Cryptos Time Has Come SEC Chair Outlines Vision for On-Chain Markets and Agentic Finance – CoinDesk

Published on: 2025-09-13

Intelligence Report: Cryptos Time Has Come SEC Chair Outlines Vision for On-Chain Markets and Agentic Finance – CoinDesk

1. BLUF (Bottom Line Up Front)

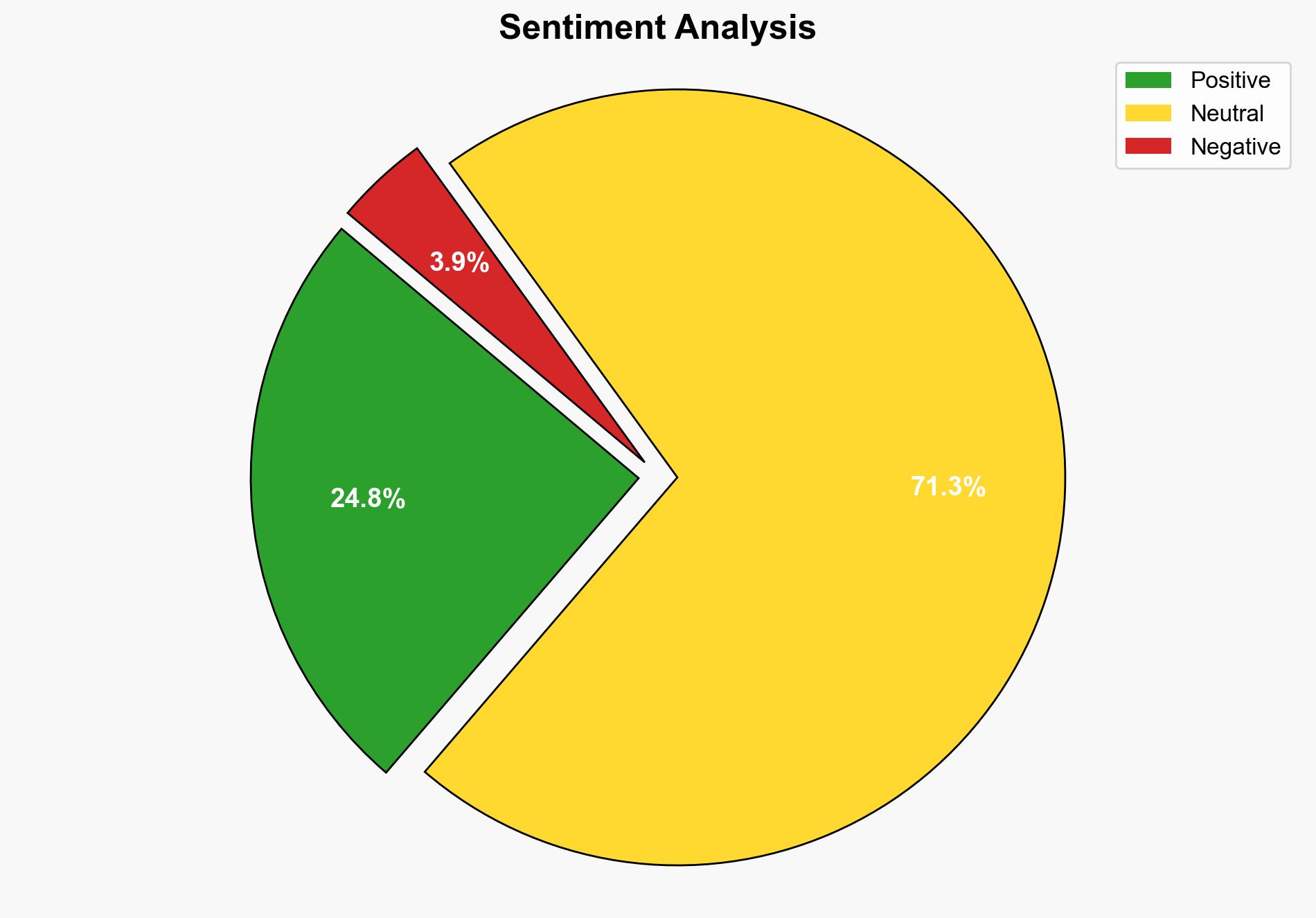

The strategic judgment suggests a moderate confidence level that the SEC’s new approach to crypto regulation could foster innovation while maintaining investor protection. The most supported hypothesis is that the SEC’s shift towards clear regulations will enhance the U.S.’s position in the global crypto market. Recommended action includes monitoring regulatory developments and preparing for potential shifts in market dynamics.

2. Competing Hypotheses

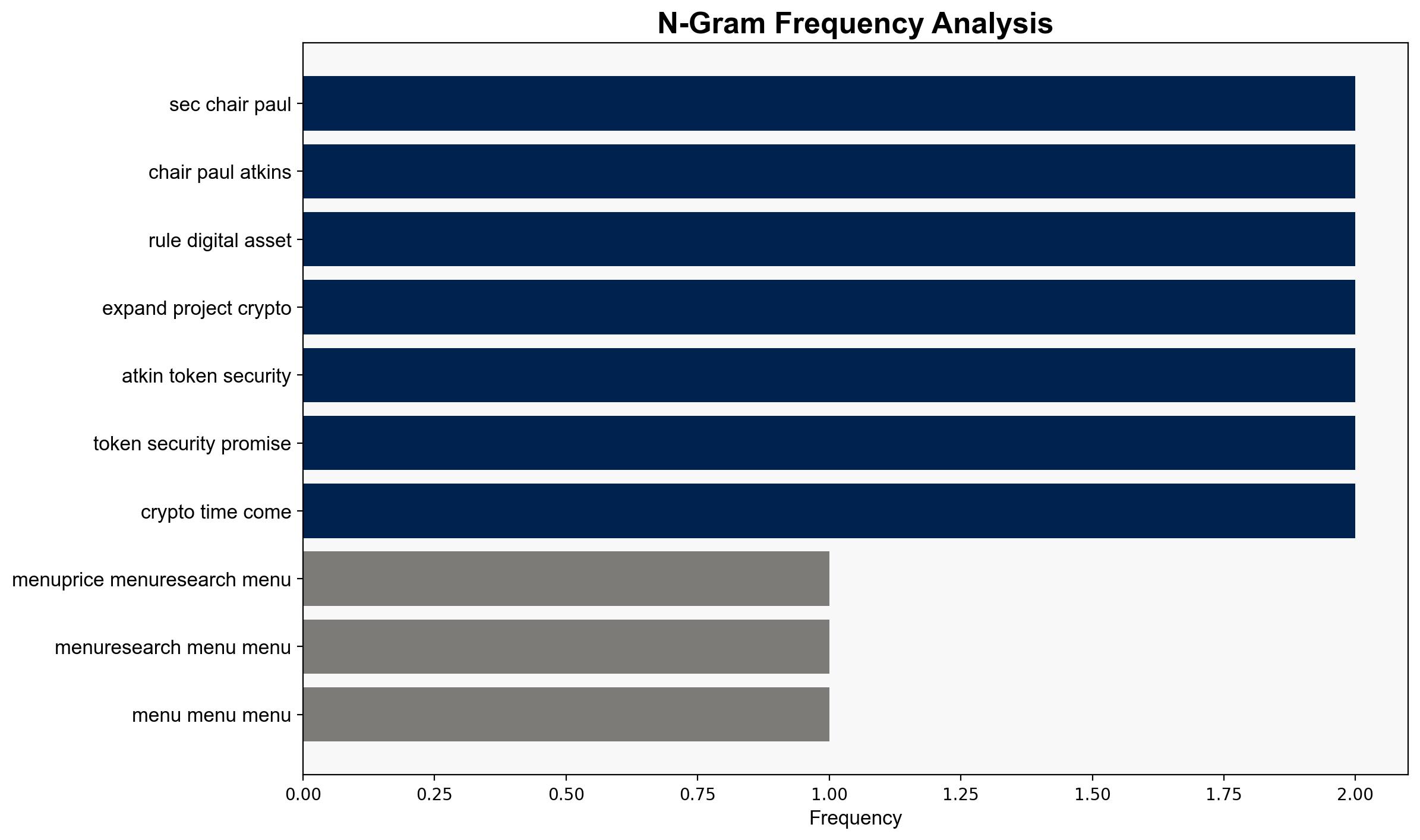

Hypothesis 1: The SEC’s initiative to establish clear regulations will successfully integrate crypto markets into the mainstream financial system, boosting innovation and market stability.

Hypothesis 2: The SEC’s regulatory changes may stifle innovation due to overregulation, causing crypto businesses to relocate to more favorable jurisdictions.

3. Key Assumptions and Red Flags

Assumptions:

– The SEC will implement regulations that balance innovation with investor protection.

– Global cooperation will be achieved to standardize crypto regulations.

Red Flags:

– Potential resistance from traditional financial institutions.

– Inconsistent global regulatory frameworks could undermine efforts.

– The assumption that AI-driven finance will seamlessly integrate with existing systems.

4. Implications and Strategic Risks

The SEC’s regulatory shift could lead to increased market participation and innovation, potentially positioning the U.S. as a leader in crypto finance. However, risks include regulatory overreach, which could drive innovation offshore, and the challenge of aligning international regulatory standards. Additionally, the rapid integration of AI in finance could introduce new cybersecurity vulnerabilities and ethical concerns.

5. Recommendations and Outlook

- Engage with policymakers to ensure balanced regulations that promote innovation.

- Monitor international regulatory developments to anticipate shifts in the global crypto landscape.

- Best Case: The U.S. becomes a hub for crypto innovation, attracting global talent and investment.

- Worst Case: Overregulation drives businesses abroad, weakening the U.S.’s competitive edge.

- Most Likely: A gradual integration of crypto into the mainstream financial system with ongoing regulatory adjustments.

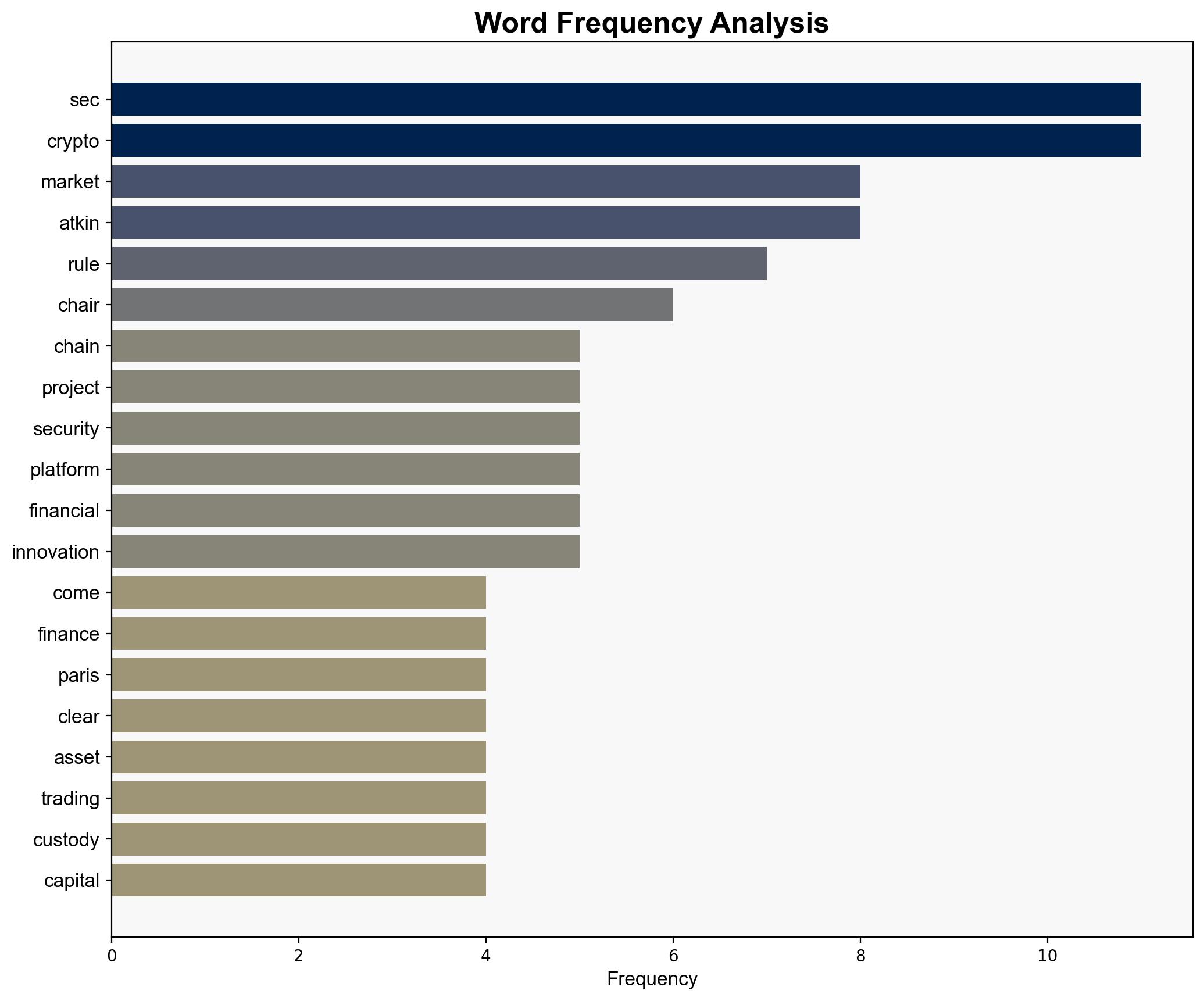

6. Key Individuals and Entities

Paul Atkins, Brian Quintenz, Tyler Winklevoss, Tal Cohen

7. Thematic Tags

national security threats, cybersecurity, financial regulation, blockchain technology