Data Breach at 700Credit Affects 5.8 Million Vehicle Owners’ Personal Information

Published on: 2025-12-16

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Millions of Car Owners Hit By Credit700 Data Breach

1. BLUF (Bottom Line Up Front)

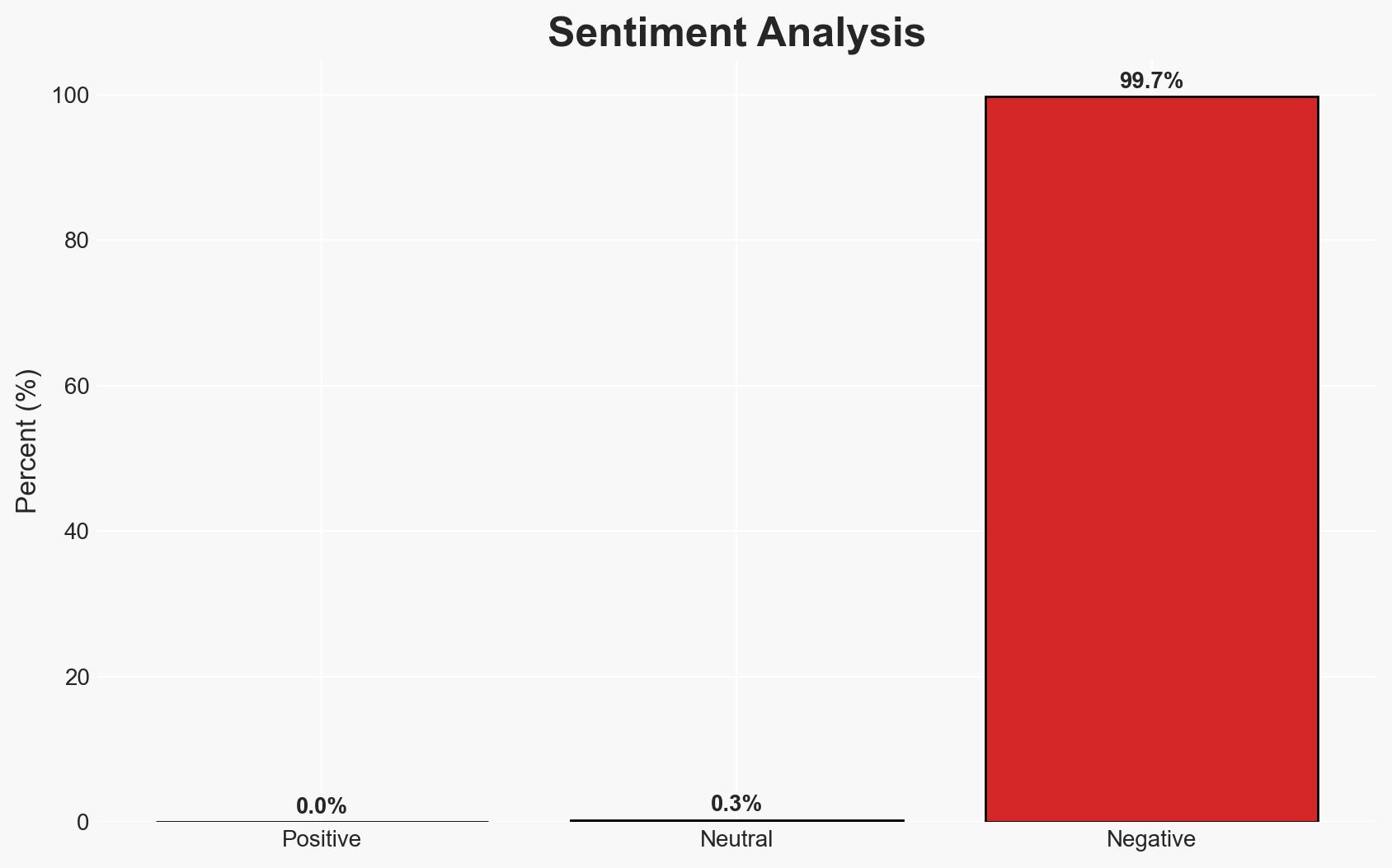

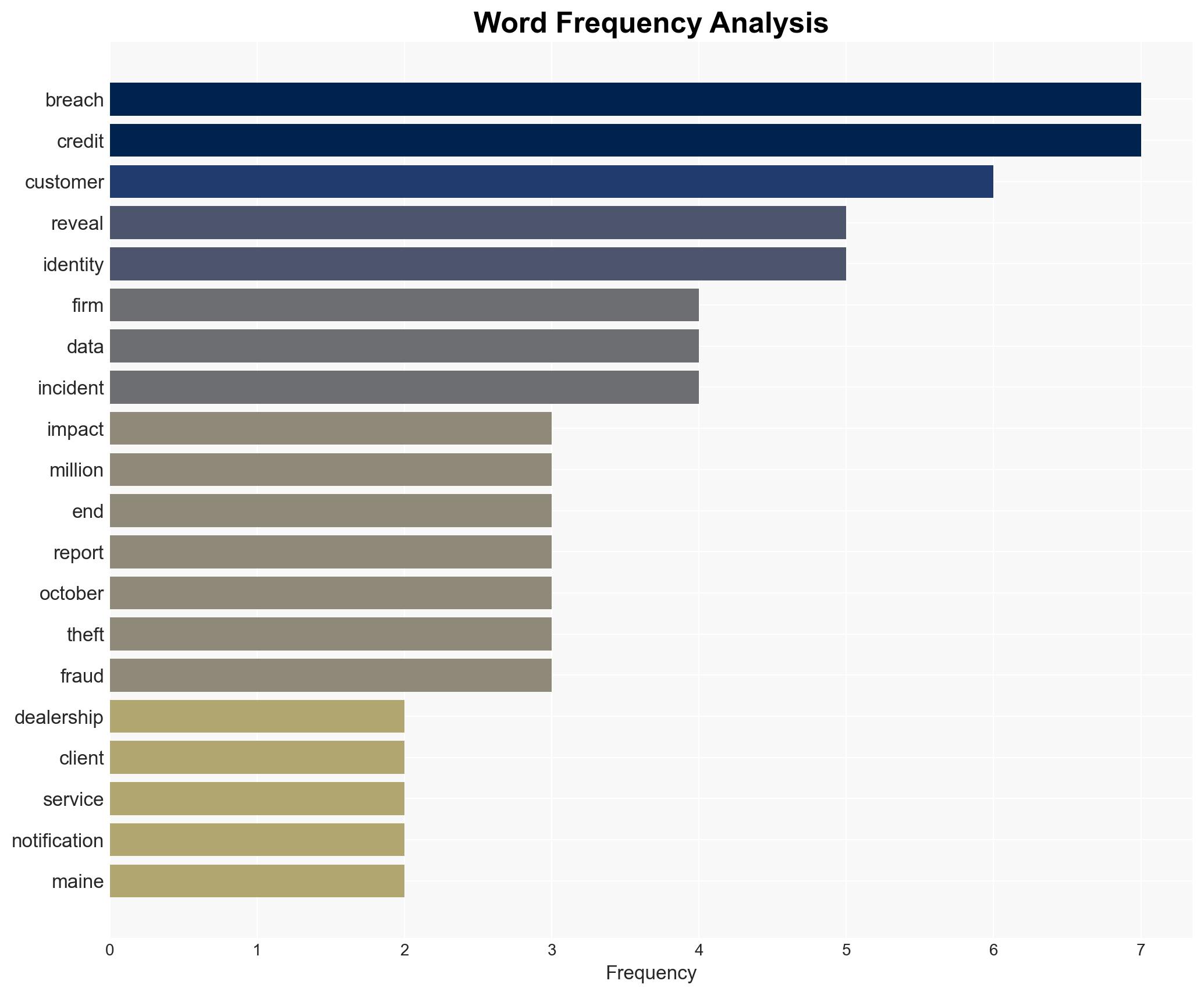

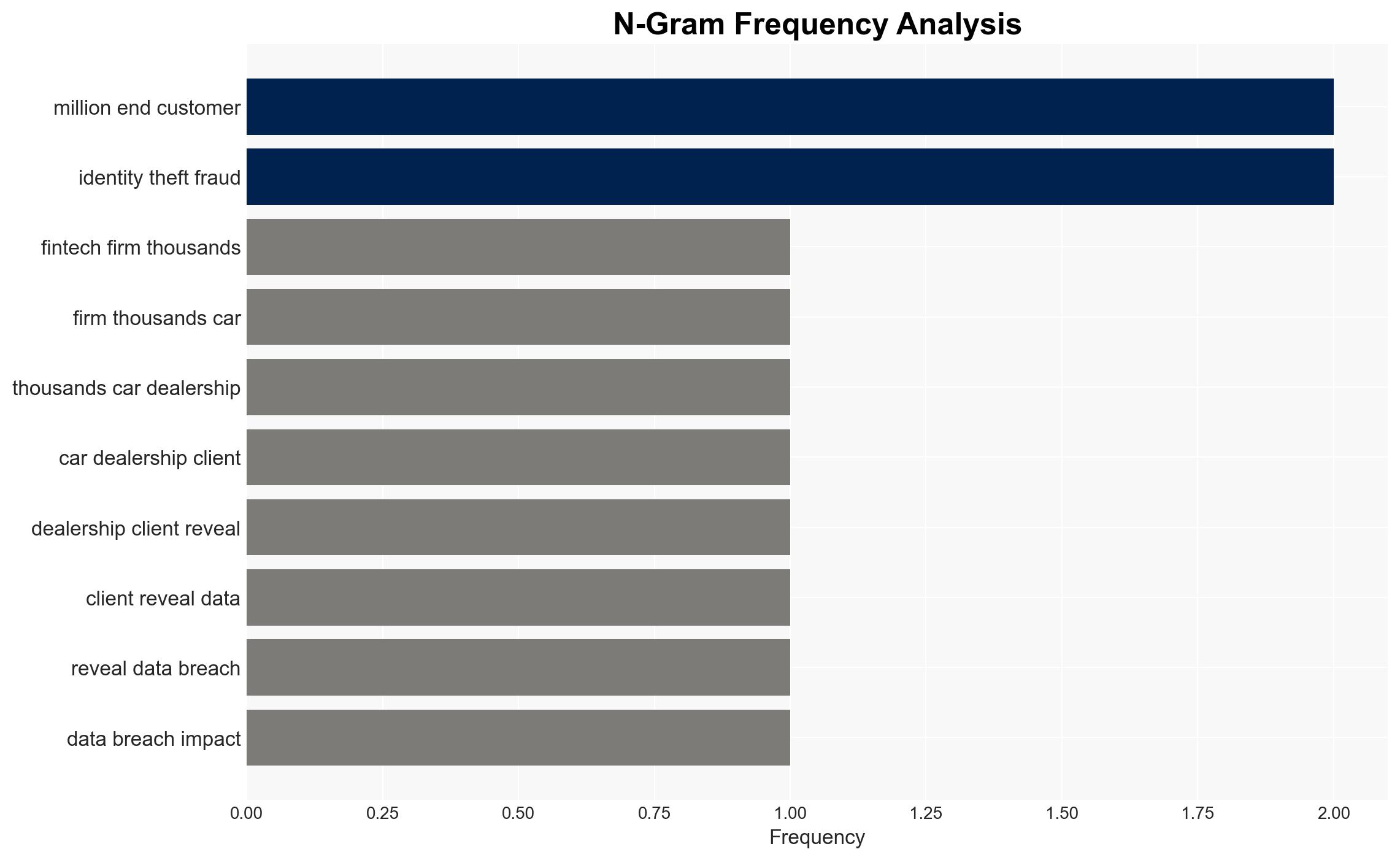

The data breach at 700Credit has exposed the personal information of 5.8 million customers, potentially increasing the risk of identity theft. The breach was facilitated by a misconfigured API, and while no misuse of data has been reported, the incident underscores vulnerabilities in fintech systems. This assessment is made with moderate confidence due to ongoing investigations and incomplete data on the breach’s full impact.

2. Competing Hypotheses

- Hypothesis A: The breach was a targeted cyber-attack exploiting a specific vulnerability in 700Credit’s API. Supporting evidence includes the identification of the misconfigured API as the breach vector. However, the lack of reported data misuse introduces uncertainty about the attackers’ intent.

- Hypothesis B: The breach resulted from a broader, opportunistic attack aimed at multiple fintech firms, with 700Credit being one of several targets. This is supported by the general increase in data breaches in 2025, but lacks direct evidence linking the breach to a larger campaign.

- Assessment: Hypothesis A is currently better supported due to the specific identification of the API misconfiguration as the breach vector. Future indicators that could shift this judgment include evidence of similar breaches at other firms or new information about the attackers’ objectives.

3. Key Assumptions and Red Flags

- Assumptions: The breach was limited to the 700Dealer.com application layer; the attackers have not yet exploited the stolen data; 700Credit’s internal network remains secure.

- Information Gaps: Details on the attackers’ identity and motives; confirmation of whether other fintech firms were targeted; comprehensive impact analysis on affected customers.

- Bias & Deception Risks: Potential underreporting of the breach’s impact by 700Credit; reliance on company-provided information which may be biased to minimize reputational damage.

4. Implications and Strategic Risks

The breach could lead to increased scrutiny of fintech security practices and regulatory pressure. If exploited, the stolen data could facilitate identity theft, affecting consumer trust and financial stability.

- Political / Geopolitical: Potential for increased regulatory actions and international cooperation on cybersecurity standards.

- Security / Counter-Terrorism: Heightened risk of identity theft and fraud, potentially funding illicit activities.

- Cyber / Information Space: Increased focus on API security and potential for further cyber-attacks exploiting similar vulnerabilities.

- Economic / Social: Possible financial losses for affected individuals and reputational damage to 700Credit, impacting customer trust and market position.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Enhance monitoring of affected accounts; conduct a comprehensive security audit; engage with cybersecurity experts to patch vulnerabilities.

- Medium-Term Posture (1–12 months): Develop partnerships with cybersecurity firms; invest in advanced threat detection systems; implement regular security training for staff.

- Scenario Outlook:

- Best: No further exploitation of data; improved security measures prevent future breaches.

- Worst: Data is used for widespread identity theft, leading to significant financial and reputational damage.

- Most-Likely: Some instances of identity theft occur, prompting regulatory changes and increased cybersecurity investments.

6. Key Individuals and Entities

- 700Credit

- Maine Office of the Attorney General

- TransUnion

- Identity Theft Resource Center (ITRC)

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

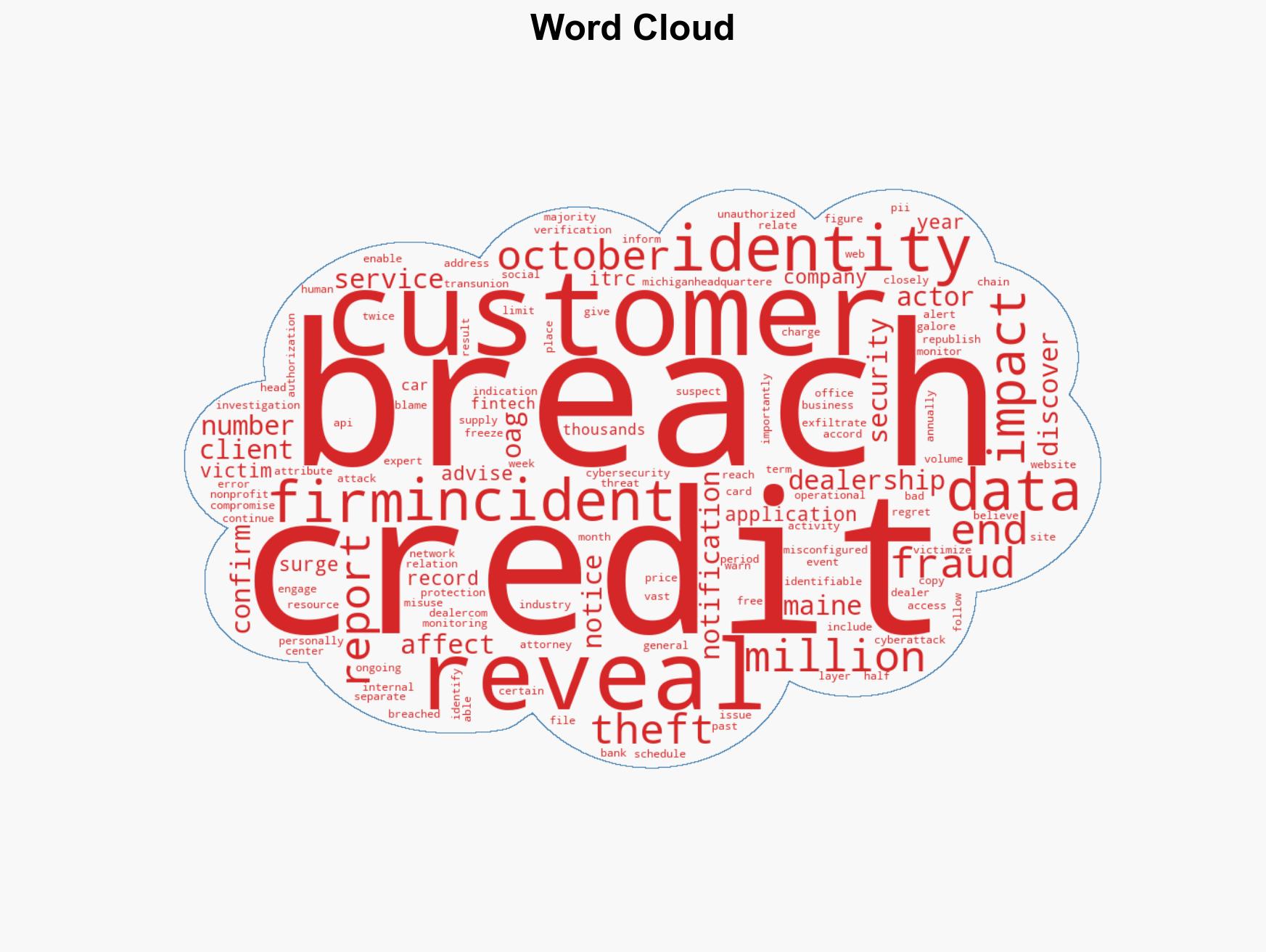

cybersecurity, data breach, fintech, identity theft, API vulnerability, regulatory impact, consumer protection

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us