Elon Musk’s xAI could soon be worth more than 200 billion – Quartz India

Published on: 2025-11-19

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Elon Musk’s xAI Valuation and Strategic Implications

1. BLUF (Bottom Line Up Front)

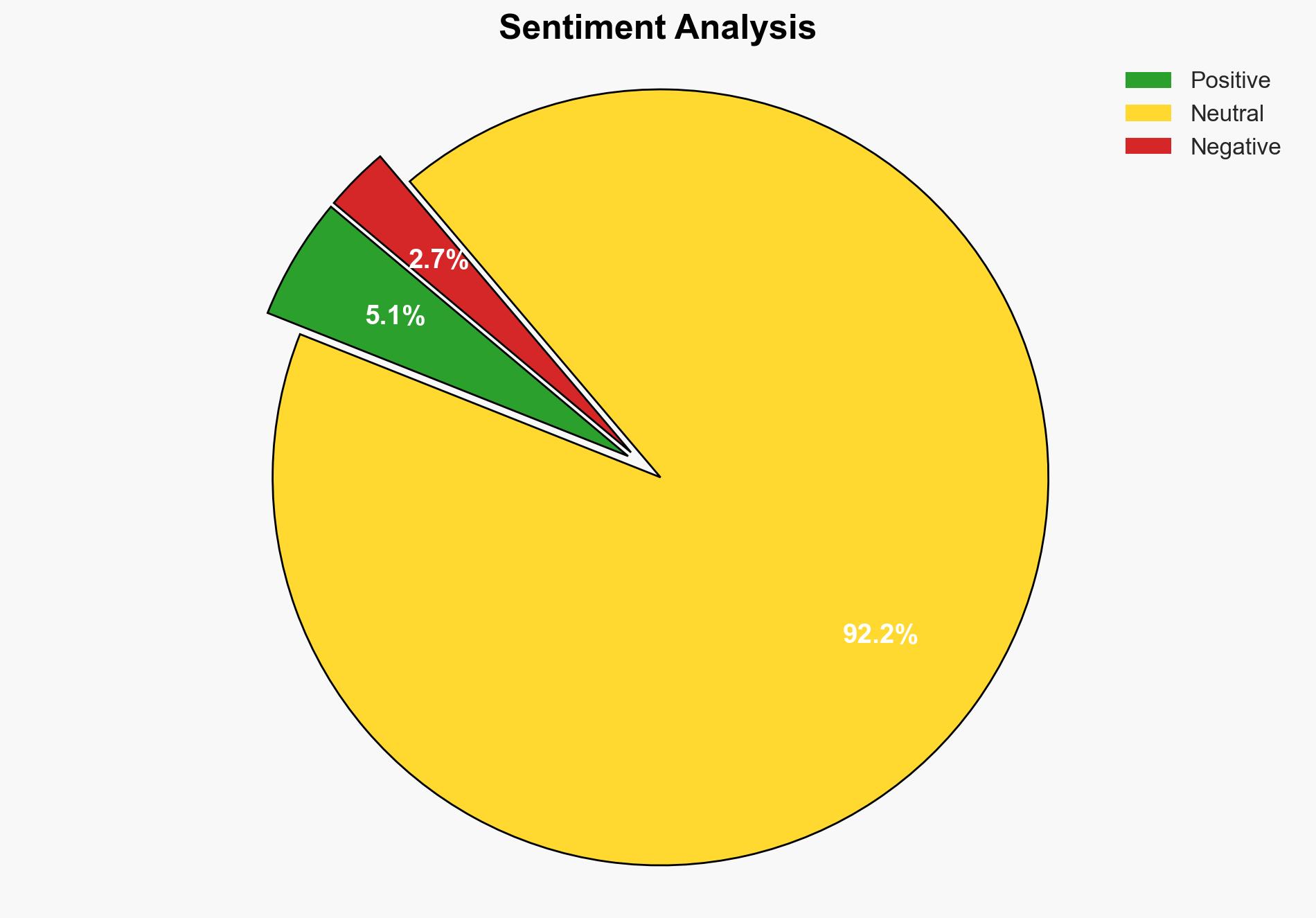

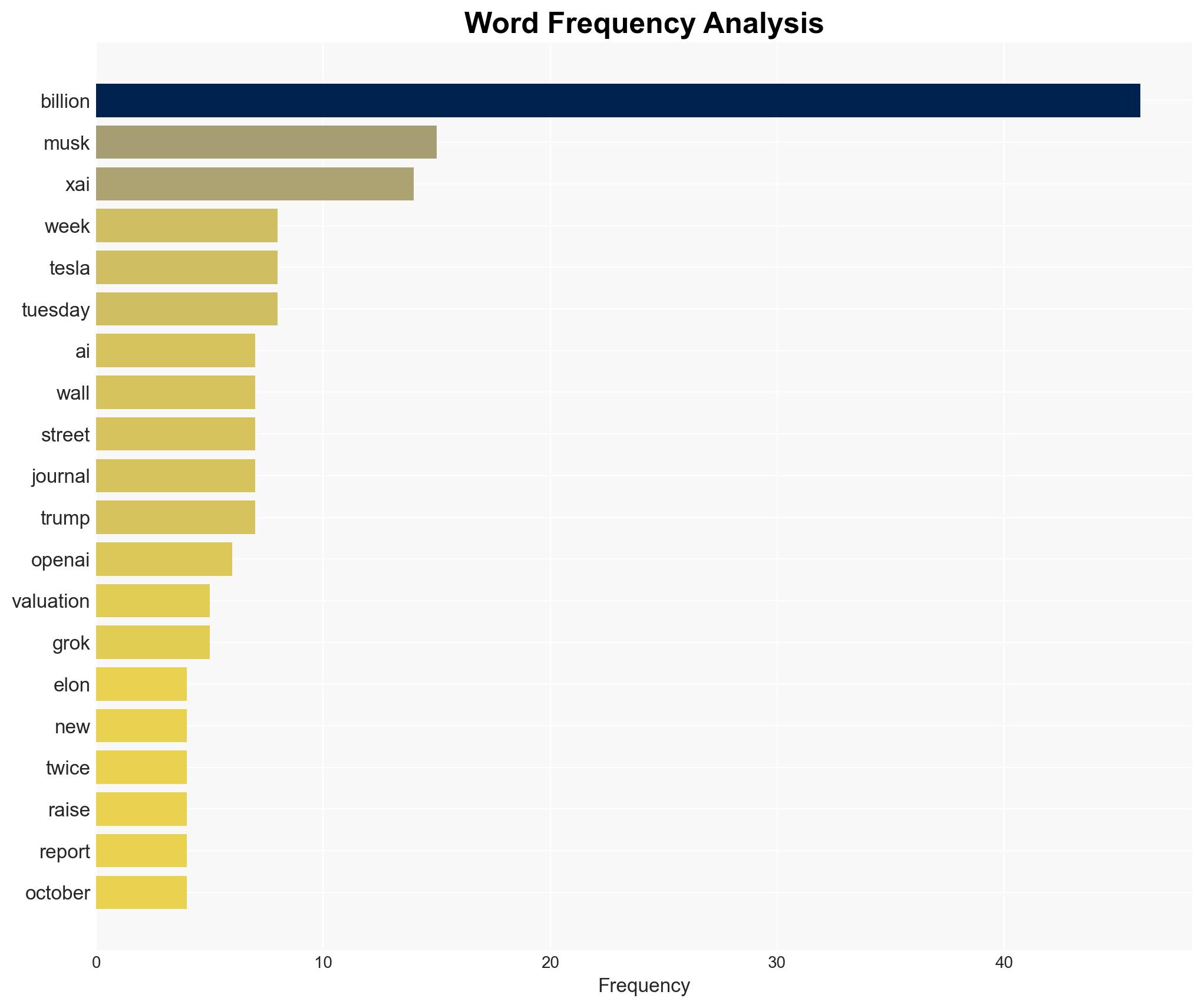

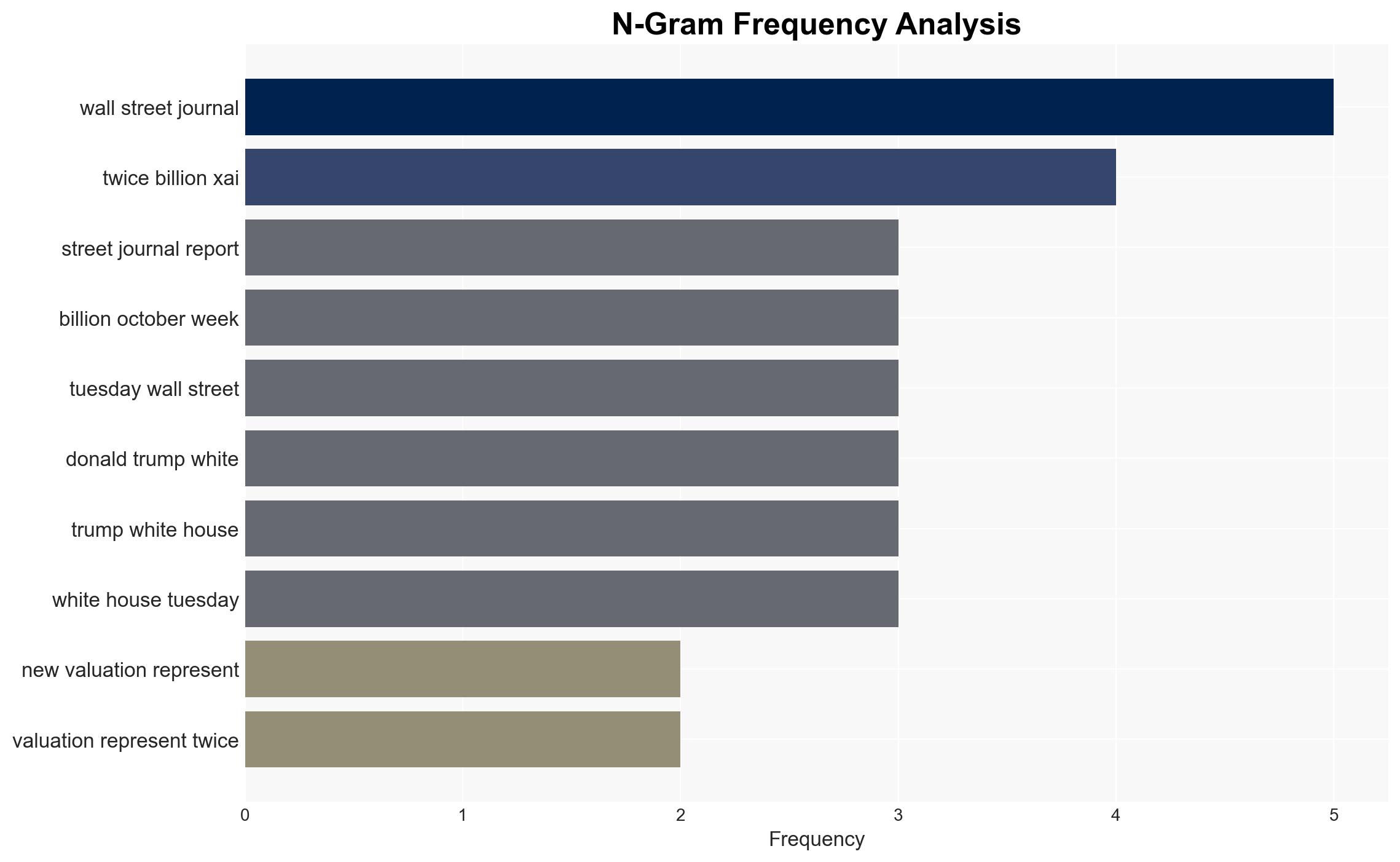

With a moderate confidence level, the most supported hypothesis is that xAI’s valuation growth is primarily driven by speculative investment trends in the AI sector, rather than intrinsic technological breakthroughs. Strategic recommendation: Monitor xAI’s technological developments and financial maneuvers closely, while preparing for potential market corrections similar to the dotcom bubble burst.

2. Competing Hypotheses

Hypothesis 1: xAI’s valuation increase is due to genuine technological advancements and strategic investments that position it as a leader in the AI sector.

Hypothesis 2: xAI’s valuation is inflated due to speculative investment trends and the current hype surrounding AI technologies, similar to historical tech bubbles.

Assessment: Hypothesis 2 is more likely given the current market trends and historical parallels with tech bubbles. The rapid valuation increase without clear evidence of breakthrough technology supports this hypothesis.

3. Key Assumptions and Red Flags

Assumptions: The valuation figures are accurate and reflect market sentiment. xAI’s technological capabilities are comparable to its competitors.

Red Flags: Lack of transparency in xAI’s technological advancements and financial disclosures. Potential for overvaluation similar to the dotcom bubble.

Deception Indicators: Public statements by Elon Musk and xAI that may exaggerate technological capabilities or market position.

4. Implications and Strategic Risks

Economic Risks: Potential for significant financial losses if xAI’s valuation corrects sharply, impacting investors and related sectors.

Political Risks: Increased scrutiny from regulators if AI valuations continue to rise unsustainably.

Informational Risks: Misinformation or exaggerated claims about AI capabilities could lead to public disillusionment and reduced trust in AI technologies.

5. Recommendations and Outlook

- Actionable Steps: Conduct thorough due diligence on xAI’s technological claims and financial health. Engage with industry experts to assess the validity of xAI’s market position.

- Best Scenario: xAI delivers on its technological promises, justifying its valuation and leading to sustainable growth.

- Worst Scenario: A market correction occurs, leading to significant financial losses and reduced investor confidence in AI technologies.

- Most-likely Scenario: xAI’s valuation remains high in the short term due to ongoing speculative investments, with potential for correction as market realities set in.

6. Key Individuals and Entities

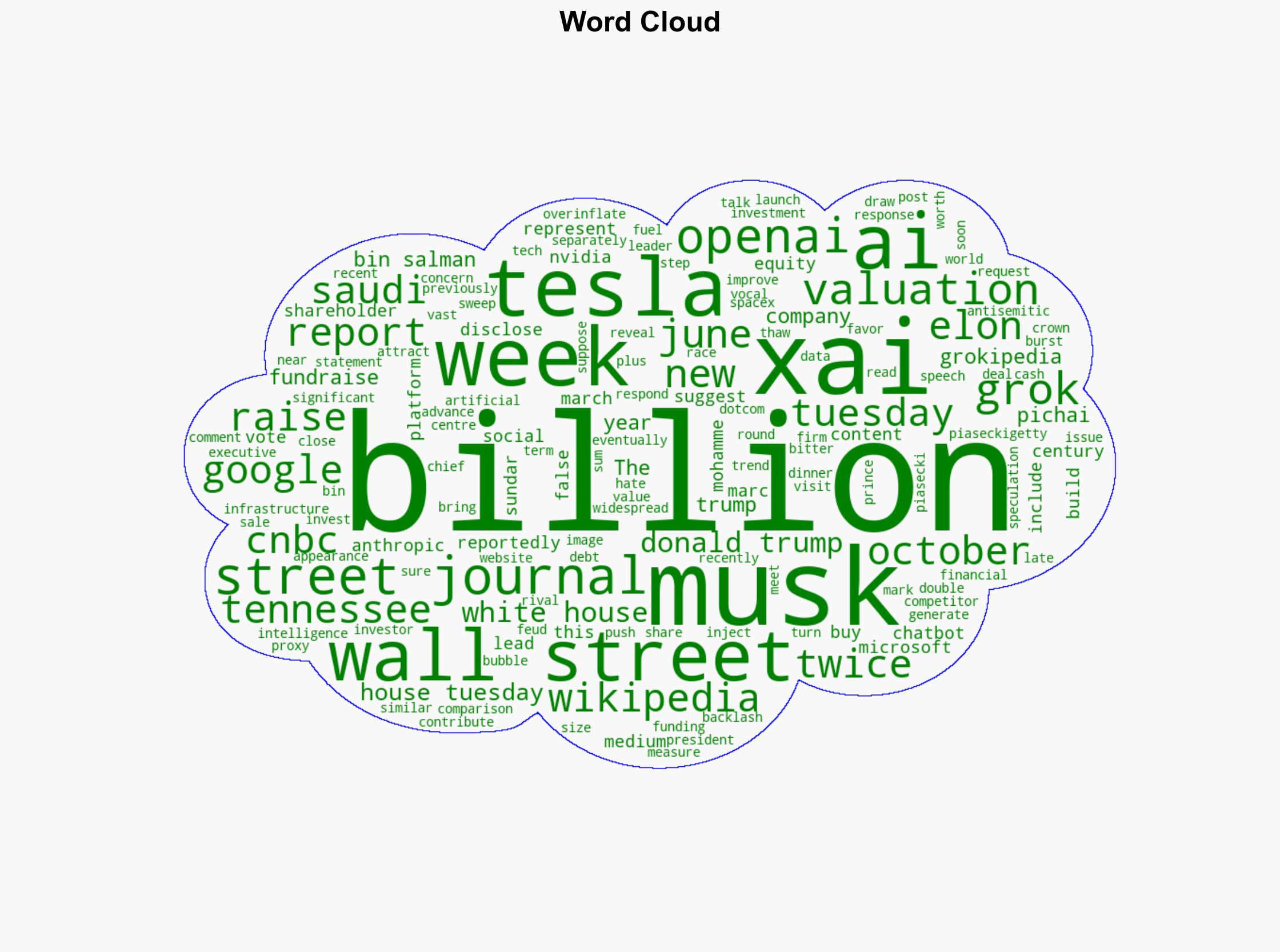

Elon Musk, Marc Piasecki, Sundar Pichai, Donald Trump, Mohammed bin Salman

7. Thematic Tags

Cybersecurity, AI Valuation, Speculative Investment, Market Trends

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us