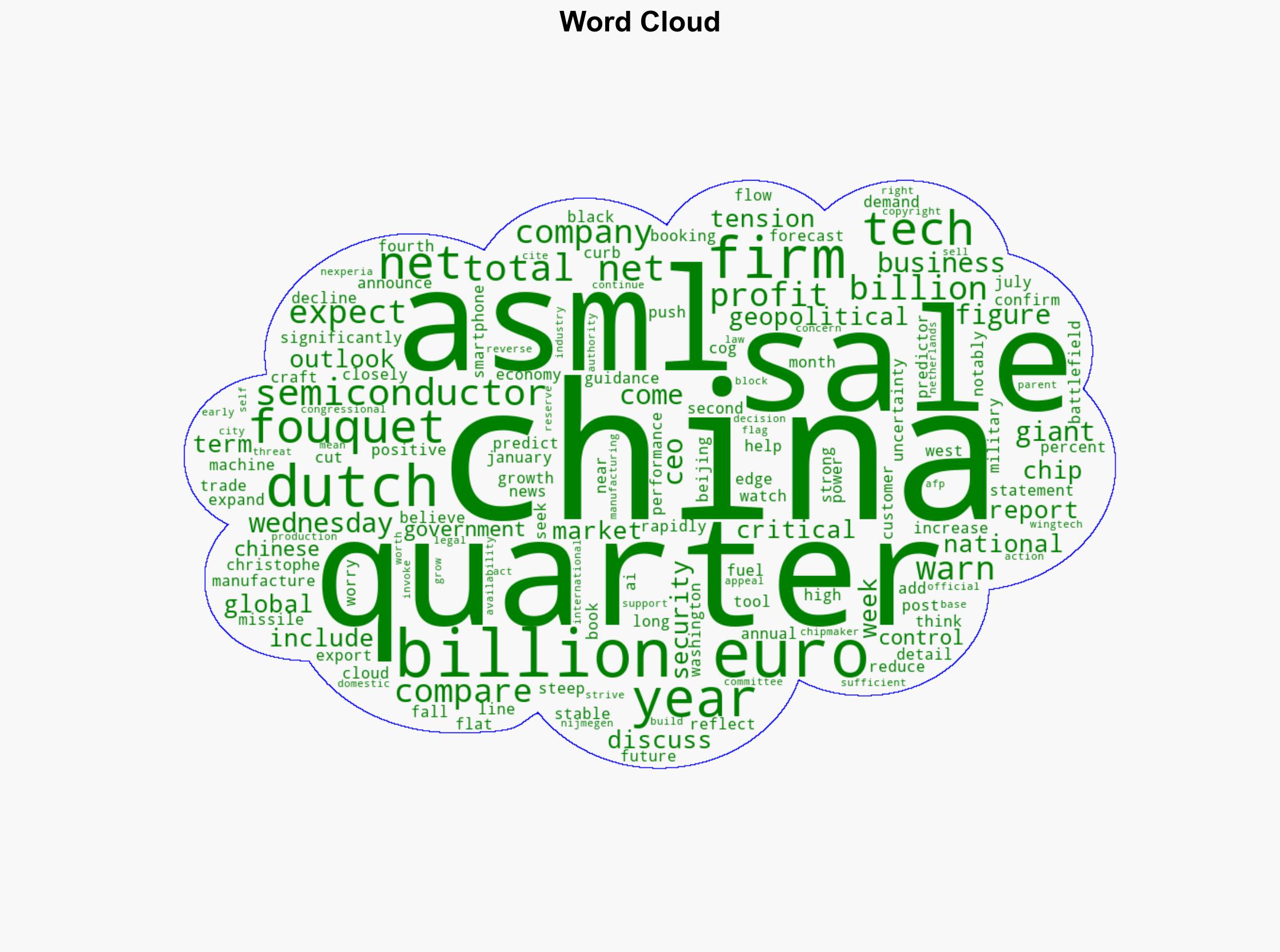

Dutch Tech Giant ASML Posts Stable Profits Warns On China Sales – International Business Times

Published on: 2025-10-15

Intelligence Report: Dutch Tech Giant ASML Posts Stable Profits Warns On China Sales – International Business Times

1. BLUF (Bottom Line Up Front)

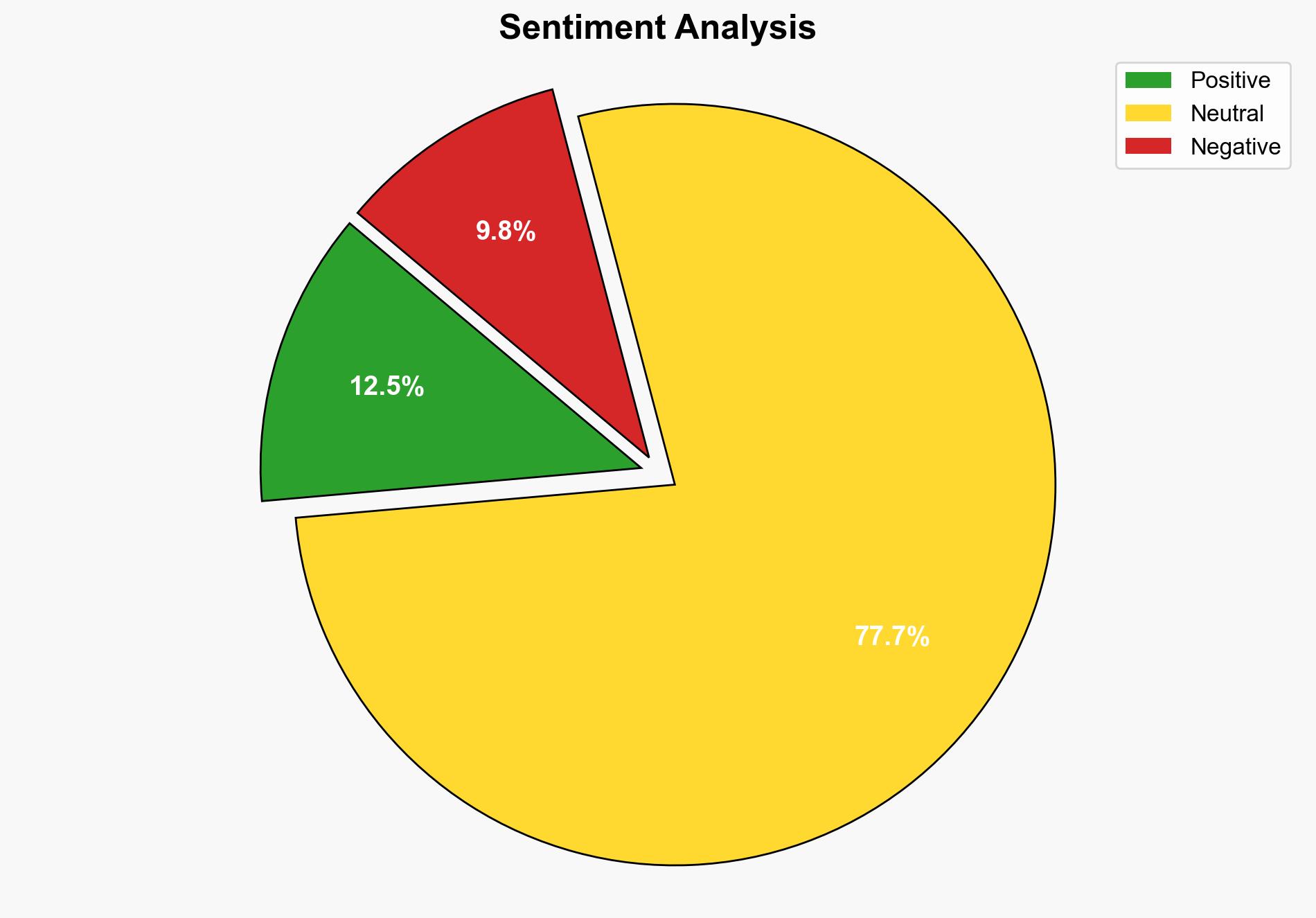

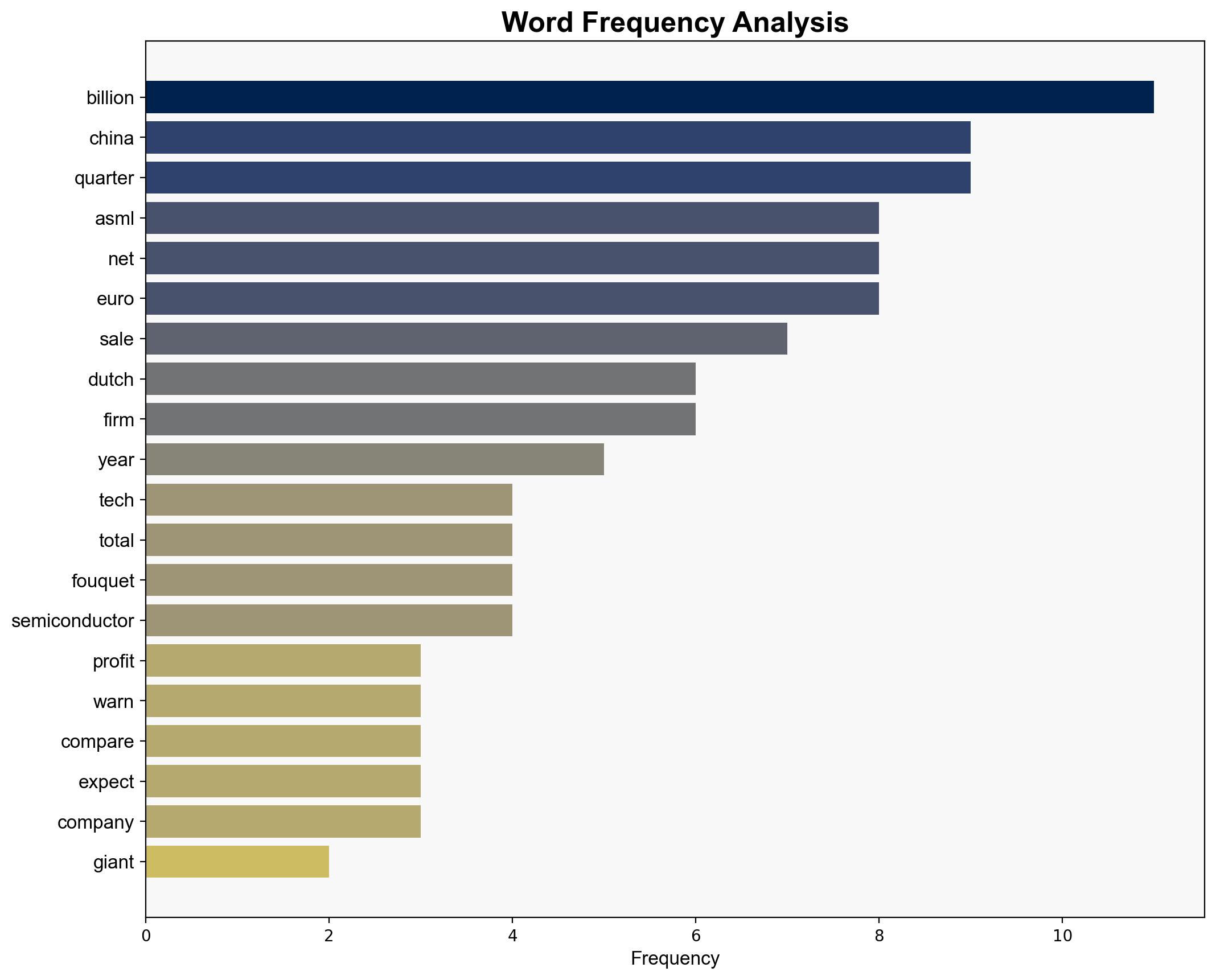

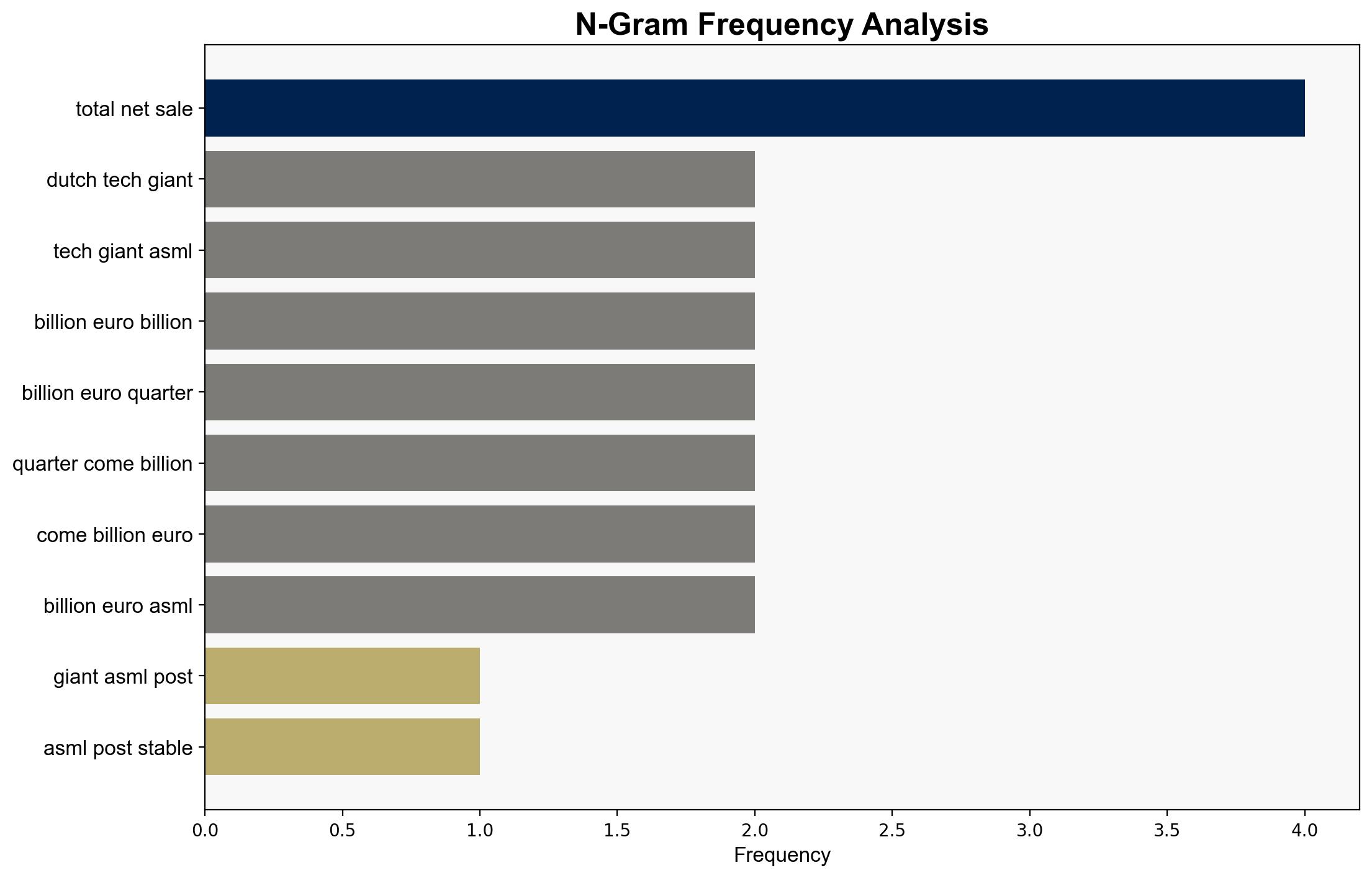

ASML’s stable profits amidst warnings of declining China sales suggest a strategic pivot may be necessary due to geopolitical tensions. The most supported hypothesis is that ASML will need to diversify its market focus away from China to mitigate risks. Confidence level: Moderate. Recommended action: ASML should enhance market penetration in regions less affected by geopolitical tensions and invest in technology that aligns with emerging global demands, such as AI.

2. Competing Hypotheses

1. **Hypothesis A**: ASML’s warning on China sales is primarily due to geopolitical tensions, which will lead to a strategic shift in market focus and investment in alternative regions.

2. **Hypothesis B**: The decline in China sales is a temporary fluctuation, and ASML will maintain its current market strategy, expecting a rebound as tensions stabilize.

Using ACH 2.0, Hypothesis A is better supported due to consistent geopolitical pressures and recent actions by the Dutch government to control technology exports to China, indicating a long-term strategic risk.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes ongoing geopolitical tensions will persist, affecting ASML’s sales in China. Hypothesis B assumes these tensions are temporary and will not significantly impact long-term sales.

– **Red Flags**: Lack of detailed data on specific geopolitical actions affecting ASML’s sales. Potential bias in assuming geopolitical tensions will not ease.

– **Blind Spots**: Possible underestimation of China’s capacity to develop domestic semiconductor capabilities, which could further impact ASML’s market share.

4. Implications and Strategic Risks

– **Economic**: A sustained decline in China sales could impact ASML’s revenue, necessitating diversification into other markets.

– **Geopolitical**: Increased tensions between China and Western countries could lead to further restrictions on technology exports, impacting ASML’s global operations.

– **Cyber**: Potential for increased cyber espionage as China seeks to bolster its domestic semiconductor industry.

– **Psychological**: Market uncertainty may affect investor confidence and ASML’s stock performance.

5. Recommendations and Outlook

- **Mitigation**: ASML should increase investments in regions with stable geopolitical climates and explore partnerships in emerging markets.

- **Opportunity**: Leverage AI and other advanced technologies to create new revenue streams.

- **Scenario Projections**:

– **Best Case**: Geopolitical tensions ease, allowing ASML to regain market share in China.

– **Worst Case**: Escalation of tensions leads to further restrictions, significantly impacting revenue.

– **Most Likely**: Gradual diversification into other markets with moderate impact on overall sales.

6. Key Individuals and Entities

– Christophe Fouquet (CEO of ASML)

– Dutch Government

– Chinese Authorities

7. Thematic Tags

national security threats, geopolitical tensions, semiconductor industry, market diversification