CleanSpark Shares Drop 5 After Upsizing 115B Convertible Note For Expansion – CoinDesk

Published on: 2025-11-11

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: CleanSpark Shares Drop 5 After Upsizing 115B Convertible Note For Expansion – CoinDesk

1. BLUF (Bottom Line Up Front)

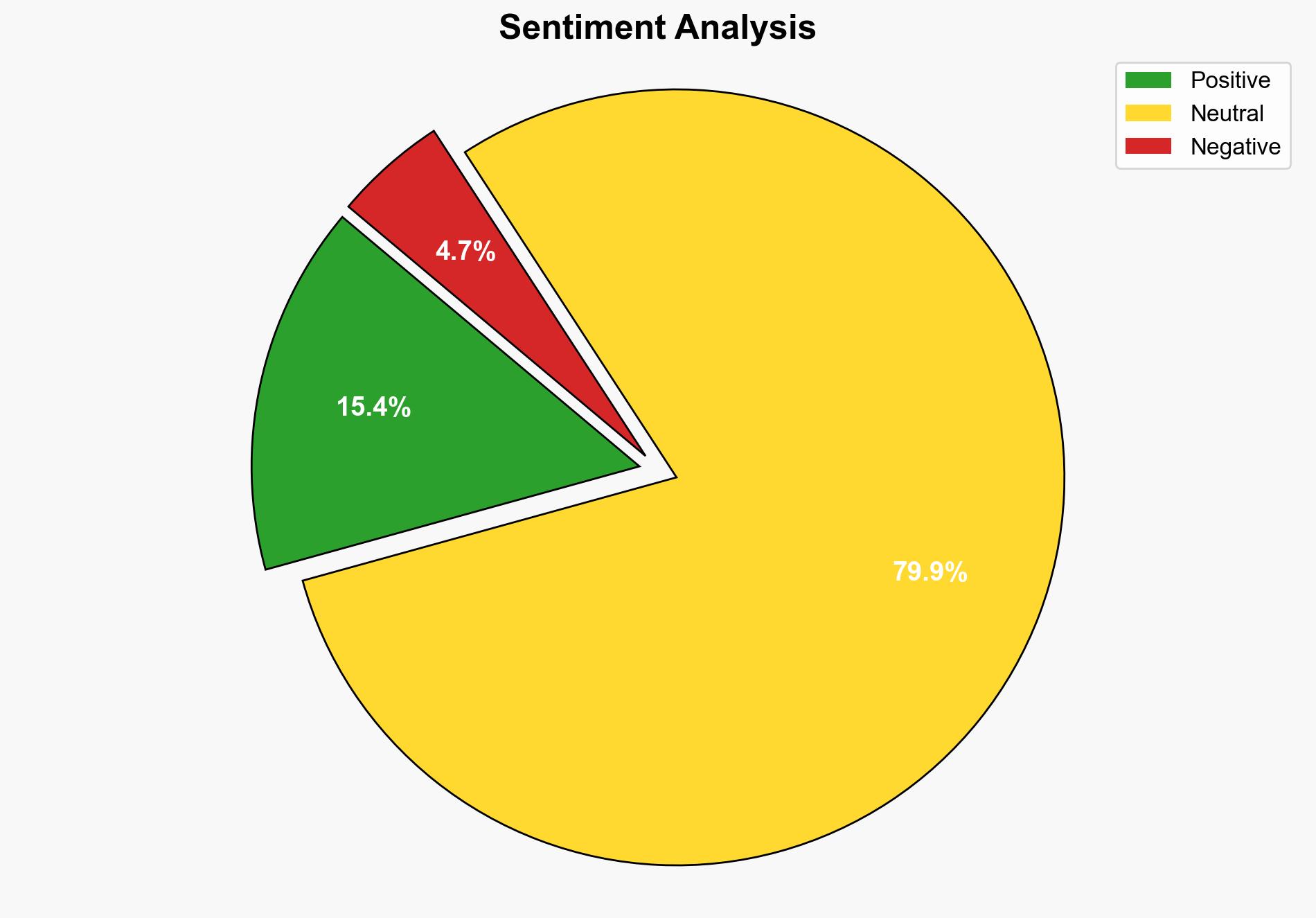

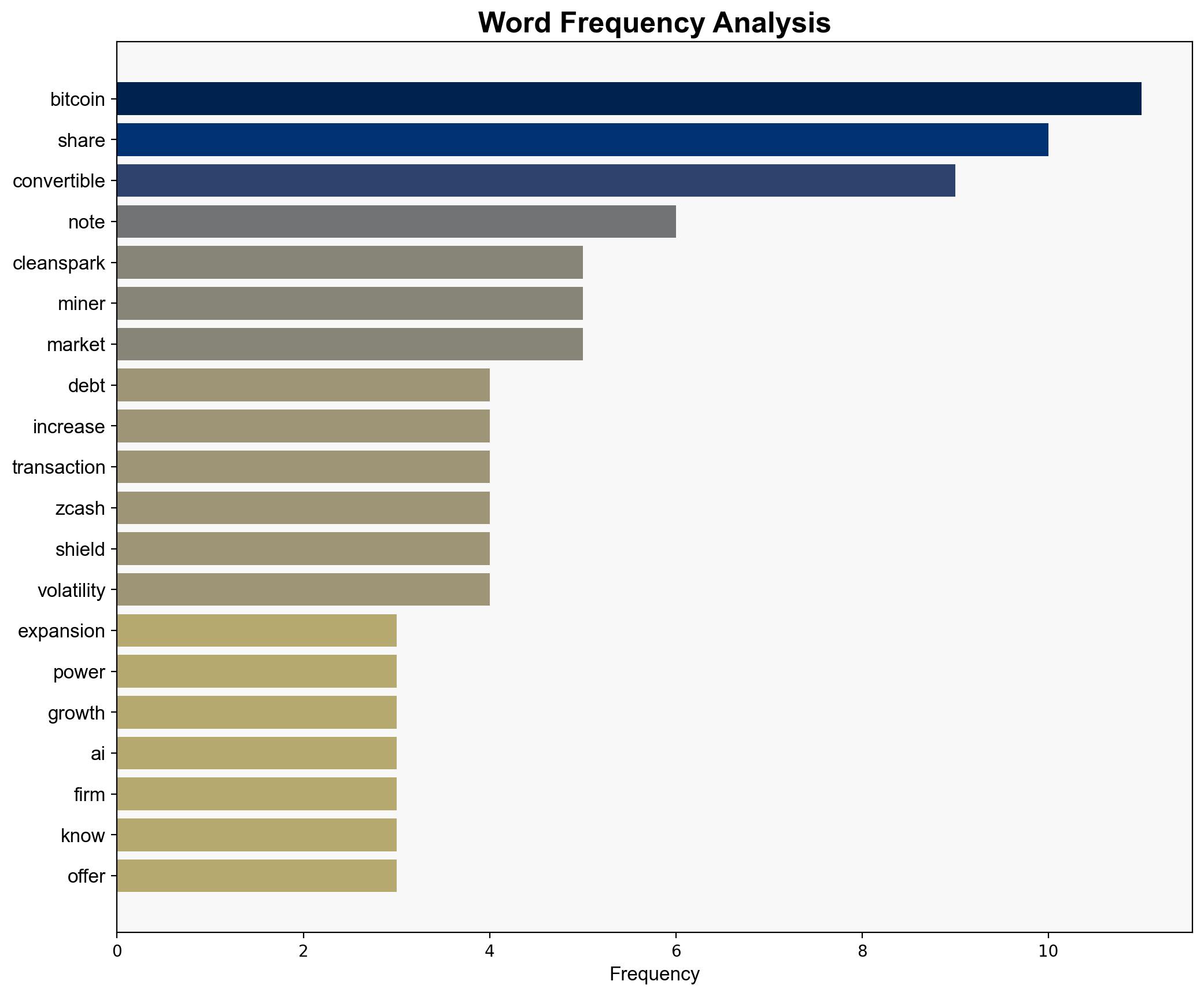

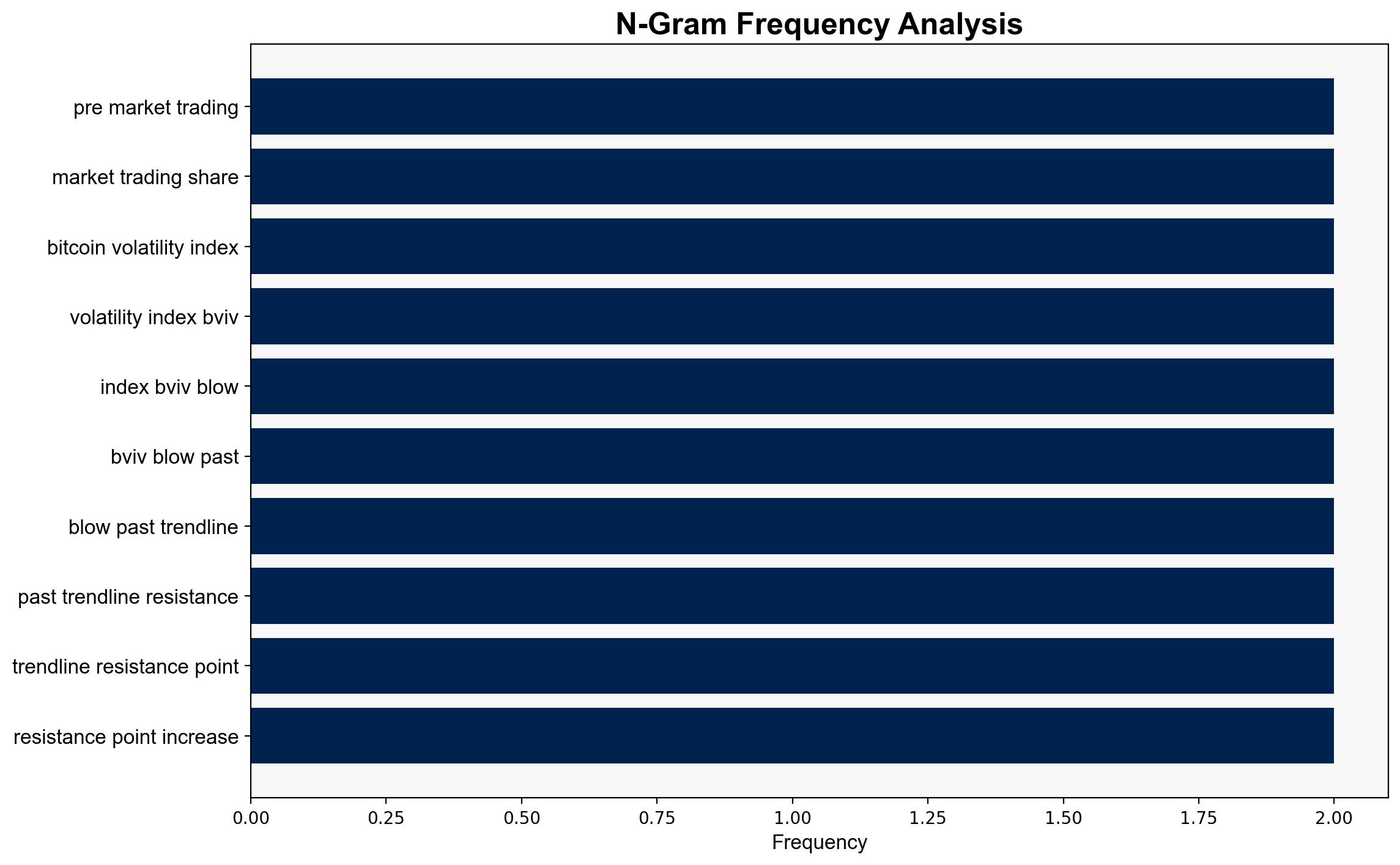

CleanSpark’s decision to upsize its convertible note offering to $115 million has resulted in a 5% drop in share prices, likely due to short-term market reactions and delta hedging by banks. The most supported hypothesis is that the share price drop is a temporary market reaction rather than a fundamental issue with CleanSpark’s strategy. Confidence Level: Moderate. Recommended action includes monitoring market reactions and investor sentiment closely, while preparing for potential volatility in the short term.

2. Competing Hypotheses

Hypothesis 1: The share price drop is primarily a result of short-term market dynamics, including delta hedging by banks involved in the convertible note deal, rather than a reflection of CleanSpark’s long-term prospects.

Hypothesis 2: The share price decline indicates deeper investor concerns about CleanSpark’s strategic direction, particularly its reliance on debt financing for expansion in a volatile cryptocurrency market.

Hypothesis 1 is more likely due to the common occurrence of share price drops following convertible note issuances, driven by delta hedging. Additionally, CleanSpark’s strategic focus on expansion aligns with broader industry trends, suggesting investor sentiment may stabilize.

3. Key Assumptions and Red Flags

Assumptions: The market will react similarly to past convertible note issuances. CleanSpark’s expansion strategy will yield positive long-term results.

Red Flags: High volatility in the cryptocurrency market could exacerbate investor concerns. Over-reliance on debt financing may strain financial stability if market conditions worsen.

4. Implications and Strategic Risks

The primary risk is increased financial pressure on CleanSpark if the cryptocurrency market experiences prolonged volatility, potentially impacting its ability to service debt. Additionally, if investor sentiment does not stabilize, it could lead to a sustained decline in share prices, affecting capital raising capabilities. The broader economic environment, including macroeconomic concerns and liquidity issues, could further influence market dynamics.

5. Recommendations and Outlook

- Monitor market reactions and investor sentiment closely to identify any shifts in perception.

- Communicate transparently with investors about the strategic rationale for the convertible note and expansion plans.

- Explore alternative financing options to mitigate over-reliance on debt.

- Best-case scenario: Market sentiment stabilizes, and CleanSpark’s expansion leads to increased profitability.

- Worst-case scenario: Prolonged market volatility and investor skepticism lead to financial strain and hinder expansion efforts.

- Most-likely scenario: Short-term volatility followed by stabilization as the market digests the convertible note issuance.

6. Key Individuals and Entities

CleanSpark (CLSK), Cantor Fitzgerald, BTIG, Terawulf (WULF), Galaxy Digital (GLXY)

7. Thematic Tags

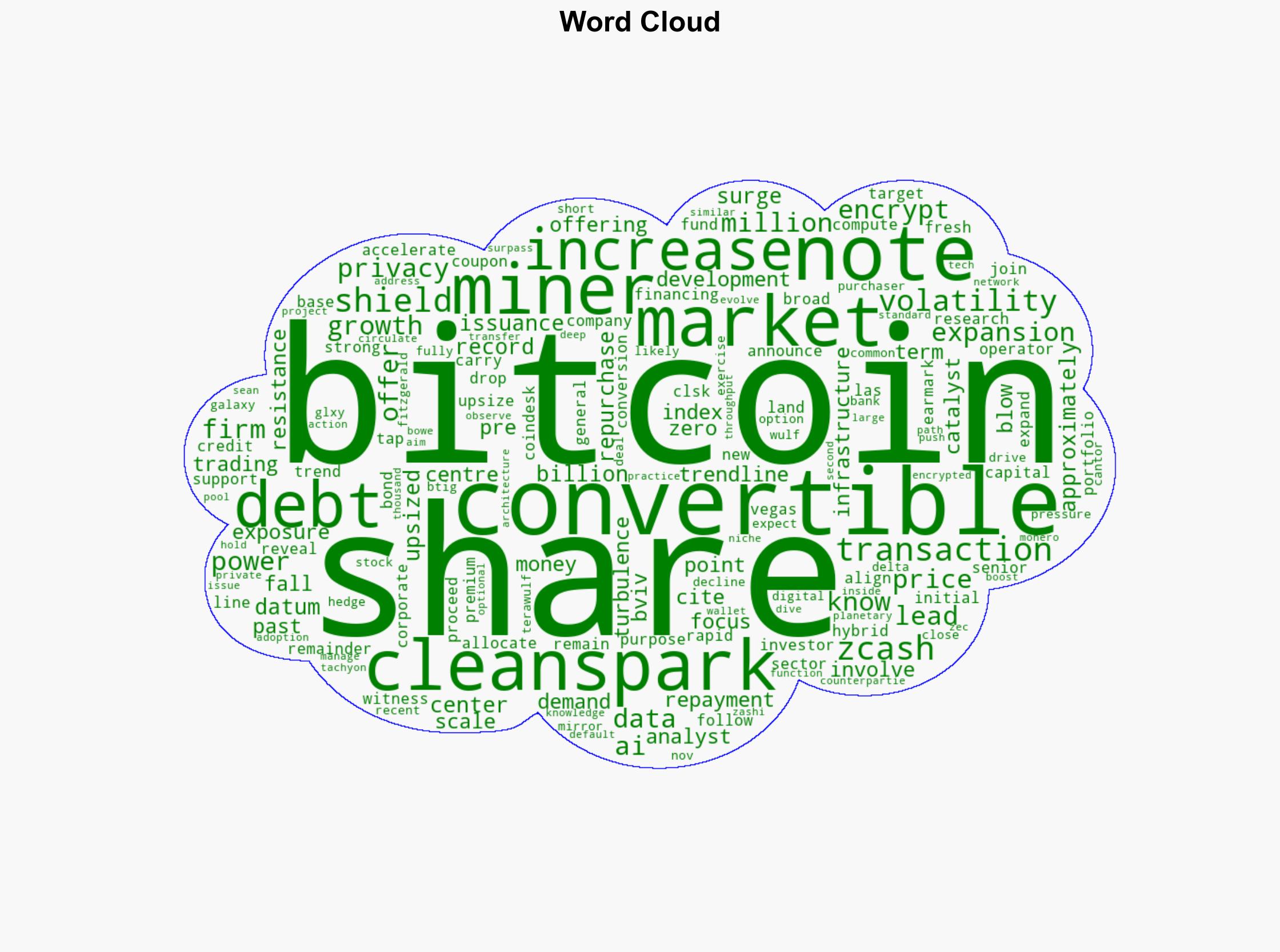

Cryptocurrency, Debt Financing, Market Volatility, Strategic Expansion

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology