Compliance Now Biggest Cyber Challenge for UK Financial Services – Infosecurity Magazine

Published on: 2025-04-15

Intelligence Report: Compliance Now Biggest Cyber Challenge for UK Financial Services – Infosecurity Magazine

1. BLUF (Bottom Line Up Front)

Compliance with evolving regulations is currently the most significant cybersecurity challenge for UK financial services, as identified by recent research from Bridewell Consulting. The EU’s Digital Operational Resilience Act (DORA) and new rules from the Financial Conduct Authority (FCA) are key regulatory drivers. Supply chain attacks pose the longest response times, while AI-powered threats are emerging concerns. Strategic recommendations include enhancing cyber resilience and adopting advanced AI solutions.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

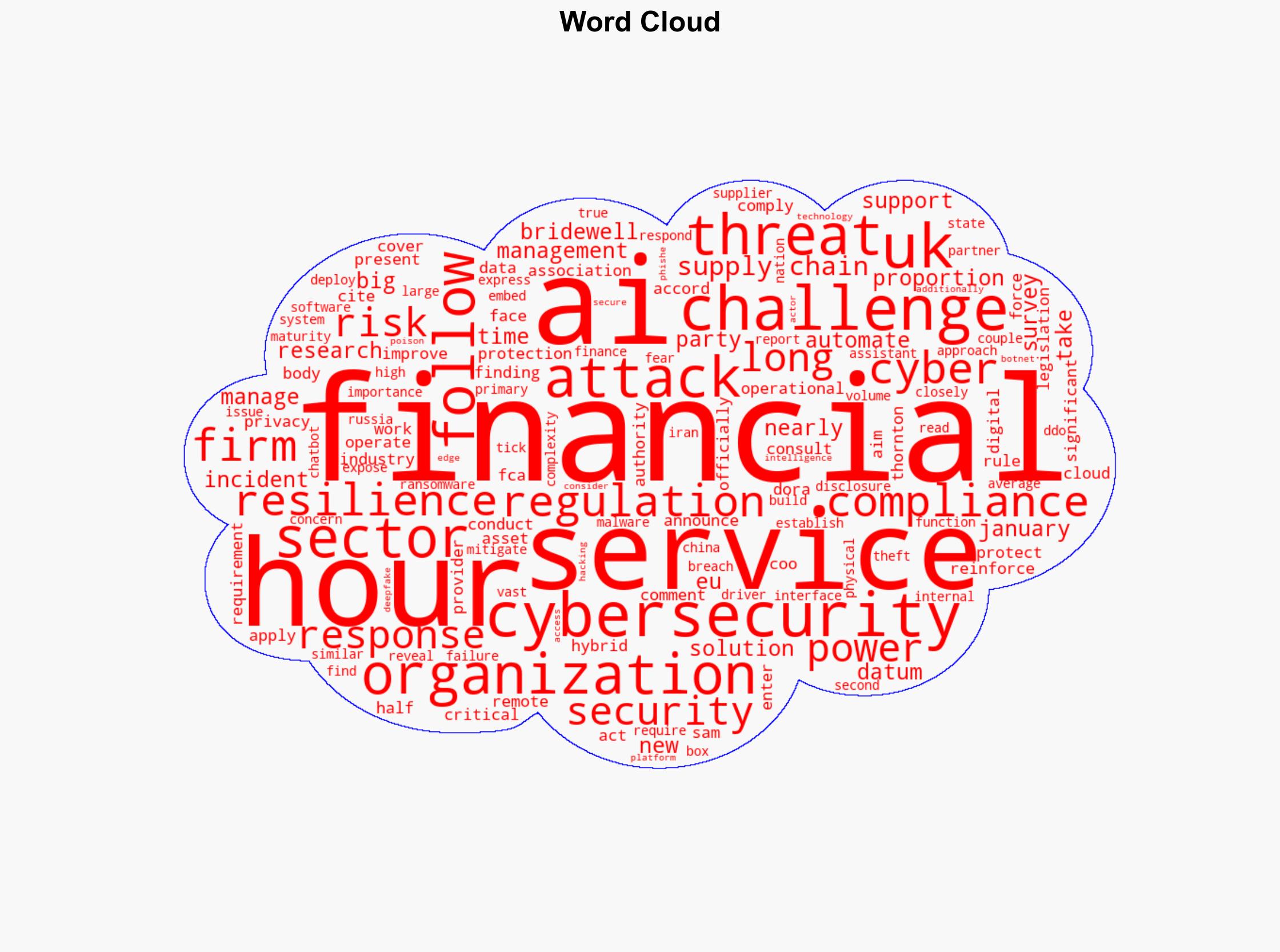

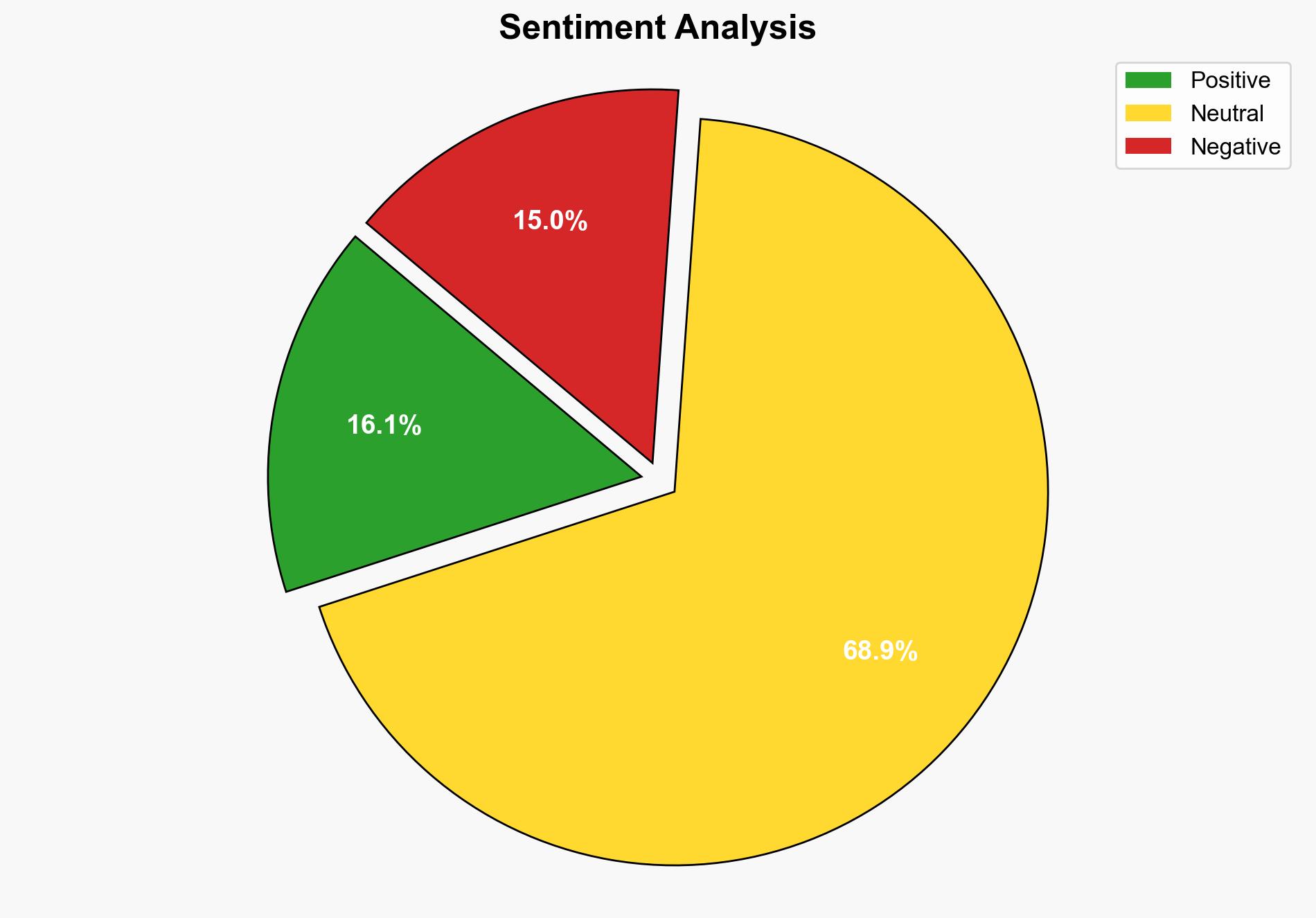

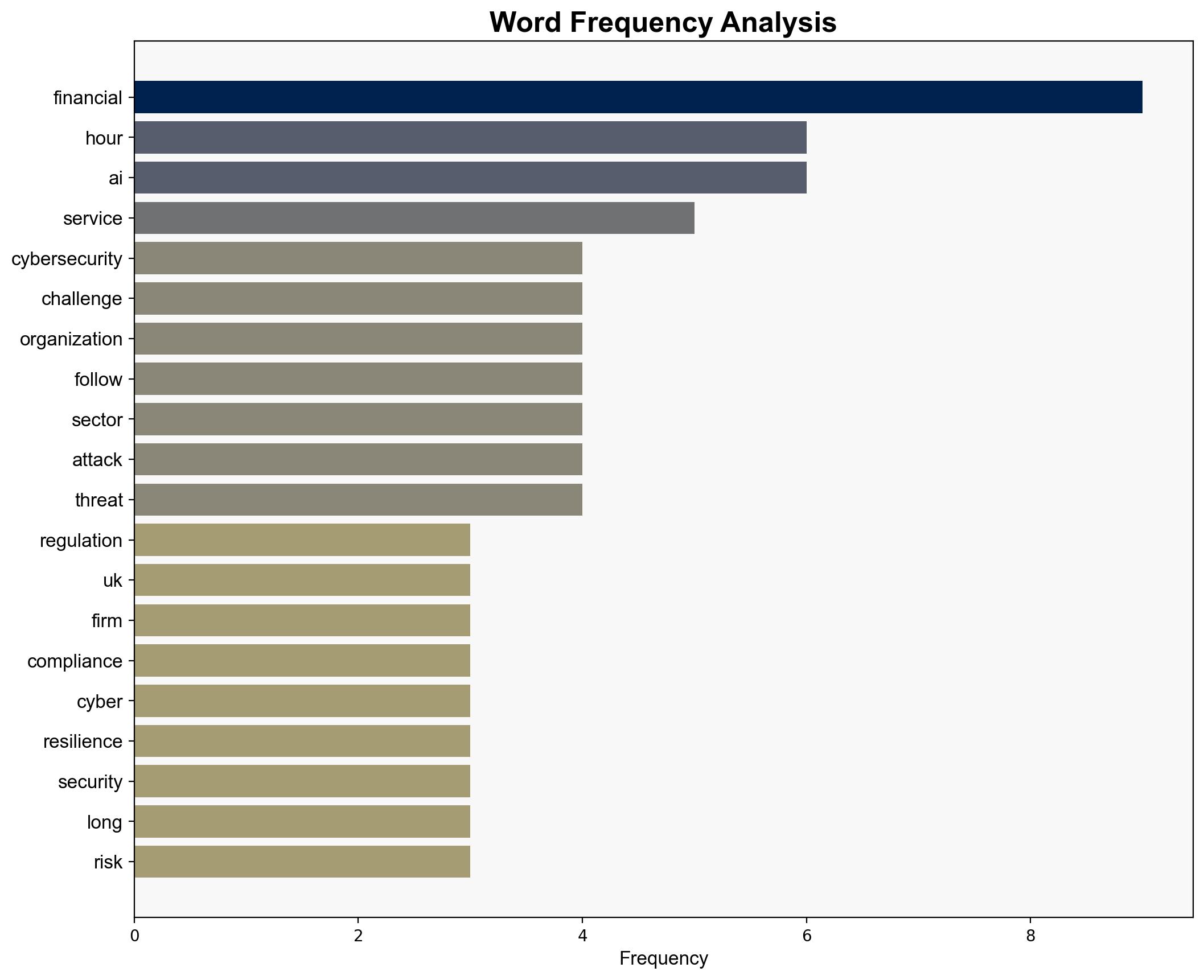

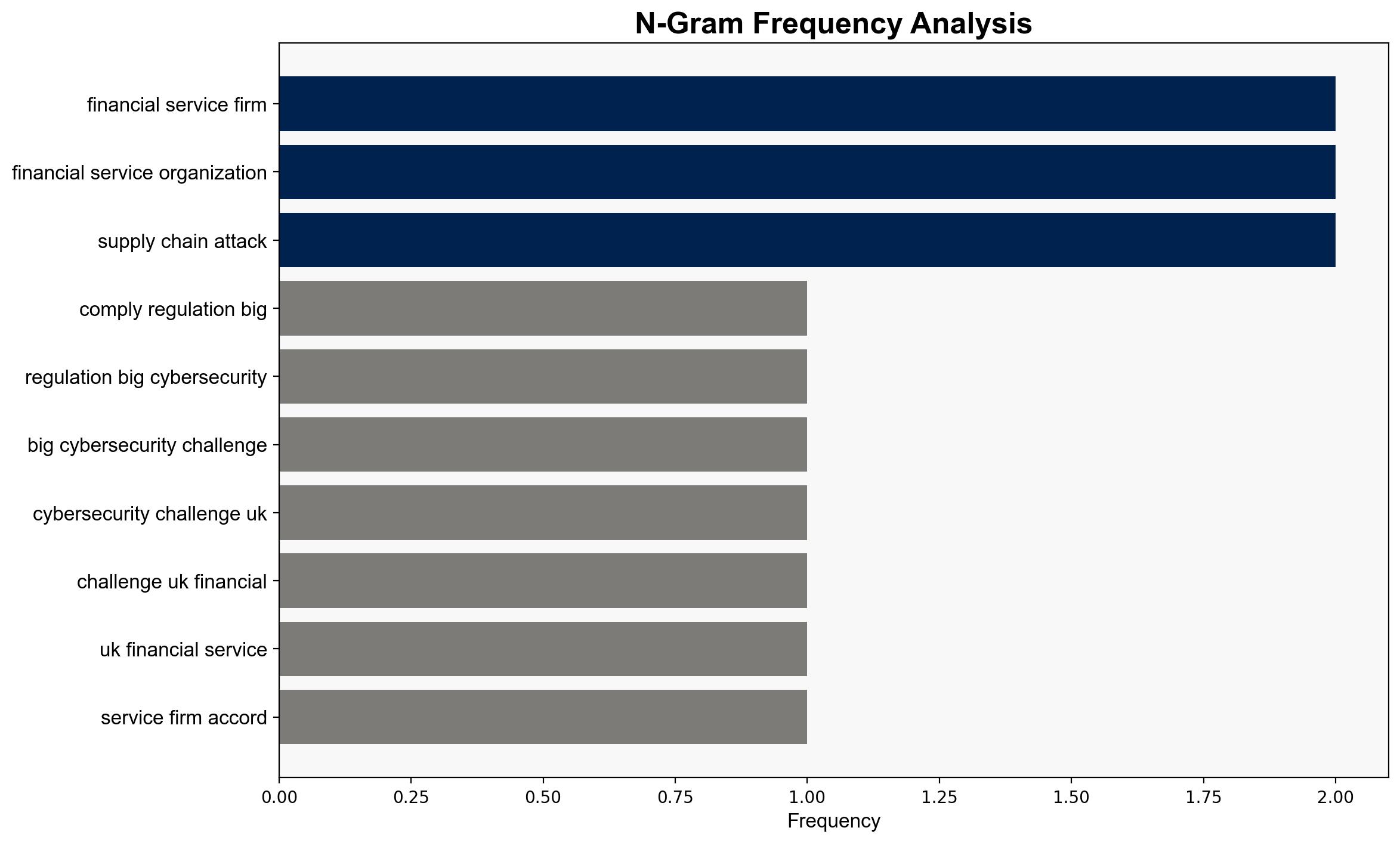

The research highlights that 44% of financial services organizations view compliance as a top cyber challenge. This is closely followed by data protection and privacy, and the need to support remote and hybrid work environments. The introduction of DORA in 2025 will impose additional compliance requirements on UK firms operating in the EU. Supply chain attacks are notably difficult to manage, requiring an average of 16 hours for incident response. AI technologies are being increasingly adopted for cybersecurity, with 33% of firms using automated incident response solutions.

3. Implications and Strategic Risks

The primary strategic risk involves the financial sector’s ability to adapt to stringent regulatory requirements, which could impact operational efficiency and increase costs. The complexity of managing supply chain risks poses a threat to national security and economic interests, particularly given the high concern over nation-state attacks from Russia, Iran, and China. The integration of AI in cybersecurity presents both opportunities and risks, with potential vulnerabilities to AI-powered threats such as phishing and botnets.

4. Recommendations and Outlook

Recommendations:

- Enhance cyber resilience by integrating comprehensive risk management frameworks aligned with regulatory requirements.

- Invest in advanced AI-driven cybersecurity solutions to improve incident response times and threat detection capabilities.

- Strengthen supply chain security protocols and conduct regular audits to mitigate risks associated with third-party providers.

Outlook:

In the best-case scenario, financial services firms will successfully integrate compliance measures, leading to improved cyber resilience and reduced incident response times. In the worst-case scenario, failure to adapt to regulatory changes could result in significant financial and reputational damage. The most likely outcome involves gradual adaptation with increased reliance on AI technologies to manage emerging threats.

5. Key Individuals and Entities

The report mentions Sam Thornton and Bridewell Consulting as key contributors to the research findings. Additionally, the Financial Conduct Authority and the European Union are significant entities influencing regulatory changes in the sector.