China retaliates again in Trump’s trade war prompting flight from US assets – Yahoo Entertainment

Published on: 2025-04-11

Intelligence Report: China retaliates again in Trump’s trade war prompting flight from US assets – Yahoo Entertainment

1. BLUF (Bottom Line Up Front)

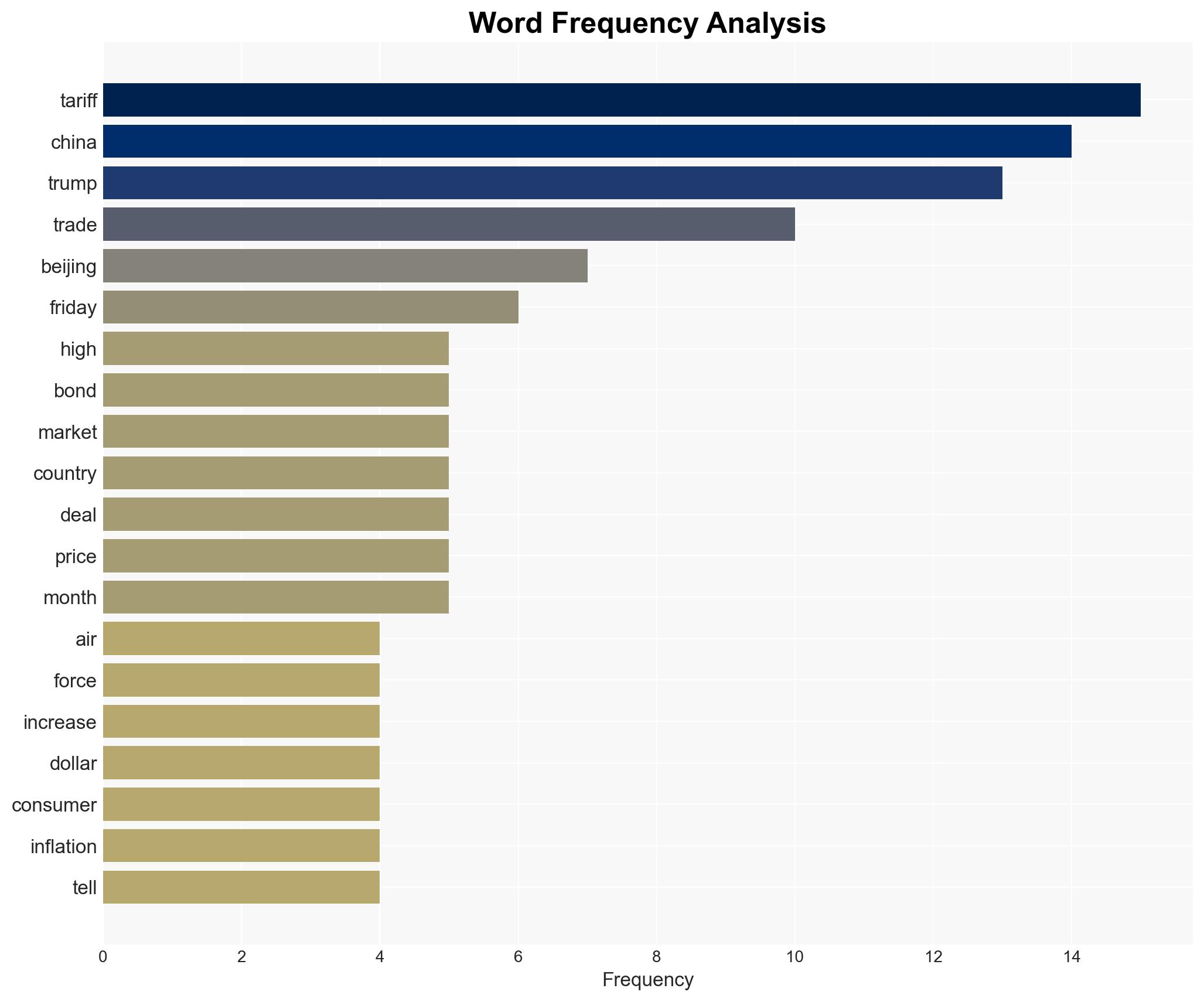

Recent escalations in the trade war between the United States and China have led to significant economic disruptions. China’s decision to increase tariffs on U.S. imports to 125% is a direct response to the U.S. raising duties on Chinese goods. This has resulted in volatility in financial markets, with a notable flight from U.S. assets and a surge in gold prices. The situation poses risks of inflation and recession, with global supply chains being threatened. Strategic engagement with international partners is crucial to mitigate these risks and stabilize economic conditions.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

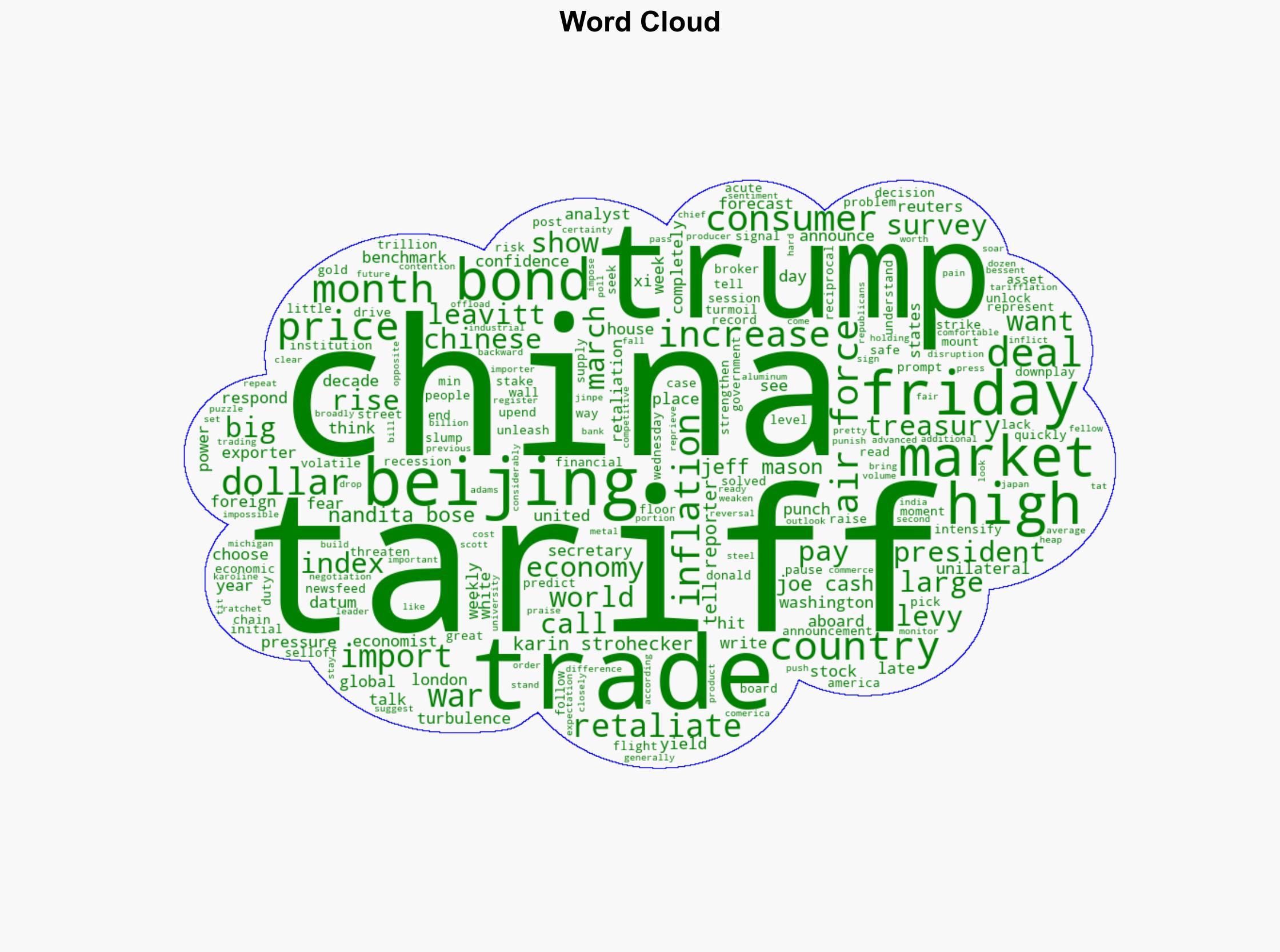

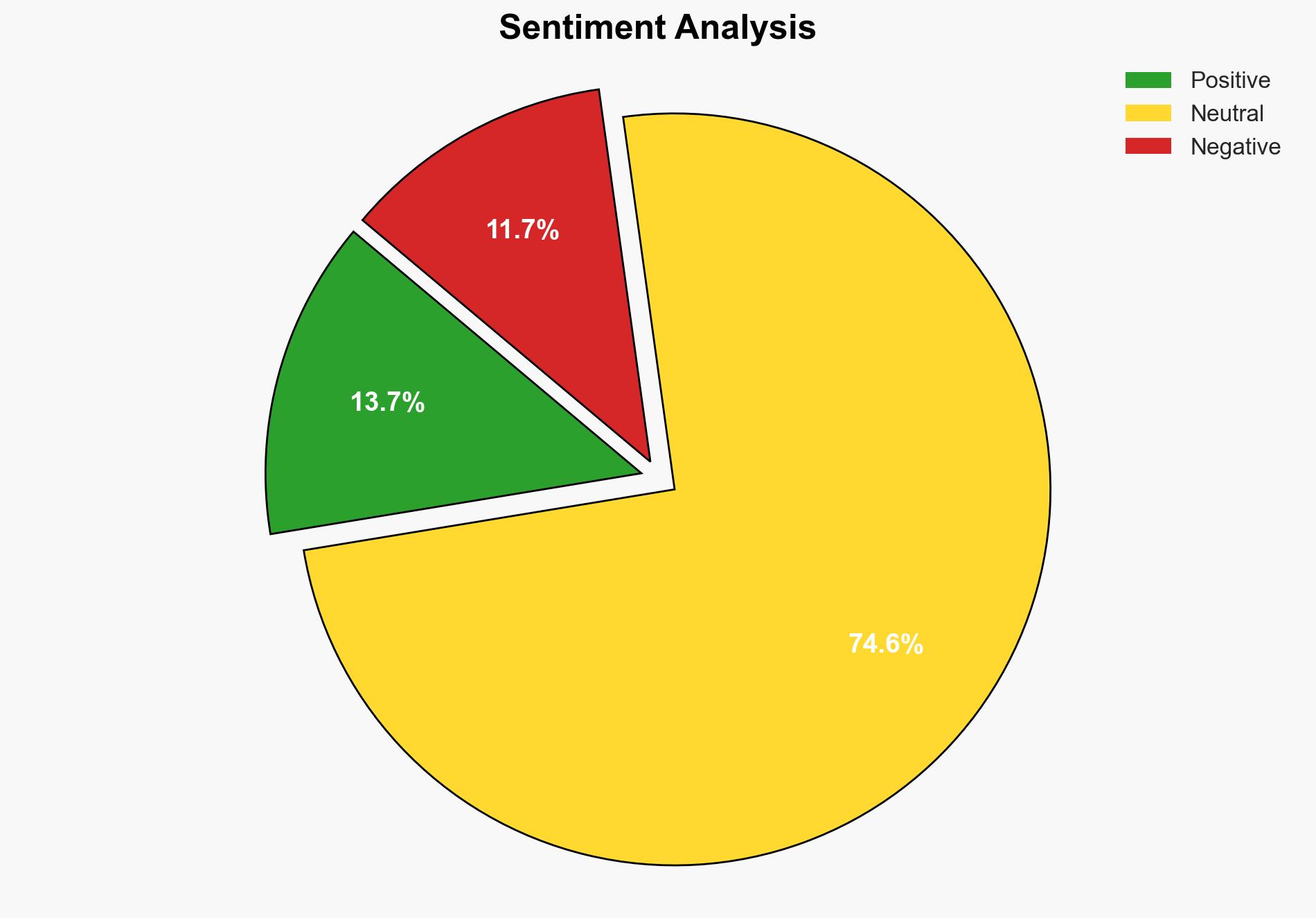

General Analysis

The trade war escalation has intensified global economic turmoil. The U.S. stock market, despite ending the week higher, experienced significant volatility. The increase in tariffs by China has exacerbated fears of inflation, with consumer surveys indicating the highest inflation concerns since 1981. The bond market saw a selloff, reflecting a lack of confidence in U.S. economic stability. The U.S. administration’s response includes a 90-day pause on tariffs for countries other than China, with ongoing trade negotiations with over 75 countries, including India and Japan. However, the uncertainty surrounding these negotiations continues to pose challenges.

3. Implications and Strategic Risks

The ongoing trade conflict between the U.S. and China presents several strategic risks:

- Economic: The tit-for-tat tariffs threaten to disrupt global supply chains, impacting trade worth over $650 billion.

- National Security: Economic instability could lead to reduced national security funding and capabilities.

- Regional Stability: The trade war may strain U.S. relations with key allies and trading partners, affecting regional alliances.

- Inflation and Recession: Increased tariffs may lead to higher consumer prices, escalating inflation fears, and potential recession risks.

4. Recommendations and Outlook

Recommendations:

- Engage in diplomatic negotiations to de-escalate the trade conflict and establish fair trade agreements.

- Implement regulatory measures to stabilize financial markets and protect consumer interests.

- Invest in technological advancements to enhance domestic production capabilities and reduce reliance on imports.

Outlook:

Best-case scenario: Successful negotiations lead to reduced tariffs and stabilized economic conditions, fostering global trade growth.

Worst-case scenario: Continued escalation results in a prolonged trade war, severe economic downturn, and strained international relations.

Most likely scenario: Ongoing negotiations with intermittent resolutions, maintaining a degree of economic uncertainty and market volatility.

5. Key Individuals and Entities

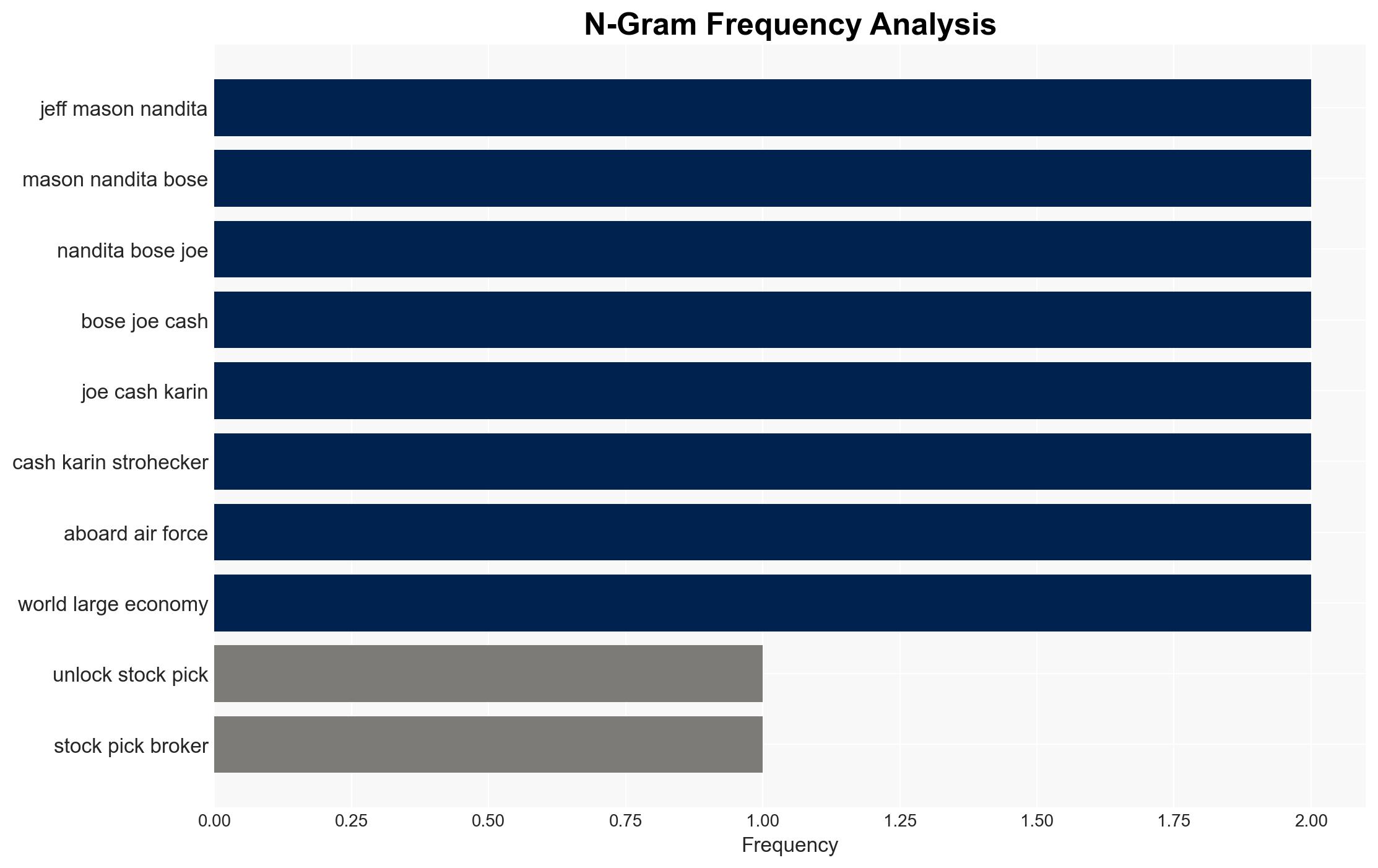

The report mentions significant individuals such as Jeff Mason, Nandita Bose, Joe Cash, and Karin Strohecker. The actions of Donald Trump are central to the current trade dynamics. The entities involved include the governments of the United States and China, as well as financial markets and international trade organizations.