Digicel refinancing on hold amid uncertainty over US justice department case – The Irish Times

Published on: 2025-04-03

Intelligence Report: Digicel refinancing on hold amid uncertainty over US justice department case – The Irish Times

1. BLUF (Bottom Line Up Front)

Digicel’s refinancing efforts are currently stalled due to uncertainties surrounding a US Department of Justice case. This situation arises amidst concerns over potential breaches of foreign bribery laws. The company’s recent debt restructuring, which involved significant changes in ownership and financial strategy, is now under scrutiny. Key stakeholders should monitor developments closely as they may impact Digicel’s financial stability and market operations.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

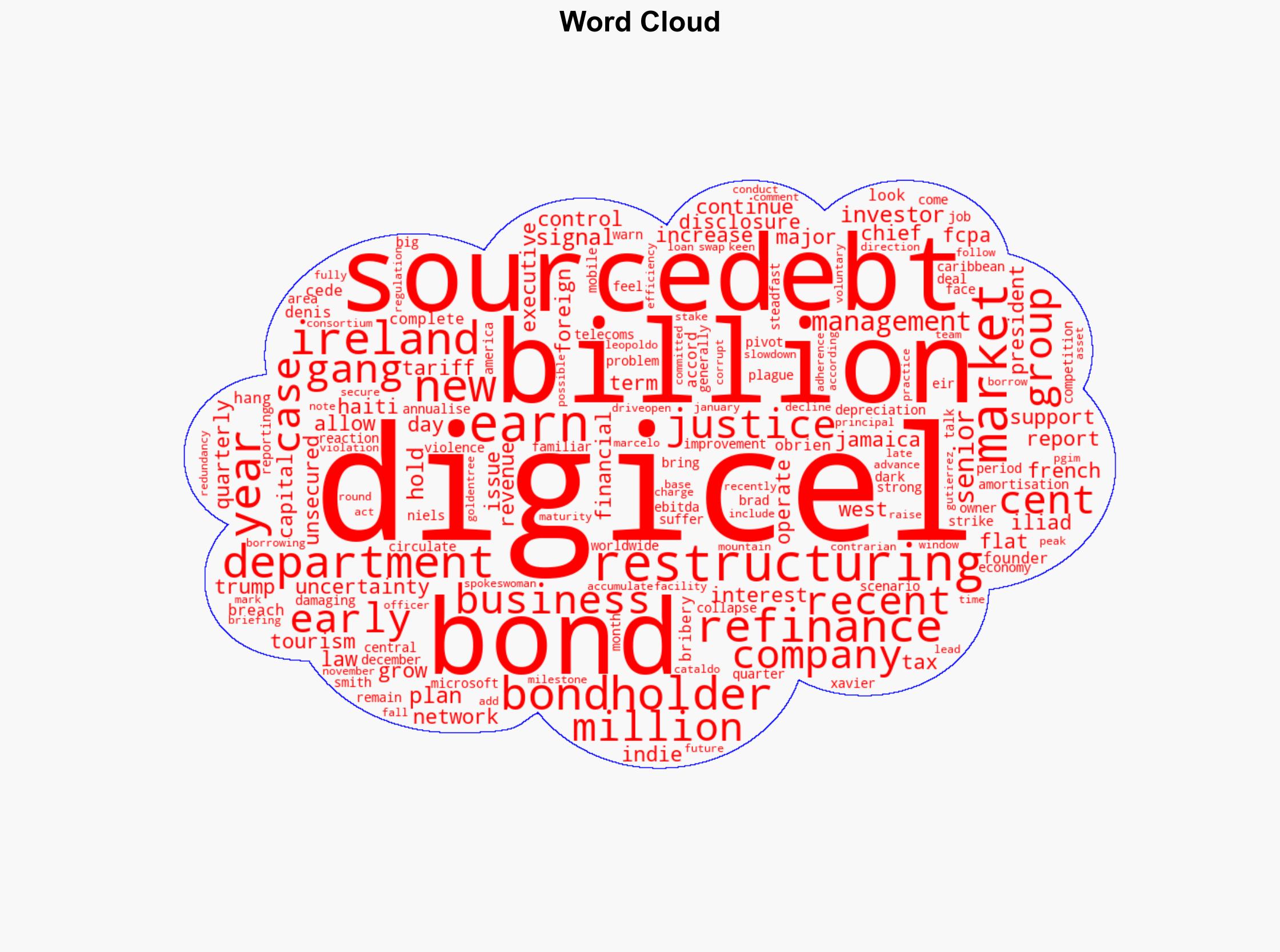

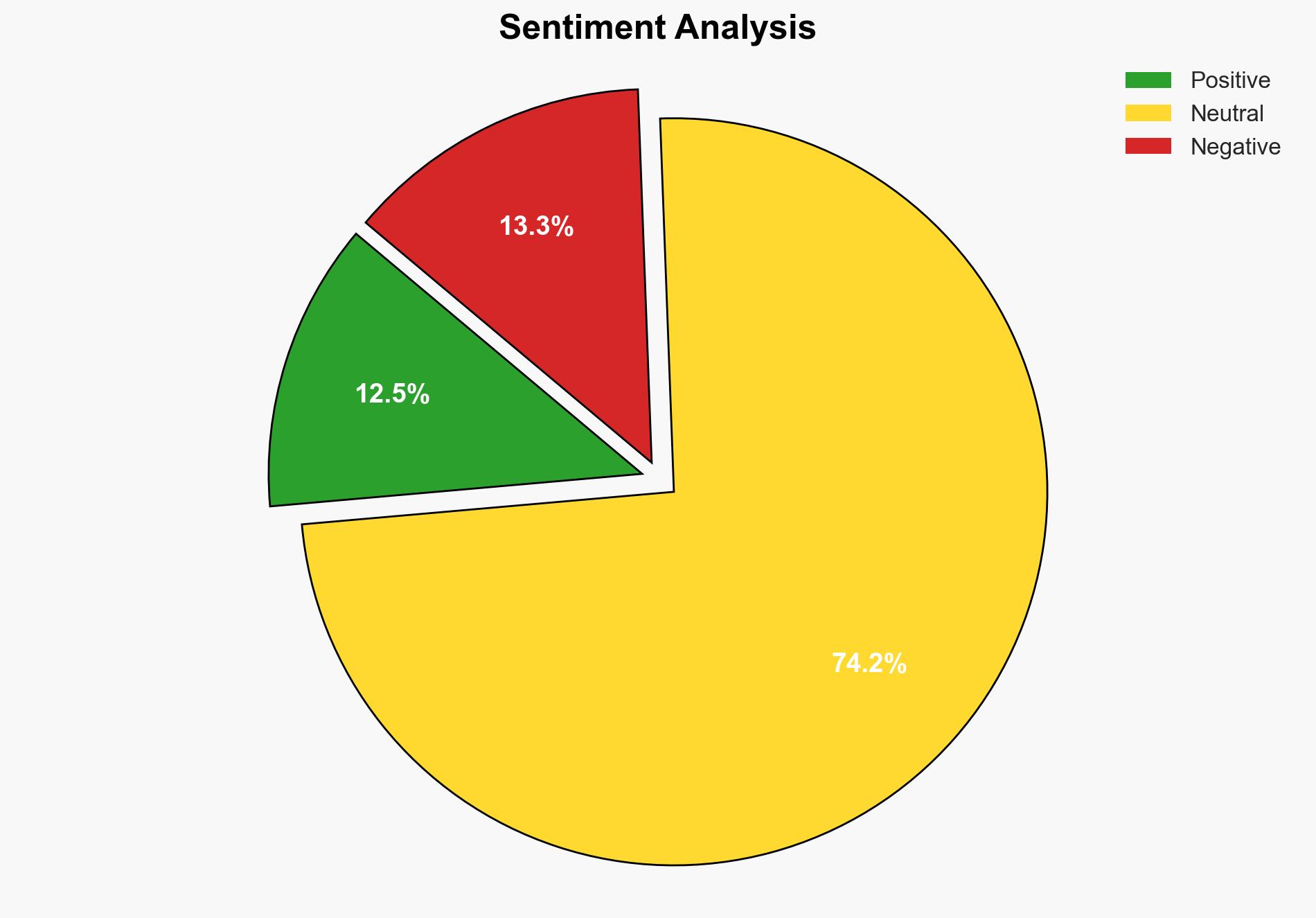

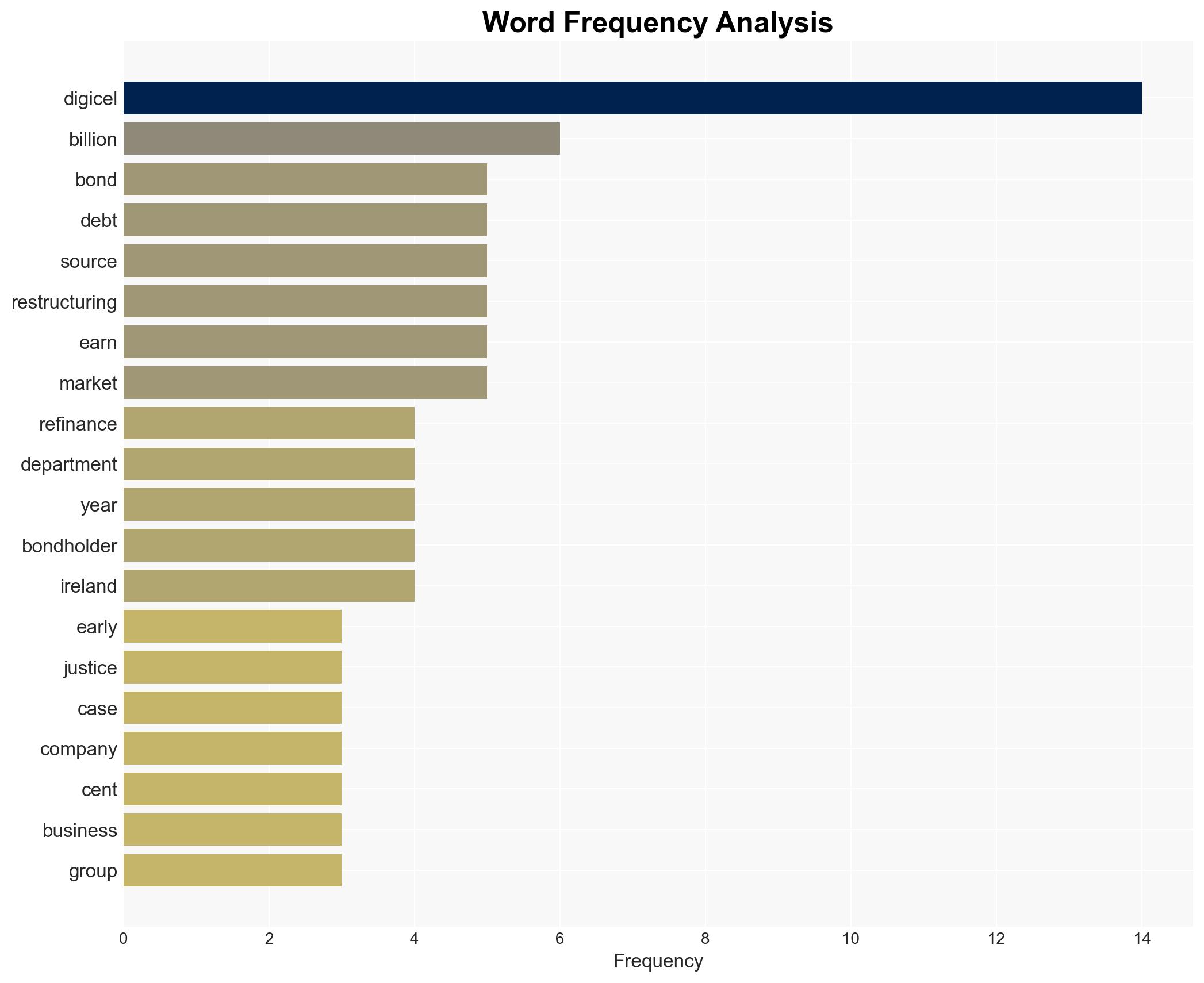

General Analysis

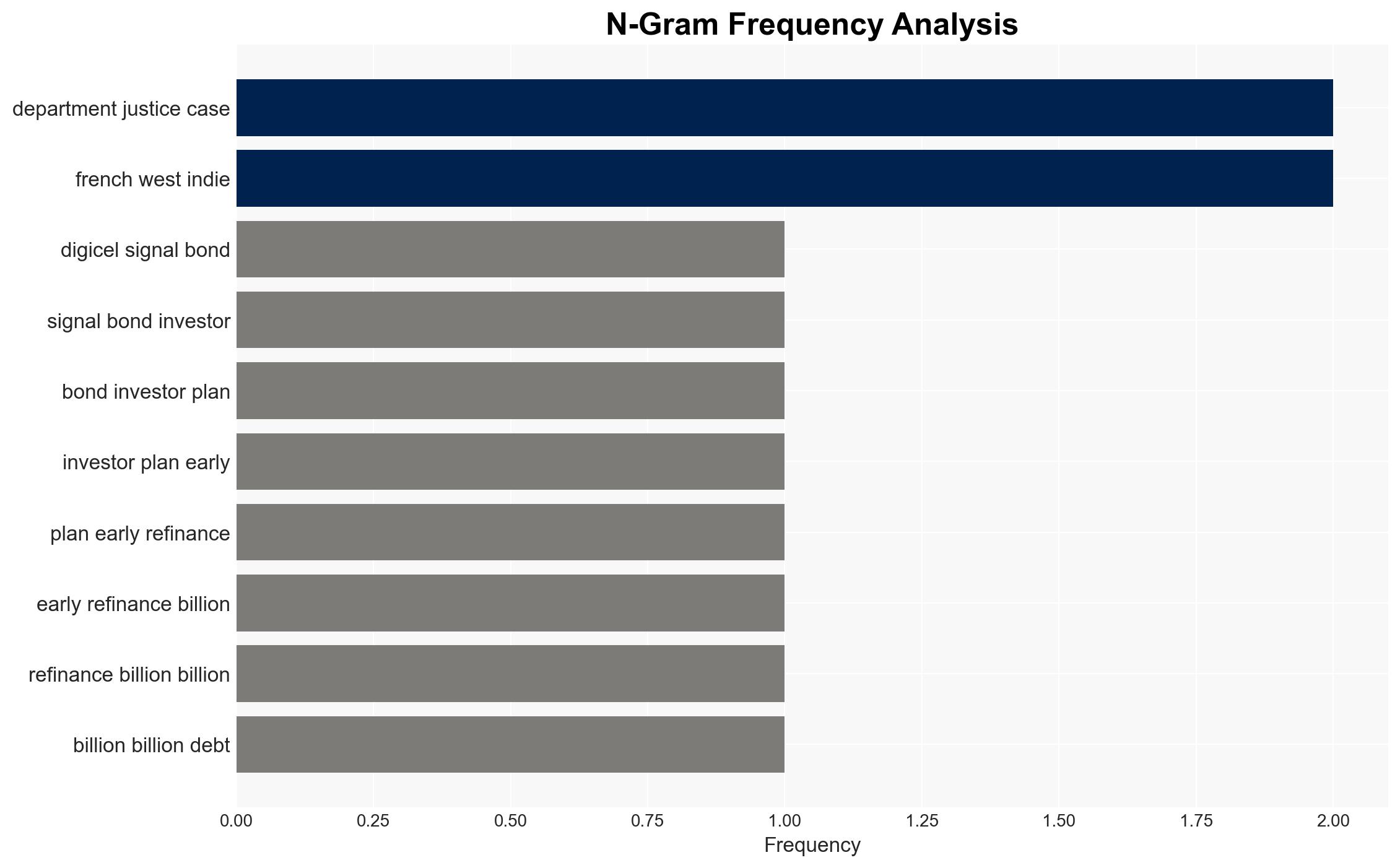

Digicel’s financial health has been under pressure due to stagnant revenues and operational challenges in regions like Haiti, where gang violence and competition have intensified. The company’s recent restructuring saw Denis O’Brien relinquish a significant portion of control to bondholders. Despite improvements in earnings before interest, tax, depreciation, and amortization (EBITDA), the refinancing process is hindered by legal uncertainties. The involvement of entities such as Xavier Niels and his business interests in the French West Indies adds complexity to the competitive landscape.

3. Implications and Strategic Risks

The ongoing legal case poses significant risks to Digicel’s refinancing plans and overall financial stability. A negative outcome could lead to increased borrowing costs and reduced investor confidence. The situation in Haiti, characterized by criminal gang dominance, further exacerbates operational risks. The broader economic implications include potential impacts on regional telecommunications markets and investor sentiment in Caribbean and Central American economies.

4. Recommendations and Outlook

Recommendations:

- Monitor legal proceedings closely and engage with legal experts to assess potential outcomes and prepare contingency plans.

- Strengthen compliance programs to mitigate risks of future legal challenges, particularly concerning foreign bribery laws.

- Explore strategic partnerships or alliances to bolster market presence and offset competitive pressures.

Outlook:

In a best-case scenario, the legal issues are resolved favorably, allowing Digicel to proceed with refinancing and stabilize its financial position. The worst-case scenario involves prolonged legal battles, leading to financial strain and potential market exit. The most likely outcome is a negotiated settlement, enabling Digicel to gradually regain investor confidence and focus on operational improvements.

5. Key Individuals and Entities

The report mentions significant individuals and organizations, including Denis O’Brien, Xavier Niels, and entities such as PGIM, Contrarian Capital Management, and Goldentree Asset Management. These individuals and entities play critical roles in the ongoing financial and strategic developments surrounding Digicel.