Digital payments companies see jump in transaction success rates via new two-factor authentication – The Times of India

Published on: 2025-10-13

Intelligence Report: Digital payments companies see jump in transaction success rates via new two-factor authentication – The Times of India

1. BLUF (Bottom Line Up Front)

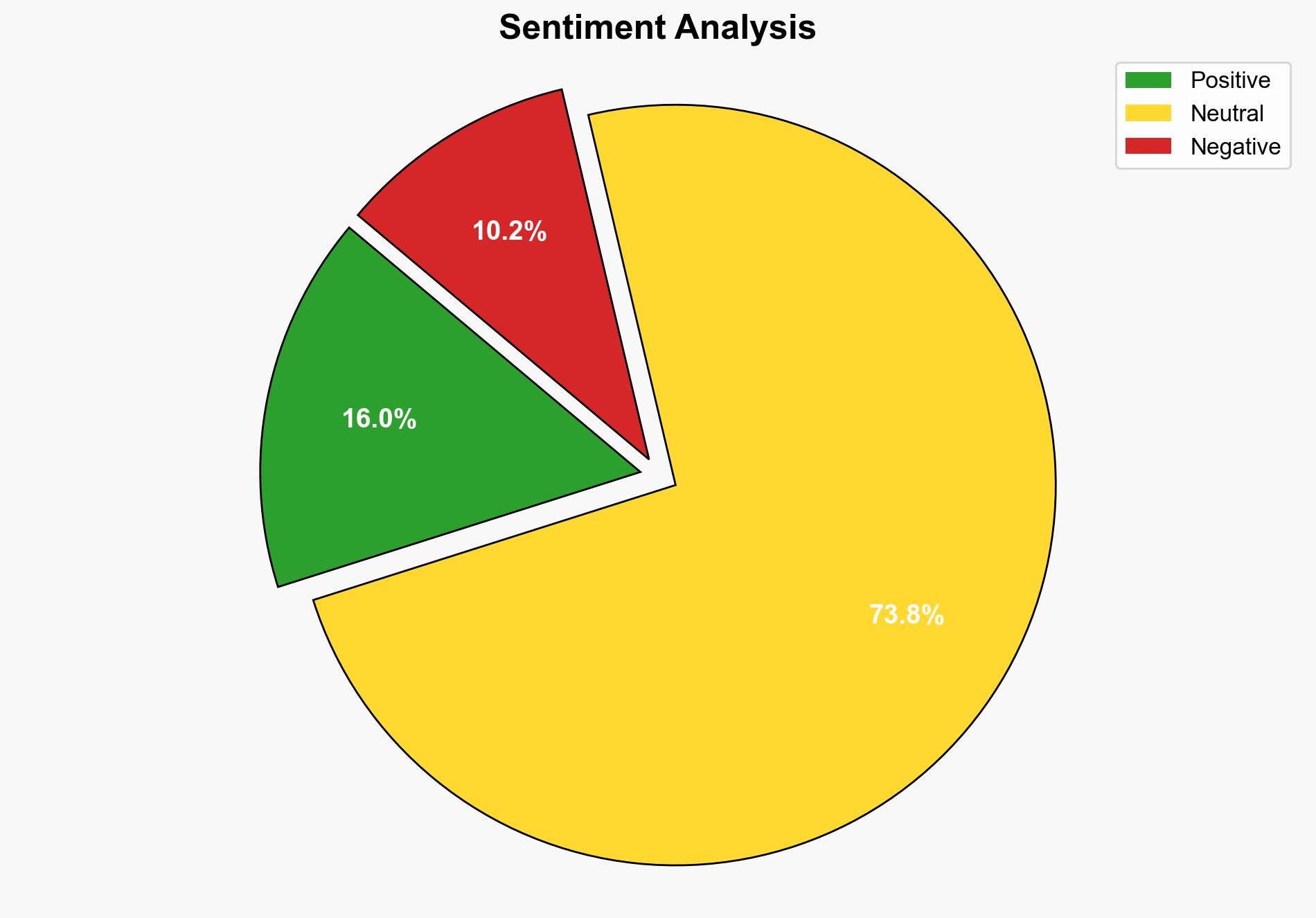

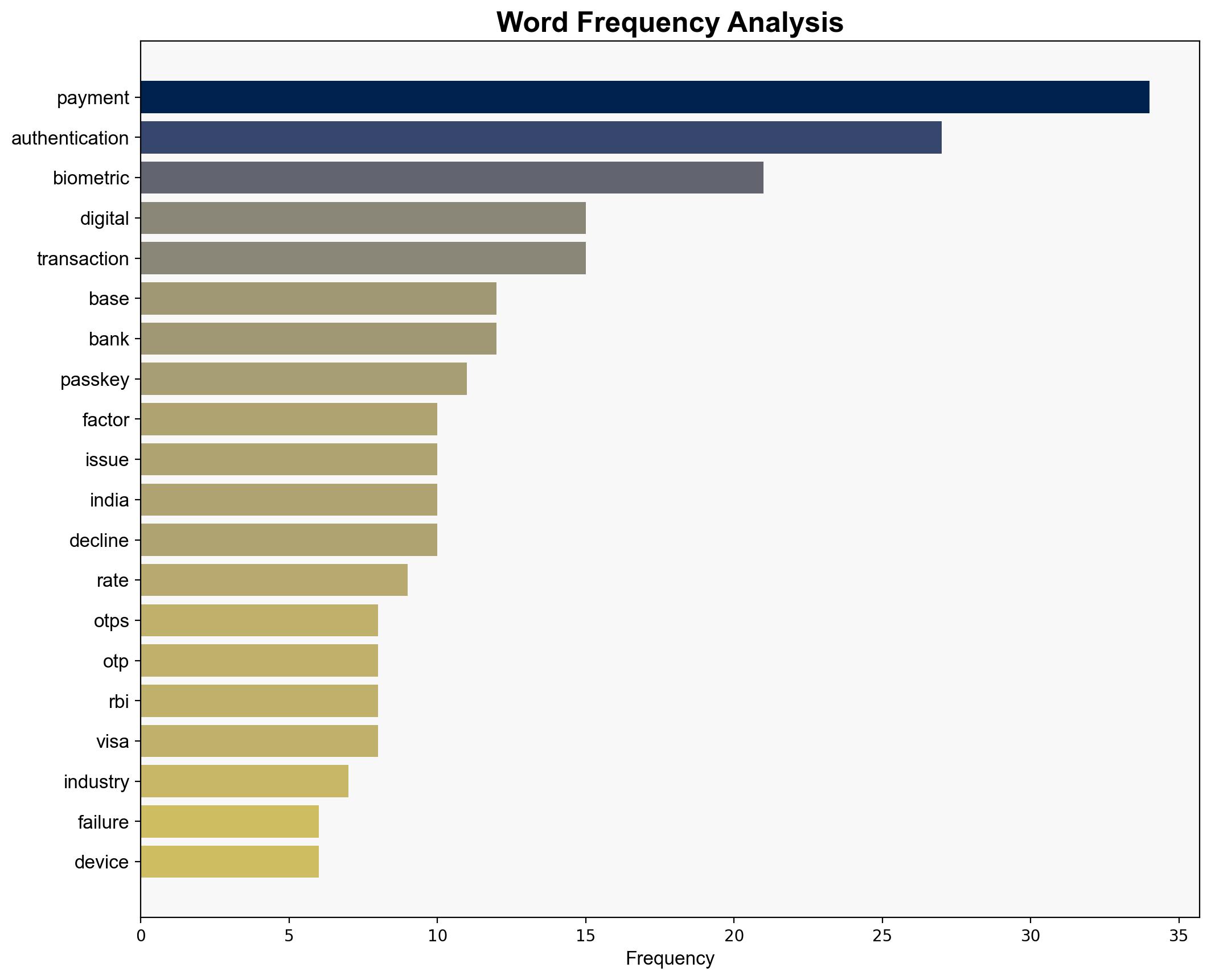

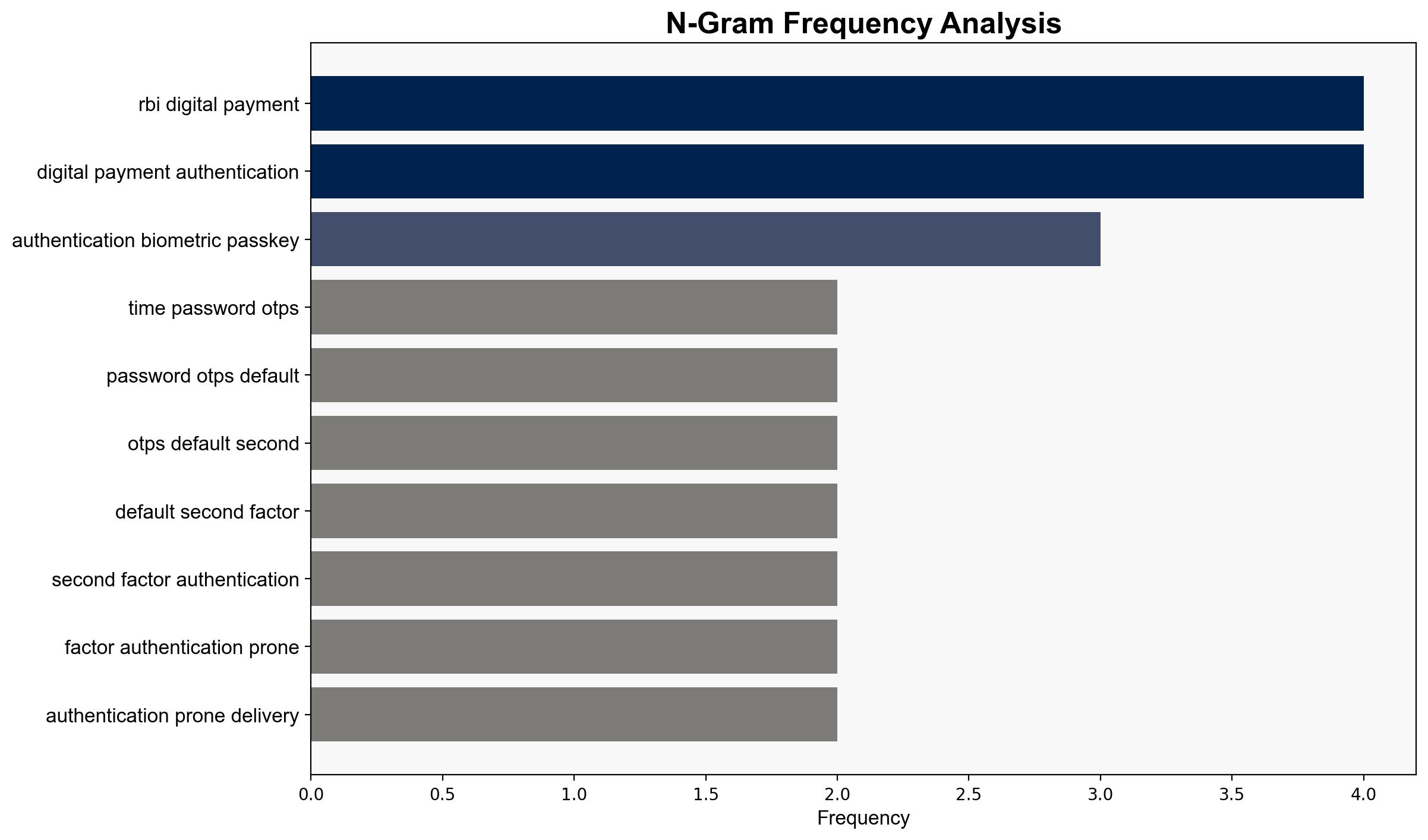

The implementation of biometric and passkey-based two-factor authentication (2FA) in digital payments is likely to significantly improve transaction success rates by reducing reliance on traditional OTPs, which are prone to delivery issues. This report evaluates two hypotheses regarding the impact of this technological shift. The most supported hypothesis suggests that biometric authentication will enhance security and efficiency, leading to widespread adoption. Confidence level: Moderate. Recommended action: Encourage further adoption of biometric 2FA while monitoring for potential security vulnerabilities.

2. Competing Hypotheses

Hypothesis 1: The adoption of biometric and passkey-based 2FA will lead to a significant increase in transaction success rates and security, reducing fraud and operational costs.

Hypothesis 2: Despite improvements, biometric and passkey-based 2FA will face challenges such as user resistance, technical integration issues, and potential new security vulnerabilities, limiting its effectiveness.

3. Key Assumptions and Red Flags

Assumptions:

– Biometric systems are assumed to be more reliable and less prone to failure than OTPs.

– Users will readily adopt biometric authentication without significant resistance.

– The technology will seamlessly integrate with existing payment systems.

Red Flags:

– Potential over-reliance on biometric data security without considering new attack vectors.

– Lack of data on long-term user acceptance and satisfaction.

– Insufficient analysis of potential technical failures or integration challenges.

4. Implications and Strategic Risks

The shift to biometric authentication could reduce fraud and enhance user experience, potentially leading to increased digital payment adoption. However, new security vulnerabilities could emerge, such as biometric data breaches or sophisticated spoofing attacks. Economically, reduced reliance on OTPs could lower operational costs. Geopolitically, widespread adoption could influence global digital payment standards, impacting international financial systems.

5. Recommendations and Outlook

- Encourage the adoption of biometric 2FA while investing in robust security measures to protect biometric data.

- Conduct user education campaigns to facilitate smooth adoption and address privacy concerns.

- Scenario Projections:

- Best Case: Widespread adoption leads to enhanced security and reduced fraud.

- Worst Case: New vulnerabilities lead to significant security breaches.

- Most Likely: Gradual adoption with moderate improvements in security and transaction success rates.

6. Key Individuals and Entities

– Girish Krishnan

– Bipin Preet Singh

– Ramakrishnan Gopalan

– Reeju Datta

– National Payment Corporation of India (NPCI)

– Visa

– Amazon Pay

– Mobikwik

– Cashfree

7. Thematic Tags

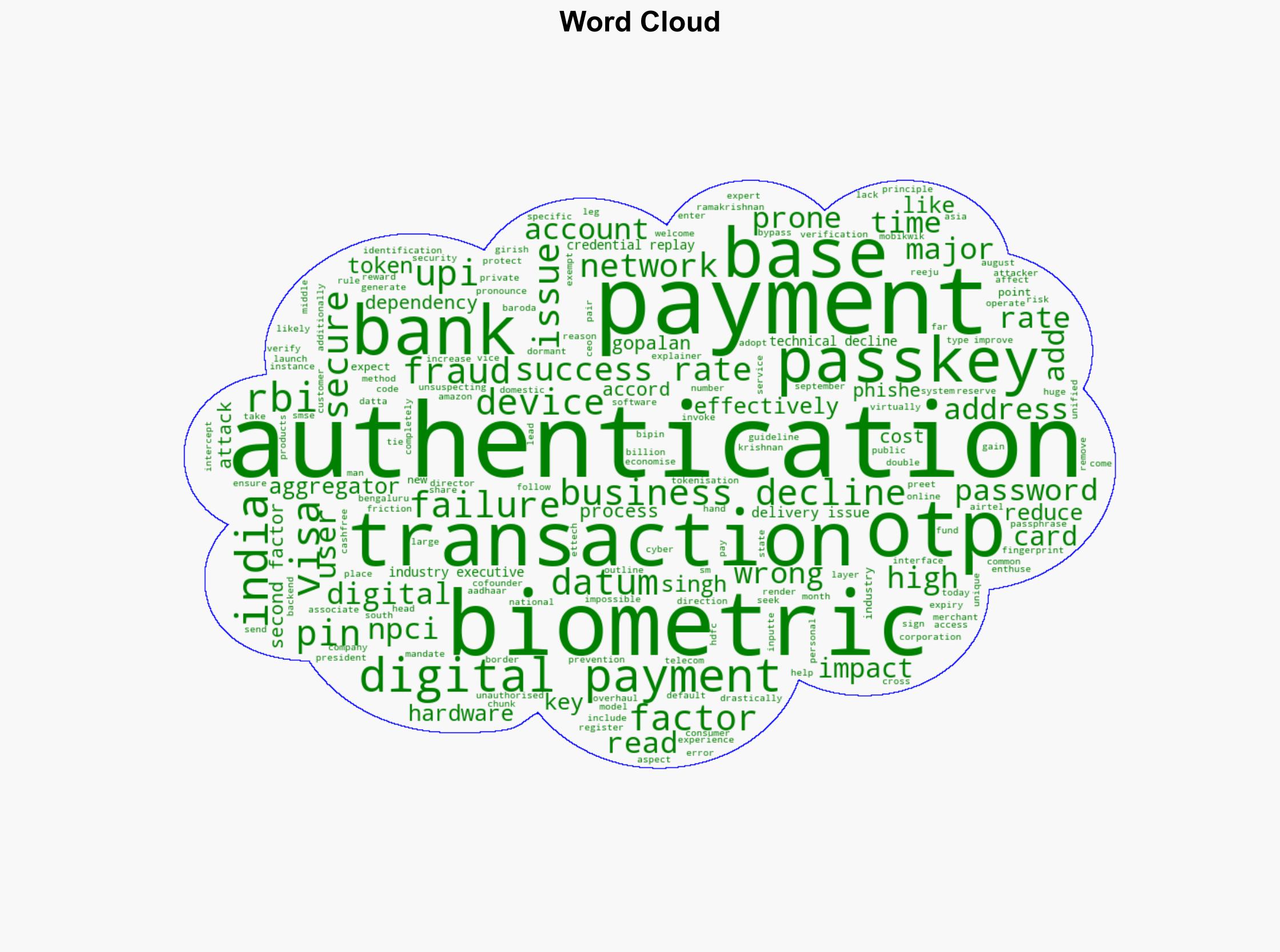

cybersecurity, digital payments, biometric authentication, fraud prevention, financial technology