CR Apple ruled Q1 smartphone shipments for the first time ever – GSMArena.com

Published on: 2025-04-15

Intelligence Report: CR Apple ruled Q1 smartphone shipments for the first time ever – GSMArena.com

1. BLUF (Bottom Line Up Front)

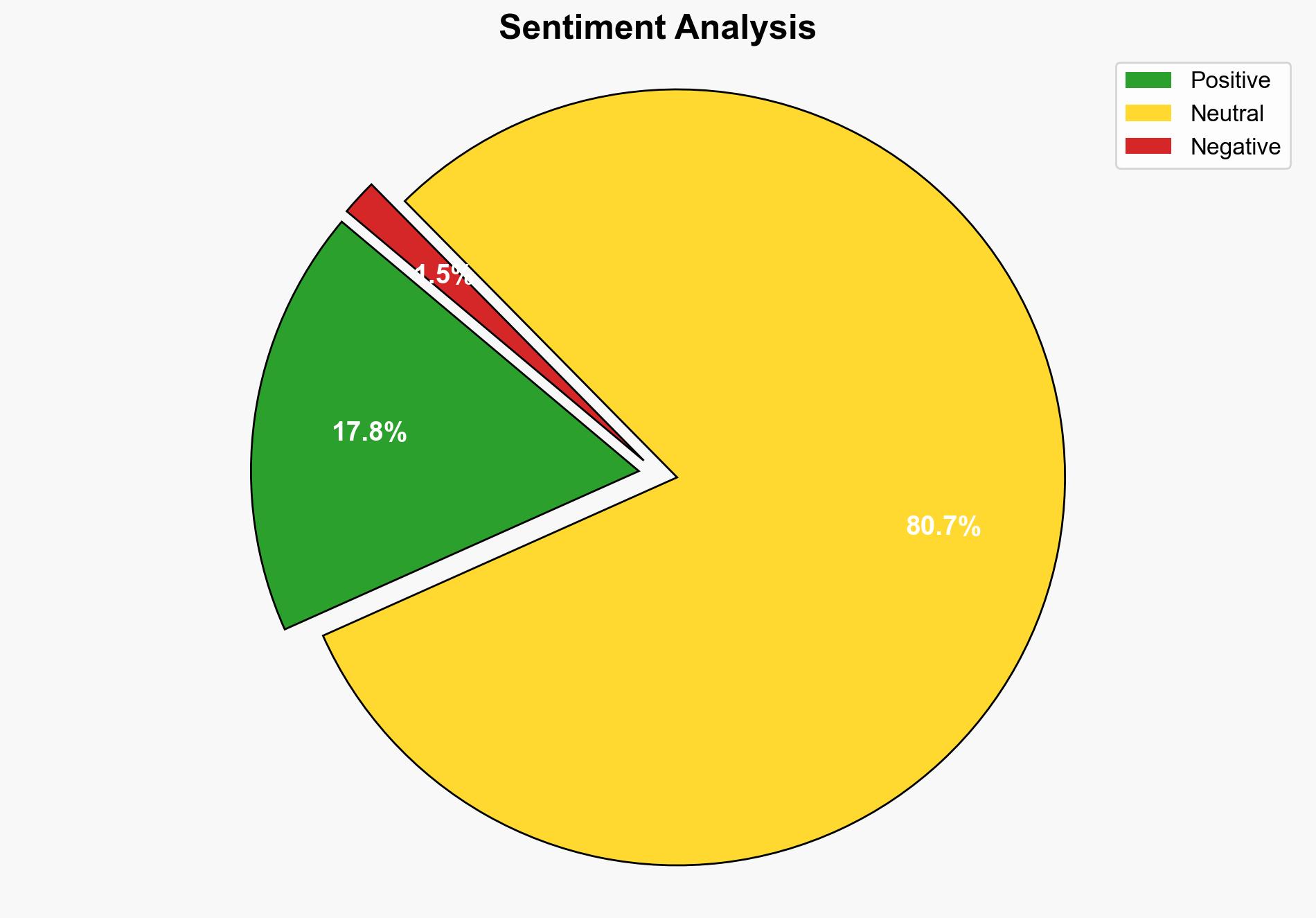

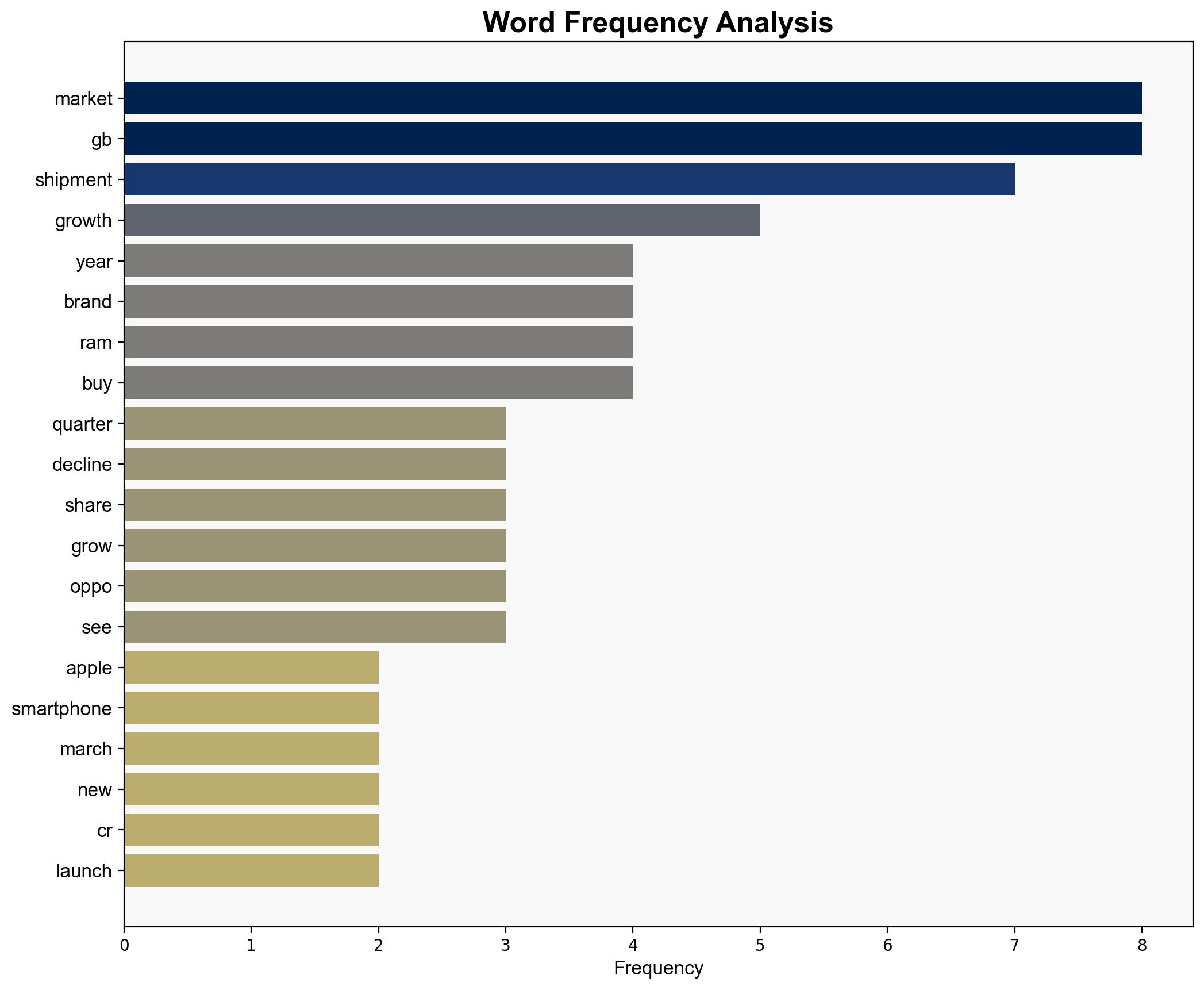

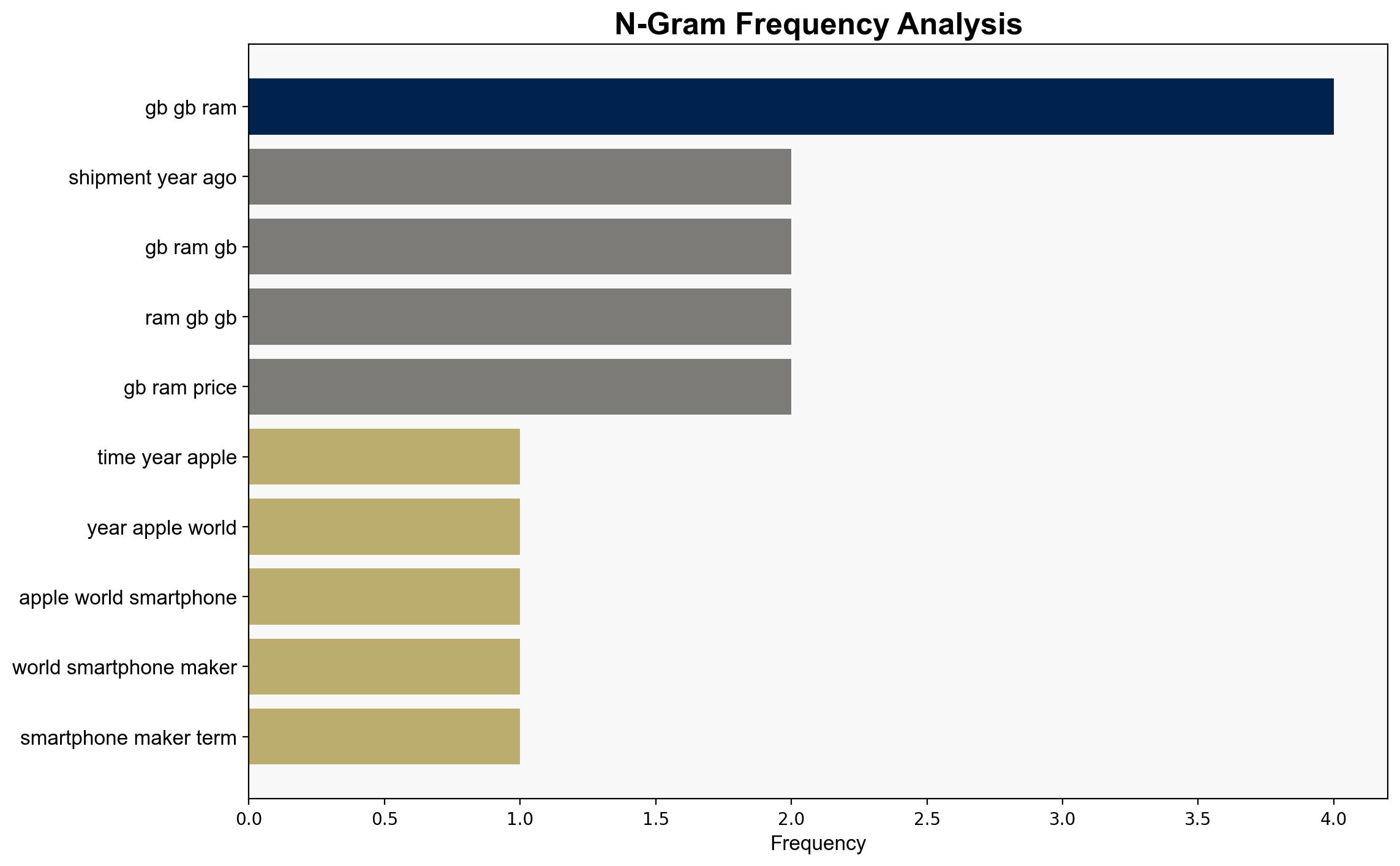

Apple has emerged as the leading global smartphone manufacturer in Q1, driven by the successful launch of the iPhone 16e. Despite stagnant or declining sales in the US, Europe, and China, Apple achieved significant growth in Japan, India, the Middle East, Africa, and Southeast Asia. The company secured a 19% market share with a 4% increase in shipments. Samsung and Xiaomi followed with 18% and 14% market shares, respectively. The overall smartphone market experienced a 3% growth in shipments, but a slight decline is anticipated for the full year due to US tariffs.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

Apple’s strategic focus on emerging markets has paid off, allowing it to capture the top position in global smartphone shipments for the first time. The iPhone 16e’s appeal in diverse regions contributed to this success. Samsung’s performance was bolstered by the launch of the S25 series, particularly the Galaxy S25 Ultra. Xiaomi maintained its growth trajectory through strong performance in China and market expansion. Vivo and Oppo showed varied growth patterns, with Vivo experiencing the fastest growth. Huawei, Honor, and Motorola demonstrated strong regional performances but did not enter the top five globally.

3. Implications and Strategic Risks

The shift in market leadership to Apple signifies potential challenges for competitors, particularly in maintaining market share in emerging regions. The anticipated decline in the smartphone market due to US tariffs poses risks to global supply chains and could impact pricing strategies. Regional stability may be influenced by shifts in manufacturing and distribution networks, particularly in Asia.

4. Recommendations and Outlook

Recommendations:

- Encourage diversification of supply chains to mitigate risks associated with geopolitical tensions and tariffs.

- Invest in market research to identify emerging consumer trends and preferences in key growth regions.

- Consider regulatory adjustments to support technological innovation and competitive market dynamics.

Outlook:

In the best-case scenario, continued innovation and strategic market entry could sustain growth for leading smartphone manufacturers. The worst-case scenario involves significant market contraction due to prolonged tariff impacts and supply chain disruptions. The most likely outcome is moderate growth with regional variations, contingent on geopolitical developments and consumer demand shifts.

5. Key Individuals and Entities

The report highlights significant entities such as Apple, Samsung, Xiaomi, Vivo, Oppo, Huawei, Honor, and Motorola. These organizations play crucial roles in shaping the global smartphone market landscape.