Cybercriminals try to cash in with sophisticated tax scams – BetaNews

Published on: 2025-03-06

Intelligence Report: Cybercriminals try to cash in with sophisticated tax scams – BetaNews

1. BLUF (Bottom Line Up Front)

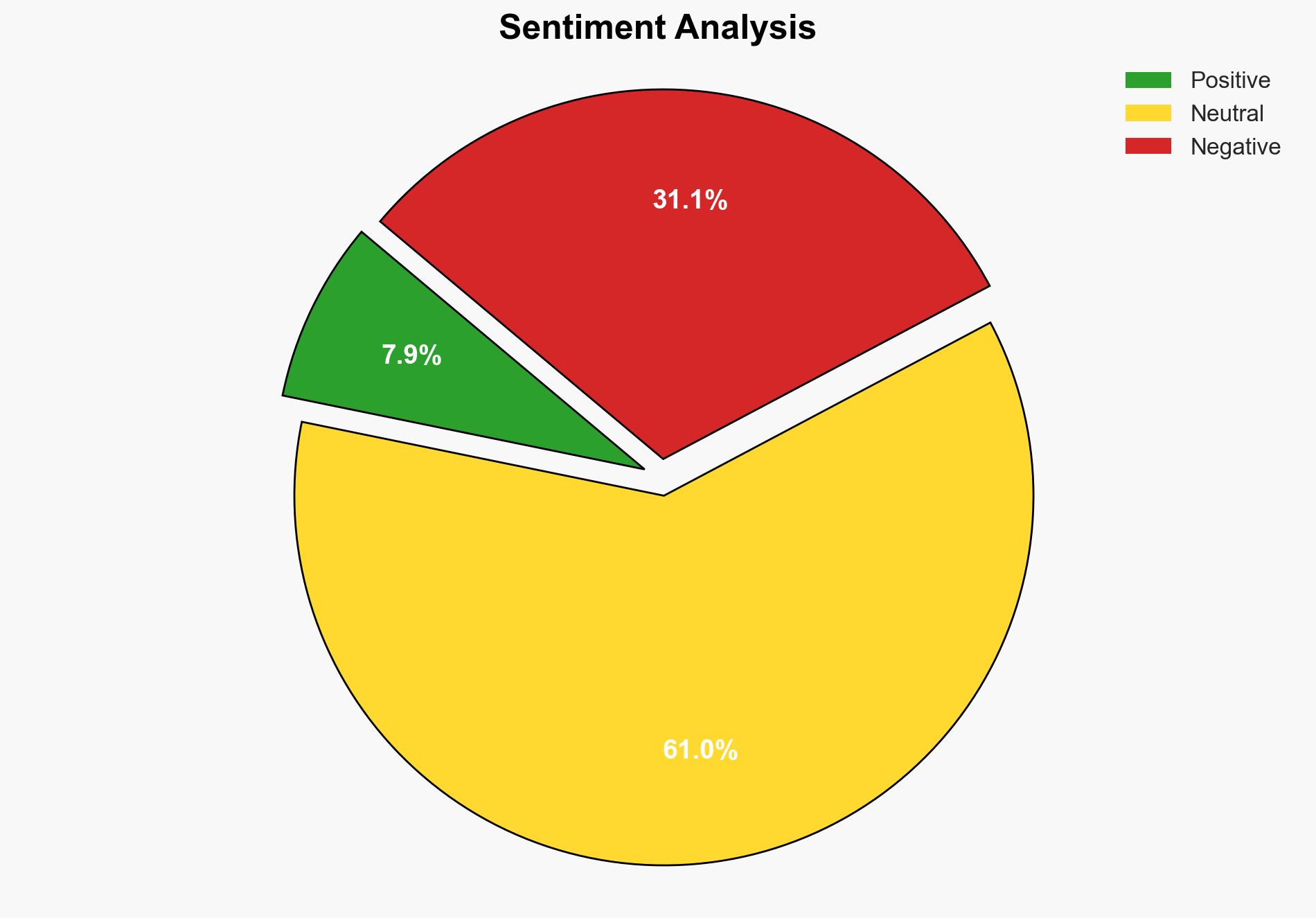

Cybercriminals are leveraging sophisticated tax scams as the tax year concludes, targeting individuals with phishing emails, deepfake phone calls, and fake tax preparation websites. A significant portion of the population is unaware of these scams, leading to financial losses. Young adults are particularly vulnerable, with a higher incidence of scam exposure and financial loss. The use of AI and deepfake technology is making these scams increasingly convincing and difficult to detect.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

Analysis of Competing Hypotheses (ACH)

The primary motivation behind these scams is financial gain through identity theft and fraudulent tax claims. Cybercriminals exploit the urgency and complexity of tax season to deceive individuals into sharing sensitive information.

SWOT Analysis

Strengths: Cybercriminals utilize advanced technologies such as AI and deepfake to enhance the realism of scams.

Weaknesses: Increased public awareness and improved cybersecurity measures can mitigate these threats.

Opportunities: Enhanced AI-driven security solutions can detect and prevent sophisticated scams.

Threats: The evolving nature of AI technology poses a continuous threat to cybersecurity.

Indicators Development

Key indicators of emerging threats include an increase in phishing emails, reports of deepfake audio scams, and the proliferation of fake tax websites. Monitoring these indicators can help in early detection and prevention.

3. Implications and Strategic Risks

The rise in sophisticated tax scams poses significant risks to financial security and personal data protection. These scams can lead to identity theft, financial loss, and erosion of trust in digital communication. The use of AI in scams could further complicate detection and response efforts, impacting national security and economic stability.

4. Recommendations and Outlook

Recommendations:

- Enhance public awareness campaigns to educate individuals on recognizing and avoiding tax scams.

- Implement advanced AI-driven cybersecurity measures to detect and prevent phishing and deepfake scams.

- Encourage regulatory updates to address the evolving nature of cyber threats and enhance penalties for cybercriminals.

Outlook:

Best-case scenario: Increased awareness and improved cybersecurity measures significantly reduce the incidence of tax scams.

Worst-case scenario: Cybercriminals continue to innovate, leading to more sophisticated scams and greater financial losses.

Most likely scenario: A gradual improvement in detection and prevention efforts, with ongoing challenges due to the evolving nature of AI technology.

5. Key Individuals and Entities

The report references Abhishek Karnik from McAfee, highlighting the role of cybersecurity experts in identifying and mitigating threats. Additionally, Karenr is credited for image contributions, emphasizing the collaborative effort in addressing cyber threats.