. Recommended action includes monitoring negotiation developments closely and preparing for potential market volatility.

2. Competing Hypotheses

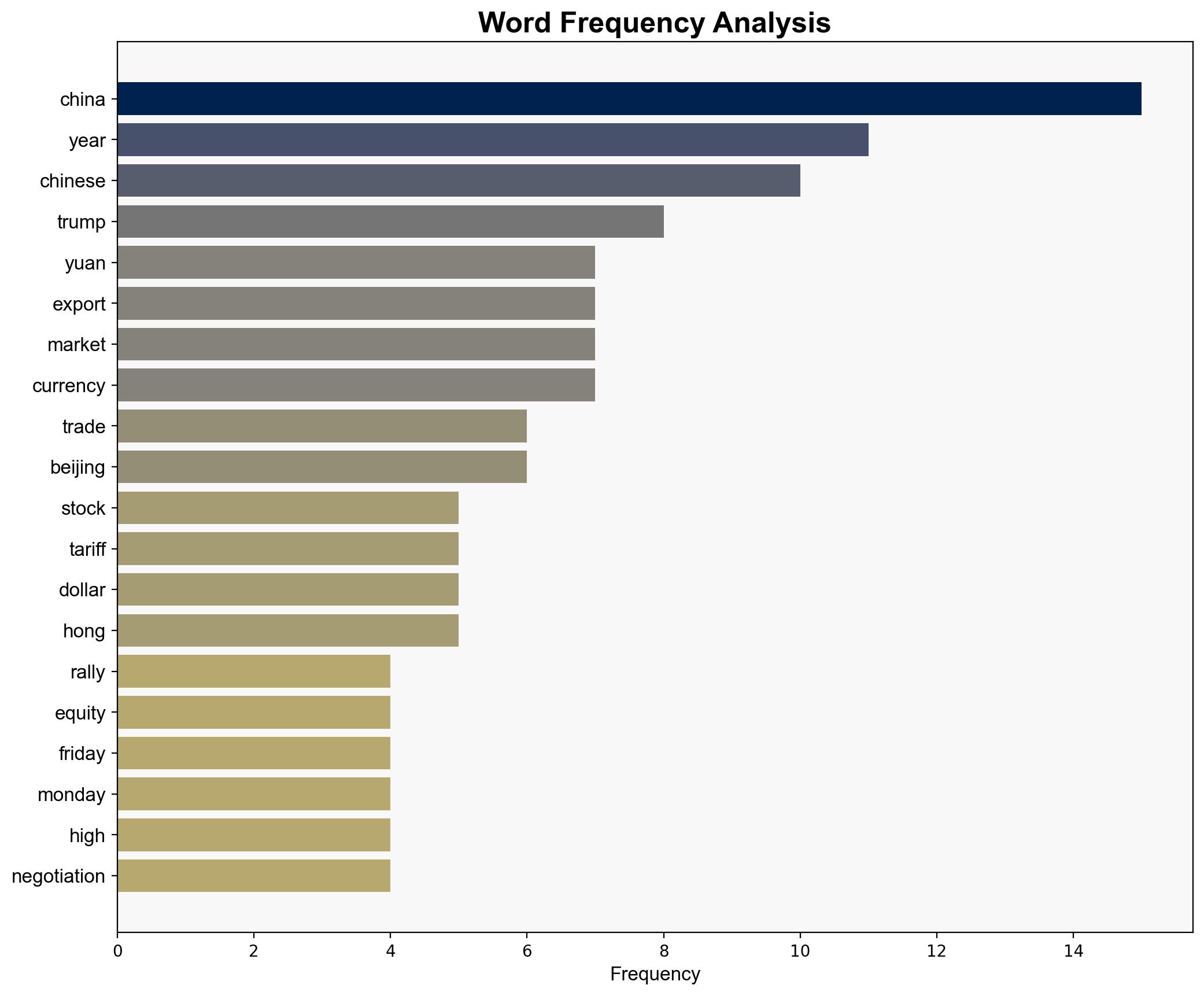

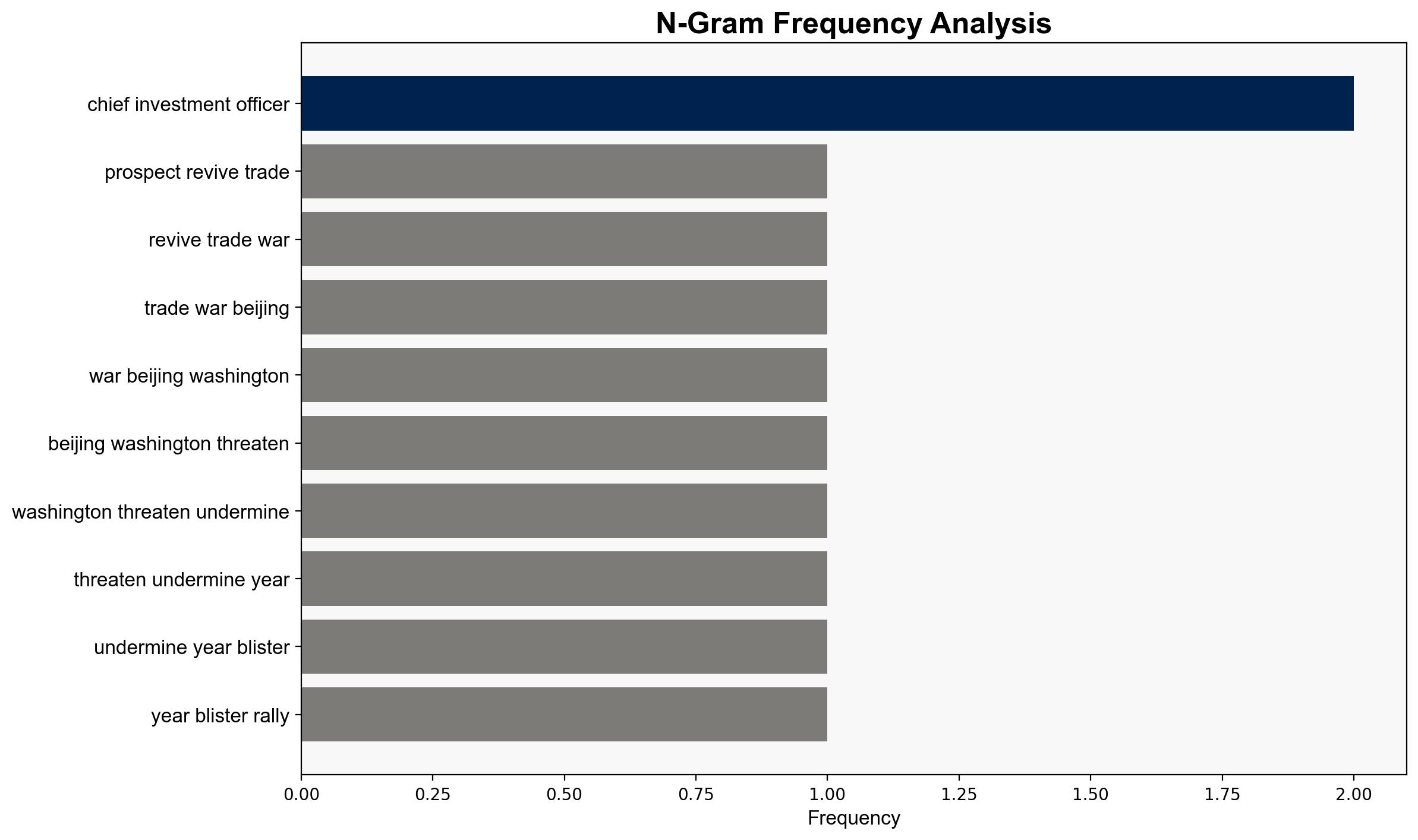

1. **Hypothesis A**: The US and China will escalate trade tensions, leading to significant economic disruptions. This hypothesis suggests that both countries will continue to impose tariffs and export controls, leading to a prolonged trade conflict.

2. **Hypothesis B**: The US and China will use the threat of tariffs and export controls as negotiation tools, ultimately reaching a compromise to avoid severe economic impacts. This hypothesis posits that both nations recognize the mutual benefits of a trade agreement and will work towards de-escalation.

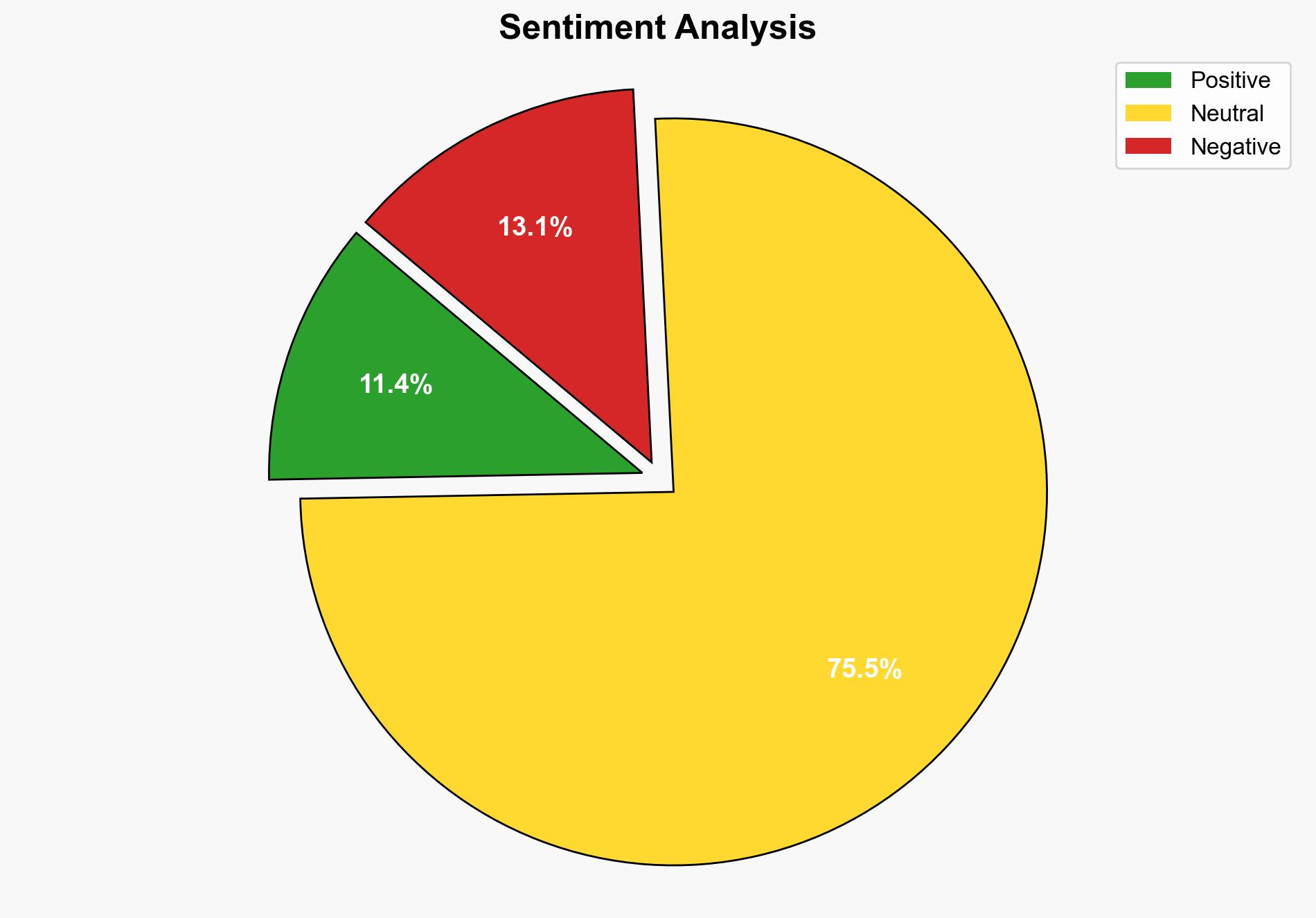

Using Bayesian Scenario Modeling, Hypothesis B is more supported due to recent signals from both the US and China indicating a willingness to negotiate, despite public posturing.

3. Key Assumptions and Red Flags

– **Assumptions**: Both hypotheses assume rational actors who prioritize economic stability. Hypothesis B assumes that recent diplomatic engagements are genuine.

– **Red Flags**: Potential cognitive bias includes over-reliance on public statements without considering private diplomatic channels. Missing data on internal political pressures within each country could alter negotiation dynamics.

4. Implications and Strategic Risks

– **Economic**: Prolonged trade tensions could lead to global market instability, impacting emerging markets and global supply chains.

– **Geopolitical**: Increased tensions may push China to strengthen alliances with other nations, potentially altering global power dynamics.

– **Psychological**: Market sentiment could be adversely affected, leading to investor uncertainty and reduced economic growth.

5. Recommendations and Outlook

- Monitor diplomatic communications and public statements for shifts in negotiation stances.

- Prepare contingency plans for market volatility, including hedging strategies.

- Scenario Projections:

- Best Case: A trade agreement is reached, stabilizing markets and improving bilateral relations.

- Worst Case: Escalation leads to a full-scale trade war, severely impacting global markets.

- Most Likely: Continued negotiations with intermittent market disruptions.

6. Key Individuals and Entities

– Donald Trump

– Xi Jinping

– Michael Brown

– Haris Khurshid

– Hao Zhou

– Hao Hong

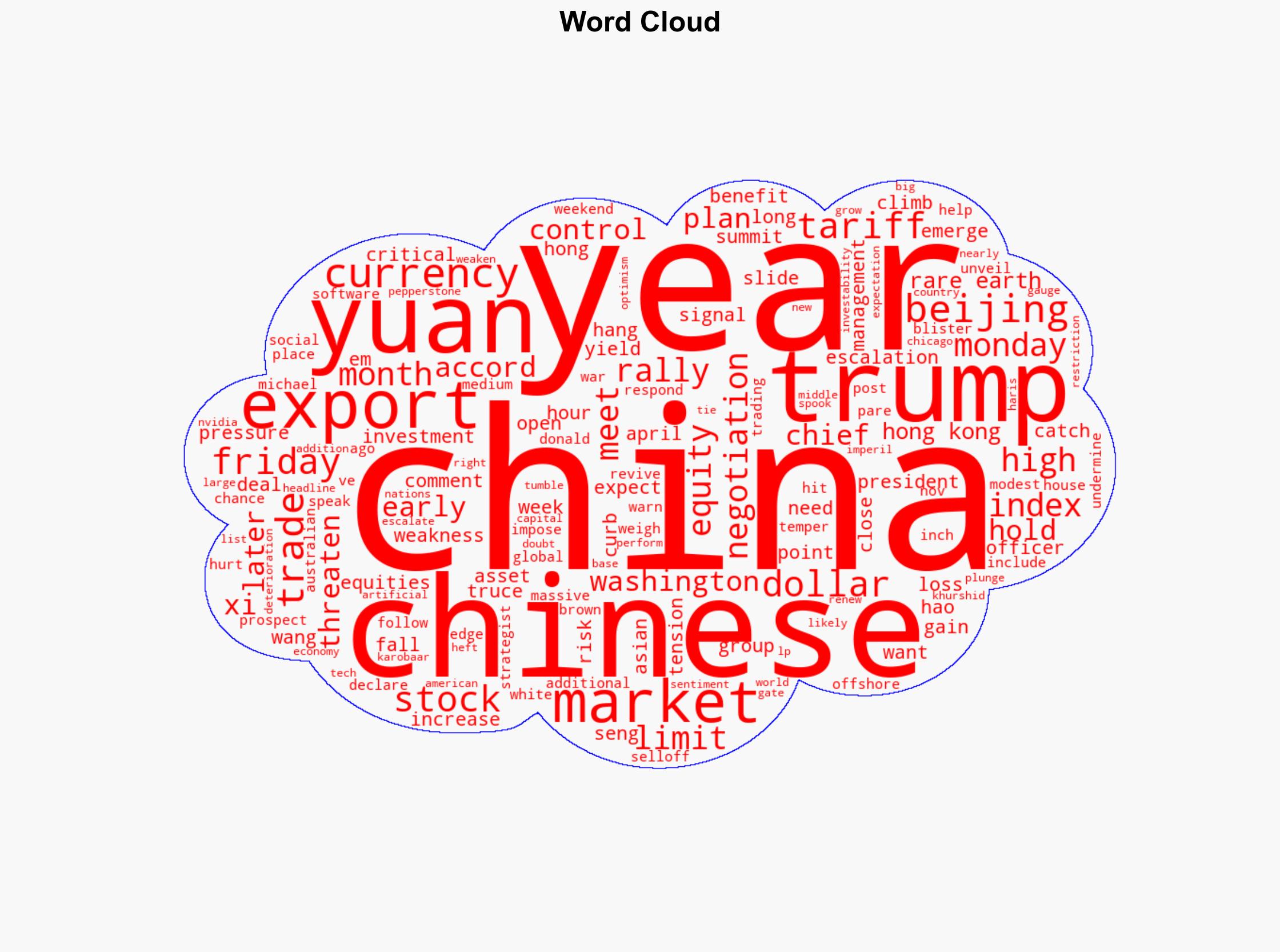

7. Thematic Tags

national security threats, economic stability, trade negotiations, geopolitical strategy