Cryptocurrency Unlocking the digital vaults – BusinessLine

Published on: 2025-08-25

Intelligence Report: Cryptocurrency Unlocking the Digital Vaults – BusinessLine

1. BLUF (Bottom Line Up Front)

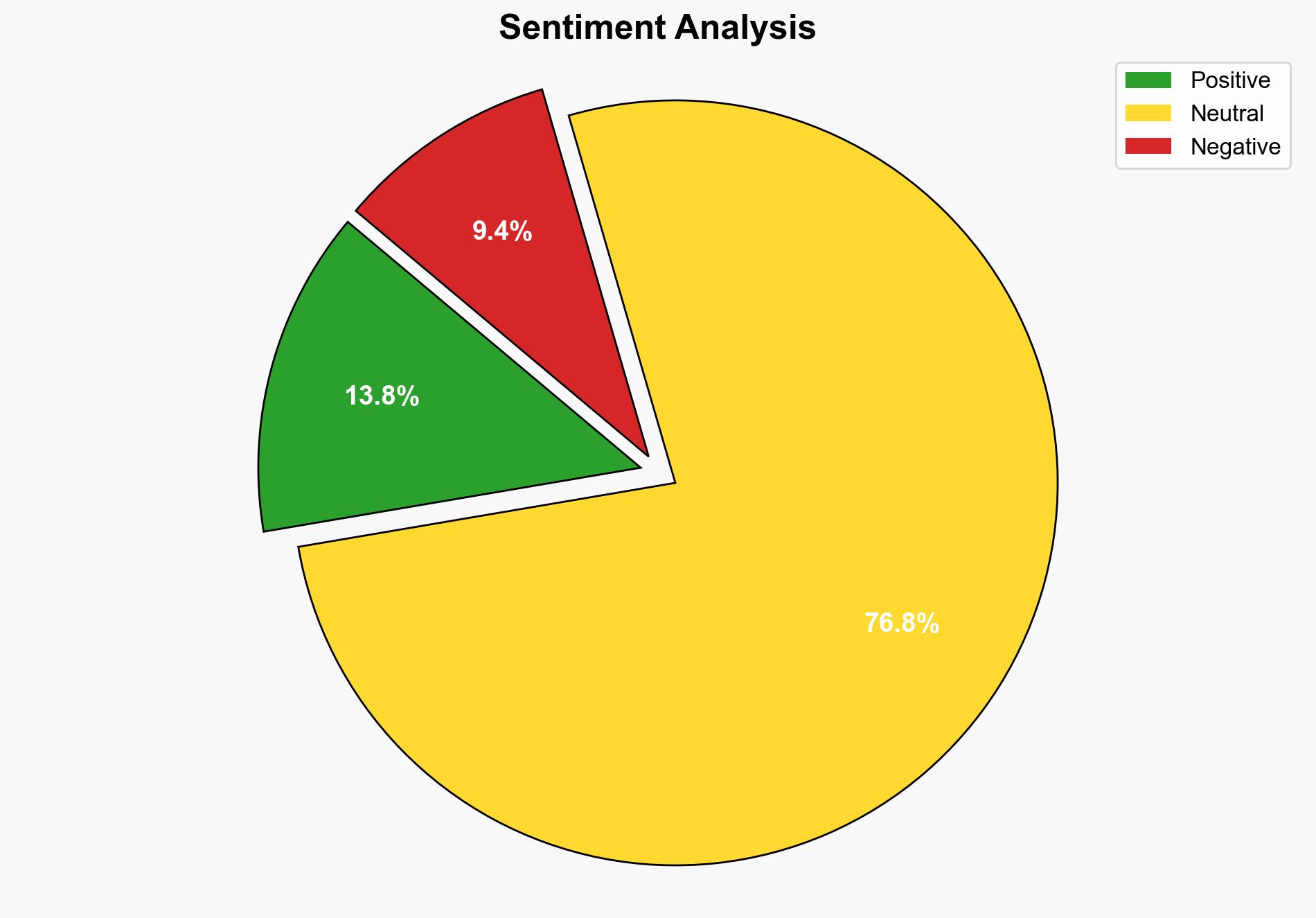

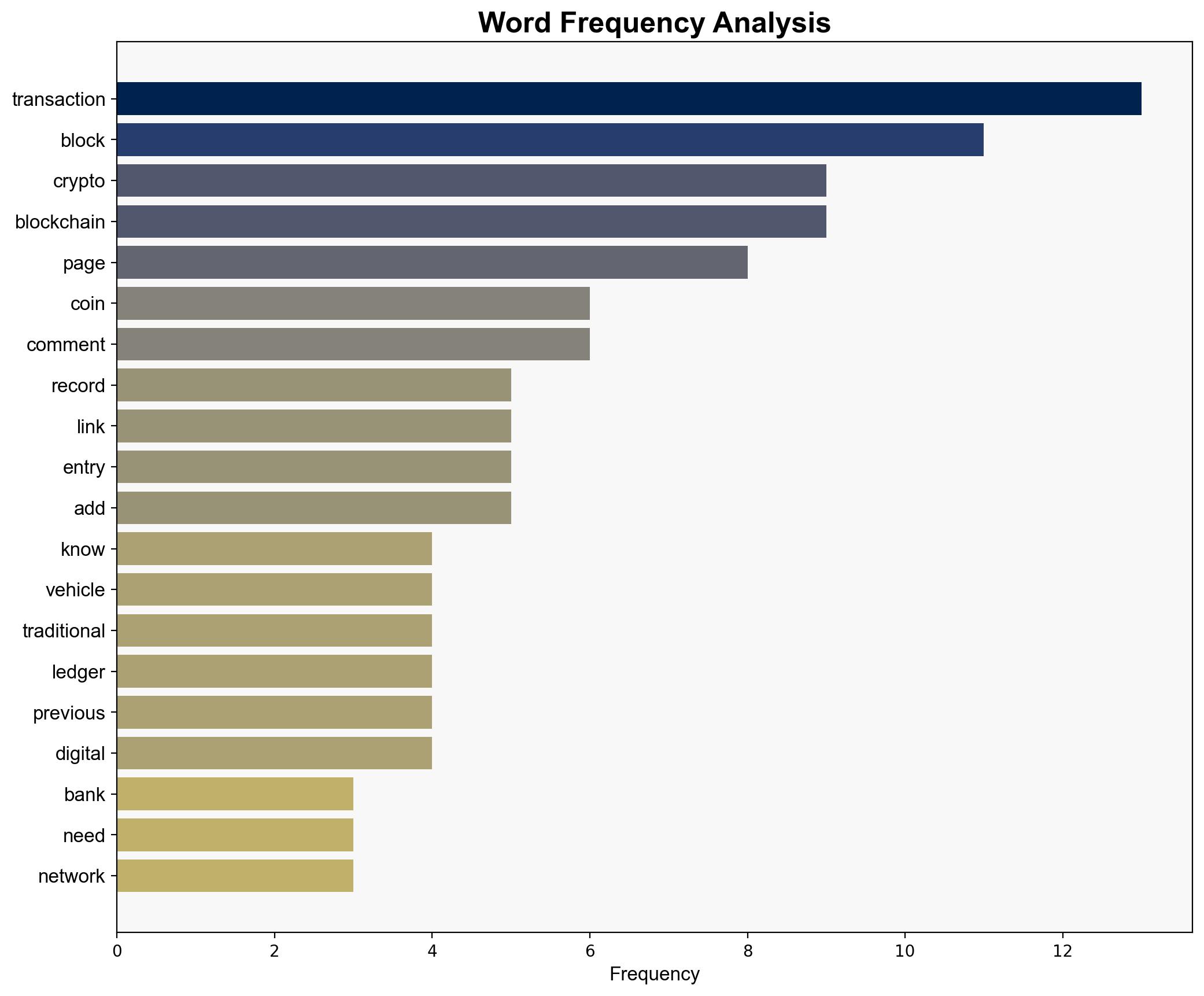

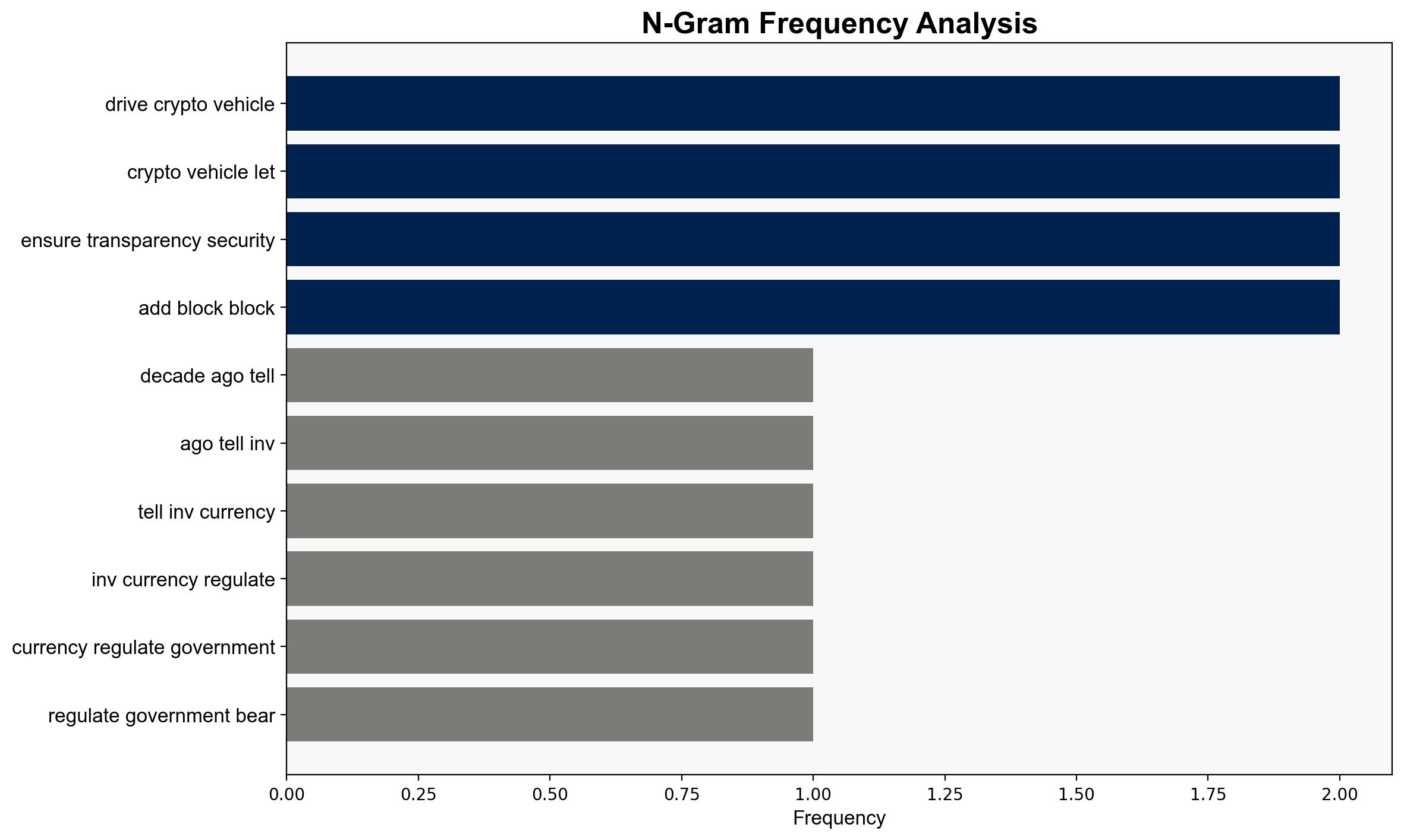

Cryptocurrency adoption is increasing globally, including in India, driven by a mix of technological innovation and speculative investment. The most supported hypothesis is that cryptocurrencies are becoming a mainstream financial asset, albeit with significant regulatory and security challenges. Confidence level: Moderate. Recommended action: Monitor regulatory developments and enhance cybersecurity measures to mitigate risks associated with decentralized finance.

2. Competing Hypotheses

Hypothesis 1: Cryptocurrencies are evolving into a mainstream financial asset class, driven by technological advancements and increasing acceptance by businesses and individuals.

Hypothesis 2: Cryptocurrencies remain a speculative investment vehicle, with significant risks due to regulatory uncertainty and potential for misuse in illicit activities.

Using ACH 2.0, Hypothesis 1 is better supported by the increasing number of firms accepting crypto payments and the growing investment by individuals. However, Hypothesis 2 is supported by the lack of regulatory clarity and the potential for cryptocurrencies to be used in illicit activities.

3. Key Assumptions and Red Flags

Assumptions:

– Cryptocurrencies will continue to gain acceptance as a legitimate form of payment.

– Regulatory frameworks will evolve to accommodate cryptocurrencies.

Red Flags:

– Regulatory crackdowns could severely impact cryptocurrency markets.

– High volatility and security breaches could undermine trust in cryptocurrencies.

4. Implications and Strategic Risks

The increasing adoption of cryptocurrencies could disrupt traditional financial systems and pose cybersecurity risks. Regulatory uncertainty may lead to market volatility and hinder broader acceptance. There is also a risk of cryptocurrencies being used for illicit activities, which could prompt stricter regulations.

5. Recommendations and Outlook

- Monitor global and regional regulatory developments to anticipate potential impacts on cryptocurrency markets.

- Enhance cybersecurity frameworks to protect against threats associated with decentralized finance.

- Scenario-based projections:

- Best Case: Regulatory clarity leads to stable growth and integration of cryptocurrencies into mainstream finance.

- Worst Case: Regulatory crackdowns and security breaches lead to a loss of trust and market collapse.

- Most Likely: Gradual acceptance with ongoing regulatory adjustments and market volatility.

6. Key Individuals and Entities

– RBI Governor (mentioned in context)

– SEBI (mentioned in context)

– NISM and CRISIL certified wealth manager (mentioned in context)

7. Thematic Tags

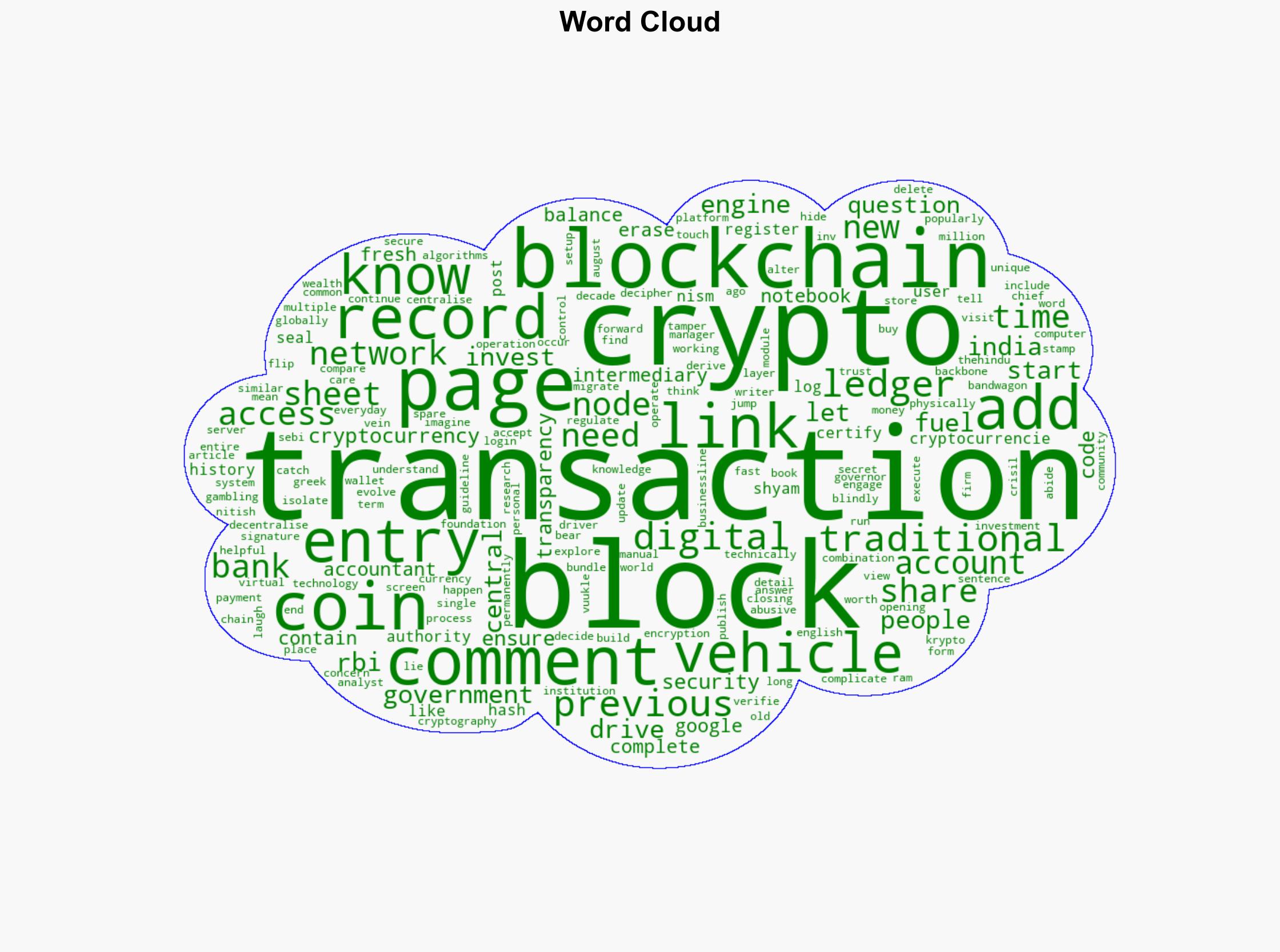

national security threats, cybersecurity, financial regulation, decentralized finance