Digicel poised to refinance 2bn early as it wins highest credit rating in years – The Irish Times

Published on: 2025-06-13

Intelligence Report: Digicel poised to refinance 2bn early as it wins highest credit rating in years – The Irish Times

1. BLUF (Bottom Line Up Front)

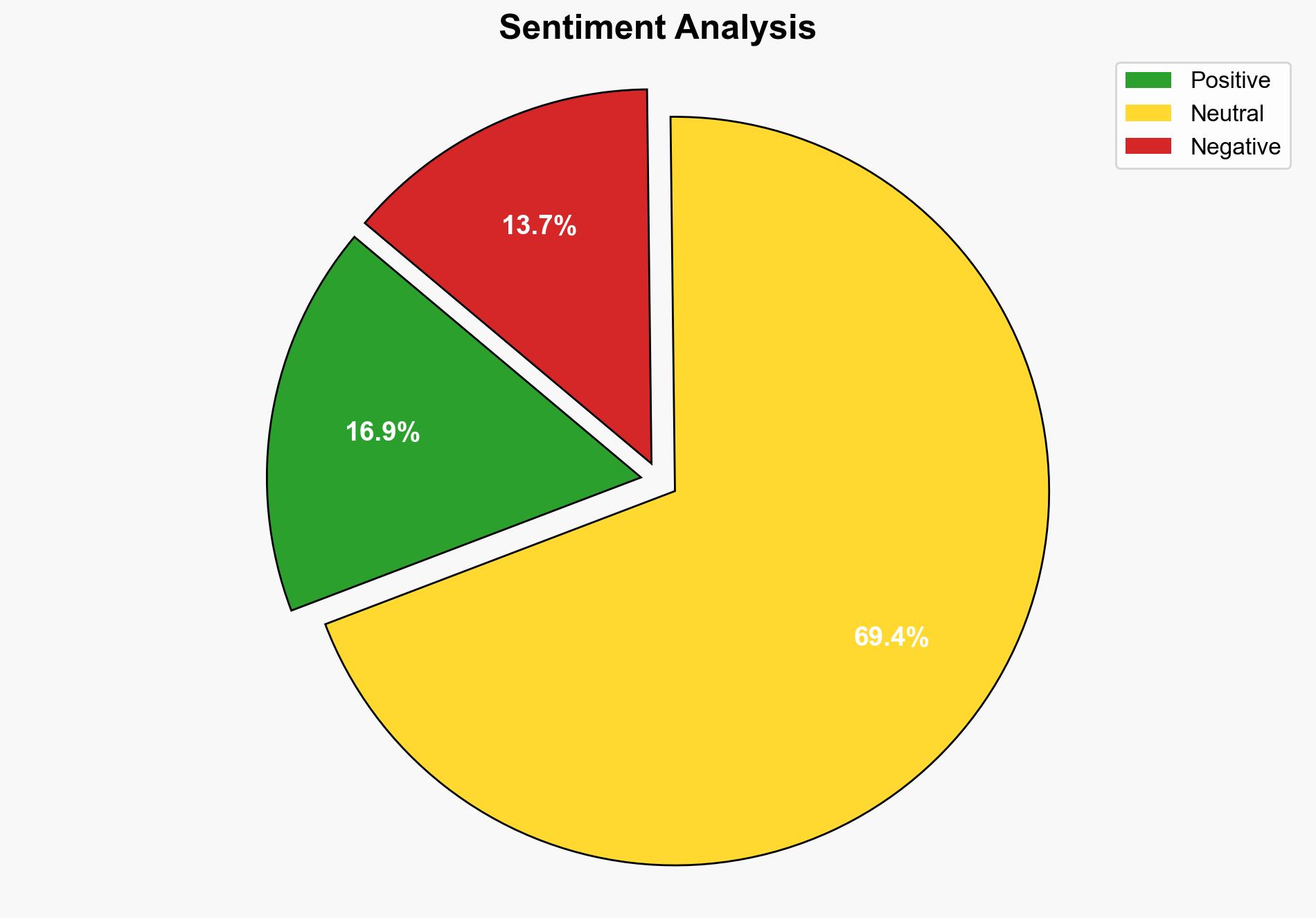

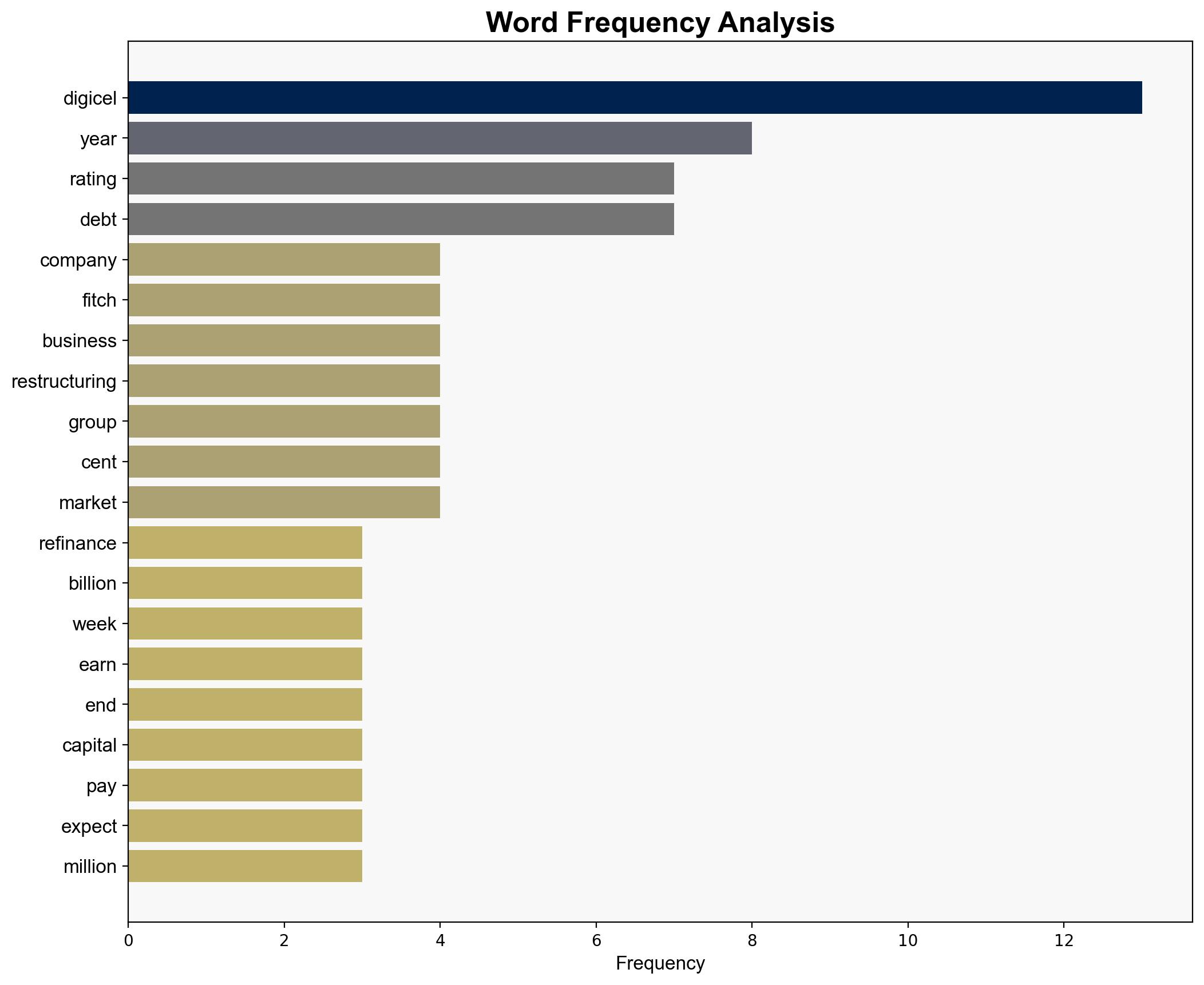

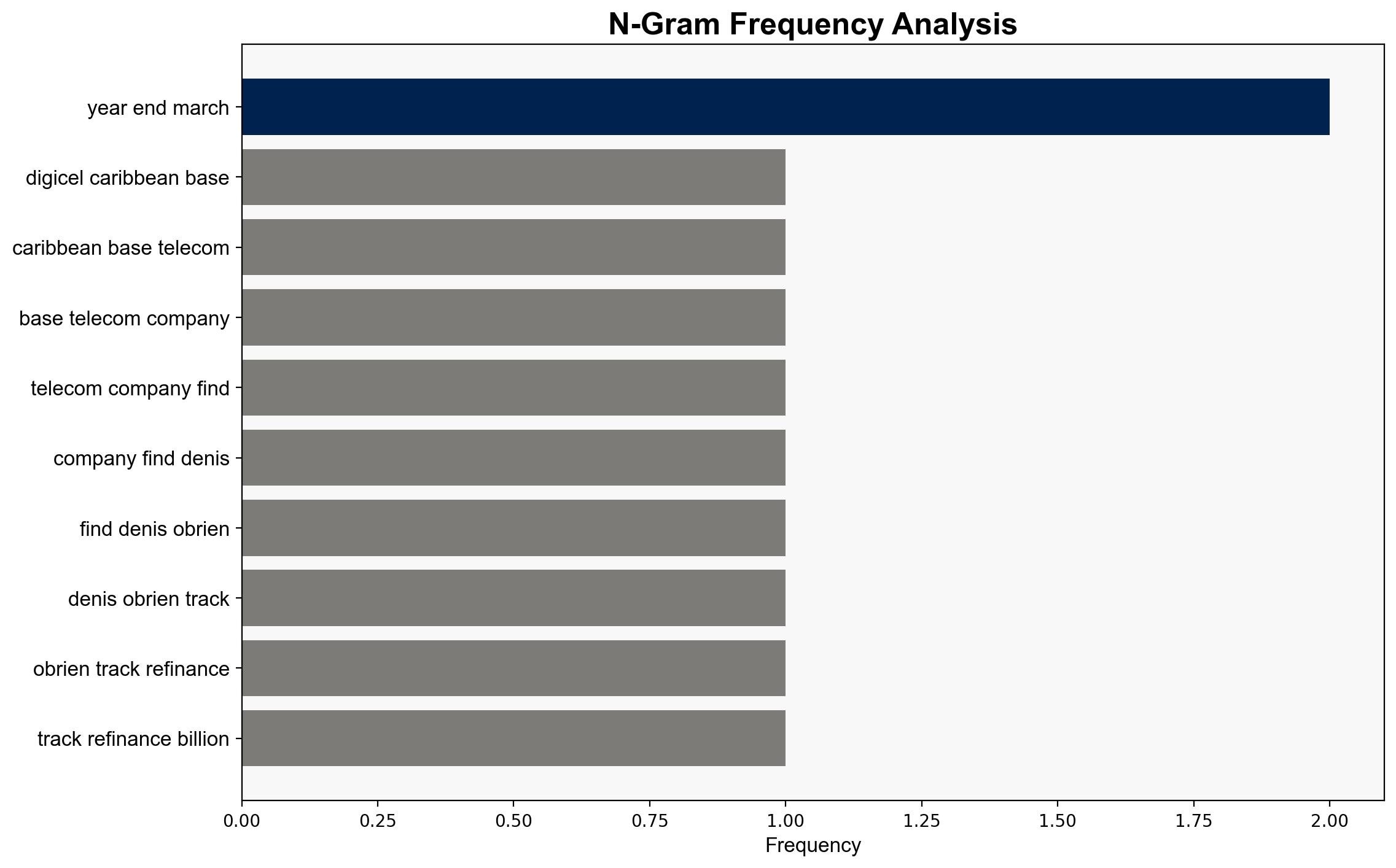

Digicel, a Caribbean-based telecommunications company, is set to refinance $2 billion in debt ahead of schedule, following an upgrade to its credit rating by Fitch Ratings. This development is a result of improved financial performance and strategic debt restructuring. The refinancing is expected to enhance Digicel’s liquidity and reduce leverage, positioning the company for continued growth despite regional economic challenges.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

– **Surface Events**: Digicel’s credit rating upgrade and early refinancing plans.

– **Systemic Structures**: Debt restructuring and strategic financial management.

– **Worldviews**: Investor confidence in Digicel’s market position and financial health.

– **Myths**: The perception of stability in volatile Caribbean markets.

Cross-Impact Simulation

Digicel’s financial restructuring may influence regional telecom markets by setting a precedent for similar companies to pursue aggressive debt management strategies. This could lead to increased competition and potential market consolidation.

Scenario Generation

– **Best Case**: Successful refinancing leads to improved financial stability and market expansion.

– **Worst Case**: Regional instability or economic downturns undermine refinancing benefits.

– **Most Likely**: Gradual financial improvement with moderate market growth.

3. Implications and Strategic Risks

Digicel’s improved credit rating and refinancing efforts reduce immediate financial risks but expose the company to regional economic volatility. The ongoing instability in markets like Haiti poses a threat to operational stability. Additionally, potential regulatory scrutiny related to foreign bribery allegations could impact future financial performance.

4. Recommendations and Outlook

- Monitor regional economic conditions and adjust financial strategies accordingly.

- Enhance compliance measures to mitigate regulatory risks associated with foreign operations.

- Scenario-based projections suggest focusing on market diversification to offset regional risks.

5. Key Individuals and Entities

– Denis O’Brien: Founder of Digicel.

– PGIM, Contrarian Capital Management, Goldentree Asset Management: Key stakeholders in Digicel’s debt restructuring.

6. Thematic Tags

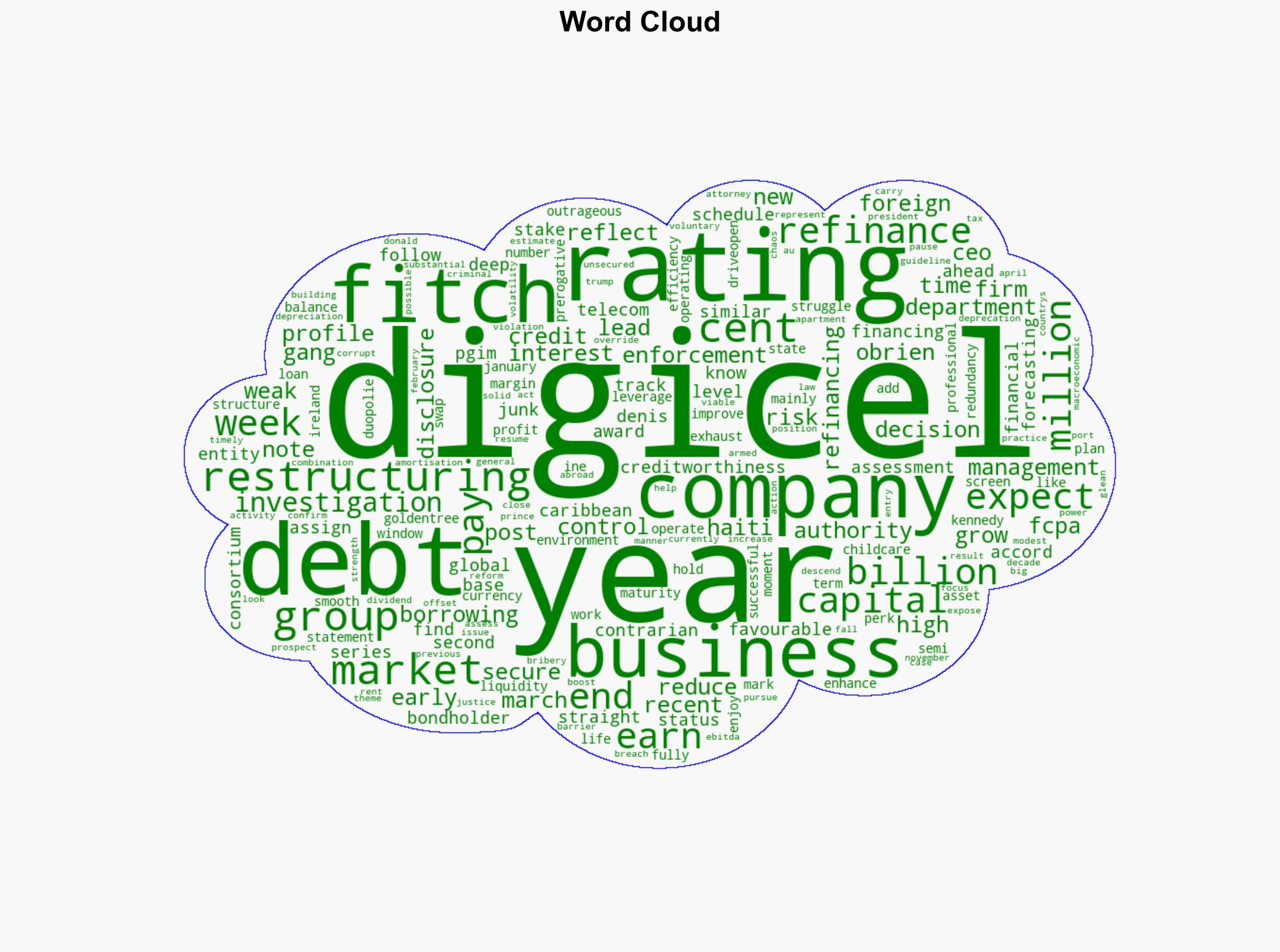

financial stability, regional economic impact, telecommunications, credit rating, debt restructuring