Dont Be a Panican Over Trumps Tariffs Wall Street – Daily Signal

Published on: 2025-04-09

Intelligence Report: Dont Be a Panican Over Trumps Tariffs Wall Street – Daily Signal

1. BLUF (Bottom Line Up Front)

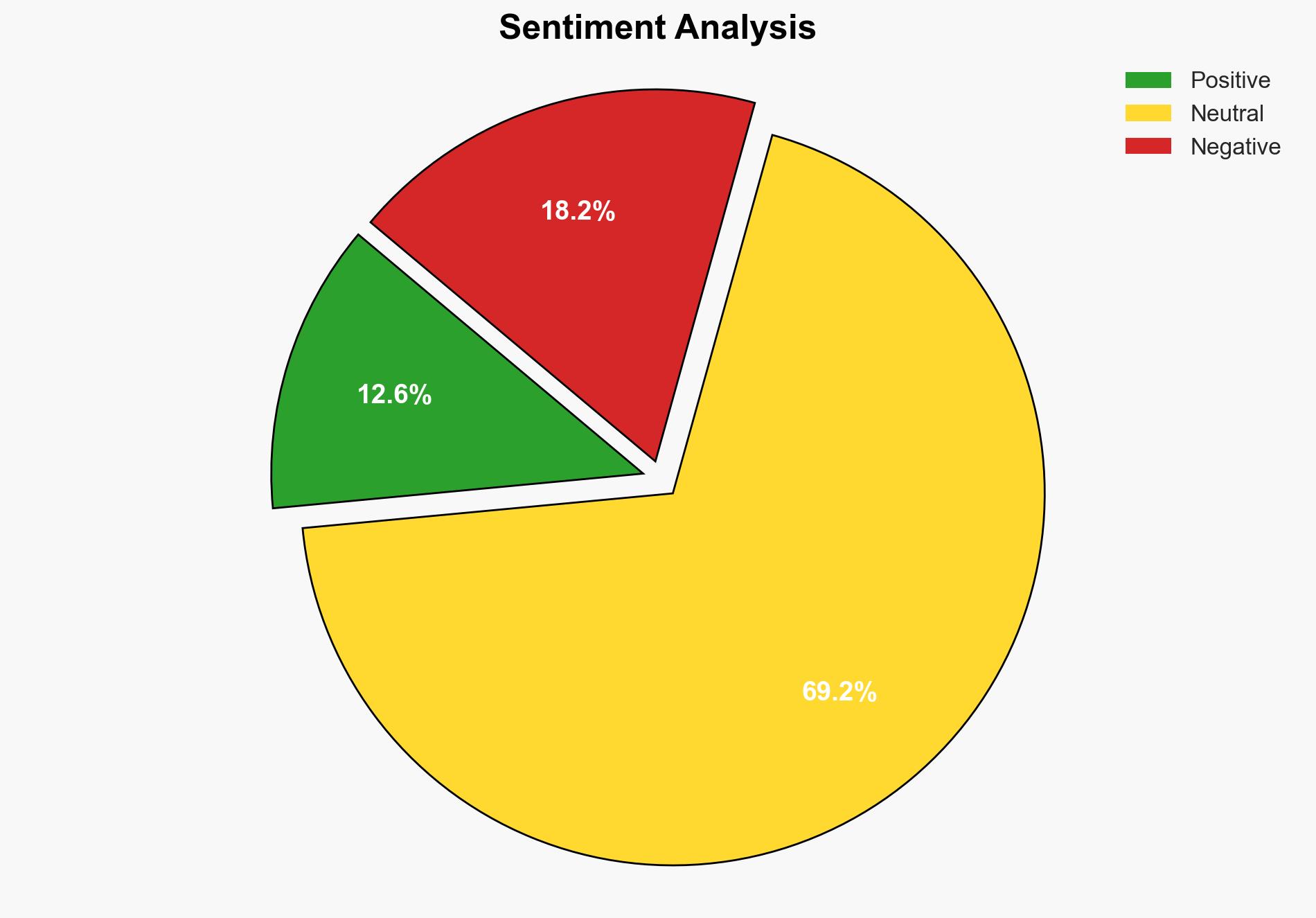

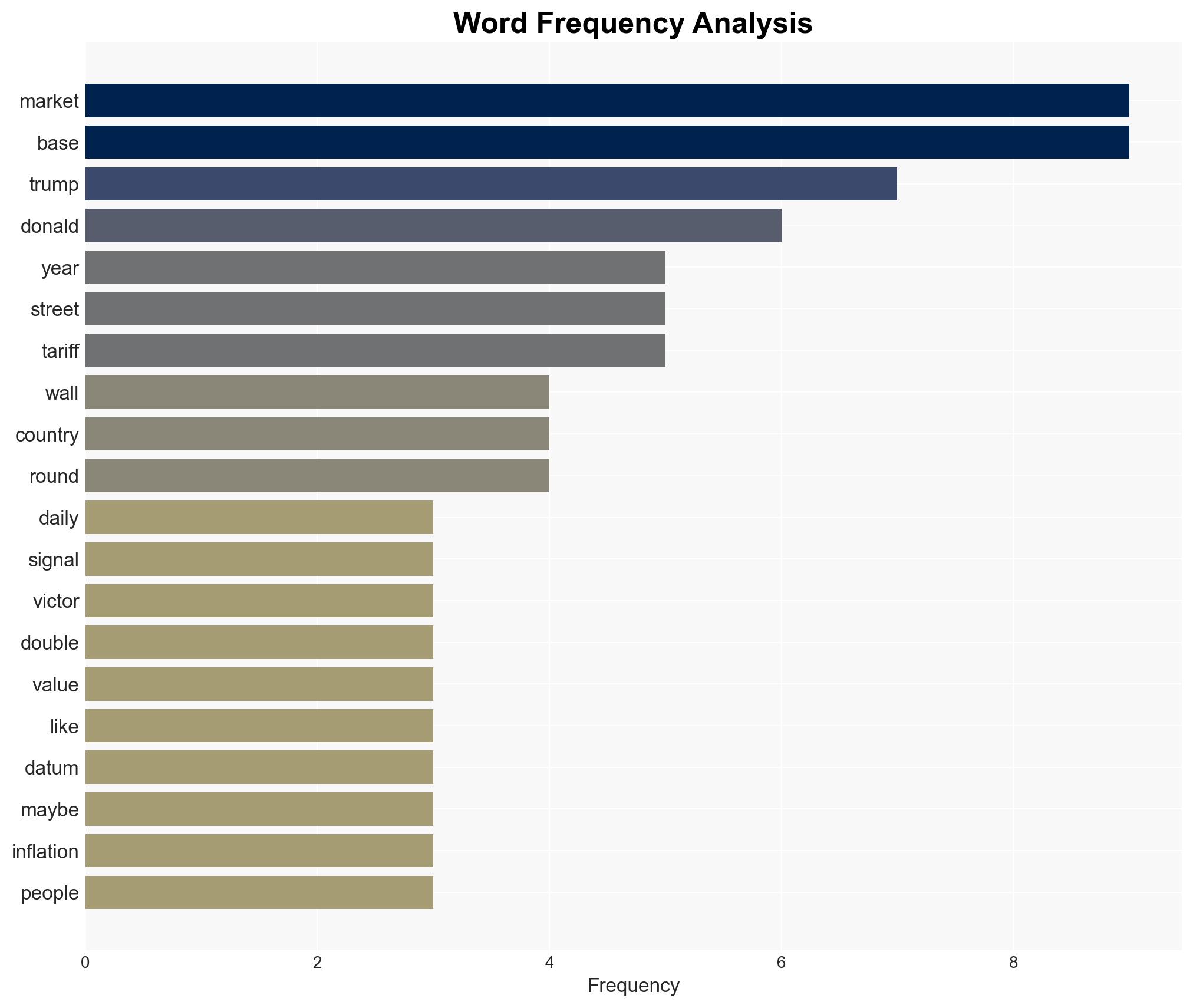

The analysis indicates that concerns over tariffs and their potential impact on Wall Street are overstated. Historical data suggests that market fluctuations attributed to policy changes by Donald Trump have not resulted in long-term negative effects. The strategic recommendation is to maintain a balanced perspective on market reactions and consider broader economic indicators before making policy adjustments.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

The market has shown resilience despite initial fears surrounding tariffs and deregulation efforts. Historical trends indicate that deregulation and tax cuts have contributed to market growth. The unemployment rate remains low, and job growth continues to surpass government predictions. Inflation concerns are present but have not yet materialized into significant economic disruptions. Geopolitical tensions, particularly involving trade negotiations and international relations, are areas to monitor.

3. Implications and Strategic Risks

Economic Implications: The potential for increased tariffs could lead to trade disputes, impacting international relations and economic stability. However, reciprocal trade agreements may mitigate these risks.

National Security Risks: Geopolitical tensions, particularly in regions like the Middle East and Eastern Europe, pose risks to global stability. The influence of external actors, such as Tehran, remains a concern.

Market Volatility: While market hysteria is a concern, historical data suggests that long-term impacts are minimal. Investors should remain cautious but not overly reactive to short-term fluctuations.

4. Recommendations and Outlook

Recommendations:

- Encourage balanced trade negotiations to avoid escalation of tariff disputes.

- Monitor inflation indicators closely and prepare contingency plans for potential economic shifts.

- Enhance diplomatic efforts to address geopolitical tensions and promote stability.

Outlook:

Best-case scenario: Successful trade negotiations lead to reduced tariffs and strengthened international relations, fostering economic growth.

Worst-case scenario: Escalation of trade disputes results in economic downturns and increased geopolitical tensions.

Most likely outcome: Continued market resilience with periodic fluctuations as trade negotiations progress and geopolitical issues are addressed.

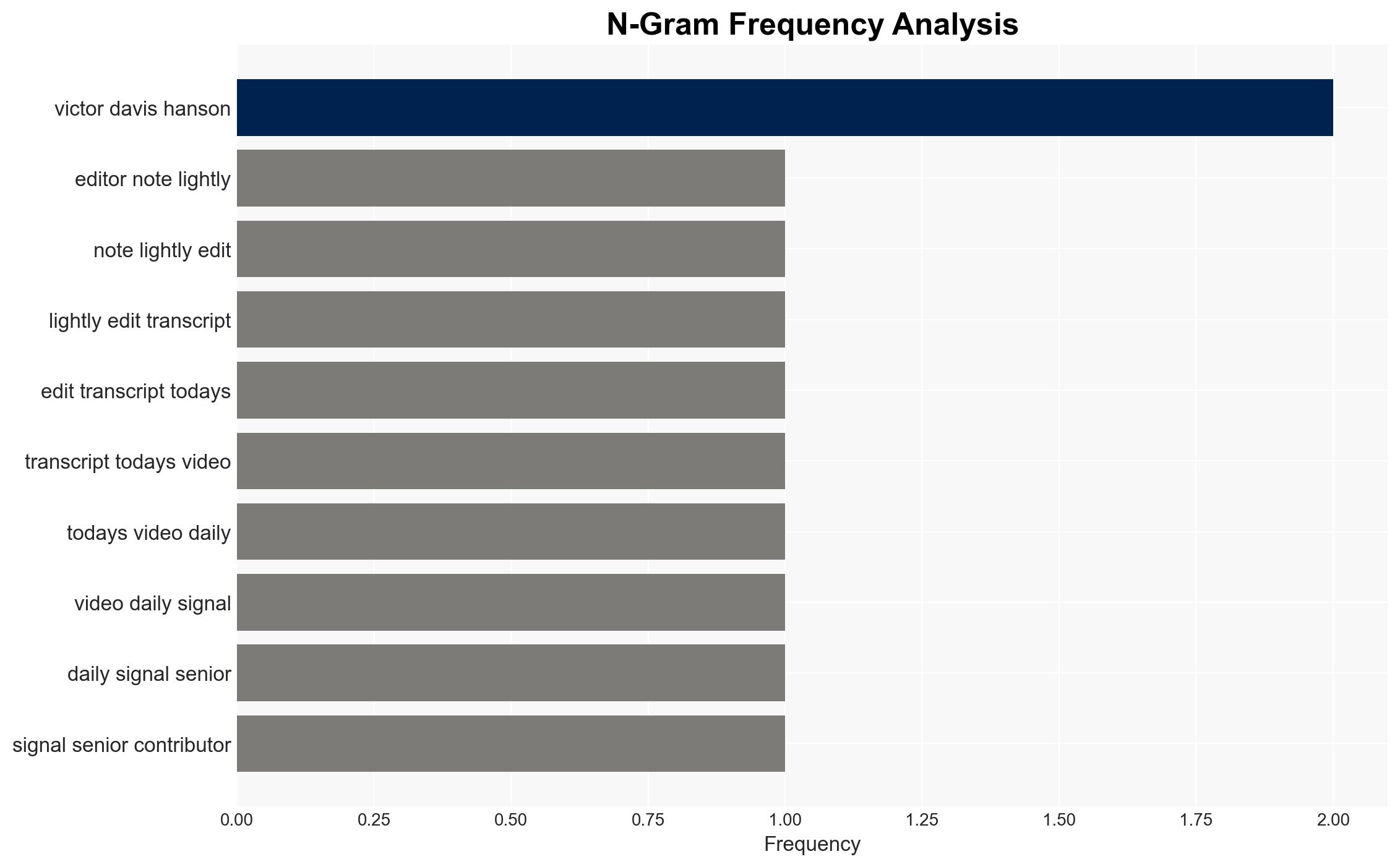

5. Key Individuals and Entities

The report mentions significant individuals such as Donald Trump and Joe Biden. It also references geopolitical entities including Tehran, Israel, and Australia. These individuals and entities play crucial roles in shaping the current economic and geopolitical landscape.