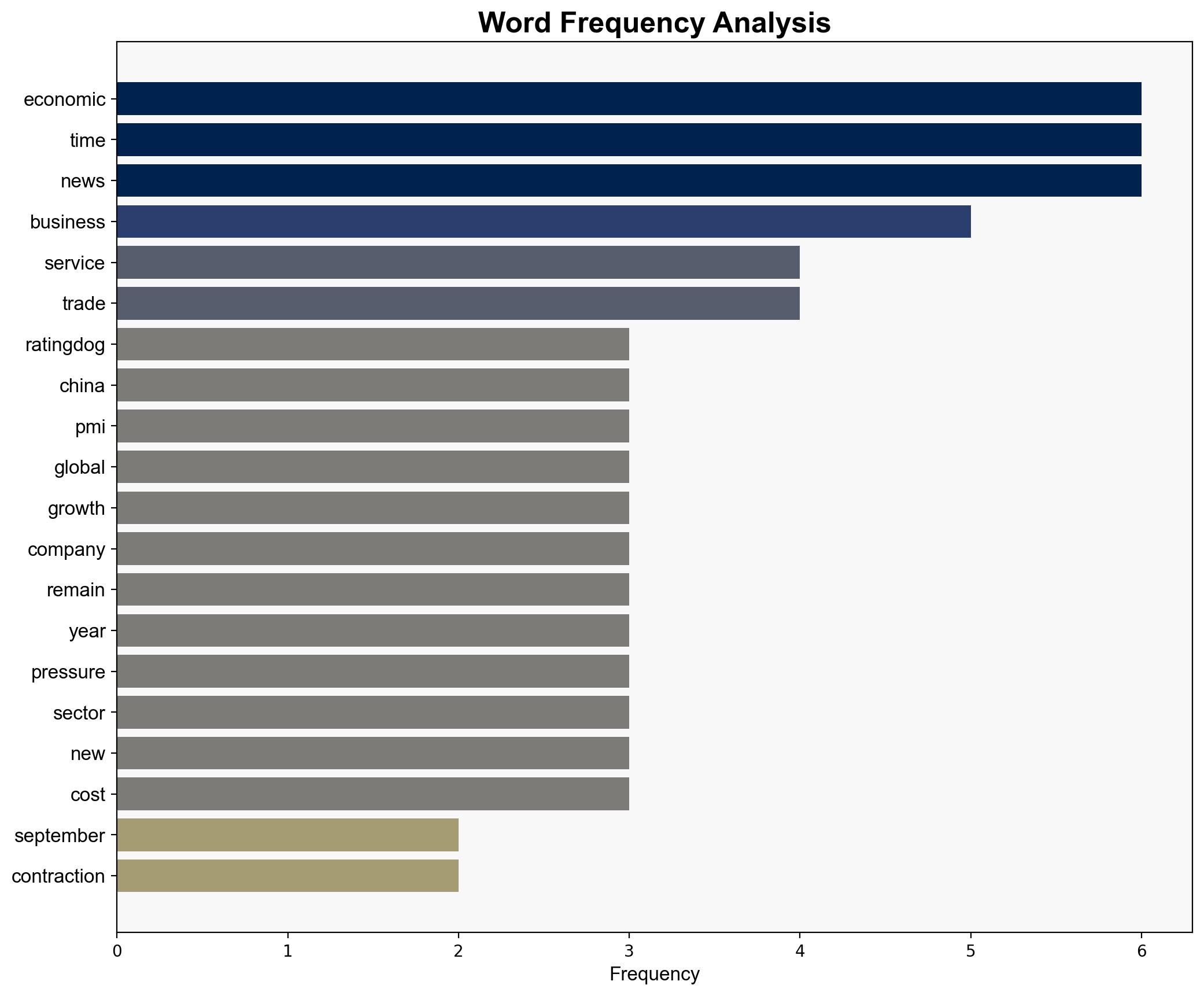

China’s services growth hits three-month low in October PMI shows – The Times of India

Published on: 2025-11-05

Intelligence Report: China’s services growth hits three-month low in October PMI shows – The Times of India

1. BLUF (Bottom Line Up Front)

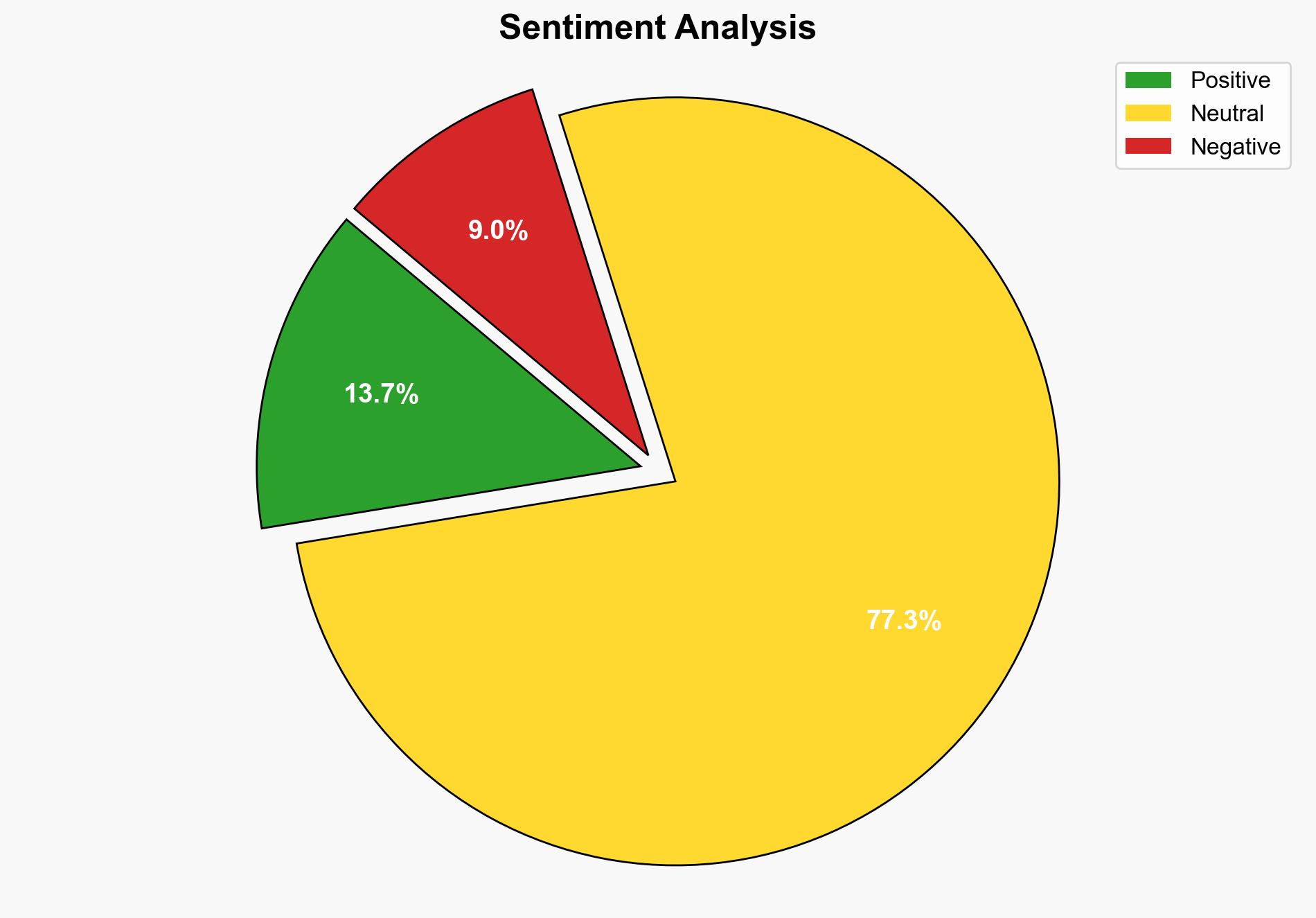

The most supported hypothesis is that China’s service sector slowdown is primarily driven by external trade uncertainties and internal economic challenges, including a prolonged property slump and weak domestic demand. Confidence level: Moderate. It is recommended that stakeholders monitor China’s policy responses, particularly in terms of stimulus measures and trade negotiations, to anticipate potential market shifts.

2. Competing Hypotheses

Hypothesis 1: The slowdown in China’s services sector is primarily due to external factors, such as global trade uncertainties and geopolitical tensions, which have led to a reduction in new export business and increased competition.

Hypothesis 2: The slowdown is primarily driven by internal economic challenges, including a prolonged property slump, weak domestic demand, and structural issues within the service sector itself.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 1 is moderately supported by evidence of global trade uncertainties and the impact of geopolitical tensions on export-oriented services. Hypothesis 2 is also supported by domestic economic indicators, such as the property market slump and weak demand, but lacks the same level of external corroboration.

3. Key Assumptions and Red Flags

– Assumption: Global trade tensions are a significant factor affecting China’s service sector.

– Red Flag: The reliance on official PMI data, which may not fully capture the performance of smaller, export-oriented service providers.

– Potential Bias: Overemphasis on external factors may overlook significant internal economic issues.

– Missing Data: Detailed breakdown of service sector performance by sub-sector and region.

4. Implications and Strategic Risks

The slowdown in China’s service sector could lead to broader economic repercussions, including reduced employment and lower consumer spending. If external trade tensions persist, this may exacerbate internal economic challenges, leading to potential social unrest or increased pressure on the Chinese government to implement further economic reforms. Geopolitical tensions could also impact global supply chains and international markets.

5. Recommendations and Outlook

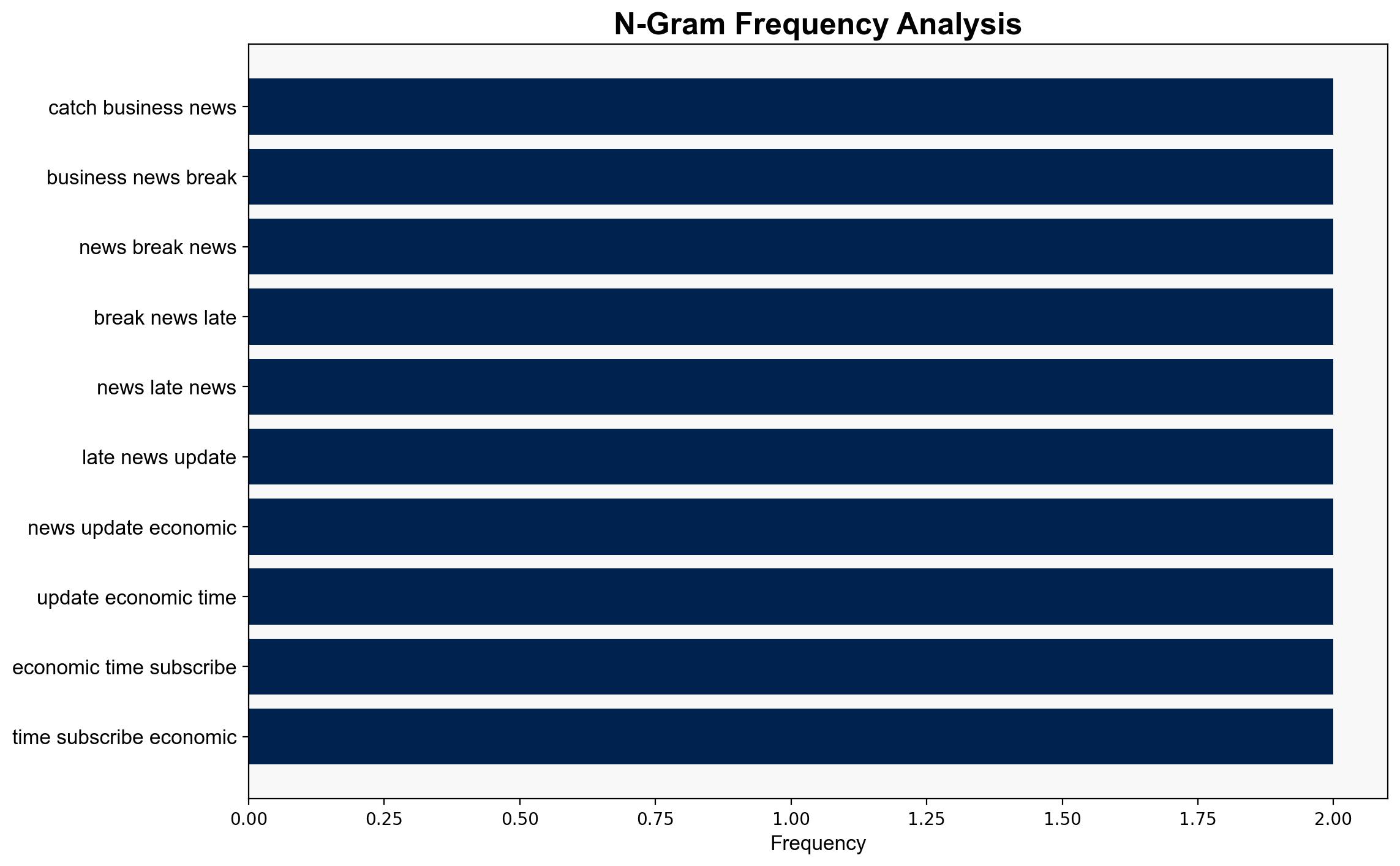

- Monitor China’s policy responses, particularly any new stimulus measures or trade agreements, to assess their potential impact on the service sector.

- Engage in scenario planning to prepare for potential escalations in trade tensions or further domestic economic slowdowns.

- Best Case: Successful trade negotiations lead to a rebound in export-oriented services.

- Worst Case: Continued trade tensions and domestic economic challenges result in a prolonged downturn in the service sector.

- Most Likely: Moderate recovery driven by targeted stimulus measures and gradual improvement in domestic demand.

6. Key Individuals and Entities

– Yao Yu, founder of Ratingdog, provides insights into employment and capacity pressures within the service sector.

– President Xi Jinping’s policies and negotiations are critical in shaping China’s economic trajectory.

7. Thematic Tags

economic challenges, trade tensions, geopolitical risks, domestic policy, service sector analysis