Diwali Muhurat trading today Timings track record trading strategy and which stocks to buy – The Times of India

Published on: 2025-10-21

Intelligence Report: Diwali Muhurat trading today Timings track record trading strategy and which stocks to buy – The Times of India

1. BLUF (Bottom Line Up Front)

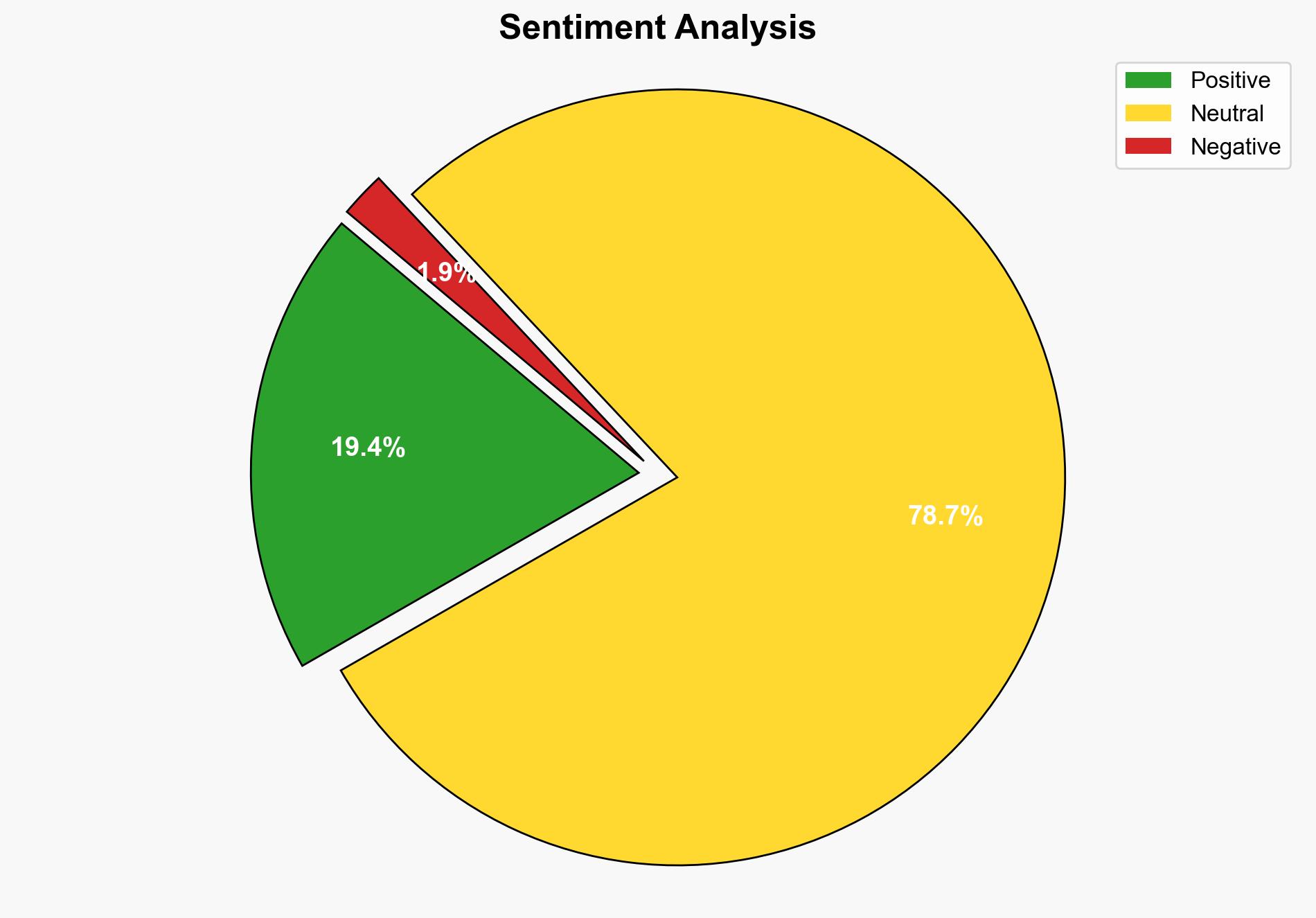

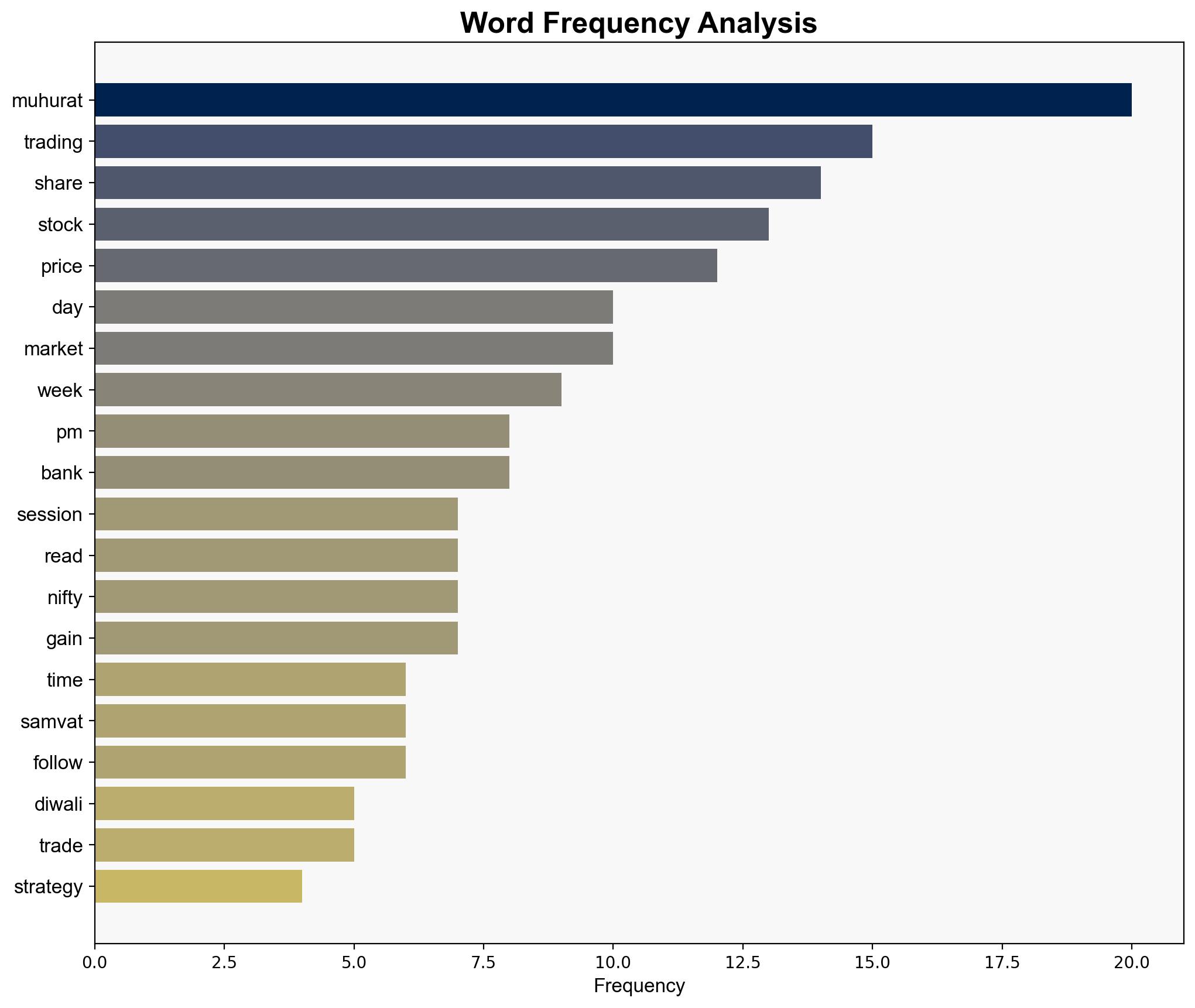

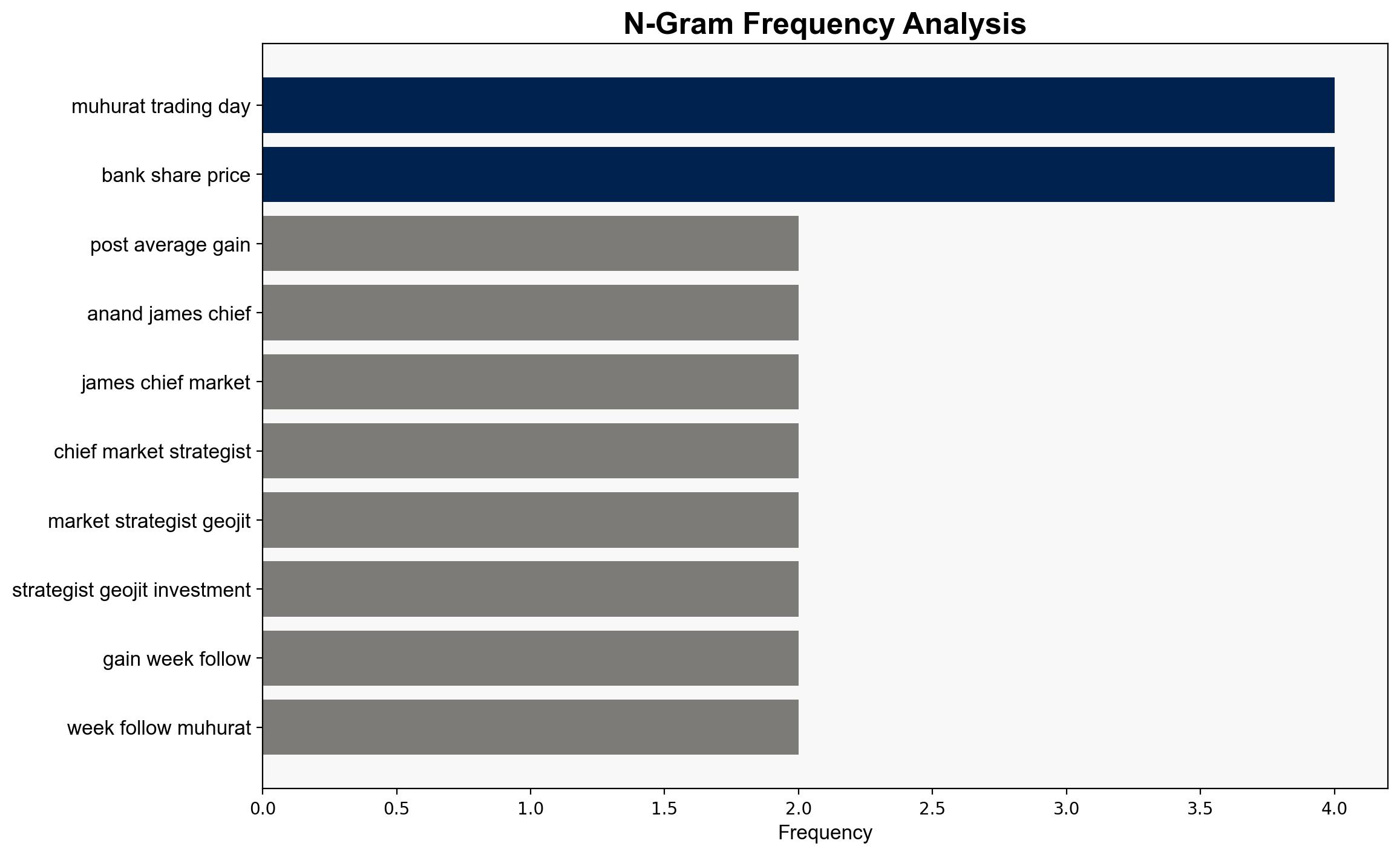

The analysis suggests that the Diwali Muhurat trading session is likely to result in positive short-term gains, particularly in midcap and smallcap indices, with a high confidence level. The most supported hypothesis is that the auspicious timing and historical trends will drive investor sentiment, leading to a bullish market. Recommended action includes focusing on midcap stocks and sectors with historical resilience, such as metals and banking, while exercising caution in realty and pharma sectors.

2. Competing Hypotheses

1. **Hypothesis A**: The Diwali Muhurat trading session will result in positive market performance, driven by historical trends and investor sentiment during the auspicious period.

2. **Hypothesis B**: The Diwali Muhurat trading session will not significantly impact market performance, as current economic conditions and market volatility overshadow traditional sentiment.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported due to historical data showing consistent gains in the week following Muhurat trading and the current bullish technical indicators such as RSI.

3. Key Assumptions and Red Flags

– **Assumptions**: Investor behavior is significantly influenced by cultural and historical factors during the Diwali period. Technical indicators like RSI are reliable predictors of short-term market movements.

– **Red Flags**: Overreliance on historical trends without considering current macroeconomic conditions. Potential for cognitive bias in assuming past performance guarantees future results.

– **Blind Spots**: Lack of consideration for external economic shocks or geopolitical events that could disrupt market trends.

4. Implications and Strategic Risks

– **Economic Implications**: A positive Muhurat trading session could boost investor confidence and liquidity in the short term, particularly in midcap and smallcap sectors.

– **Strategic Risks**: Over-optimism based on historical trends could lead to misallocation of resources if current economic conditions deteriorate. Potential for increased volatility if external factors are not accounted for.

– **Cascading Threats**: A failure to achieve expected gains could lead to a rapid sell-off, exacerbating market volatility.

5. Recommendations and Outlook

- Focus on midcap and smallcap stocks with historical resilience during the Muhurat trading period.

- Exercise caution with realty and pharma sectors, which have historically underperformed post-Muhurat.

- Monitor macroeconomic indicators and geopolitical developments closely to adjust strategies as needed.

- Scenario Projections:

- Best Case: Sustained bullish trend with significant gains in midcap and smallcap indices.

- Worst Case: Market volatility increases due to unforeseen economic or geopolitical events, negating historical trends.

- Most Likely: Moderate gains in line with historical patterns, with potential sector-specific outperformance.

6. Key Individuals and Entities

– Anand James, Chief Market Strategist at Geojit Investment

– Kotak Security

– Adani Port

– ICICI Bank

– Reliance Industry

– Bajaj Finance

– SBI Card

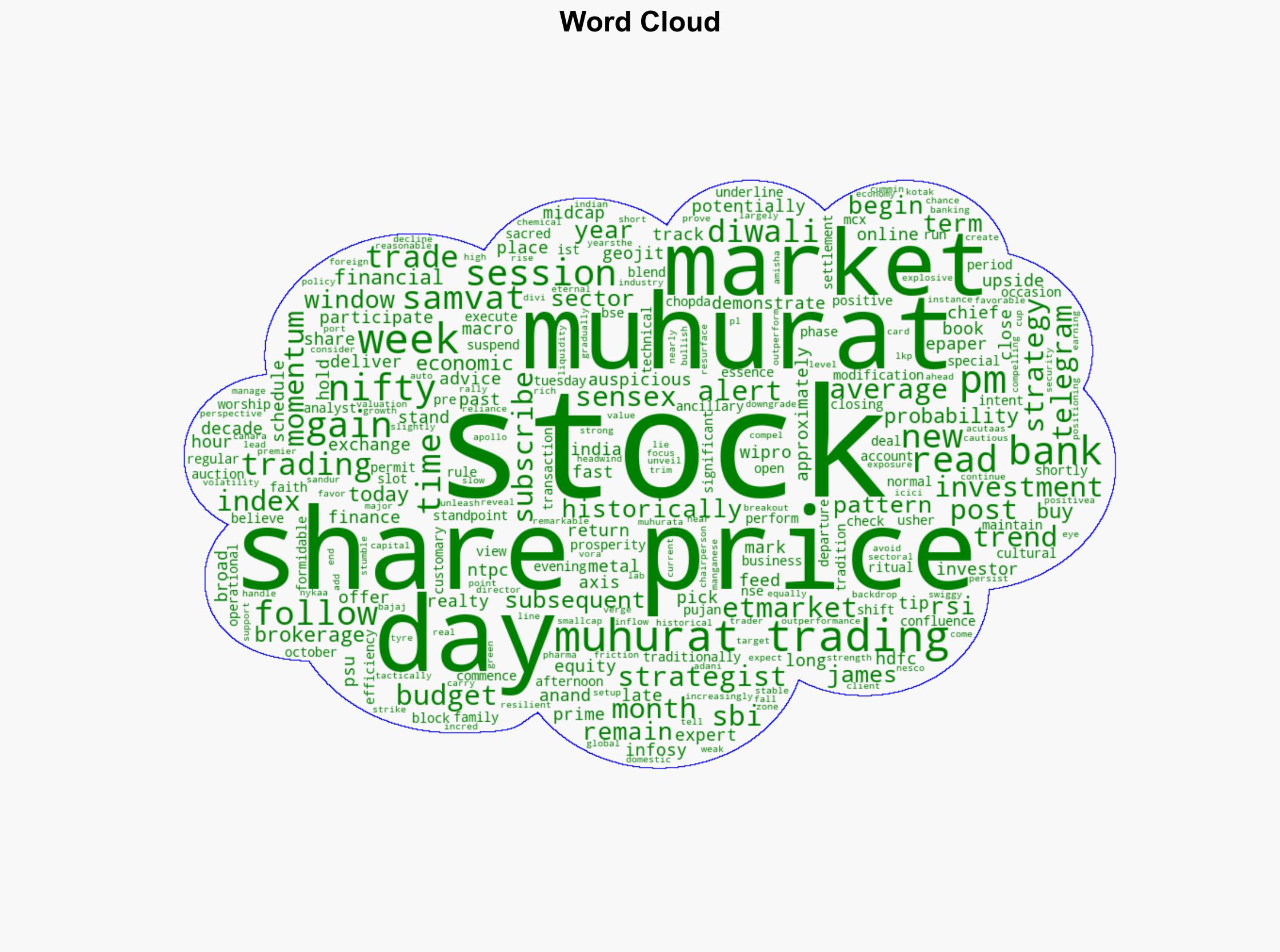

7. Thematic Tags

financial markets, cultural influence, economic forecasting, investment strategy