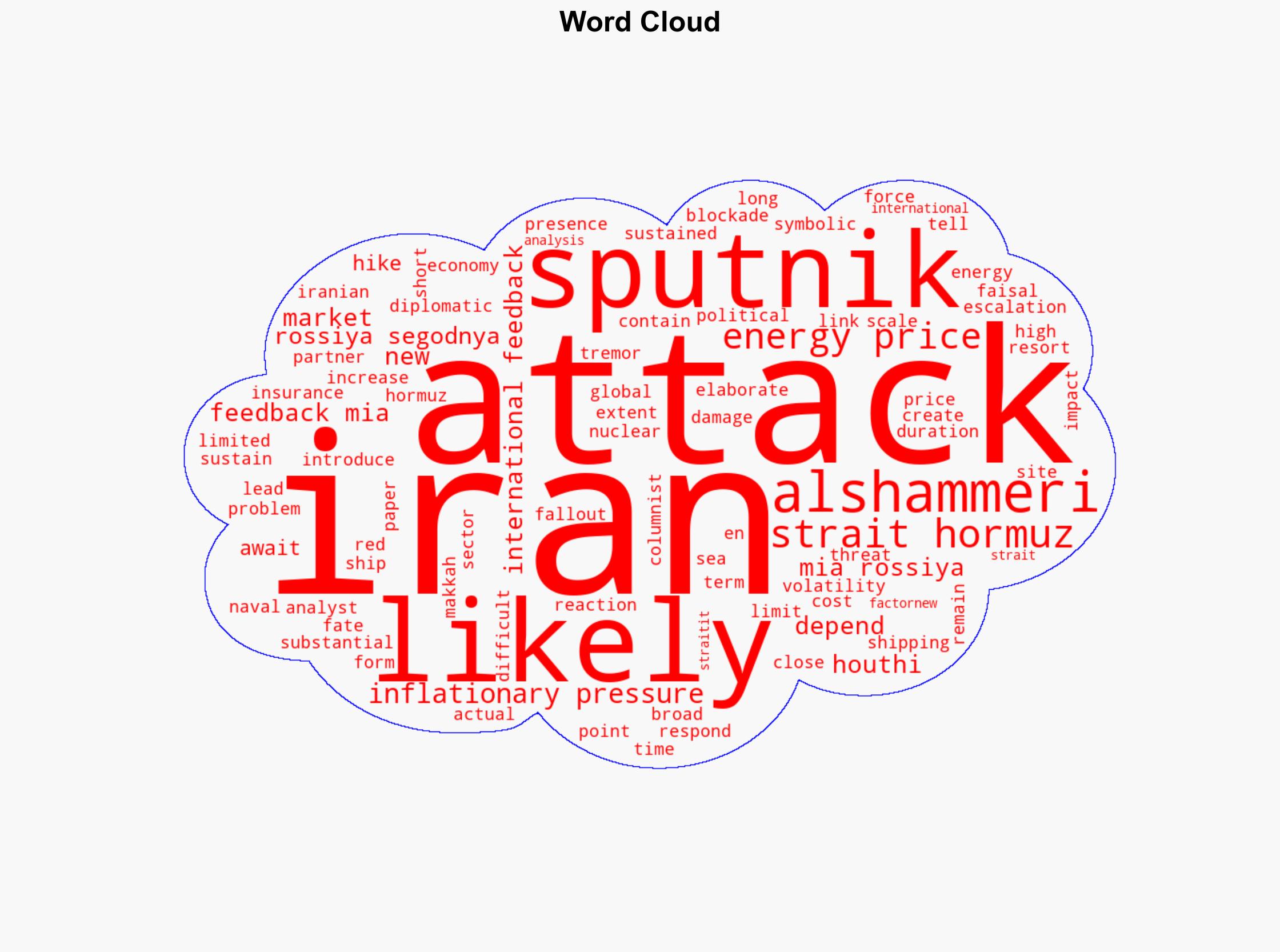

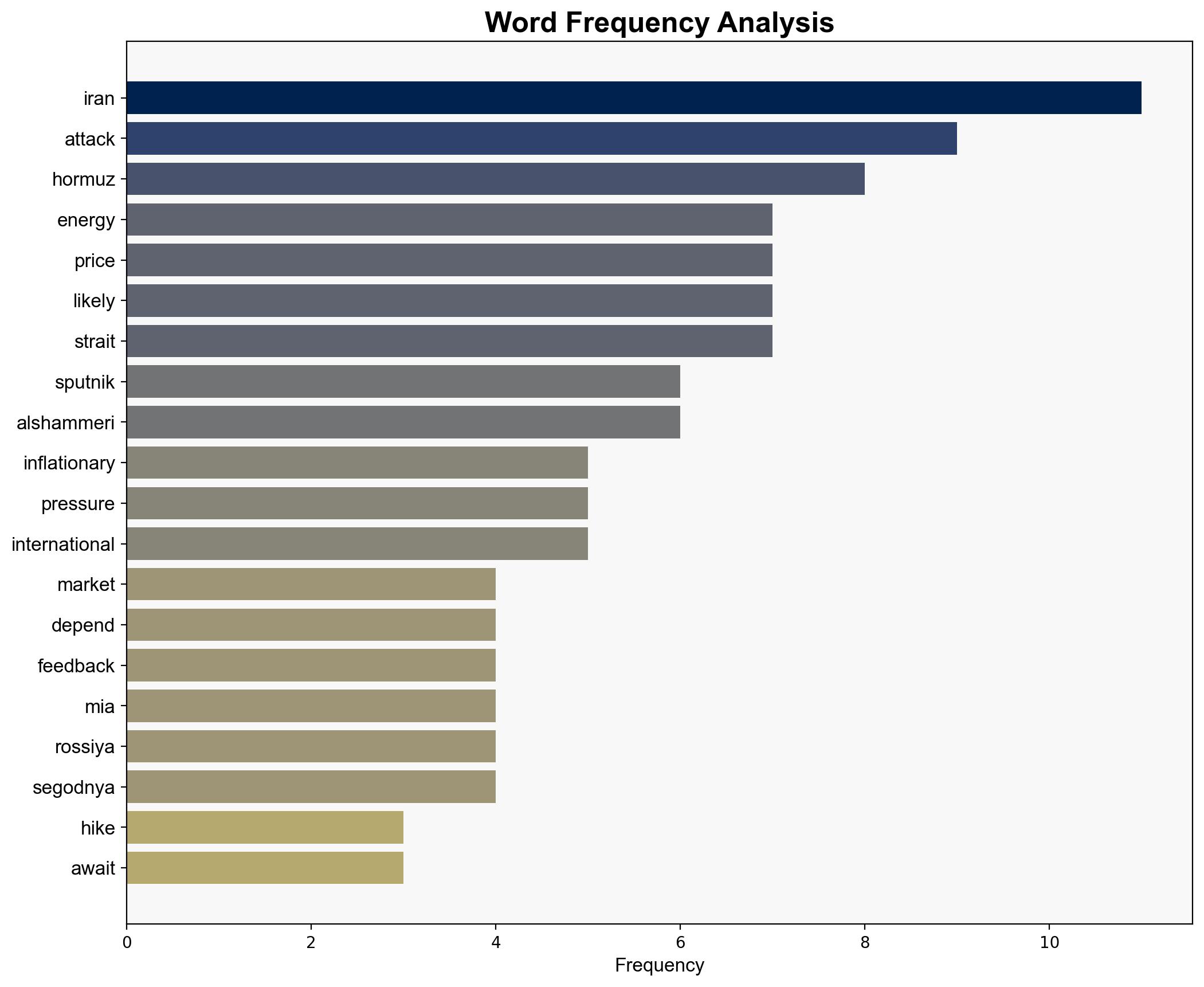

Energy Price Hike and Inflationary Pressure Likely Await US for Attacking Iran – Sputnikglobe.com

Published on: 2025-06-22

Intelligence Report: Energy Price Hike and Inflationary Pressure Likely Await US for Attacking Iran – Sputnikglobe.com

1. BLUF (Bottom Line Up Front)

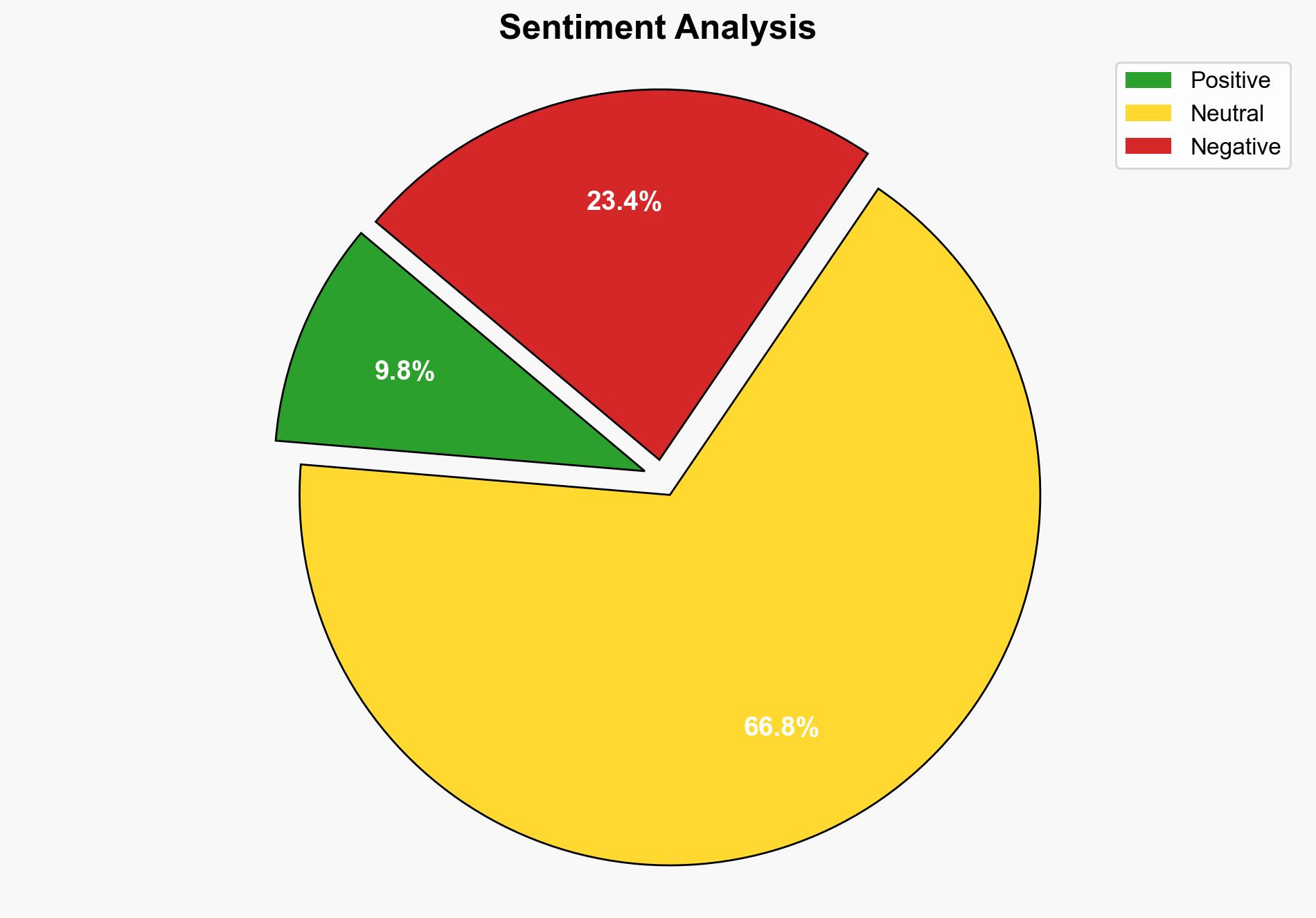

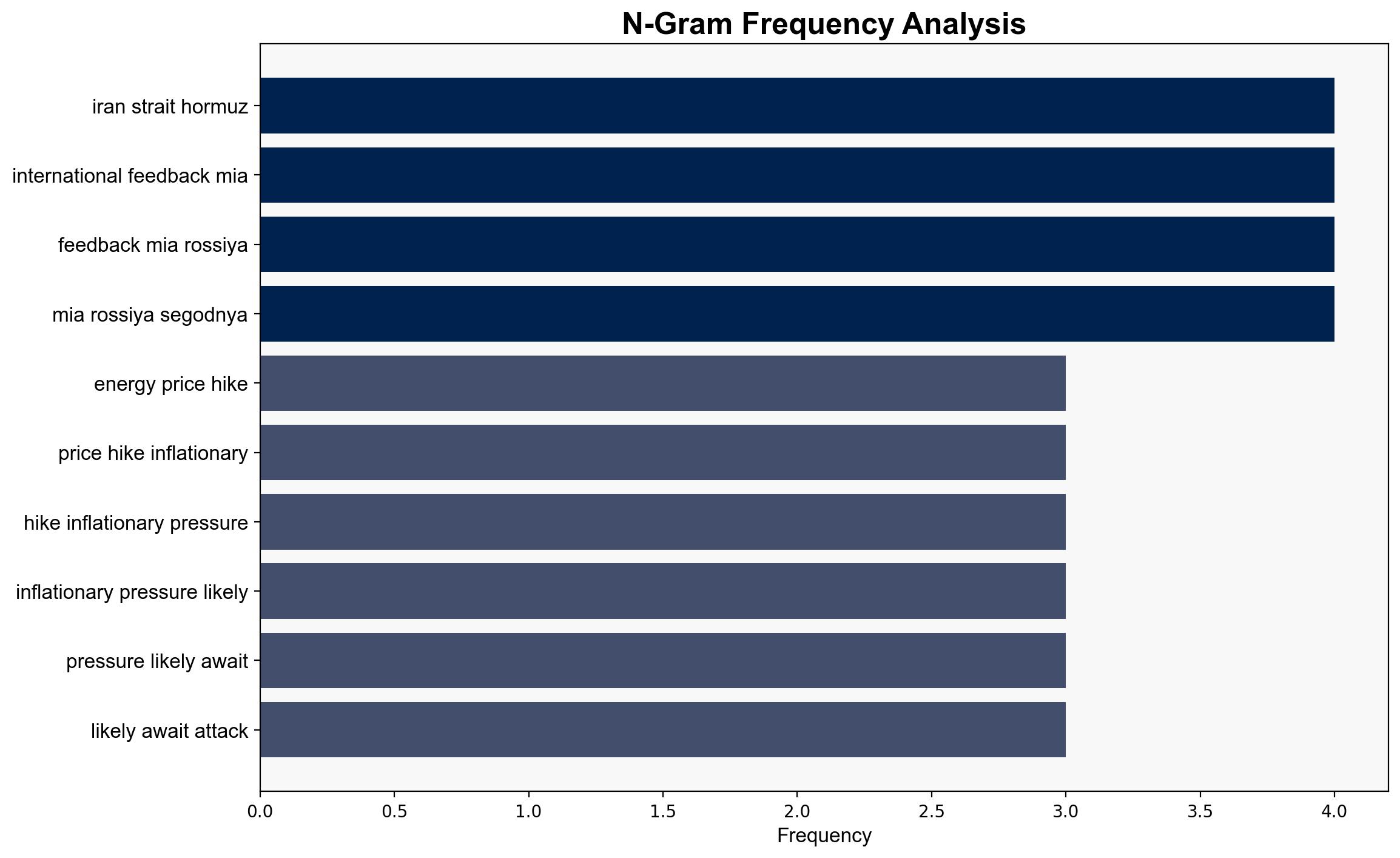

The potential attack on Iran, particularly targeting its nuclear sites, is likely to result in short-term volatility in the global energy market. This could lead to an increase in energy prices and inflationary pressures. The extent of these impacts will depend on Iran’s response, which could range from symbolic actions to broader escalations affecting the Strait of Hormuz. Strategic recommendations include preparing for potential disruptions in energy supply and considering diplomatic channels to mitigate escalation.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

Surface events include potential military actions and their immediate impacts on energy prices. Systemic structures involve geopolitical tensions and the strategic importance of the Strait of Hormuz. Worldviews encompass regional power dynamics and international diplomatic relations. Myths relate to historical narratives of conflict and economic resilience.

Cross-Impact Simulation

The simulation models interactions between Iran’s potential responses and global economic dependencies. A symbolic reaction may cause limited market tremors, while a significant escalation could lead to sustained price increases and broader economic disruptions.

Scenario Generation

Scenarios explore outcomes based on varying assumptions about Iran’s actions and international responses. These include scenarios where the Strait of Hormuz remains open versus scenarios involving its closure and the resultant global economic impacts.

3. Implications and Strategic Risks

Key risks include disruptions in global energy supply chains, increased insurance costs for shipping, and heightened inflationary pressures. The potential closure of the Strait of Hormuz poses a significant threat to global oil transportation. Cross-domain risks involve potential cyber threats and regional military escalations.

4. Recommendations and Outlook

- Enhance strategic reserves and diversify energy sources to mitigate supply disruptions.

- Engage in diplomatic efforts to de-escalate tensions and maintain open communication channels with regional partners.

- Scenario-based projections: Best case – Limited symbolic actions with minimal market impact. Worst case – Prolonged closure of the Strait of Hormuz leading to significant economic disruptions. Most likely – Short-term volatility with moderate price increases.

5. Key Individuals and Entities

Faisal Alshammeri

6. Thematic Tags

national security threats, energy security, geopolitical tensions, economic impact