Crypto Trader Scores 250M Payday as Trump-Linked WLFI Hits Open Market – CoinDesk

Published on: 2025-09-02

Intelligence Report: Crypto Trader Scores 250M Payday as Trump-Linked WLFI Hits Open Market – CoinDesk

1. BLUF (Bottom Line Up Front)

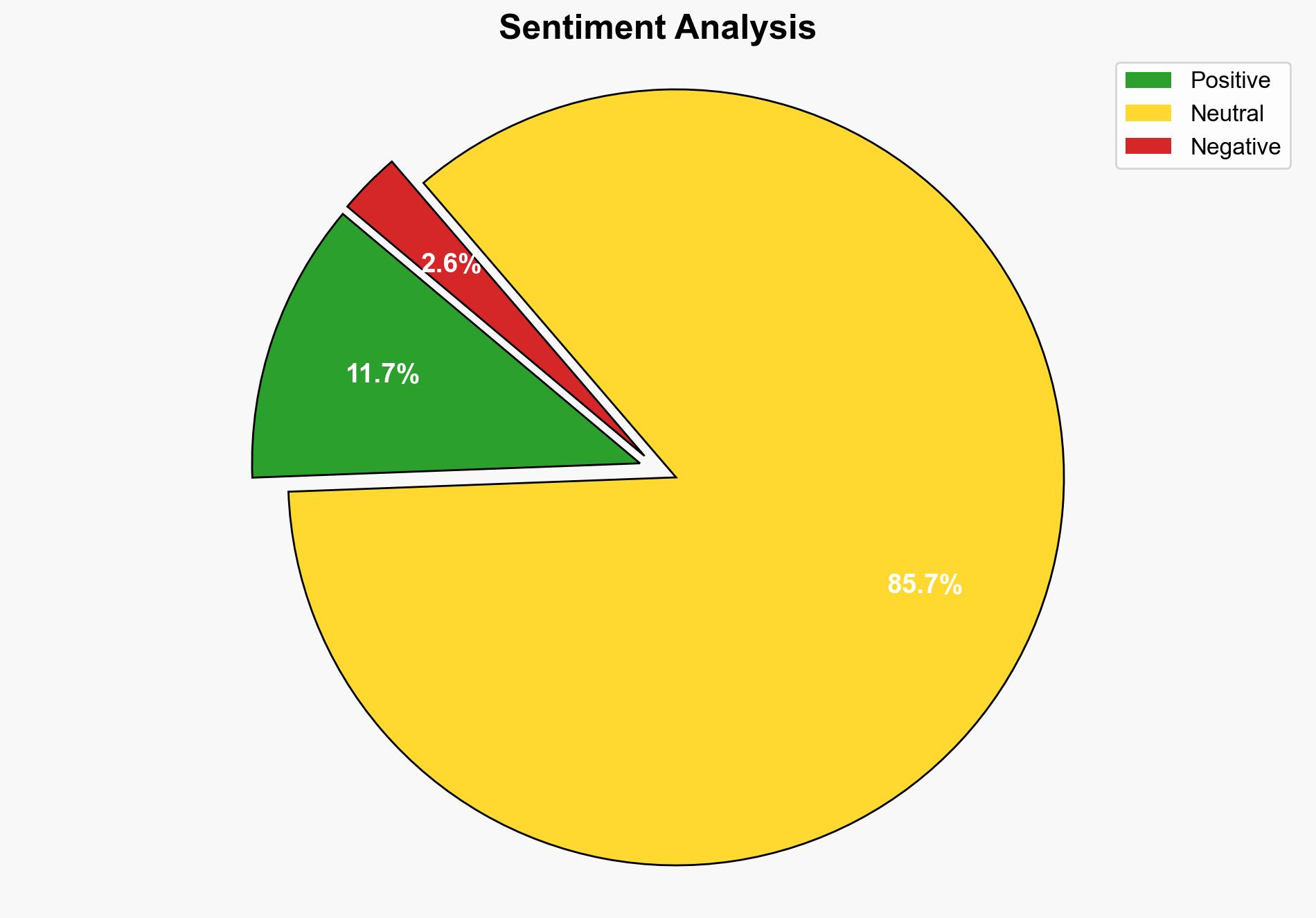

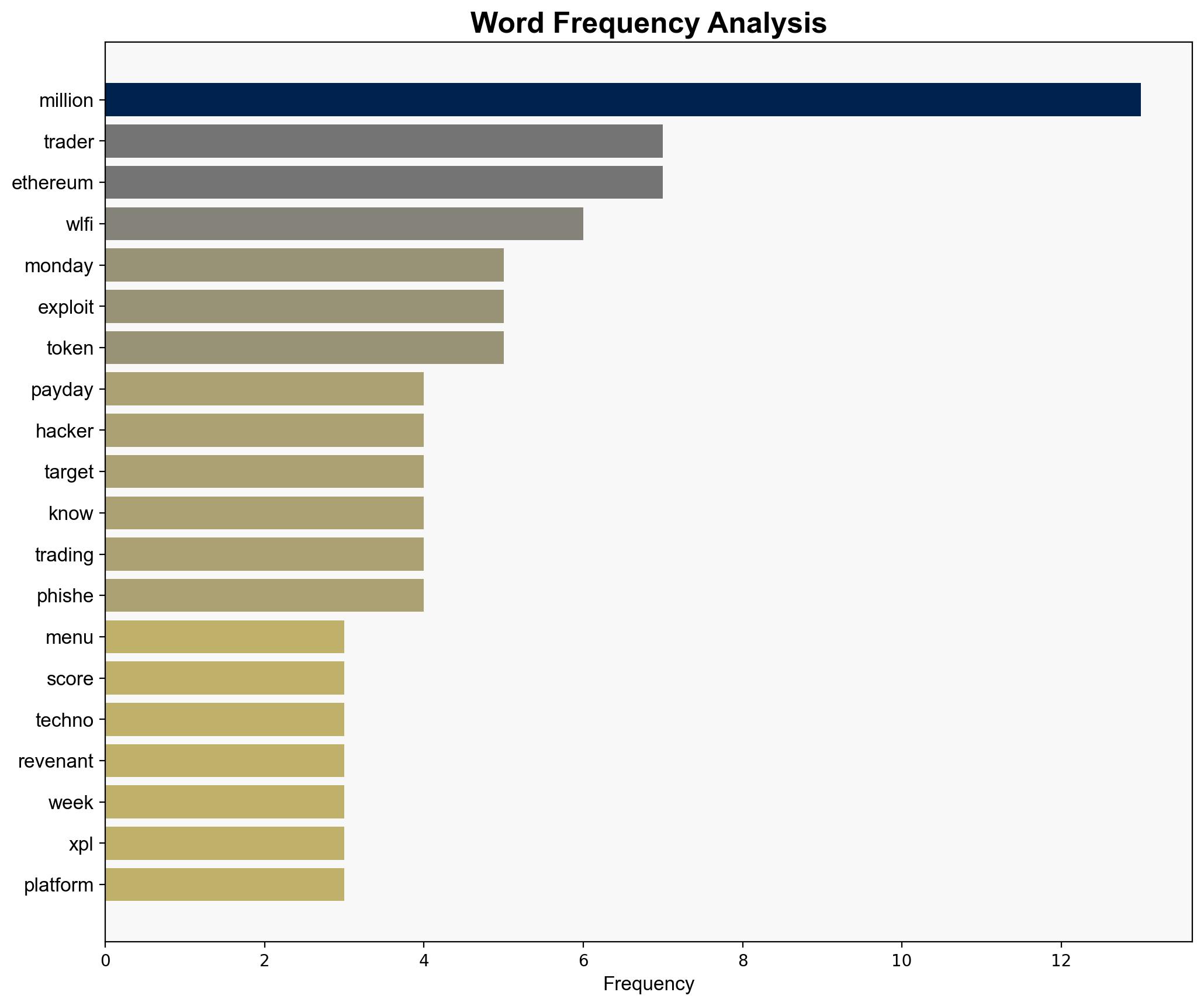

The most supported hypothesis is that the pseudonymous trader, known as Techno Revenant, leveraged insider knowledge or sophisticated trading algorithms to capitalize on WLFI’s market debut, resulting in a $250 million profit. This hypothesis is supported by the timing and scale of the profits. The confidence level is moderate due to potential gaps in data regarding the trader’s identity and methods. Recommended action includes monitoring for further market manipulations and enhancing security protocols against phishing and exploitation attacks.

2. Competing Hypotheses

1. **Hypothesis A:** Techno Revenant utilized insider information or advanced trading algorithms to achieve the massive payday. This is supported by the trader’s ability to predict market movements and the significant profits realized in a short timeframe.

2. **Hypothesis B:** The trader’s success was primarily due to market volatility and luck, with no insider knowledge or advanced techniques involved. This is suggested by the rollercoaster market session and the possibility of coincidental timing.

Using ACH 2.0, Hypothesis A is better supported due to the scale of profits and the trader’s history of significant wins, which suggests a pattern of strategic market engagement rather than mere chance.

3. Key Assumptions and Red Flags

– **Assumptions:**

– The trader had access to unique market insights or algorithms.

– WLFI’s market behavior was predictable to those with sufficient expertise.

– **Red Flags:**

– Lack of transparency regarding the trader’s identity and methods.

– Potential for market manipulation or collusion.

– The timing of the phishing attacks coinciding with the market debut.

4. Implications and Strategic Risks

The incident highlights vulnerabilities in decentralized finance (DeFi) systems, particularly regarding security against phishing and exploitation. There is a risk of increased regulatory scrutiny on crypto markets, which could impact market stability and investor confidence. The association with Trump-linked entities may also attract geopolitical attention, potentially influencing market perceptions and actions.

5. Recommendations and Outlook

- Enhance monitoring of crypto market activities for signs of manipulation or insider trading.

- Strengthen cybersecurity measures to protect against phishing and exploitation attacks.

- Engage with regulatory bodies to ensure compliance and mitigate potential legal risks.

- Scenario Projections:

- Best Case: Improved security and transparency lead to increased investor confidence and market growth.

- Worst Case: Continued vulnerabilities result in significant financial losses and regulatory crackdowns.

- Most Likely: Incremental improvements in security and regulation stabilize the market.

6. Key Individuals and Entities

– Techno Revenant (pseudonymous trader)

– WLFI (World Liberty Financial)

– Ethereum Foundation

– Vitalik Buterin

– Danny Ryan

– Vivek Raman

7. Thematic Tags

national security threats, cybersecurity, financial market manipulation, decentralized finance, regulatory scrutiny