Coinbase to Invest in India’s CoinDCX Expand in South Asia and the Middle East – Decrypt

Published on: 2025-10-15

Intelligence Report: Coinbase to Invest in India’s CoinDCX Expand in South Asia and the Middle East – Decrypt

1. BLUF (Bottom Line Up Front)

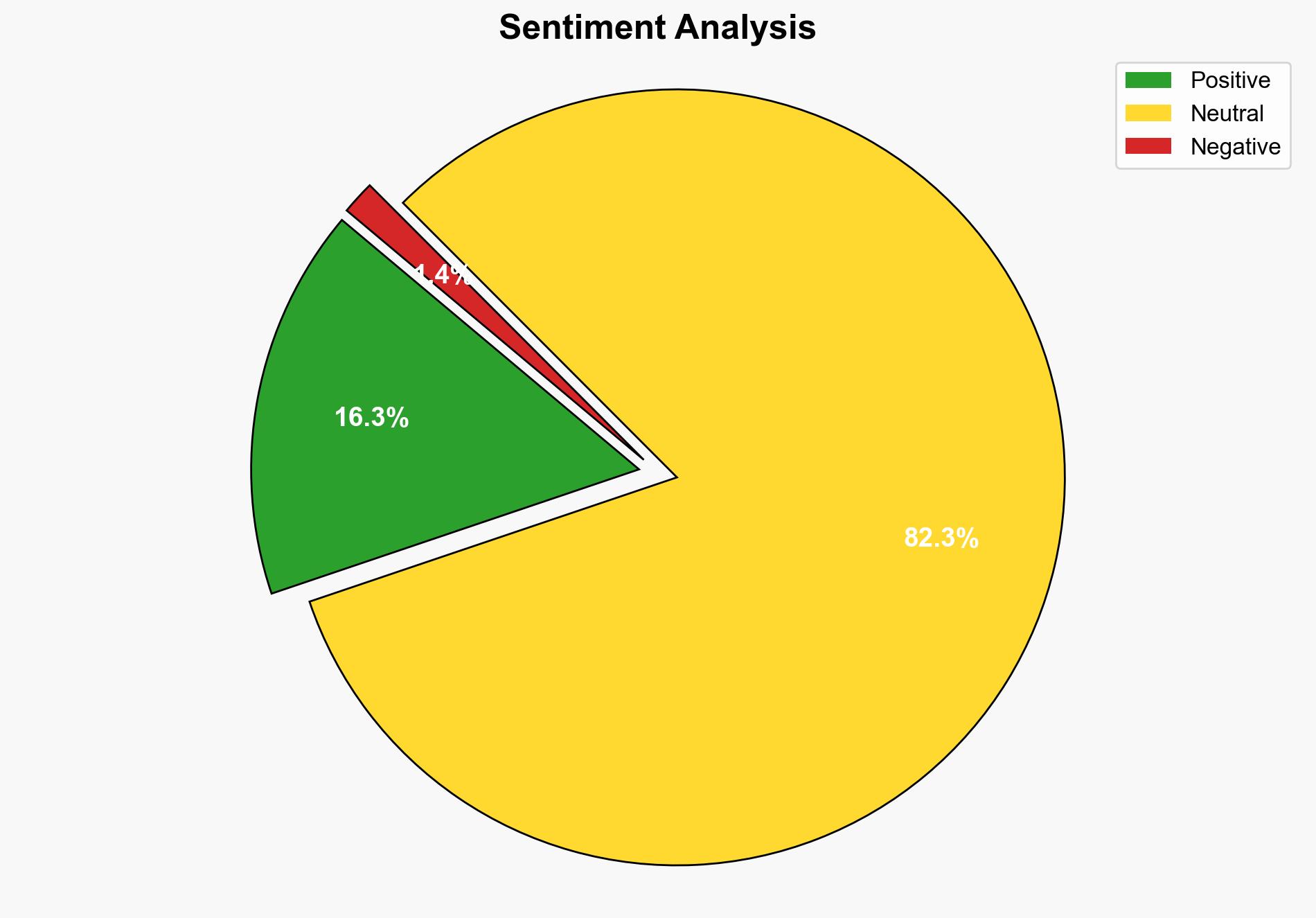

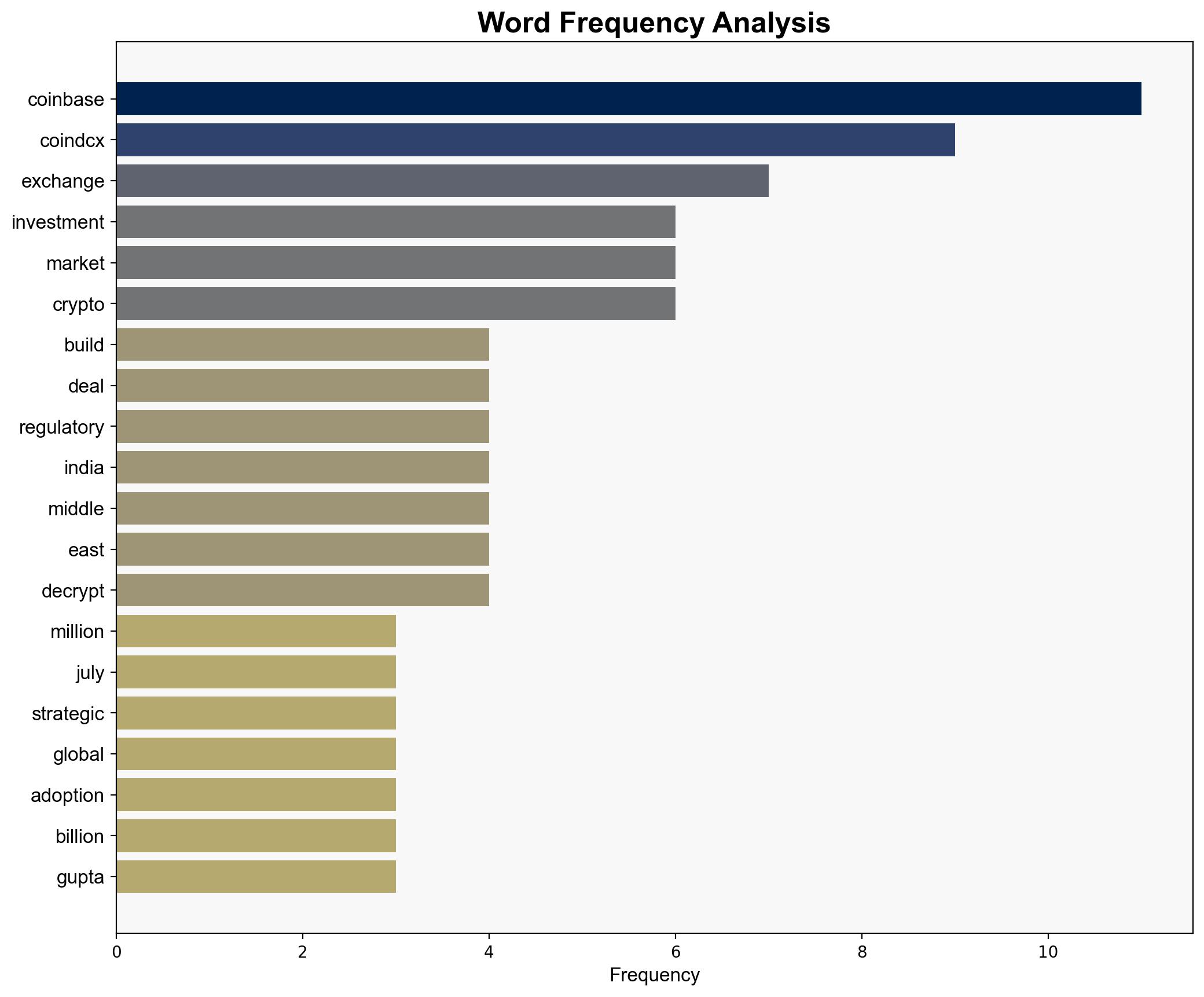

Coinbase’s investment in CoinDCX is strategically aimed at leveraging existing regulatory relationships to penetrate the Indian and Middle Eastern crypto markets. The most supported hypothesis suggests that this partnership is a calculated move to circumvent direct regulatory challenges. Confidence level: Moderate. Recommended action: Monitor regulatory developments and CoinDCX’s market performance to assess the partnership’s effectiveness.

2. Competing Hypotheses

Hypothesis 1: Coinbase’s investment in CoinDCX is primarily a strategic partnership to leverage CoinDCX’s regulatory relationships and market presence in India and the Middle East, avoiding direct regulatory hurdles.

Hypothesis 2: Coinbase’s investment is a precursor to a potential acquisition of CoinDCX, allowing Coinbase to establish a stronger foothold in the region through eventual ownership.

Using Bayesian Scenario Modeling, Hypothesis 1 is more supported due to the explicit denial of acquisition rumors by CoinDCX’s CEO and the focus on strategic alignment and partnership in public statements.

3. Key Assumptions and Red Flags

Assumptions:

– CoinDCX’s regulatory relationships will remain stable and beneficial.

– The partnership will effectively navigate complex regulatory environments.

Red Flags:

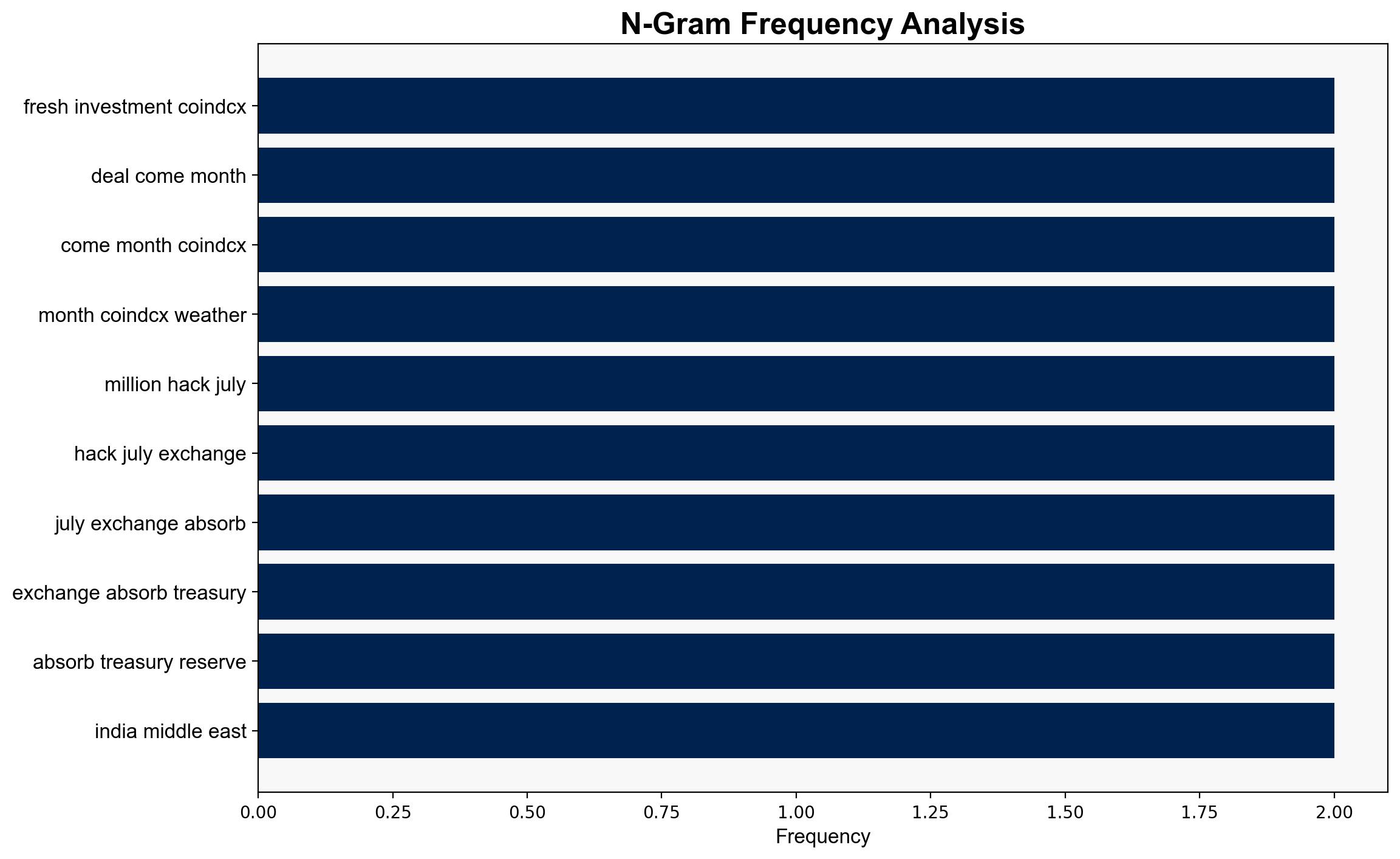

– CoinDCX’s recent hack and financial challenges could undermine stability.

– The denial of acquisition rumors may be strategic misdirection.

4. Implications and Strategic Risks

The partnership could accelerate crypto adoption in India and the Middle East, potentially reshaping regional financial landscapes. However, regulatory changes or further security breaches could pose significant risks. The partnership’s success hinges on CoinDCX’s ability to maintain regulatory favor and operational integrity.

5. Recommendations and Outlook

- Monitor regulatory changes in India and the Middle East that could impact the partnership.

- Assess CoinDCX’s security measures and financial health to gauge partnership stability.

- Scenario Projections:

- Best Case: Successful regulatory navigation and increased market share.

- Worst Case: Regulatory crackdowns or security breaches disrupt operations.

- Most Likely: Gradual market penetration with moderate regulatory challenges.

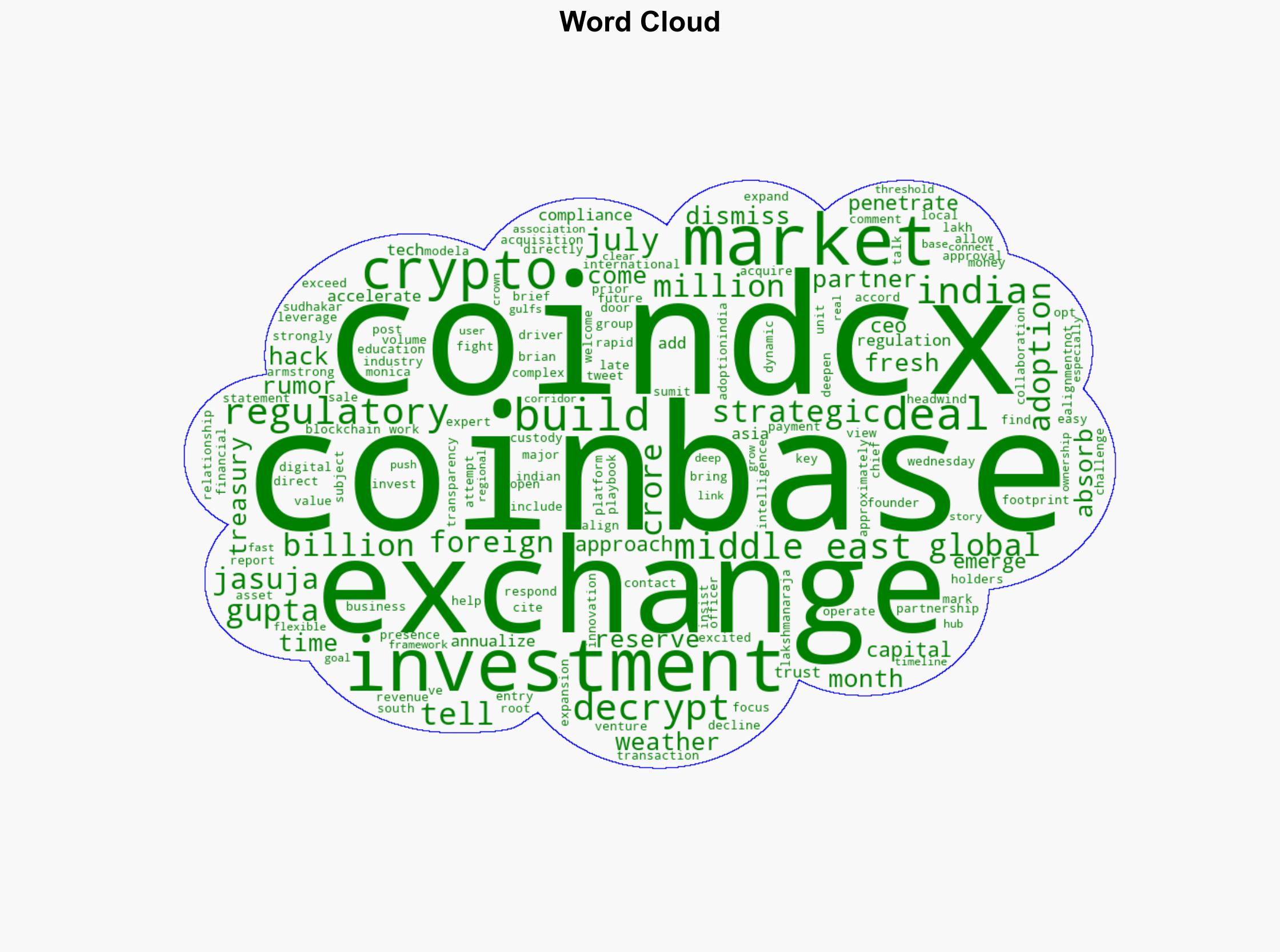

6. Key Individuals and Entities

– Sumit Gupta

– Brian Armstrong

– Sudhakar Lakshmanaraja

– Monica Jasuja

7. Thematic Tags

crypto market expansion, regulatory strategy, investment partnership, regional market penetration