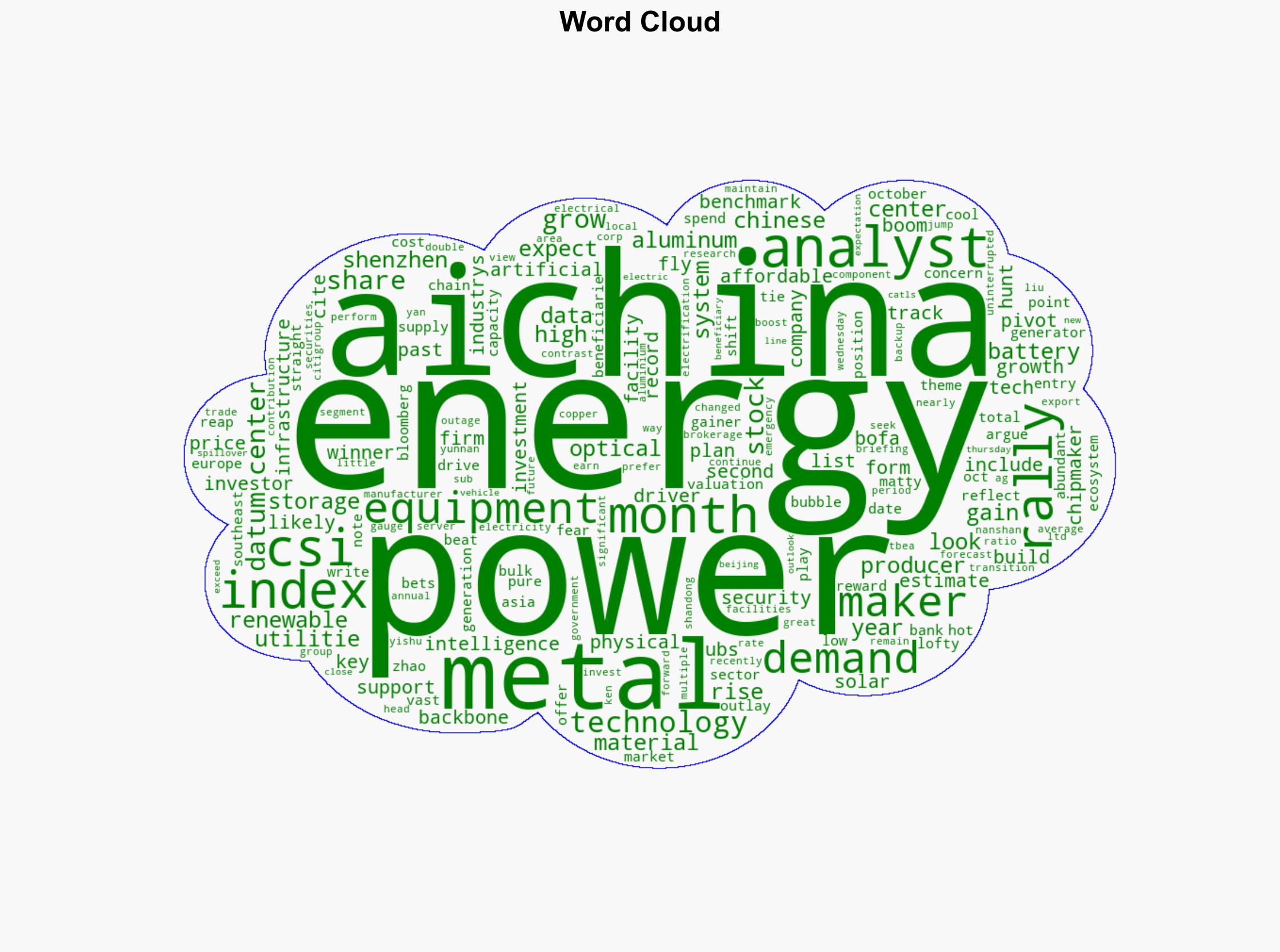

Chinas AI Bets Pivot to Power Metals as Tech Bubble Fears Grow – Financial Post

Published on: 2025-11-15

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Chinas AI Bets Pivot to Power Metals as Tech Bubble Fears Grow – Financial Post

1. BLUF (Bottom Line Up Front)

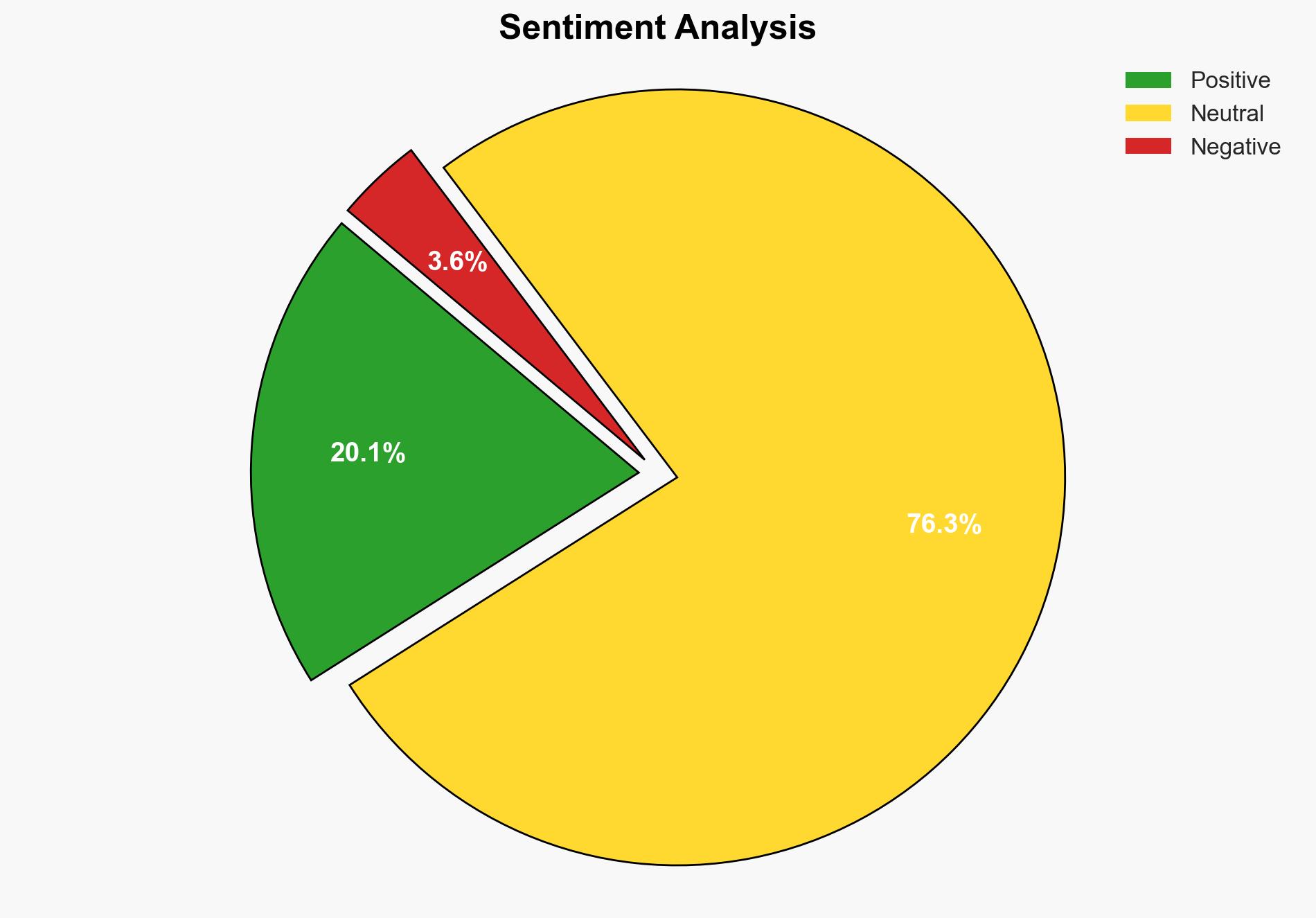

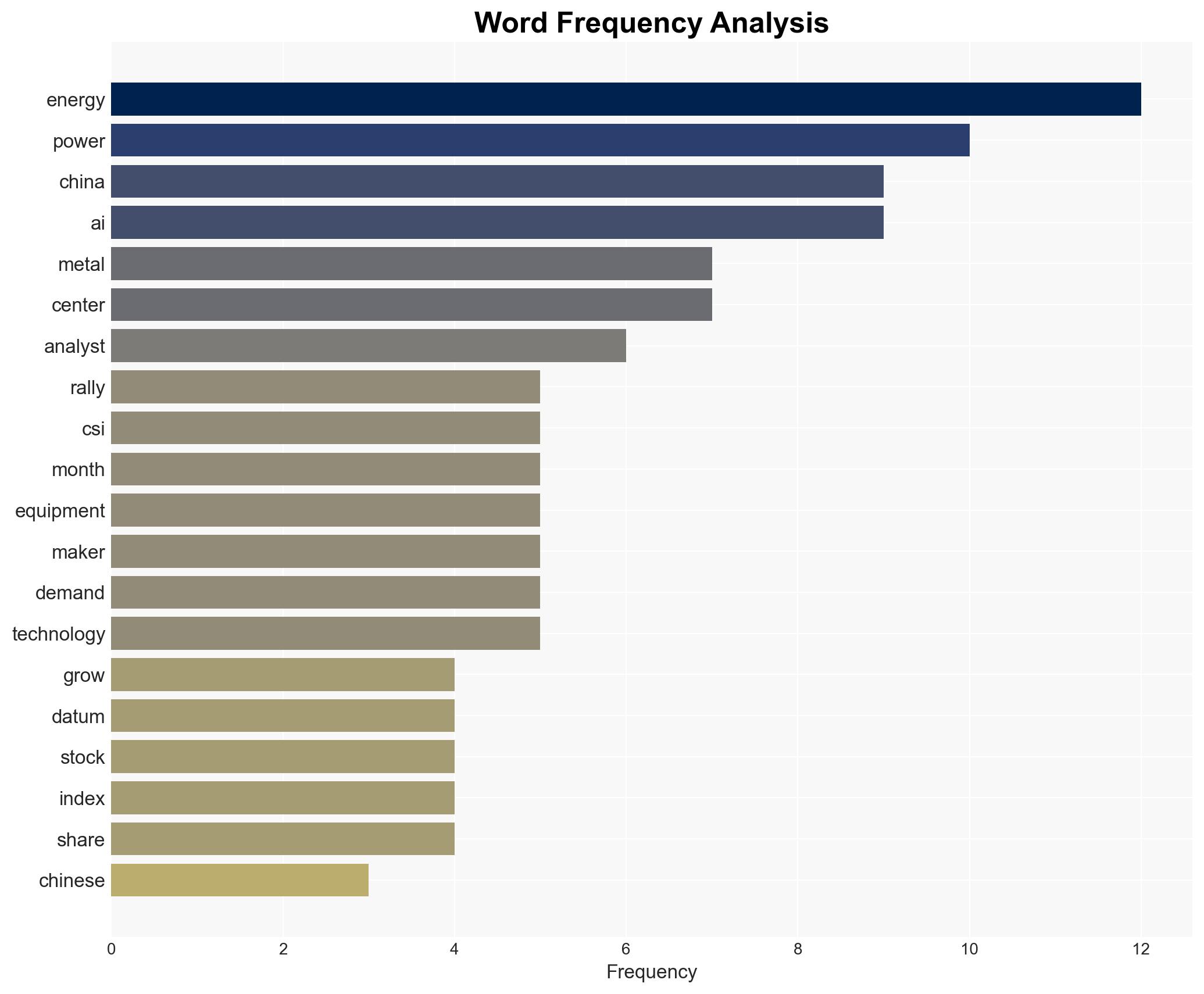

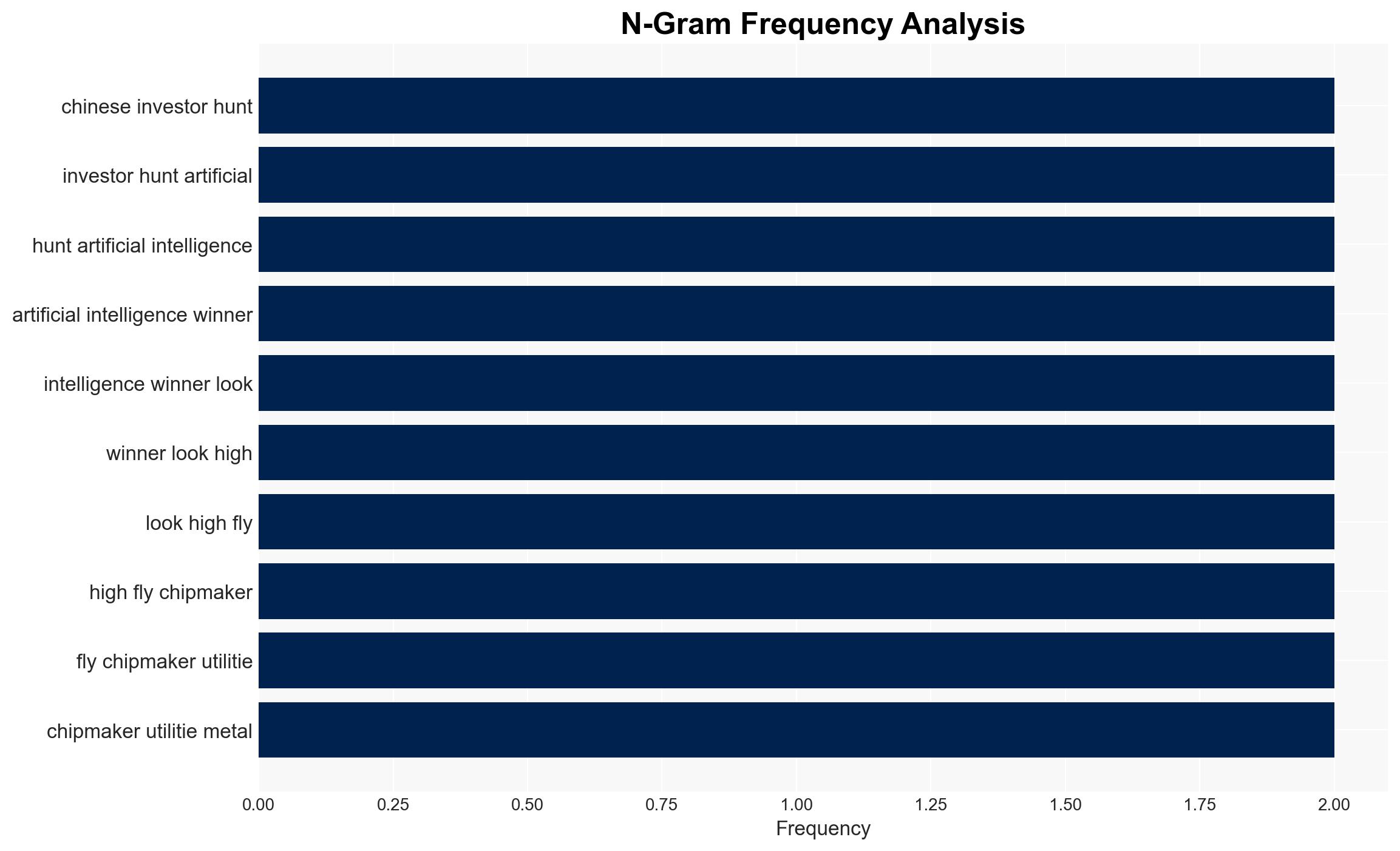

The strategic pivot of Chinese investors from high-valuation AI stocks to power metals and infrastructure investments reflects a calculated risk mitigation strategy amidst fears of an AI tech bubble. This shift is likely to bolster China’s energy and AI infrastructure, positioning it as a leader in AI-related industries. Confidence Level: Moderate. Recommended action includes monitoring China’s energy sector investments and assessing the potential impact on global AI and energy markets.

2. Competing Hypotheses

Hypothesis 1: Chinese investors are shifting focus to power metals and infrastructure due to overvaluation concerns in the AI sector. This hypothesis is supported by the observed rally in energy and metal stocks and the strategic alignment with China’s long-term energy and AI infrastructure goals.

Hypothesis 2: The pivot is a strategic maneuver to strengthen China’s geopolitical influence by securing critical supply chains in power metals and energy infrastructure. This is plausible given China’s vast generation capacity and low power costs, which could enhance its competitive edge globally.

The first hypothesis is more likely given the immediate financial market indicators and investor behavior, although the second hypothesis cannot be ruled out due to China’s broader strategic objectives.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that AI stock valuations are indeed inflated and that the shift to power metals is primarily economically driven. Another assumption is that China’s energy infrastructure investments will yield the anticipated returns.

Red Flags: Potential misinterpretation of market signals or over-reliance on short-term trends could lead to strategic missteps. Additionally, there is a risk of underestimating geopolitical motivations behind investment shifts.

4. Implications and Strategic Risks

The shift towards power metals and infrastructure could lead to increased competition for these resources globally, potentially driving up prices and affecting international supply chains. Politically, it may enhance China’s leverage in global energy markets. Economically, a miscalculation in the AI sector’s valuation could lead to broader market instability if a bubble bursts. Cyber risks may arise from increased reliance on AI infrastructure.

5. Recommendations and Outlook

- Monitor China’s investments in energy and AI infrastructure to assess potential impacts on global markets.

- Engage with international partners to ensure diversified supply chains for critical materials.

- Best-case scenario: China’s strategic pivot stabilizes its economy and strengthens its global position in AI and energy sectors.

- Worst-case scenario: A misjudged AI bubble burst leads to significant economic downturn and global market disruptions.

- Most-likely scenario: Gradual stabilization of AI stock valuations with sustained growth in power metals and infrastructure sectors.

6. Key Individuals and Entities

Matty Zhao (BofA Securities Analyst), Ken Liu (Head of Greater China Energy Transition and Renewables Research), Yishu Yan (China Utilities Analyst, UBS Securities).

7. Thematic Tags

Cybersecurity, Geopolitical Strategy, Energy Infrastructure, AI Investment, Market Valuation

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us

·