Coca-Cola third quarter results rise with help from mini cans and premium drinks – Associated Press

Published on: 2025-10-21

Intelligence Report: Coca-Cola third quarter results rise with help from mini cans and premium drinks – Associated Press

1. BLUF (Bottom Line Up Front)

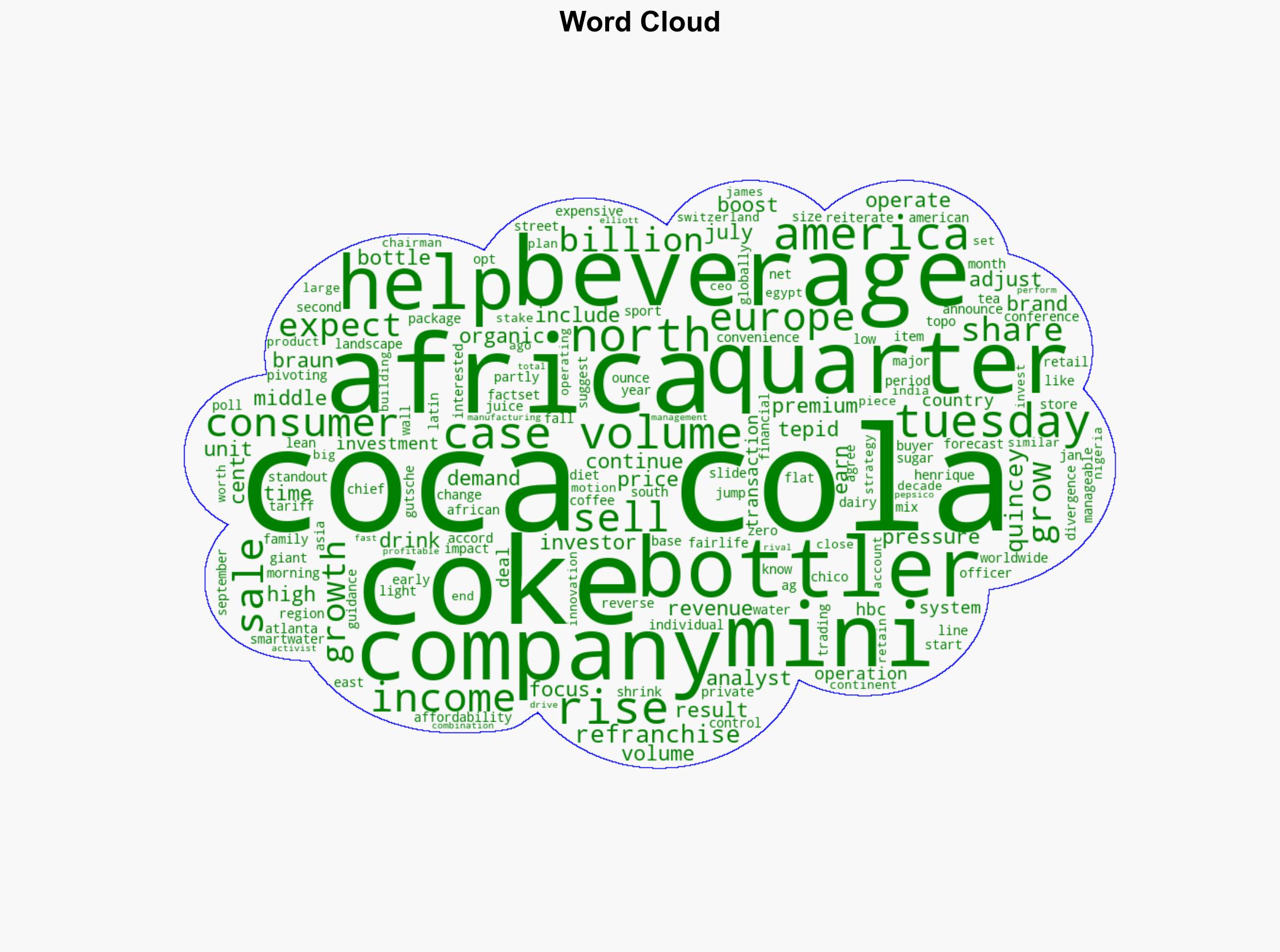

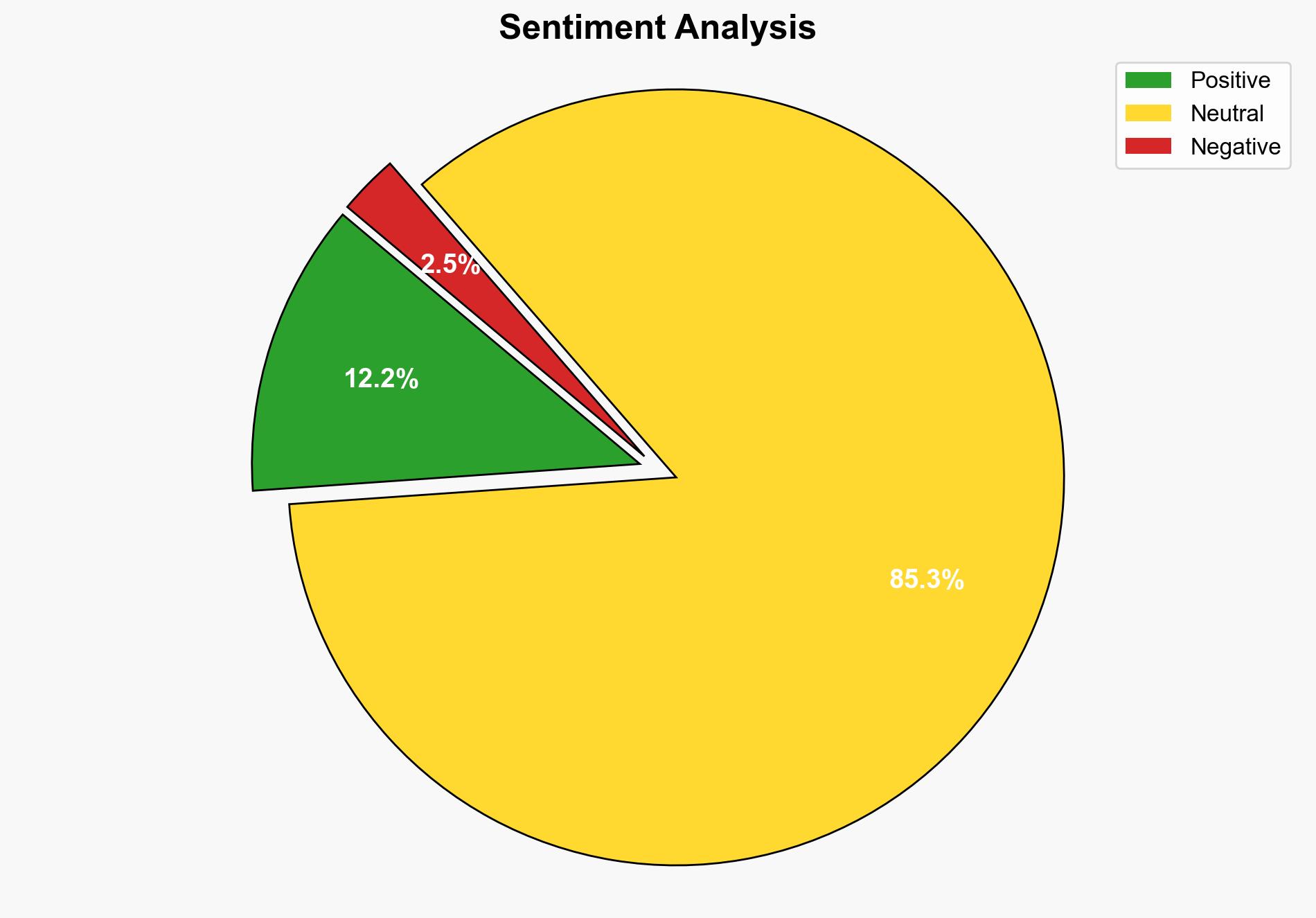

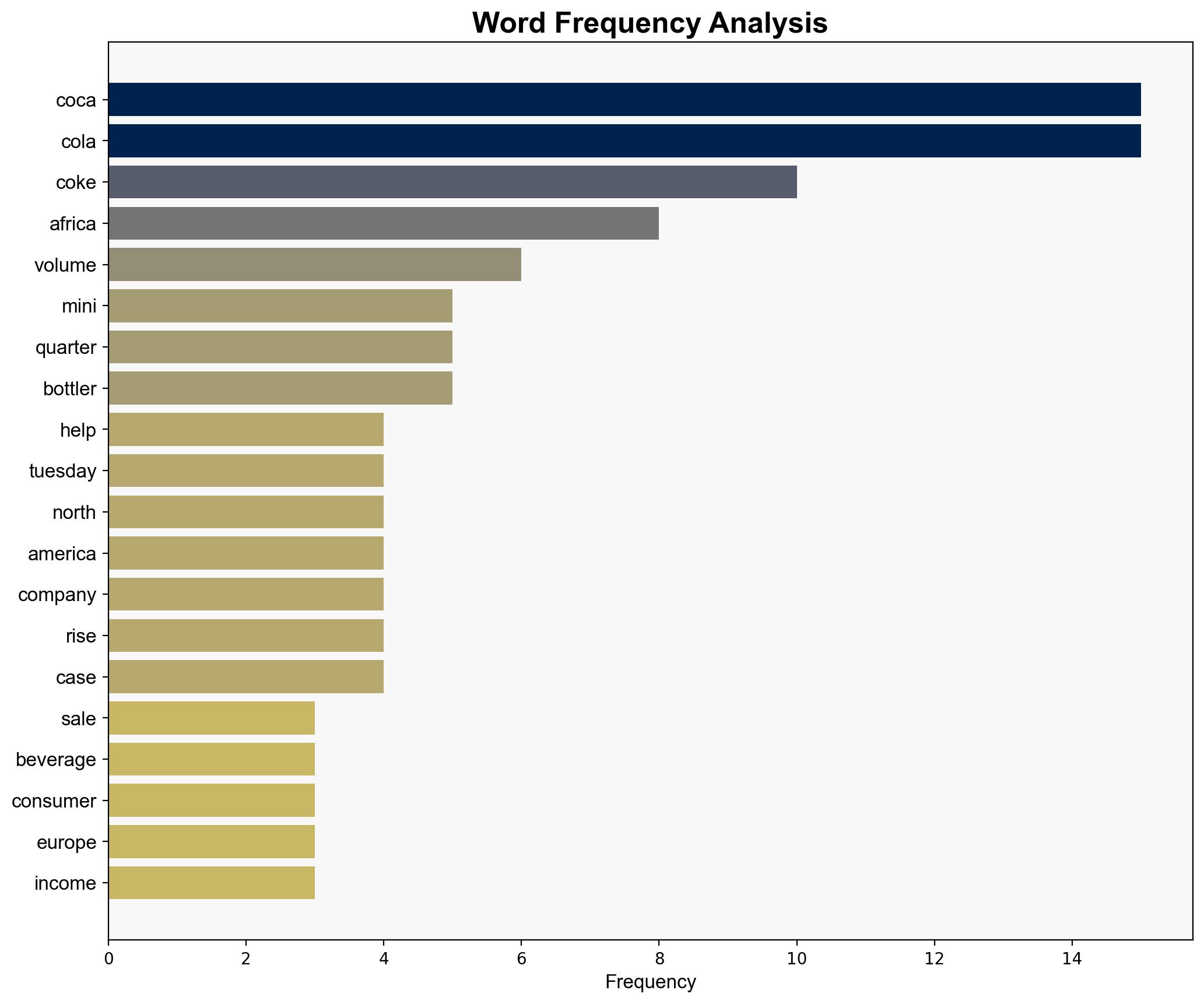

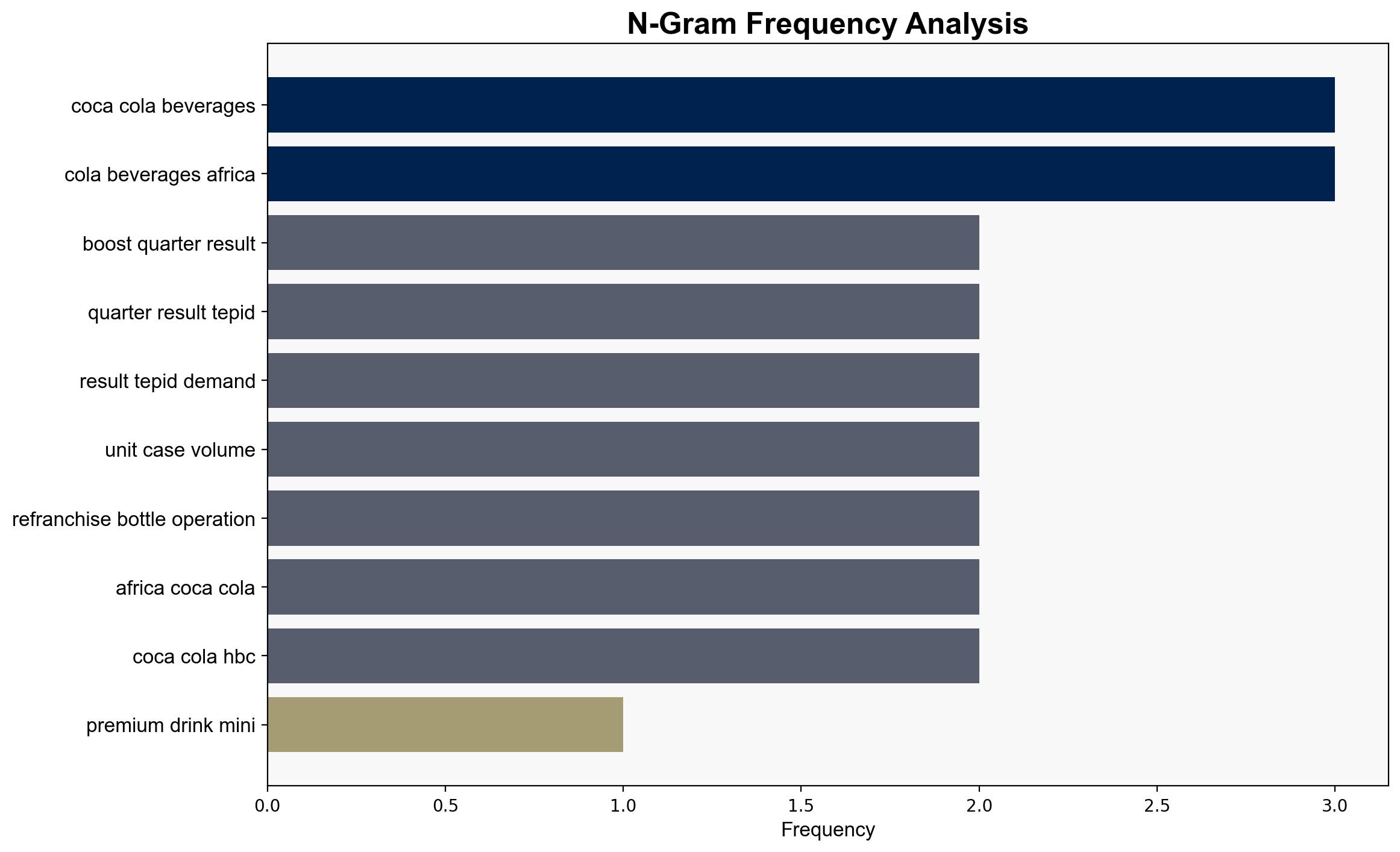

Coca-Cola’s strategic focus on mini cans and premium drinks has contributed to its third-quarter revenue growth despite tepid demand in certain markets. The most supported hypothesis is that Coca-Cola’s product diversification strategy is effectively capturing different consumer segments, leading to stable financial performance. Confidence level: Moderate. Recommended action: Continue refining product offerings and monitor consumer trends closely to sustain growth.

2. Competing Hypotheses

1. **Hypothesis A**: Coca-Cola’s revenue growth is primarily driven by its strategic shift towards premium drinks and mini cans, effectively targeting high-income consumers and adapting to changing consumer preferences.

2. **Hypothesis B**: The revenue growth is a temporary effect of aggressive marketing and pricing strategies, which may not be sustainable in the long term given the economic pressures on middle and low-income consumers.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that high-income consumers will continue to favor premium products and that mini cans will remain attractive due to convenience and perceived value. Hypothesis B assumes that economic pressures will eventually outweigh the appeal of premium products and smaller packaging.

– **Red Flags**: The divergence in consumer behavior between high-income and middle/low-income segments could lead to over-reliance on a narrow consumer base. Additionally, the impact of tariffs and economic downturns on consumer spending is not fully addressed.

4. Implications and Strategic Risks

– **Economic**: Continued focus on premium products could alienate price-sensitive consumers, risking market share loss if economic conditions worsen.

– **Geopolitical**: The refranchising strategy in Africa and India could expose Coca-Cola to geopolitical risks and regulatory challenges in these regions.

– **Psychological**: Consumer perception of value and brand loyalty may shift rapidly, impacting sales if not managed proactively.

5. Recommendations and Outlook

- **Mitigate Risks**: Diversify product offerings to include more affordable options to capture a broader consumer base.

- **Exploit Opportunities**: Leverage data analytics to better understand consumer trends and refine marketing strategies.

- **Scenario Projections**:

– **Best Case**: Sustained growth through successful adaptation to consumer trends and expansion in emerging markets.

– **Worst Case**: Decline in sales due to economic downturns and failure to appeal to price-sensitive consumers.

– **Most Likely**: Moderate growth with fluctuations based on regional economic conditions and consumer preferences.

6. Key Individuals and Entities

– Henrique Braun

– James Quincey

– Coca-Cola HBC AG

– Gutsche Family Investments

7. Thematic Tags

economic strategy, consumer behavior, market adaptation, global expansion