Double Supply Whammy Knocks Down Oil Prices – OilPrice.com

Published on: 2025-09-30

Intelligence Report: Double Supply Whammy Knocks Down Oil Prices – OilPrice.com

1. BLUF (Bottom Line Up Front)

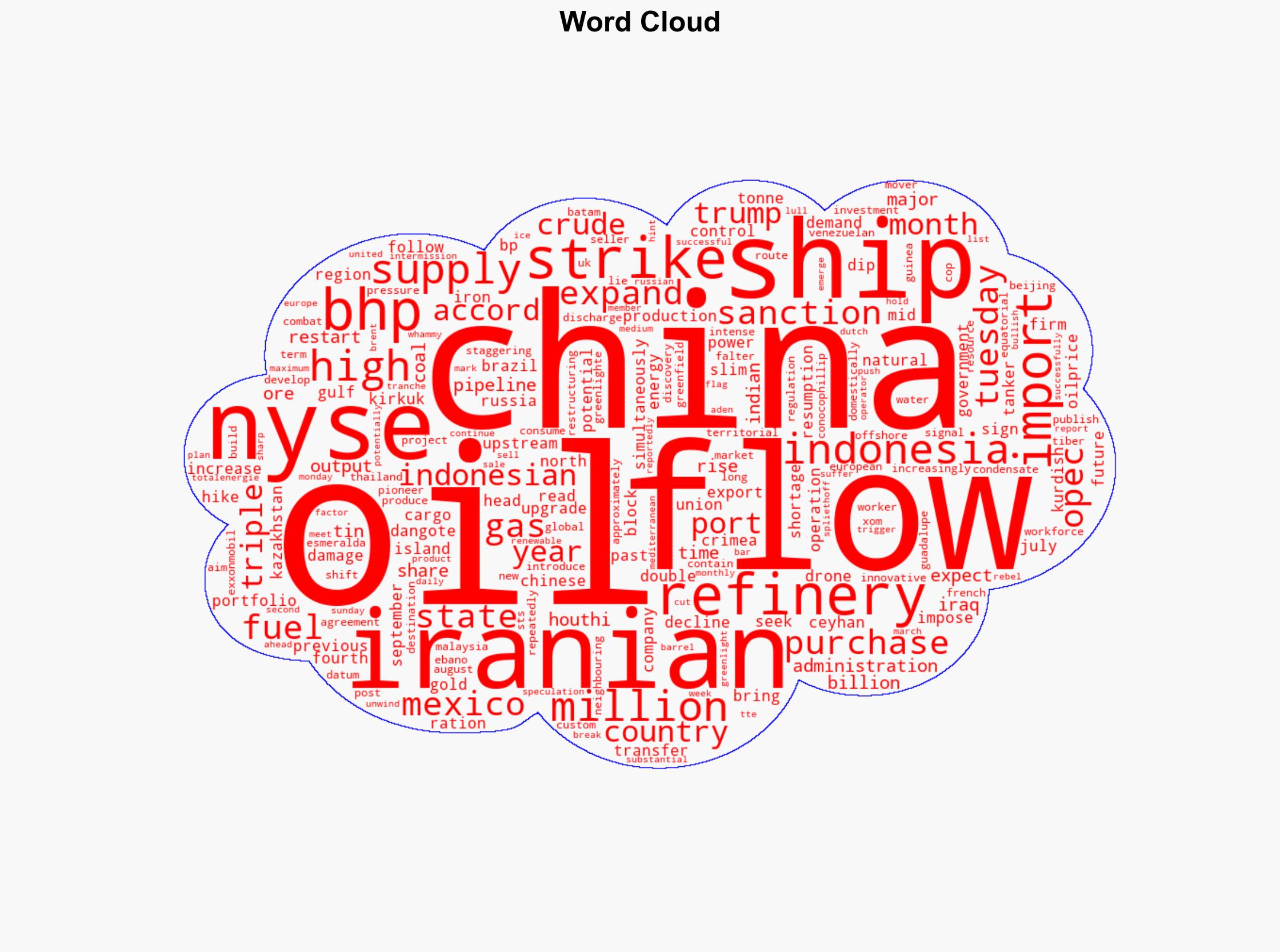

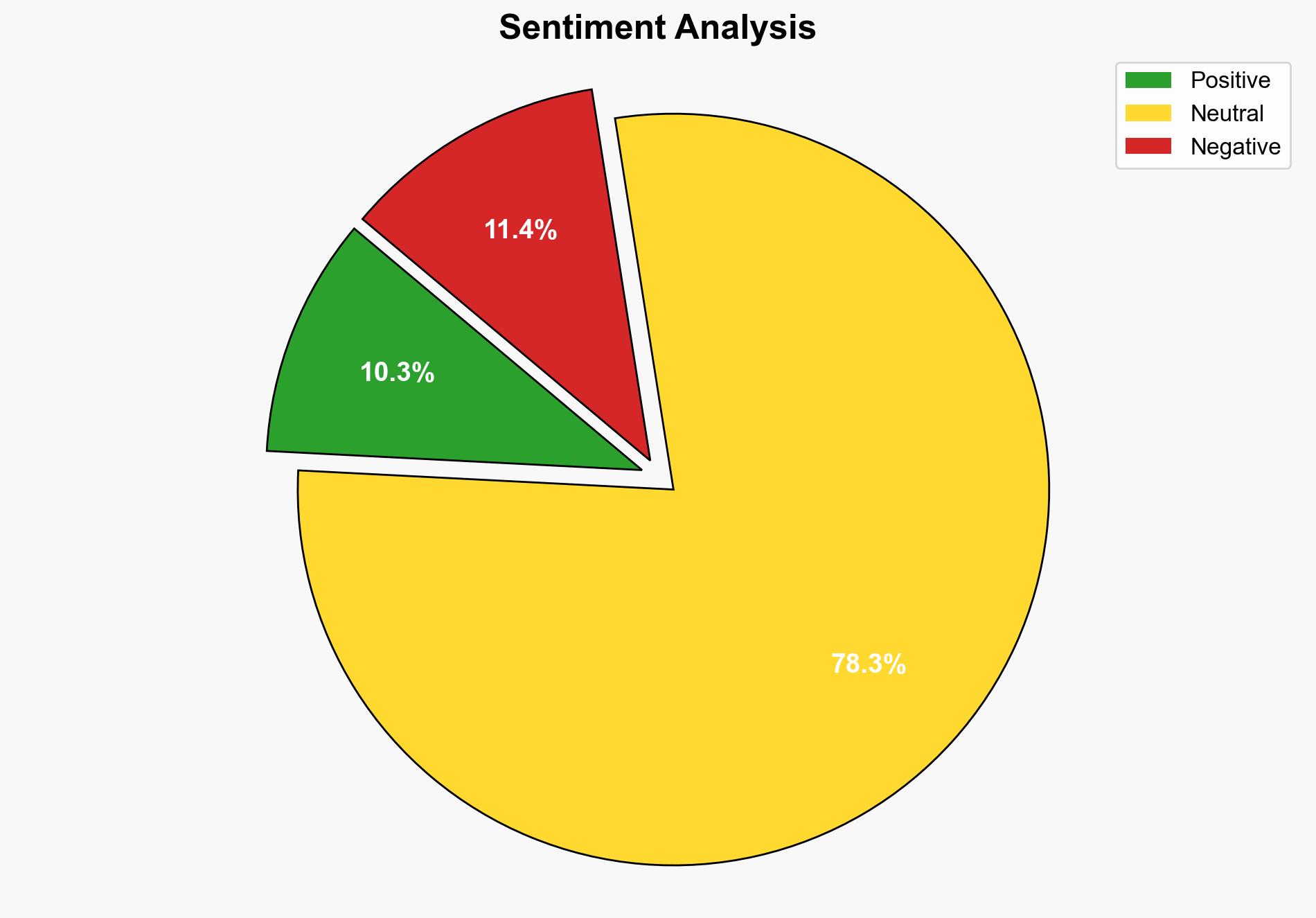

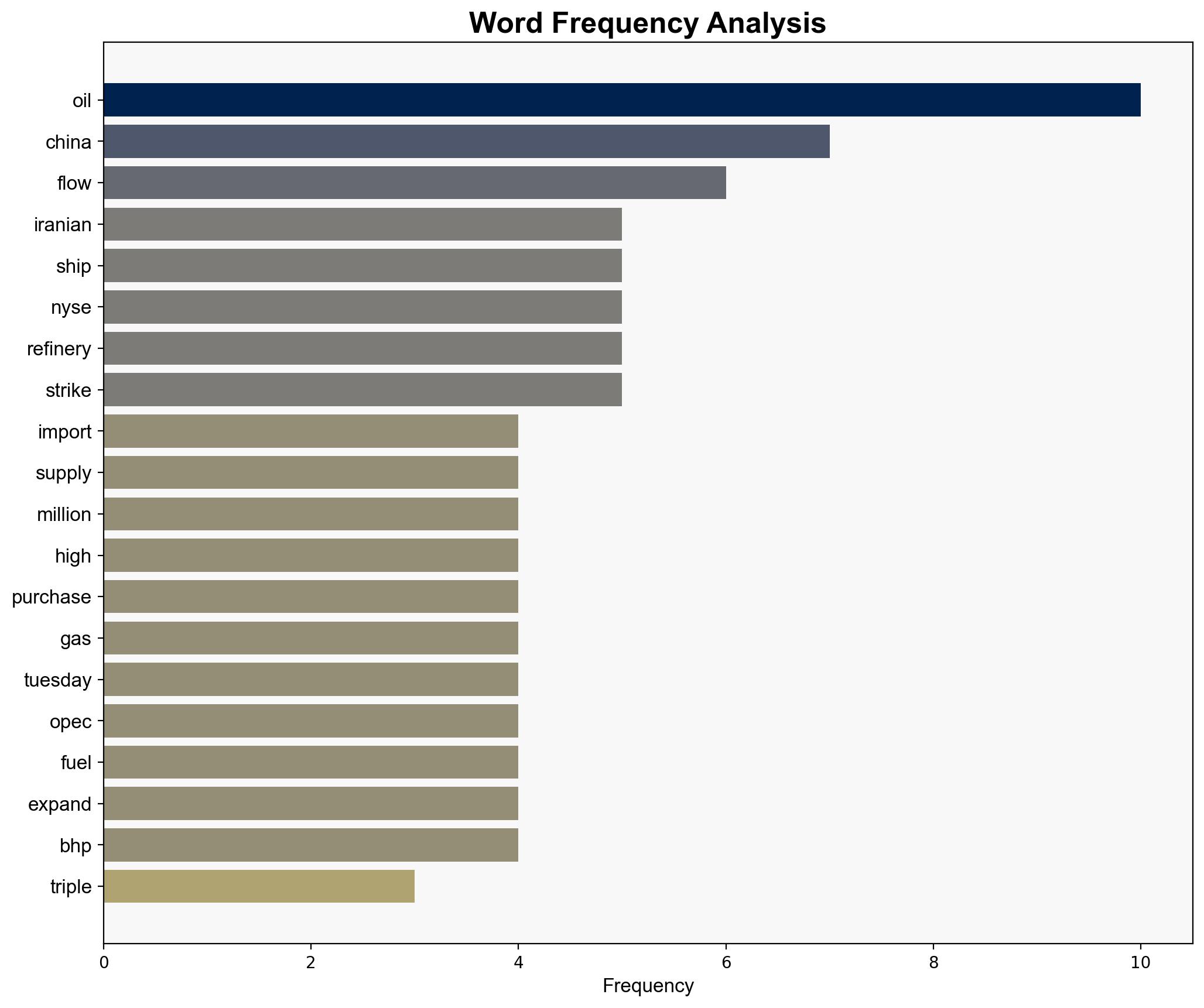

The most supported hypothesis is that the recent decline in oil prices is primarily driven by increased supply from multiple sources, including Iran and Iraq, alongside strategic maneuvering by China to secure oil imports. Confidence level is moderate due to potential geopolitical disruptions and market volatility. Recommended action: Monitor geopolitical developments and adjust strategic reserves and contracts to mitigate supply chain risks.

2. Competing Hypotheses

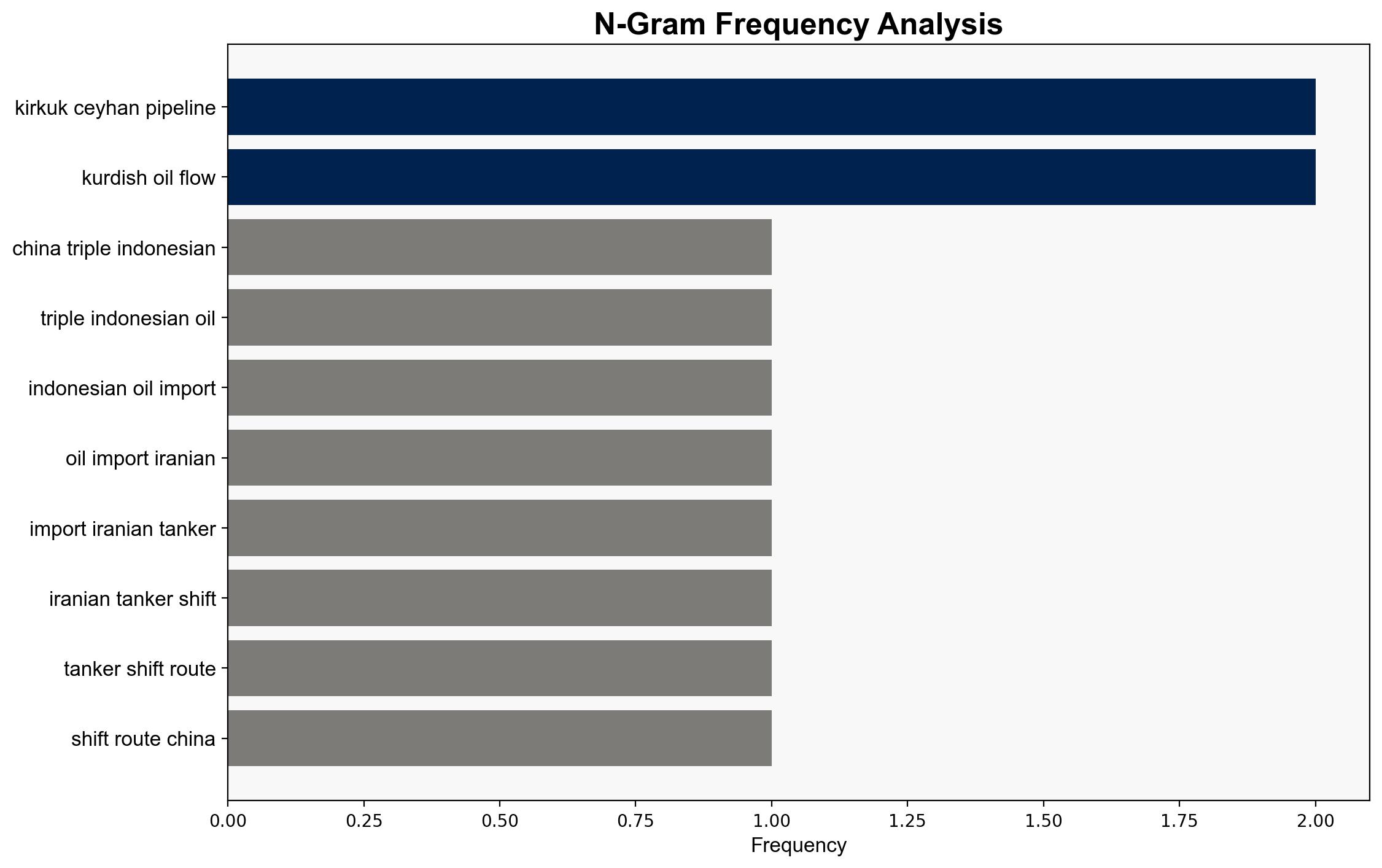

1. **Increased Supply Hypothesis**: The decline in oil prices is primarily due to a surge in supply from Iran and Iraq, as well as China’s strategic import practices. This is supported by Iran’s innovative shipping methods and Iraq’s restart of the Kirkuk-Ceyhan pipeline.

2. **Demand Weakness Hypothesis**: The price decline is driven more by weakening demand in key markets such as India and Europe, exacerbated by economic slowdowns and geopolitical tensions, rather than supply increases alone.

Using ACH 2.0, the Increased Supply Hypothesis is better supported by the data, particularly the documented increase in Chinese imports and the resumption of Iraqi oil flows.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the reported increases in oil supply will continue without significant geopolitical disruptions. The demand in India and Europe is assumed to remain weak.

– **Red Flags**: Potential underreporting of geopolitical tensions that could disrupt supply chains. The reliability of Chinese import data could be compromised by strategic misinformation.

– **Blind Spots**: Lack of detailed analysis on the impact of U.S. energy policies and potential retaliatory actions by affected countries.

4. Implications and Strategic Risks

– **Economic**: Prolonged low oil prices could strain economies reliant on oil exports, potentially leading to regional instability.

– **Geopolitical**: Increased Iranian oil flow might provoke further sanctions or military actions, impacting global supply chains.

– **Psychological**: Market volatility could undermine investor confidence, affecting broader economic stability.

5. Recommendations and Outlook

- Enhance monitoring of geopolitical developments in the Middle East and Asia to anticipate supply disruptions.

- Consider diversifying energy sources and increasing strategic reserves to buffer against potential supply shocks.

- Scenario Projections:

- Best: Stabilization of oil prices as supply and demand balance.

- Worst: Escalation of geopolitical tensions leading to significant supply disruptions.

- Most Likely: Continued volatility with gradual stabilization as markets adjust to new supply dynamics.

6. Key Individuals and Entities

– ExxonMobil

– ConocoPhillips

– BP

– TotalEnergies

– BHP Group

– Dangote Group

7. Thematic Tags

national security threats, energy security, geopolitical dynamics, market volatility