Coinbase Is Building Private Transactions for Base CEO Brian Armstrong Says – CoinDesk

Published on: 2025-10-22

Intelligence Report: Coinbase Is Building Private Transactions for Base CEO Brian Armstrong Says – CoinDesk

1. BLUF (Bottom Line Up Front)

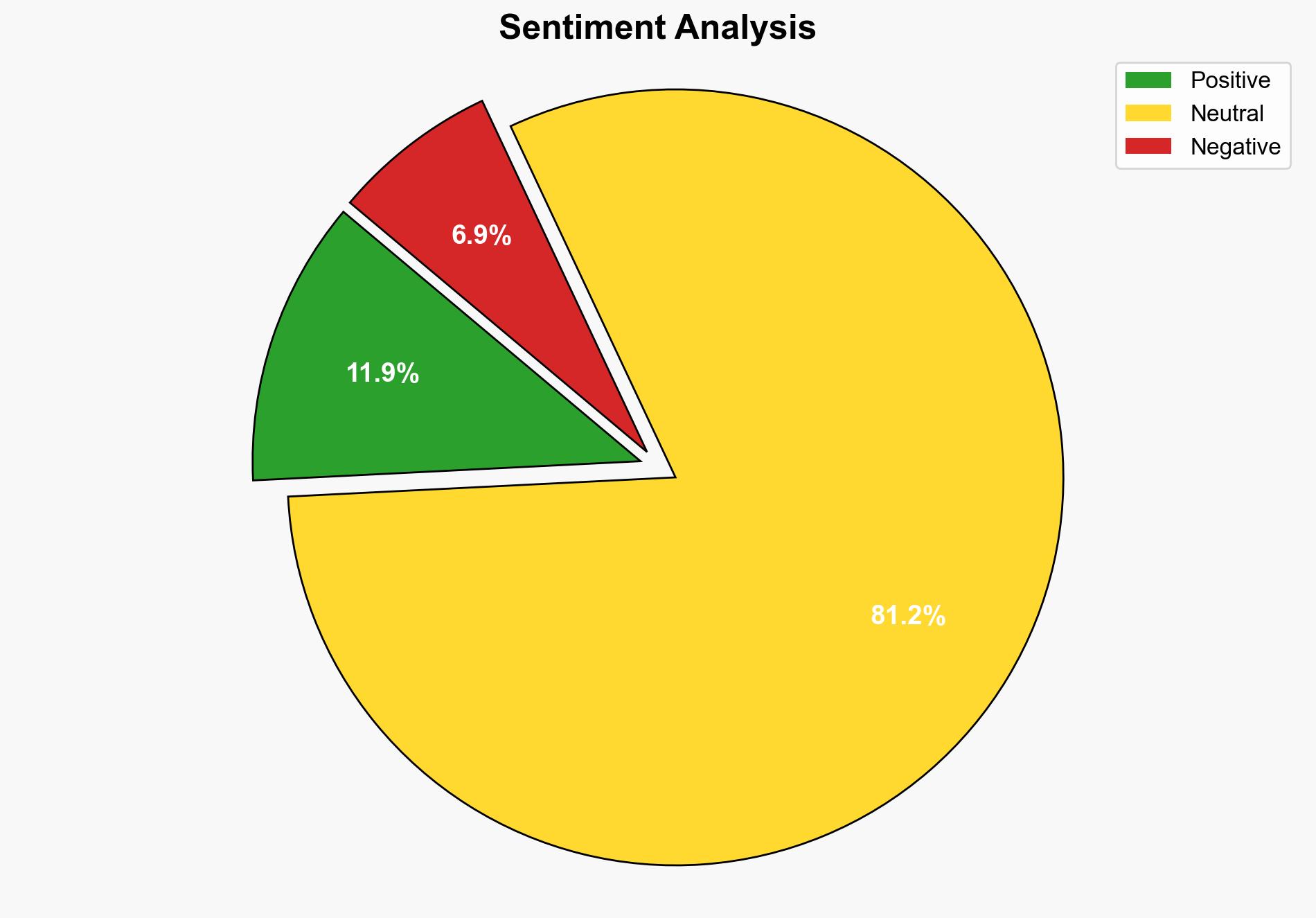

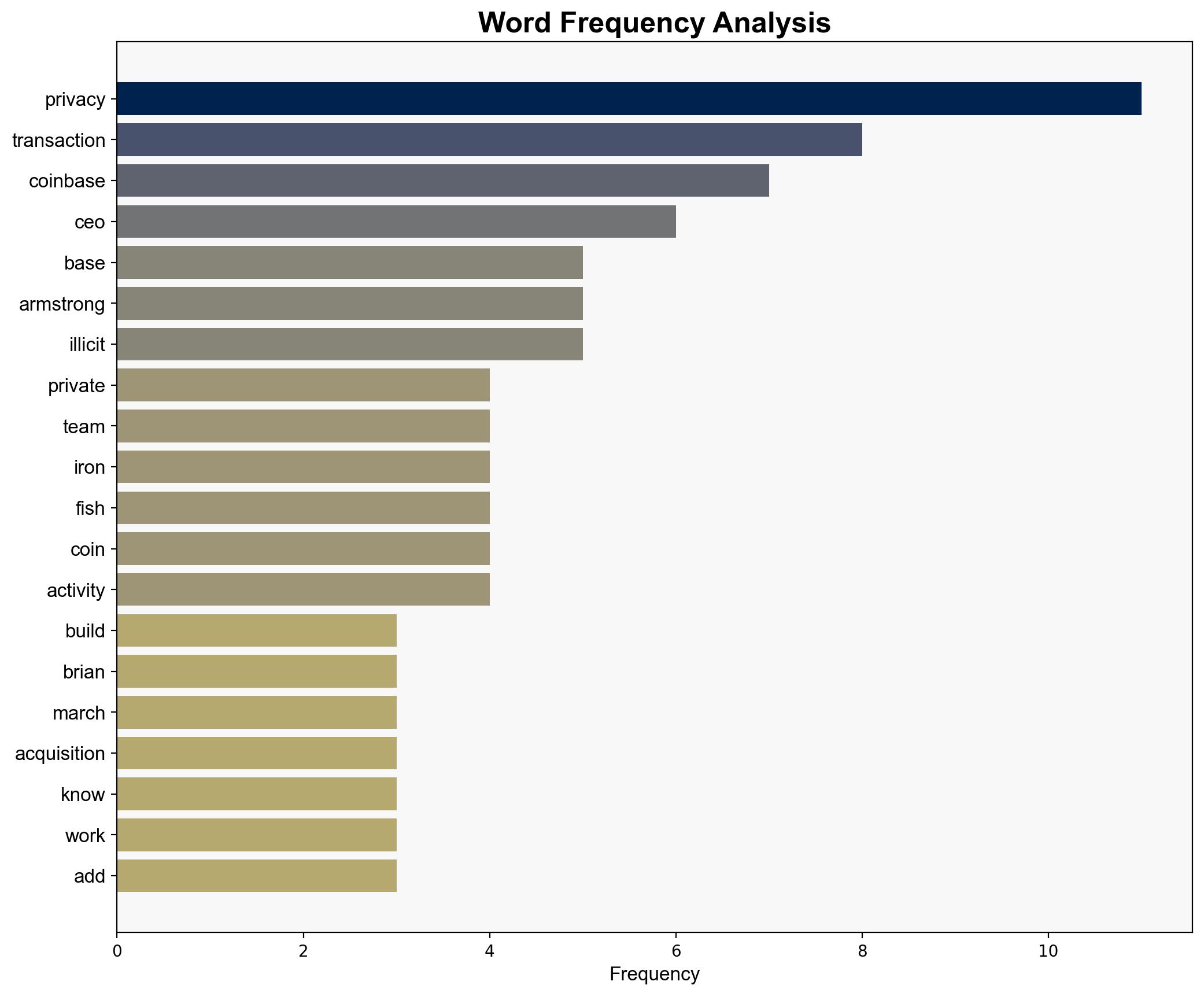

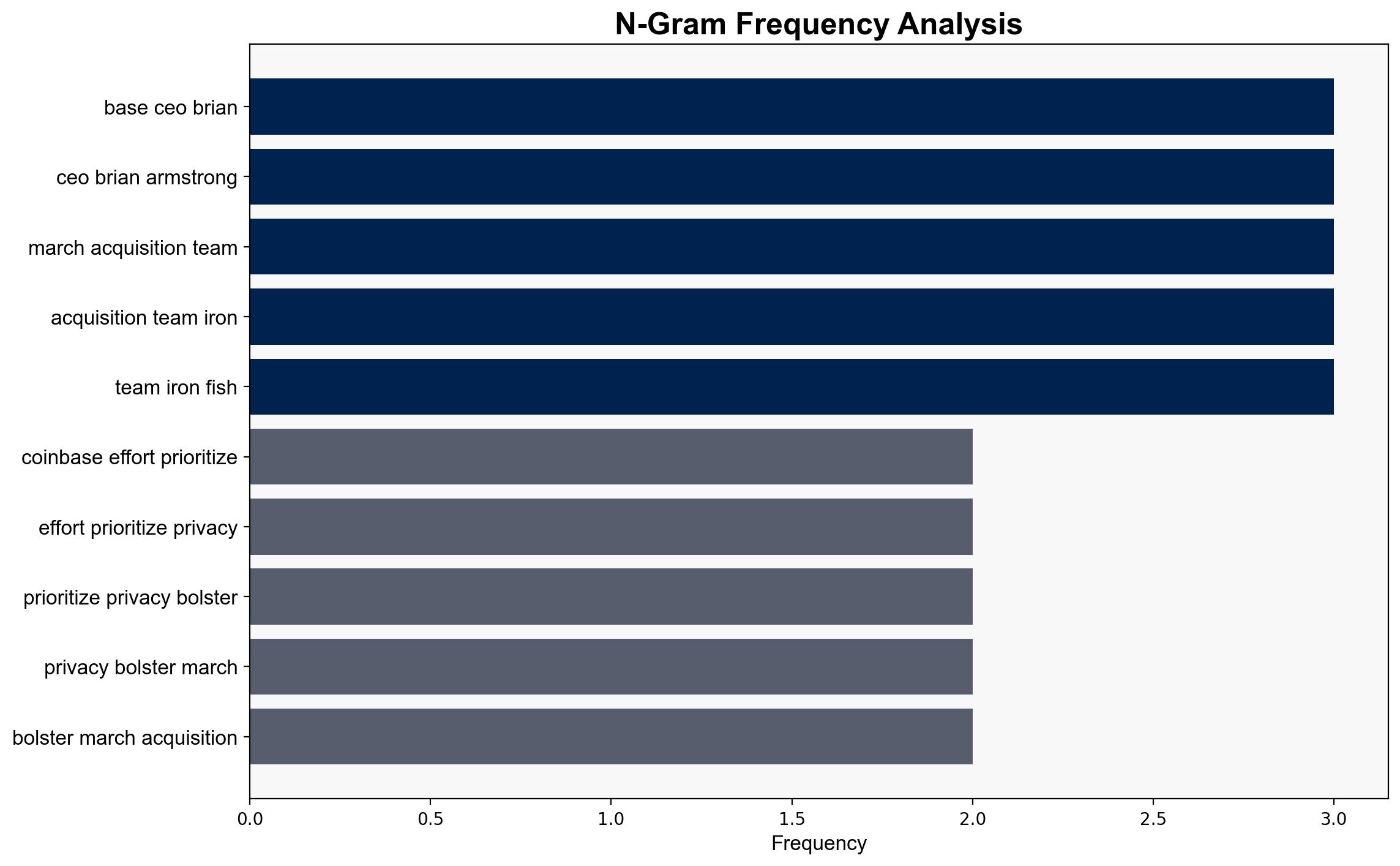

Coinbase’s initiative to integrate private transactions into its network could enhance user privacy but may face significant regulatory challenges. The most supported hypothesis is that Coinbase aims to balance user privacy with compliance, leveraging its acquisition of Iron Fish. Confidence level: Moderate. Recommended action: Monitor regulatory responses and prepare for potential compliance adjustments.

2. Competing Hypotheses

1. **Hypothesis A**: Coinbase is prioritizing user privacy to gain a competitive edge in the cryptocurrency market, responding to increased demand for privacy-focused solutions.

2. **Hypothesis B**: Coinbase is strategically positioning itself to comply with anticipated regulatory changes by developing privacy features that can be selectively applied, ensuring both user privacy and regulatory compliance.

Using ACH 2.0, Hypothesis B is better supported due to Coinbase’s acquisition of Iron Fish, which specializes in privacy-preserving technology, indicating a nuanced approach to privacy and compliance.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that privacy features can be effectively balanced with regulatory compliance. There is an implicit belief that regulatory bodies will allow such privacy enhancements if compliance mechanisms are robust.

– **Red Flags**: The lack of detailed information on how Coinbase plans to address potential regulatory pushback is concerning. Additionally, the assumption that privacy technology will not be misused for illicit activities is a potential blind spot.

4. Implications and Strategic Risks

– **Economic**: Enhanced privacy features could attract more users, increasing market share. However, regulatory backlash could lead to fines or restrictions, impacting financial stability.

– **Cyber**: Increased privacy may lead to heightened scrutiny from cybersecurity agencies concerned about illicit activities.

– **Geopolitical**: Coinbase’s actions could influence global regulatory standards, potentially leading to a fragmented regulatory landscape.

– **Psychological**: Users may perceive Coinbase as a leader in privacy, enhancing brand loyalty, but regulatory actions could damage trust.

5. Recommendations and Outlook

- Engage with regulators proactively to shape privacy standards and ensure compliance.

- Develop a robust internal compliance framework to mitigate regulatory risks.

- Scenario Projections:

- Best Case: Successful integration of privacy features with regulatory approval, leading to increased user base and market leadership.

- Worst Case: Regulatory crackdown leads to fines and loss of user trust, negatively impacting market position.

- Most Likely: Gradual integration of privacy features with ongoing negotiations with regulators, maintaining a stable market position.

6. Key Individuals and Entities

– Brian Armstrong

– Iron Fish

– Jonathan Hugh

– Peter Tassiopoulos

7. Thematic Tags

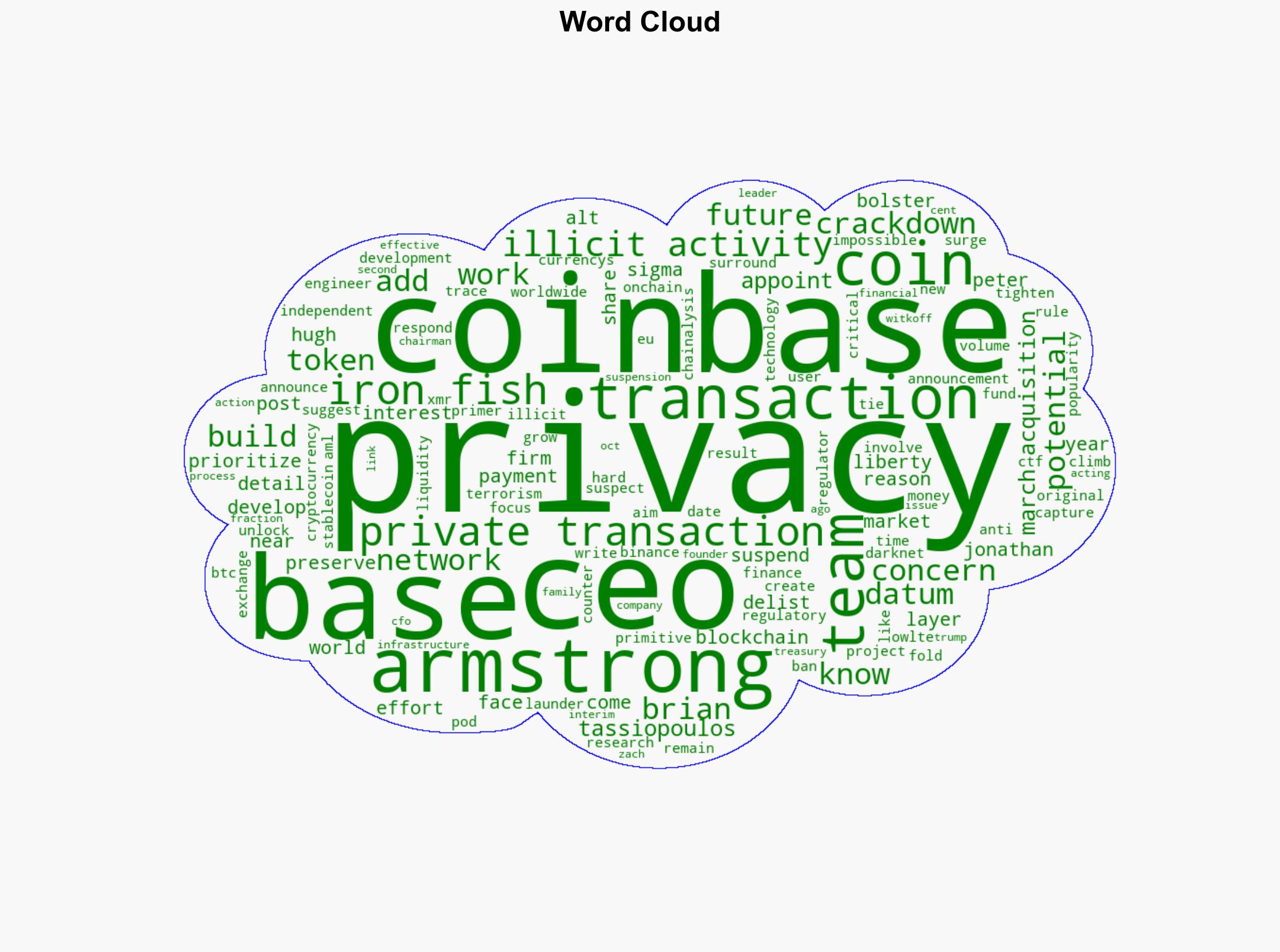

national security threats, cybersecurity, counter-terrorism, regulatory compliance