Economics Investing For Preppers – Survivalblog.com

Published on: 2025-10-17

Intelligence Report: Economics Investing For Preppers – Survivalblog.com

1. BLUF (Bottom Line Up Front)

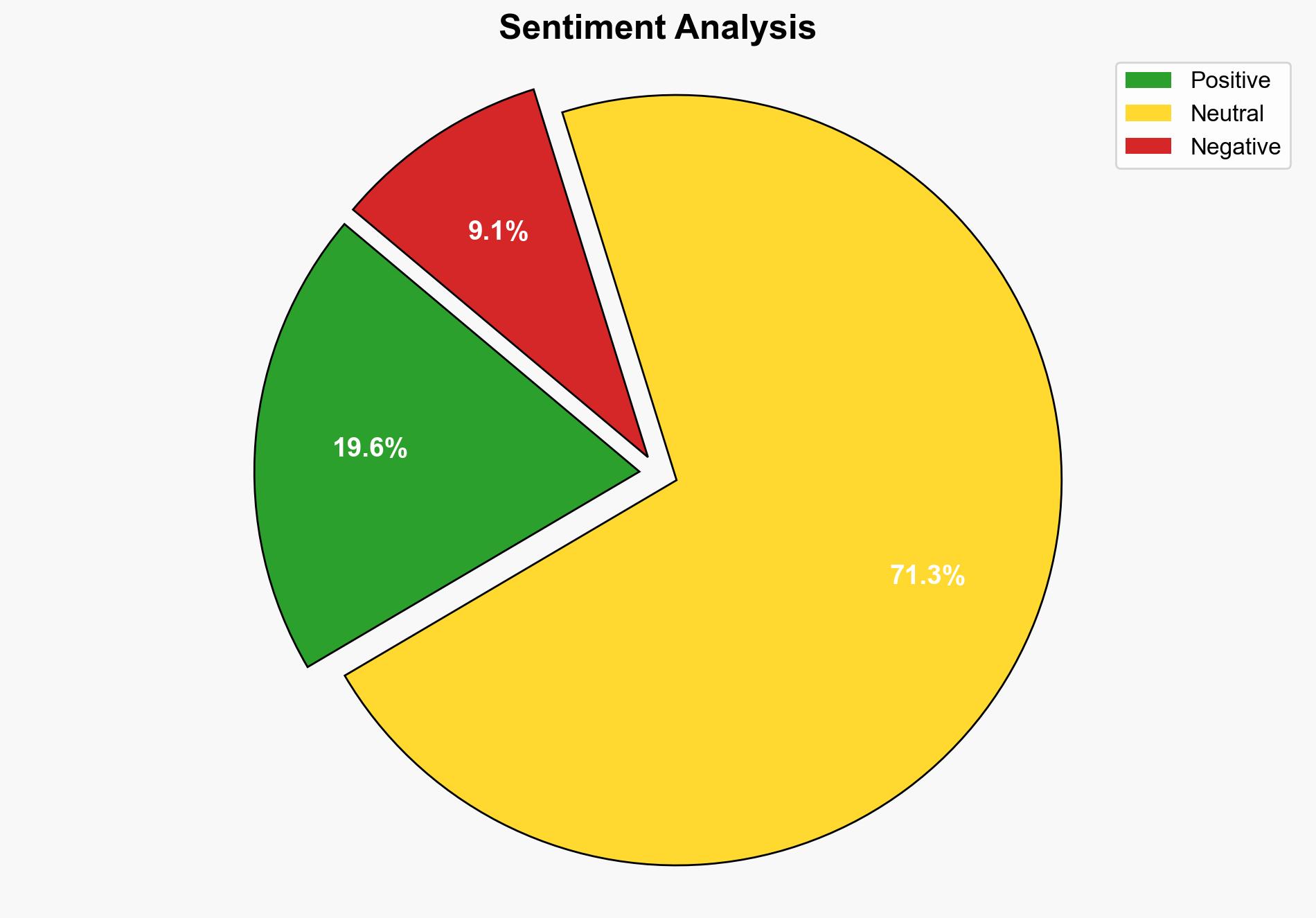

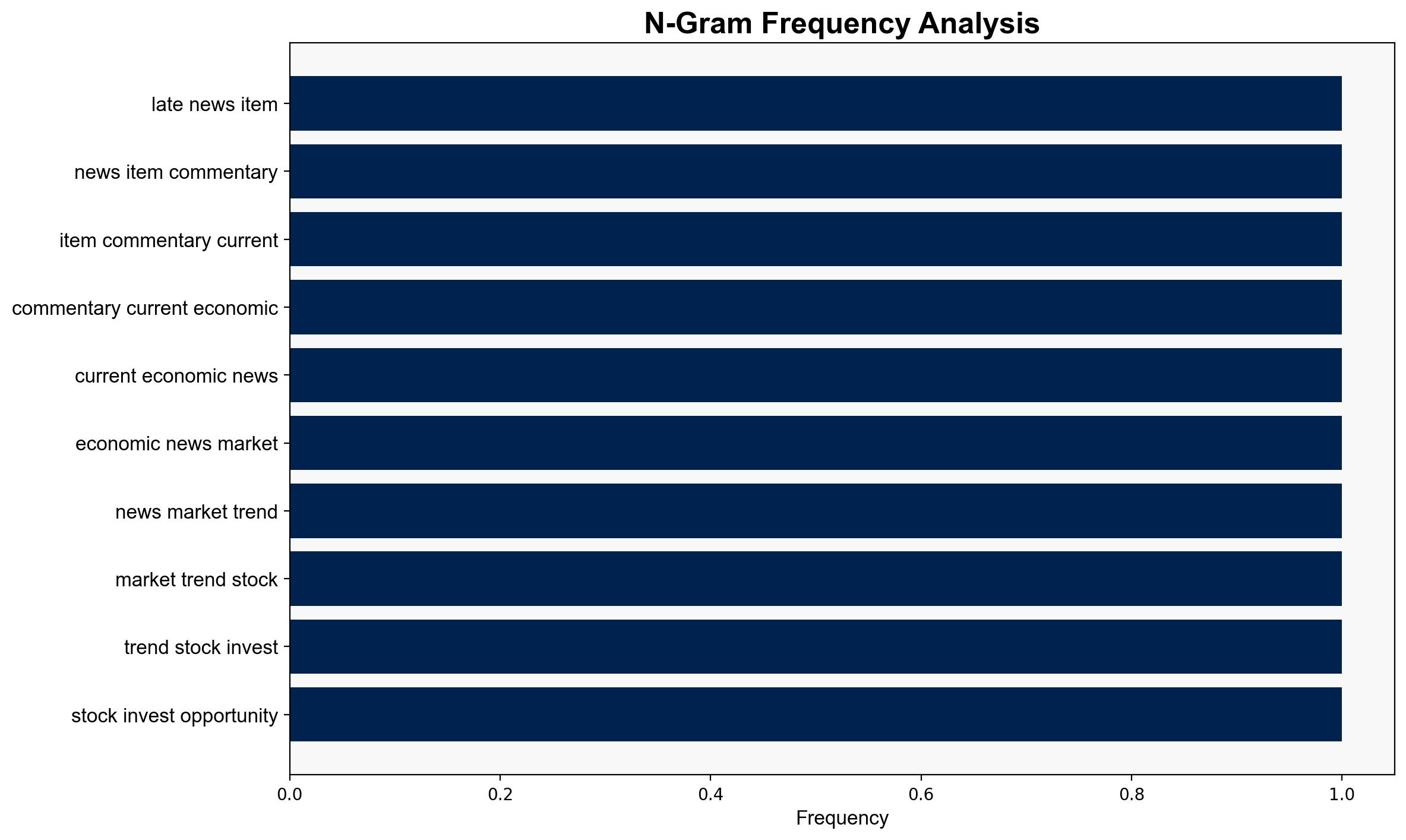

The analysis suggests a high confidence level in the hypothesis that the article promotes a contrarian investment strategy emphasizing tangible assets like precious metals over traditional equities. The recommended action is to consider diversifying investment portfolios to include tangible assets as a hedge against potential economic instability and currency devaluation.

2. Competing Hypotheses

Hypothesis 1: The article advocates for a shift away from traditional stock markets towards tangible assets such as precious metals due to an anticipated decline in the dollar’s dominance and potential economic instability.

Hypothesis 2: The article is primarily a marketing tool designed to promote precious metals and other tangible assets by creating a sense of urgency and fear about the future of traditional financial markets.

Using ACH 2.0, Hypothesis 1 is better supported as the article provides multiple references to economic trends, expert opinions, and historical patterns that align with the potential decline of the dollar and increased value of tangible assets. Hypothesis 2 lacks substantial evidence beyond the tone of urgency and fear.

3. Key Assumptions and Red Flags

Key assumptions include the belief that the dollar’s dominance is waning and that precious metals will continue to rise in value. A potential cognitive bias is the confirmation bias, where the article selectively highlights data supporting its thesis. Red flags include the lack of counterarguments or alternative investment strategies, which could indicate a one-sided perspective.

4. Implications and Strategic Risks

If the dollar’s dominance declines, there could be significant impacts on global trade and economic stability, leading to increased demand for tangible assets. This scenario could escalate into broader economic challenges, including inflation and market volatility. The psychological impact on investors could lead to panic selling and market disruptions.

5. Recommendations and Outlook

- Consider diversifying investment portfolios to include a mix of tangible assets and traditional equities to hedge against potential economic instability.

- Monitor global economic indicators and currency trends to adjust investment strategies proactively.

- Scenario Projections:

- Best Case: The dollar stabilizes, and diversified portfolios yield balanced returns.

- Worst Case: A rapid decline in the dollar leads to economic turmoil, with tangible assets becoming the primary safe haven.

- Most Likely: Gradual shifts in currency and market dynamics necessitate ongoing portfolio adjustments.

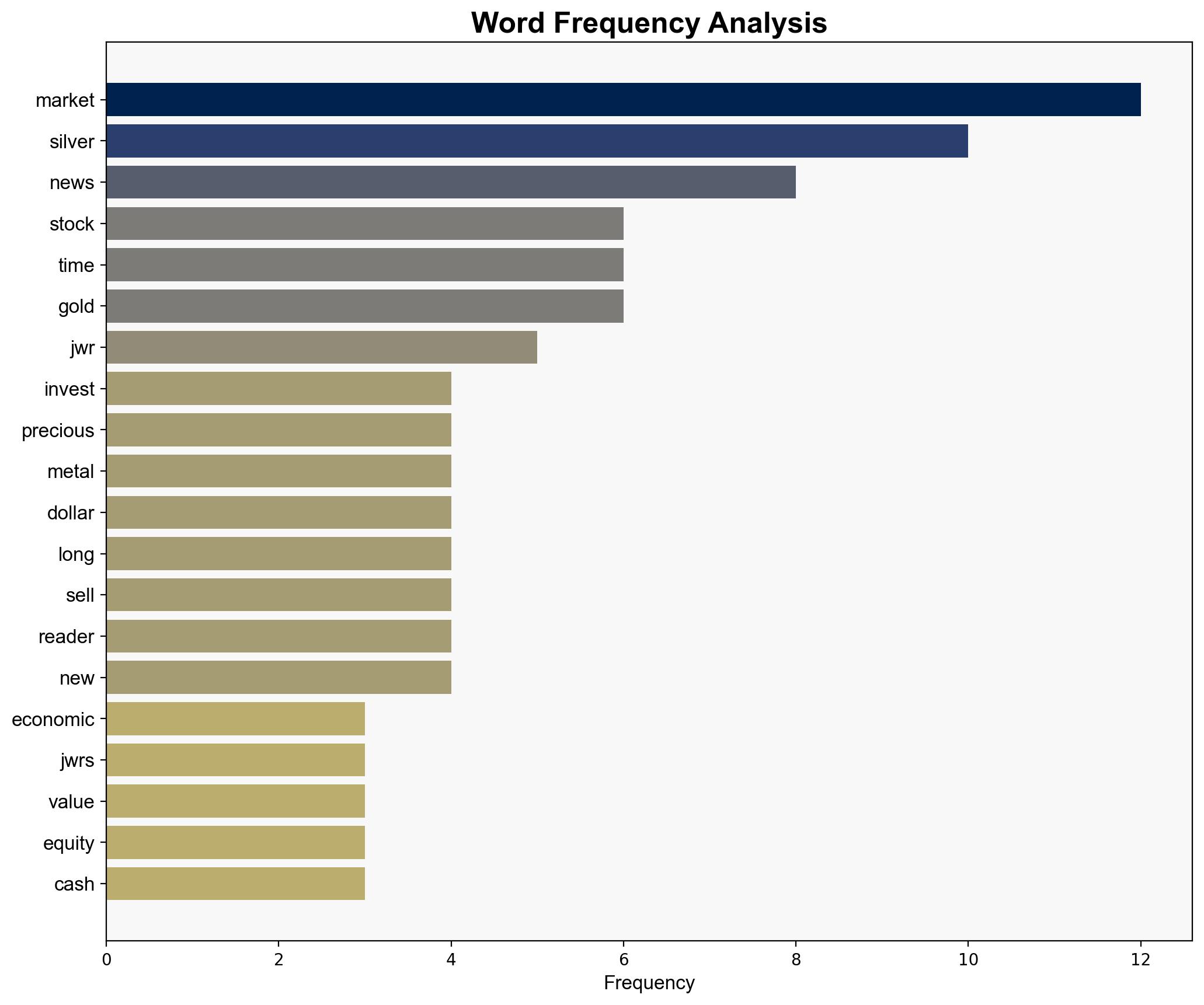

6. Key Individuals and Entities

– JWR (presumably the author or a key figure in the article)

– Martin Armstrong (mentioned in the context of economic forecasts)

– Andy Schectman (provides commentary on global currency paradigms)

7. Thematic Tags

national security threats, economic stability, investment strategy, currency devaluation